Institutional Insights: Goldman Sachs FX in Focus

.jpeg)

FX in Focus—Linking FX Performance and Flows

Most G10 currencies have outperformed their short-term fundamentals against the Dollar year-to-date, though the extent of this outperformance has become more varied recently. Regions actively reallocating away from the US, such as Europe, are experiencing the most pronounced effects on their currencies. This highlights the significant role portfolio flows have played in driving returns this year.

While flows are generally a supportive factor for FX returns rather than the primary driver, they have recently accounted for a larger share of EUR/USD outperformance compared to other cyclical factors. Traditionally, inflows into local currencies are viewed as strengthening them against the Dollar, but recent trends show that outflows from US assets are increasingly influencing these movements.

Following the notable Dollar depreciation, we anticipate a slowdown unless new catalysts emerge, such as earlier or deeper Federal Reserve rate cuts. Lower hedging costs in certain regions, like Japan, could shift the dynamics of the Dollar’s decline to areas that have not yet been significantly involved in reallocating investments. Additionally, we believe flows may contribute to realized FX volatility, which has recently eased alongside more stable US economic data.

Linking FX Performance and Flows

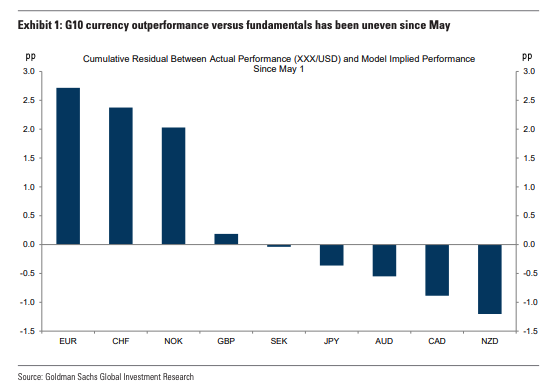

Year-to-date, most G10 currencies have outperformed their short-term fundamentals against the Dollar. However, the degree of outperformance has varied, with European currencies benefiting the most, while AUD, CAD, and NZD have lagged behind cyclical drivers (Exhibit 1). The performance trends in the first half of the year suggest that flows and carry considerations have been key contributors to currency returns.

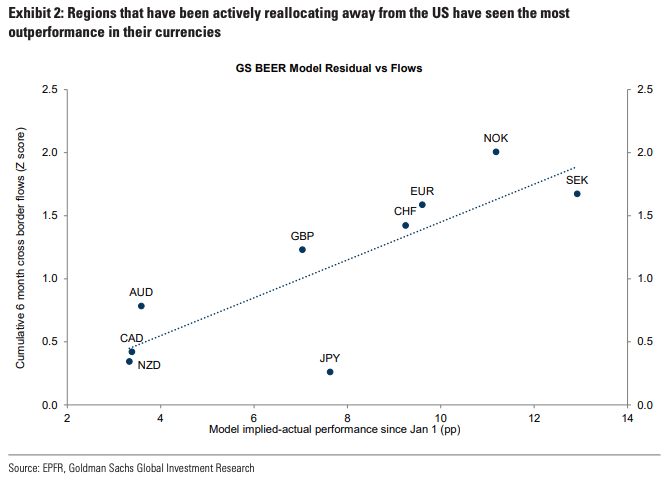

The Dollar has generally underperformed relative to our cyclical models, though this trend is not consistent across all regions. Excluding the period of market stress in April, patterns in cross-border flows provide insight into this discrepancy. Regions actively reallocating assets away from the US have experienced the strongest currency outperformance (Exhibit 2). In contrast, regions with more subdued repatriation activity have seen significantly weaker currency gains.

