Institutional insights: Goldman Sachs Chart of The Day

GS chart of the day :: negativity

FICC and Equities

bottom line ... if you're feeling bearish, you're in line with the consensus ... that doesn't necessarily mean you're incorrect, but you are with the majority

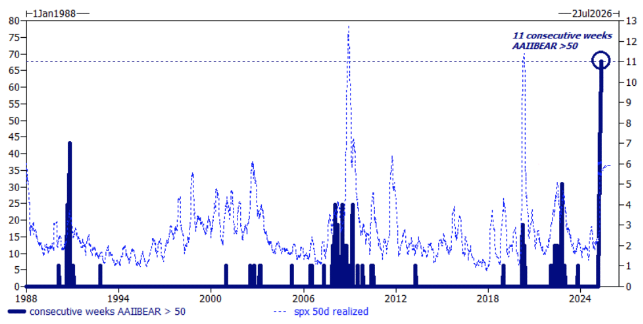

1/ the AAII survey has been conducted weekly since 1987

2/ investors can be classified as bullish, bearish, or neutral

3/ throughout the entire history of this survey, investors have *never* been this persistently bearish...

for 11 consecutive weeks, over 50% of respondents have expressed a negative outlook on the

market

4/ the previous record was 7 weeks in 1990 ... the maximum in 2008 was 4 ... and in 2022 it was 5

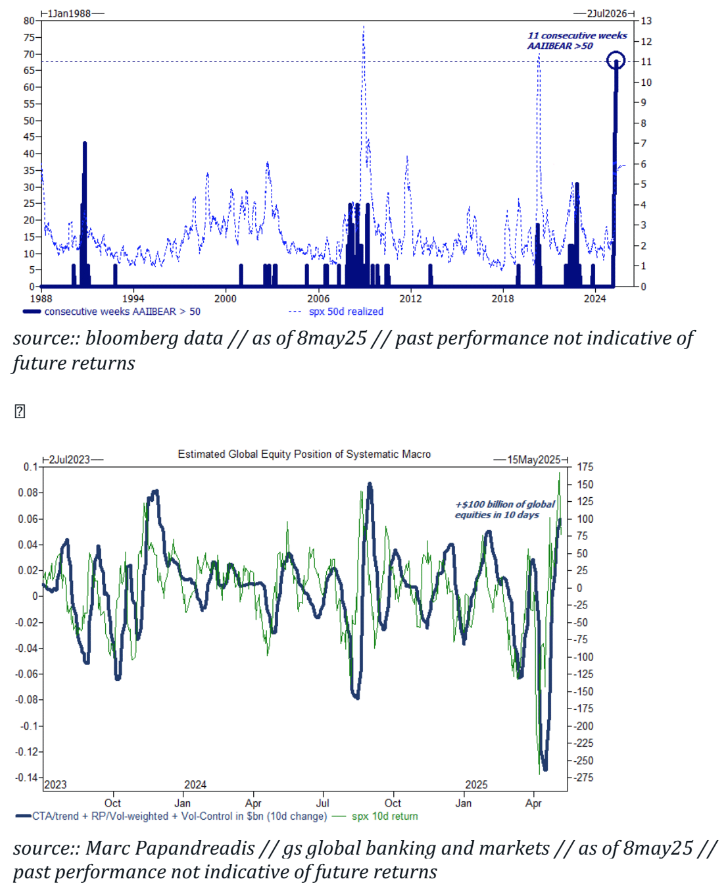

5/ A natural follow-up question is, "if everyone is bearish, who is buying?" ... the (un)natural response is a systematic community that has acquired approximately $100 billion in global equities over the last 10 days

... a significant sell-off will be harder to achieve if everyone is expecting it ... the 4700 - 5700 trading range is often cited (the fear of missing out is evident today as we approach the upper limit) ... despite the substantial rally, sentiment has yet to shift positively (that needs to take place for stocks to begin a sell-off)

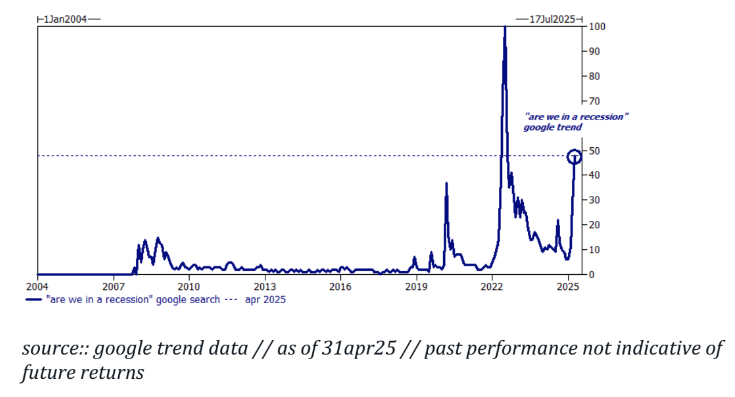

... bonus chart, "are we in a recession" google searches are at their second highest point ever (only surpassed by searches during actual recessions

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!