Institutional Insights: Goldman Sachs Global FX Trader 31/03/31

.jpeg)

Global FX Trader Drawbacks of the Clawbacks

USD: The Drawbacks of the Clawbacks

Our analysis, based on price movements and client discussions, suggests that markets perceive tariffs as less enduring compared to other policy changes that negatively affect the Dollar. We anticipate no major shifts in this perception from the tariff announcements expected next week. Economists predict an initially high headline figure, followed by a drawn-out implementation period, with the final tariff likely lower than the initial proposal—indicating that negotiation is an integral part of the process. While markets remain susceptible to negative surprises, the threshold for such an outcome next week is high, likely hinging more on the implementation timeline than the initial "sticker shock."

This is particularly relevant given ongoing concerns about the US growth outlook. In this context, Friday’s payroll data may play a more significant role in shaping the Dollar’s near-term trajectory than the tariff announcements, despite the latter’s potential structural importance. Over time, we believe a more hawkish trade agenda should benefit the Dollar, assuming other factors remain constant. Although concerns to the contrary have merit and the data is somewhat mixed, the balance of price action and surveys still supports this conclusion.

First, high-frequency price action consistently reflects the Dollar’s typical initial reaction to tariff headlines in both directions. Second, much of the Dollar’s decline this year can be attributed to the Euro, particularly following the German fiscal surprise—the broad Dollar index is up 2% compared to pre-election levels, even as the DXY remains flat. Third, other policy issues, such as DOGE-related shifts and potential moves toward greater fiscal restraint, have added to uncertainty and raised concerns over US growth. It’s common for tighter fiscal policies and idiosyncratic slowdown fears to weigh on the Dollar.

Recent weakness in consumer sentiment appears more aligned with these broader concerns than with tariffs. For instance, while half of the respondents in the University of Michigan survey cited government policy as a source of unfavorable business news, only 1% mentioned the trade deficit—down from 8% during 2018-2019. Instead, households expressed more anxiety about job security and major purchases. Supporting this, our non-manufacturing survey tracker has dropped by 3 points, while manufacturing surveys have shown net improvement—an unexpected pattern if tariffs were the primary driver.

Lastly, while European data has been more resilient than anticipated, this is not a universal trend. For example, Canadian business sentiment has plummeted to its lowest level in 25 years, as indicated by the CFIB survey, with our Canada CAI falling from over 2% in Q4 to -1%. These observations underscore the broader context for FX in 2025: tariff increases are not happening in isolation. So far, the cumulative effect of other measures has been predominantly negative for the Dollar.

JPY: A More Attractive Hedge. The evolving market response to tariffs in recent weeks has made tactical positioning for April 2 increasingly complex, particularly in FX. One key challenge lies in the uncertainty surrounding how the market might react to an aggressive tariff outcome—both in terms of scale and timeline. Specifically, the market could focus on the implications for US growth due to heightened uncertainty, as observed recently, or it may shift attention to dampened optimism elsewhere, such as in Europe. Additionally, given the heightened scrutiny on tariffs, any outcome short of immediate implementation could provide some relief.

Overall, markets appear more susceptible to downside surprises in the US outlook than to upside ones. This suggests that the upcoming slate of activity data next week (e.g., ISMs, jobless claims, NFP) could play a pivotal role in shaping tactical direction, particularly if the tariff developments are well-absorbed on the day. While confidence in the data outcomes remains low, the recent weakening in soft indicators and broadly declining sentiment increase the likelihood that hard data will follow suit. The recent miss in personal spending further supports this view and amplifies the probability that markets will perceive tariffs as a greater negative for the US given the softening economic outlook.

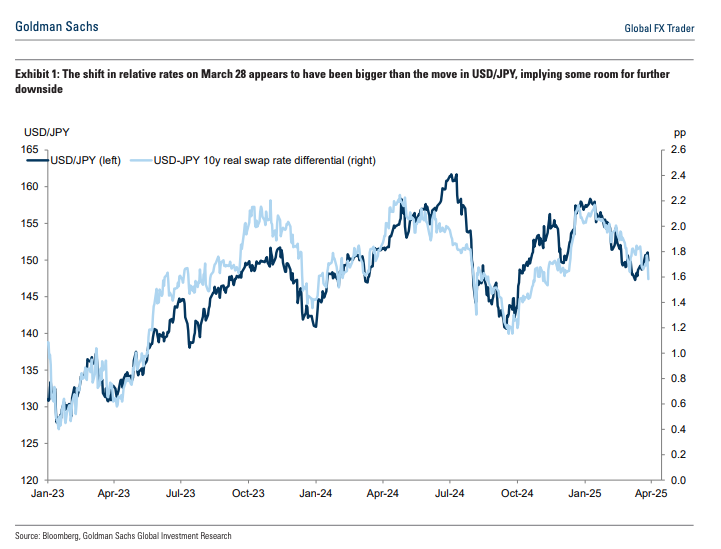

As a result, we maintain a bias toward lower longer-end yields and equities, while continuing to recommend our open trade to short AUD/JPY with a target of 90.5. The relative rate shift on March 28 also appears to have outpaced the movement in USD/JPY, suggesting additional room for downside (Exhibit 1). The primary risk to this trade would be stronger-than-expected US data next week, which could challenge the narrative of rising recession odds. However, current momentum and the balance of risks point in the opposite direction, making a long JPY position an increasingly appealing hedge for US equities—a more compelling strategy than it has been in quite some time.

GBP: Navigating Fiscal Challenges

The Spring Statement on Wednesday introduced a series of spending cut measures, updated OBR forecasts, and UK borrowing projections that largely aligned with expectations. While the Sterling held up relatively well during the announcement, we believe risks persist for renewed fiscal-driven downward pressure on the currency, akin to the episode in mid-January. Gilt yields remain near their January peaks, leaving Sterling exposed to a potential sharp sell-off in global duration. However, this vulnerability appears to be well understood by the markets. Given the government’s proactive approach to addressing fiscal concerns—evident in the Spring Statement and beyond—we anticipate that the UK and Sterling will manage to navigate the challenging fiscal landscape for now. We also view the prevailing bearish sentiment surrounding the Pound as overstated.

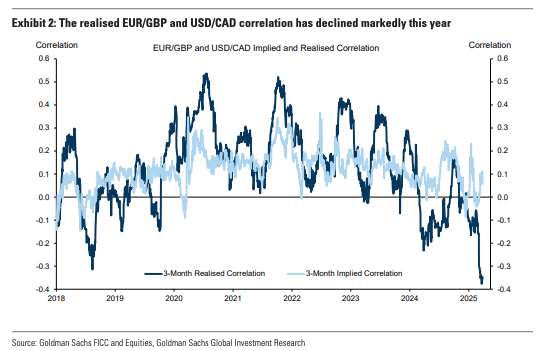

A key factor supporting our more optimistic outlook for Sterling is its relative strength when tariff risks are priced in. If the April 2nd tariff announcements align with our economists’ expectations, this could catalyze a tactical decline in EUR/GBP. Furthermore, Sterling’s resilience to tariff risks is evident in other areas of the FX market. The year-to-date realized correlation between EUR/GBP and tariff-sensitive Dollar pairs (e.g., USD/CAD and USD/MXN) has significantly weakened. While other factors, such as the positive correlation between GBP and USD with US equities, may contribute to this trend, we believe Sterling’s muted reaction to tariff risks has been—and will continue to be—a crucial element.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!