Institutional Insights: Goldman Sachs - Global FX Trader 24/03/25

.jpeg)

USD: Diminished, Not Finished. Last week, we revised our Dollar forecasts downward but still anticipate some degree of Dollar strength from current levels. Two key factors support this view.

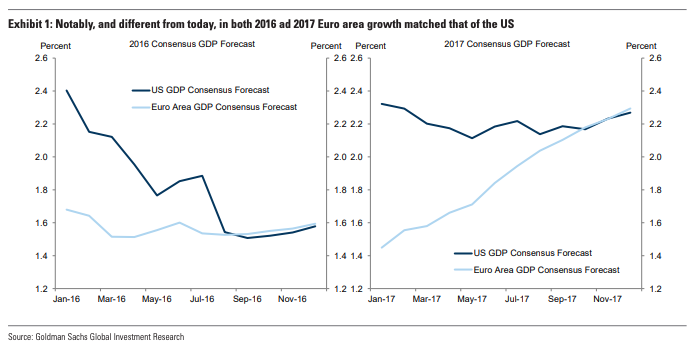

First, the market seems to have quickly adjusted to the shifting growth outlook, moving ahead of the forecast revisions our teams have made for 2025. In the Euro area, FX markets appear to be placing an unusual emphasis on long-term growth prospects. This is likely due to expectations that more balanced global growth could drive a shift in capital flows and trigger a significant FX movement, similar to what occurred in 2017. While some rotation has been observed, it has been relatively modest compared to the heightened investor interest. We believe it’s prudent to monitor this risk but note several critical differences between the current environment and 2017. Back then, the rebalancing flows followed a period of US growth underperformance in 2016 and a surprising surge in Euro area growth in 2017. Importantly, during those years, Euro area growth was on par with the US. This is not the case today. For 2025, while our US growth expectations have become more subdued, we still project US growth to more than double that of the Euro area. Although the US growth downgrade represents a significant shift in our outlook, we remain slightly below consensus for both the US and Euro area. Second, our economists lowered US growth forecasts primarily due to expectations of a more substantial rise in tariffs. However, we believe this development should still support the Dollar. Until very recently, market pricing has aligned more closely with a traditional slowdown narrative. There is clear evidence that shifts in U.S. policy have contributed to the decline in USD reserve holdings over the past decade. However, the strength of the Dollar indicates that private sector inflows have more than offset this trend so far. To address the recent outflows, tangible returns—not rhetoric—will ultimately determine the outcome.

EUR: April Showers. Investors are beginning to shift their focus toward the looming tariff risks expected in the coming weeks. Treasury Secretary Bessent announced that on April 2nd, countries will receive a single figure representing the U.S.'s effort to reciprocate for various tariff and non-tariff trade barriers. This figure is anticipated to prompt countries to offer concessions in hopes of negotiating the number downward. In addition, product-specific tariffs and new investigations are likely on the horizon.

Our economists project that the effective tariff rate could rise by approximately another 7 percentage points, adding to the 3 percentage point increase already seen, with risks leaning toward an even steeper climb. This baseline goes beyond merely equalizing tariff differentials but does not fully account for other non-tariff barriers highlighted by the administration, such as VAT and currency valuation concerns.

We expect the Euro to increasingly reflect these risks in the coming weeks, especially given a likely lull in fiscal catalysts—aside from next week’s PMI releases, which may offer early signs of optimism. While the extended implementation period for tariffs might initially provide markets with a sense of relief, we anticipate that tariffs will exert downward pressure on the Euro over time. This is due to the Eurozone economy's sensitivity to global trade and delayed fiscal support. Markets are also likely to begin assessing which portions of the tariff increases may prove harder to negotiate away.

As we’ve maintained, when tariff increases are tied to economic fundamentals or revenue generation, markets tend to view them as more enduring. We believe we are nearing that point. While there is a possibility that retaliation and relatively inelastic supply chains could weigh on the Dollar instead, this outcome would require extreme assumptions. For now, the typical market reaction to tariff-related developments remains clearly evident on a high-frequency basis.

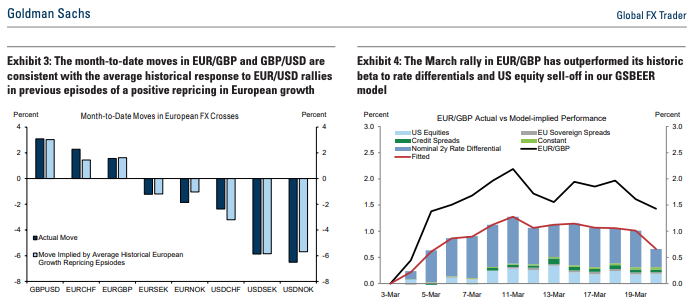

GBP: Riding the European Wave. Sterling has been performing in the middle range of the G10 currencies so far this month, largely mirroring broader trends within the European FX market. Historical patterns of European growth re-ratings suggest that recent movements in GBP/USD and EUR/GBP align closely with expectations based on past performance relative to the EUR/USD rally (Exhibit 3). However, EUR/GBP has slightly outperformed compared to the move implied by our GSBEER model (Exhibit 4). While Euro price action remains the primary driver for Sterling, we see limited justification for further EUR/GBP upside based solely on the positive European growth news already priced in.

Domestically, attention will shift to the UK’s fiscal event this Wednesday (26th). Our economists anticipate sustained fiscal pressures over the long term, with Chancellor Reeves expected to focus on welfare spending cuts and fiscal consolidation rather than introducing expansionary measures. This approach suggests relatively modest downside risks for Sterling this week. Looking ahead, we believe Sterling has opportunities to distinguish itself from its European counterparts. Its relative resilience to US tariffs, particularly as the April 2nd tariff deadline approaches, is a key advantage. While Sterling may face challenges in the near term due to limited relief on the broader cyclical outlook and risk pricing, a potential easing of US growth concerns could exert downward pressure on EUR/GBP.

On the domestic front, incoming data remains mixed, but the Bank of England has responded to global and domestic uncertainties with a cautious yet relatively hawkish 8-1 hold at its recent meeting. Overall, we maintain a constructive outlook on Sterling, though European and US growth dynamics will likely continue to dominate movements in EUR/GBP and GBP/USD in the coming weeks. Reflecting the recent shifts in the European FX market driven by fiscal and growth re-ratings, we have revised our 3-, 6-, and 12-month GBP/USD forecasts to 1.29, 1.26, and 1.24 (from 1.26, 1.26, and 1.22 previously). Similarly, we have adjusted our EUR/GBP forecasts to 0.83, 0.82, and 0.82.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!