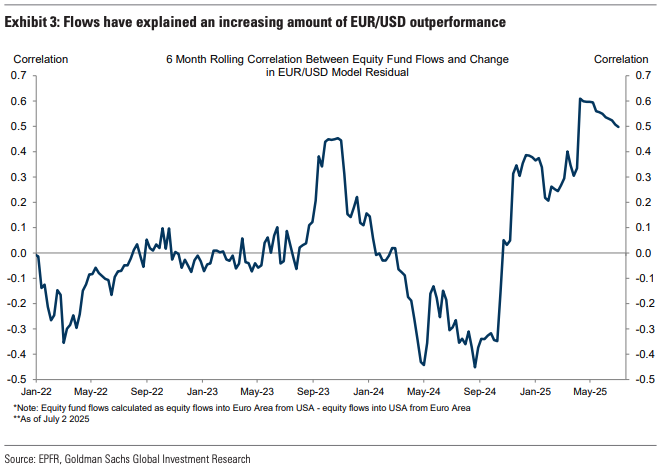

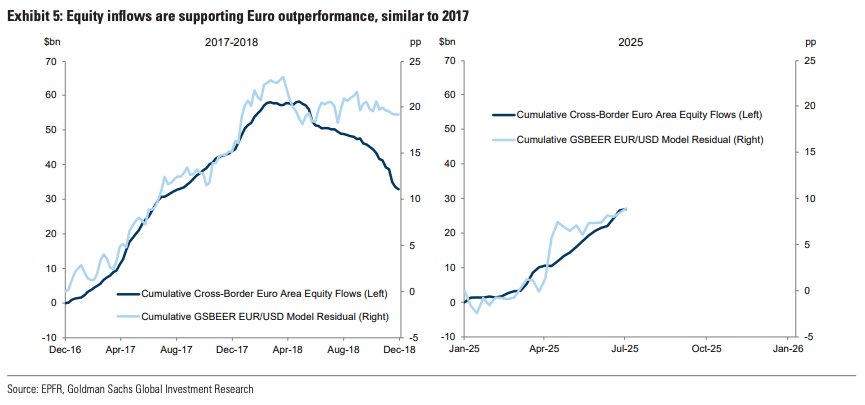

Portfolio flows have traditionally played a supportive role in driving FX returns, though not the primary factor. Historically, a portfolio inflow equivalent to 1% of total AUM has been associated with approximately a 0.3% appreciation against the Dollar, assuming other conditions remain constant. However, recent trends indicate that portfolio flows have gained prominence as a key driver of FX returns (Exhibit 3). Notably, cross-border equity fund flows now account for a growing portion of the divergence between actual EUR/USD performance and the returns predicted by our fundamental GSBEER model.

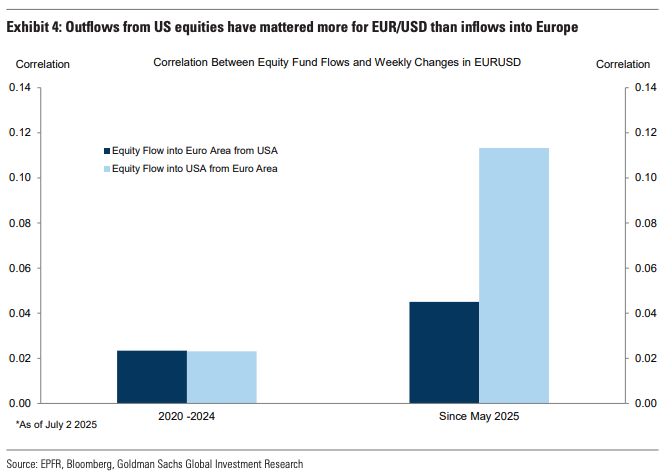

We often emphasize foreign portfolio inflows as a key driver of currency strength. For instance, when analyzing the impact of fund flows on EUR/USD, our models typically focus on U.S. investments in European equities. However, recent trends indicate that European divestment from U.S. assets has played a more significant role in influencing EUR/USD than U.S. inflows into European equities (Exhibit 4). Several factors contribute to this shift.

First, European outflows from U.S. equities have been unusually high, following a period of consistent buying throughout most of 2024. Second, while U.S. investments in the Euro area traditionally account for a larger portion of total flows into European equity funds compared to European investments in U.S. equities, this dynamic has recently changed, with European demand becoming increasingly prominent in total U.S. flows. Third, these outflows from U.S. equities may be linked to less visible factors, such as heightened FX hedging activity by European institutional investors, which can also influence currency markets. Lastly, evidence of repatriation flows suggests a potential shift in marginal allocation preferences for new investments. This shift can drive price changes even in the absence of direct fund flows.

Rate differentials have been a significant driver of EUR/USD strength in recent weeks, and we continue to believe that relative macroeconomic performance will be the key factor determining the Dollar’s trajectory. However, recent trends underscore the inherent instability of correlations between asset classes, which are highly context-dependent. Foreign exchange markets can occasionally diverge from other cyclical indicators, such as rate differentials, for extended periods—particularly during shifts in portfolio allocations. This phenomenon has occurred before, notably during the 2017 episode, which shares several similarities with the current environment.

Back in 2017, a notable depreciation of the Dollar sparked concerns about the U.S.’s “twin deficits” and broader themes like de-Dollarization. In retrospect, this period coincided with substantial inflows into the Eurozone, driven by more balanced global growth prospects—a more plausible explanation, as evidenced by subsequent price movements. While the underlying causes and initial conditions differ somewhat this time, early signs suggest that the recent divergence from rate differentials may be unfolding in a similar manner (Exhibit 5).

We believe the recent divergence between FX returns and our BEER models is temporary. Such dislocations often occur when other cyclical assets, such as interest rates, fail to fully reflect balance of payments pressures compared to flows. However, this relationship is expected to normalize over time. For now, flows—and the shifts in investor appetite they reveal—are likely to remain influential. After a significant adjustment, we anticipate the pace of Dollar depreciation to slow unless new catalysts emerge, such as earlier or more aggressive Fed rate cuts. This analysis highlights why such factors could be pivotal. For instance, lower hedging costs in certain regions, like Japan, might shift the Dollar’s decline toward markets that have yet to see substantial changes in investment allocations. Additionally, this research underscores that flows can introduce FX volatility not fully captured by models focused on inflation and monetary policy forecasts.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!