GS Tactical Flow-of-Funds: Year-End Rally 2.0

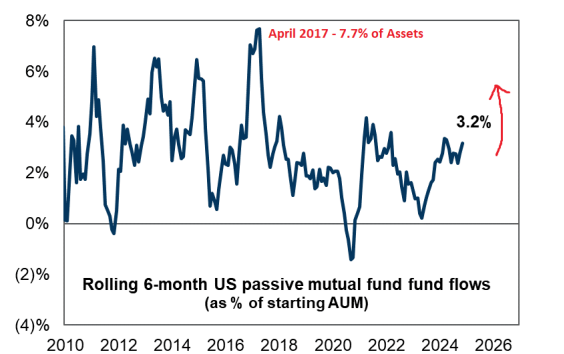

According to the Goldman Sachs flow guru Scott Rubner, his note on Wednesday was the most replied to email that he has sent in the last 20 plus years, and had a record number of incoming questions this weekend. The 2016 playbook was passive inflows into US equities were all the rage. US Equity flows saw sizeable inflows for 6 months until April 2017. The current rolling 6-month US passive flows are 3.2% of AUM. On $12 Trillion of assets, this could imply $540 Billion worth of post-election demand to match the 2016 pace. There has been >$12 Billion inflows EACH DAY for the past week. I haven’t seen these figures since 2016.

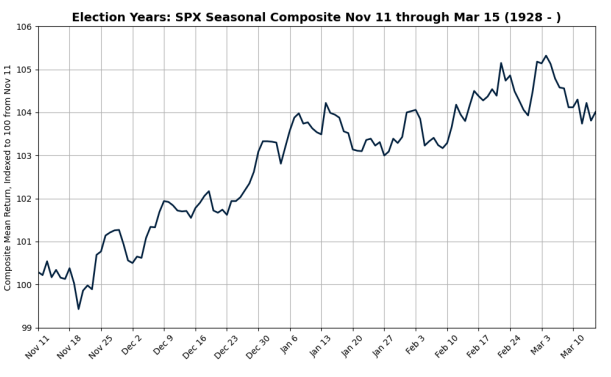

All the incoming questions had a similar tone: "How high can US equities go before 12/31/2024?" "Who has room to add length?" "Are you seeing high quality institutional buying - not covering?" etc. Investors were forced to take lower var into the event, and now, given the material reset in volatility, the green light has been turned on from risk managers. The consensus was correct. Buy orders were on the pads of global Wall Street traders looking for any weakness and have now gone to market. I am spending a TON of time on the #January Effect. January is the largest month of the year for inflows, and every PWM advisor is starting to make their year-end calls - think #Rotation nation. We started to see passive sector inflows this week. Seasonals do not fade post the election; the typical pattern is to rally into the Inauguration (1/20/2025) before topping out in February. I think we see $6300 by the end of the year and also a quick rally in early January. There are 34 days left to trade in 2024.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

-1731402867.jpeg)