Institutional insights: Goldman Sachs FX Morning Notes

GS FX Morning Notes: Was It All a Bad Dream? Not Quite.

Research | Economics | JUST NOW

Tariff Court Ruling:

The recent ruling by the Court of International Trade to block the majority of tariff hikes is significant for FX markets in three key ways:

1. Inflationary Impact: The decision blocks 6.7 percentage points of tariff increases introduced this year, which will influence market perceptions regarding the overall inflationary effects of trade policy. This development could, in turn, have broader implications for the economy and U.S. assets.

2. Restoration of Confidence: The ruling is likely to restore some confidence in institutional checks and balances, reinforcing the strength of governance mechanisms.

3. Market Relief: While the decision is expected to provide relief across risk markets, U.S. equities, which have underperformed year-to-date, are showing relatively stronger potential gains, as indicated by futures. These factors should generally support the Dollar, particularly against safe-haven currencies like the Yen and Swiss Franc, though the impact may be less pronounced against risk-sensitive G9 and emerging market currencies, which could also benefit from the broader risk-on sentiment.

However, this is unlikely to mark the end of tariff policy. If the administration wins its appeal or pursues alternative legal avenues for tariff implementation, it could result in a more entrenched tariff agenda. As a result, the current relief may be short-lived, presenting two-sided risks for markets until the policy direction is fully clarified.

While the administration plans to appeal the ruling, this process will take time. Economists anticipate that the White House may respond by announcing a similar across-the-board tariff under Section 122. This would allow the administration to initiate a series of Section 301 cases against larger trading partners, potentially paving the way for tariffs exceeding 10% in some instances. Looking ahead, if the court ruling against IEEPA tariffs is upheld, smaller trading partners or countries with minimal trade surpluses may experience the most enduring relief.

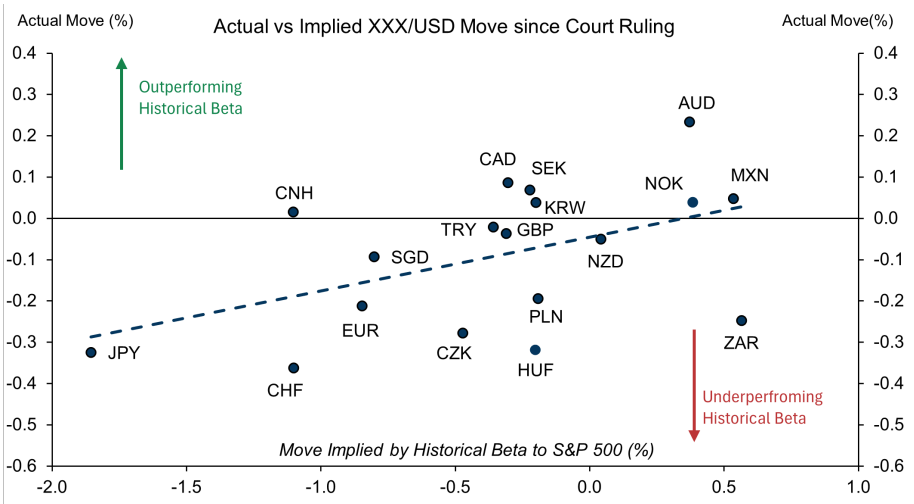

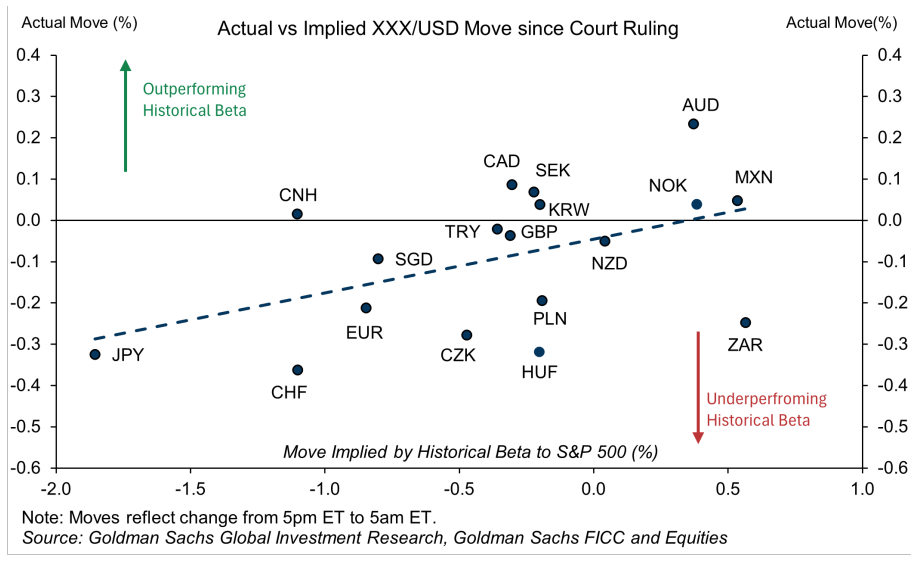

Chart of the Day:

Several key themes emerge from the FX market's immediate reaction to the court ruling:

1. Limited Dollar Reaction: Despite a notable rebound in U.S. equity futures (~+1.6% on S&P futures), the Dollar's response has been relatively muted, with the DXY index rising only ~+0.2% since the ruling. This combination of risk-on sentiment and modest Dollar strength aligns with the recent positive correlation between Dollar movements and global equities, insulating higher-beta Dollar pairs from significant reaction.

2. Euro Complex Underperformance: The Euro complex, including EUR, CHF, and CE3 currencies, has underperformed relative to their typical risk beta. This reflects the Euro and Swiss Franc's enhanced safe-haven characteristics in recent trading.

3. CNH and CAD Outperformance: The Chinese Yuan (CNH) and Canadian Dollar (CAD) have emerged as clear outperformers relative to their risk beta. This likely reflects the direct economic relief these currencies' domestic economies could experience from a potential suspension of existing U.S. tariffs.

In summary, the court ruling has provided some immediate relief to markets, but the broader implications for FX and trade policy remain uncertain, presenting risks and opportunities on both sides.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!