Institutional Insights: Goldman Sachs - Global FX Trader 28/7/25

Goldman Sachs Global FX Trader

USD: Pressures on the Dollar

The U.S. has announced a series of preliminary trade agreements that are likely to exert downward pressure on the Dollar over time. These deals align with economists’ expectations, featuring a reset higher in baseline tariff rates alongside reductions in key sector-specific tariffs. This trajectory is expected to keep the Dollar subdued by avoiding disruptive outcomes that might have triggered safe-haven flows and solidifying higher tariff rates, which could negatively impact U.S. terms of trade. As the baseline tariff shifts from being a temporary placeholder to the new norm, markets now have greater clarity on the local landing zone. These manageable yet significant tariff adjustments are likely to weigh on U.S. economic performance, reducing foreign investor appetite—compounded by this week’s uninspiring Fed developments—and thereby eroding the Dollar’s strength further.

Although the effective tariff rate changes have been relatively modest thus far, foreign producers in the auto sector have shouldered much of the burden, while industries with smaller passthrough effects are now beginning to feel the impact. From an FX perspective, the shifting tariff burden introduces dynamics that could drive further Dollar depreciation. Near-term catalysts include: (1) potential FOMC discussions next week that may keep a September rate cut in play, especially if labor market momentum concerns persist; (2) upcoming trade negotiations with China, which could maintain a strengthening bias in the CNY fix; and (3) risks of weaker-than-expected labor market data in Friday’s NFP report, following seasonal distortions in the prior payrolls report.

Taken together, we maintain a negative outlook on the Dollar and view EUR/JPY downside as an attractive hedge against near-term asymmetries. However, we anticipate less dramatic moves than those seen in April, given the narrower distribution of likely outcomes and the market’s ability to absorb escalations with major trading partners like the EU. Additionally, the U.S. economy has demonstrated greater resilience to higher tariff rates than previously expected, and the Dollar has already depreciated significantly.

JPY: Bullish Outlook Amid Tactical Risks

The Yen faces several potential catalysts in the week ahead, including the FOMC decision on Wednesday, the BoJ decision shortly thereafter, U.S. payrolls on Friday, and the August 1 trade deadline. While risks appear skewed toward renewed USD/JPY downside, we recommend caution before initiating fresh shorts due to three key factors:

1. Volatility Around BoJ Meetings: Over the past year, the Yen has experienced the largest volatility-adjusted moves around BoJ meetings. Any hawkish signal, such as an upgrade to the growth outlook or reduced caution on future rate hikes, could prompt significant reactions. However, there is no urgency for rate hikes, and markets have already priced in roughly 65% odds of an October hike, up from 40% earlier this week.

2. Benign Macro Backdrop: A relatively stable macro environment may slow USD/JPY downside compared to other currency pairs, particularly if incoming data push expectations for Fed rate cuts further out.

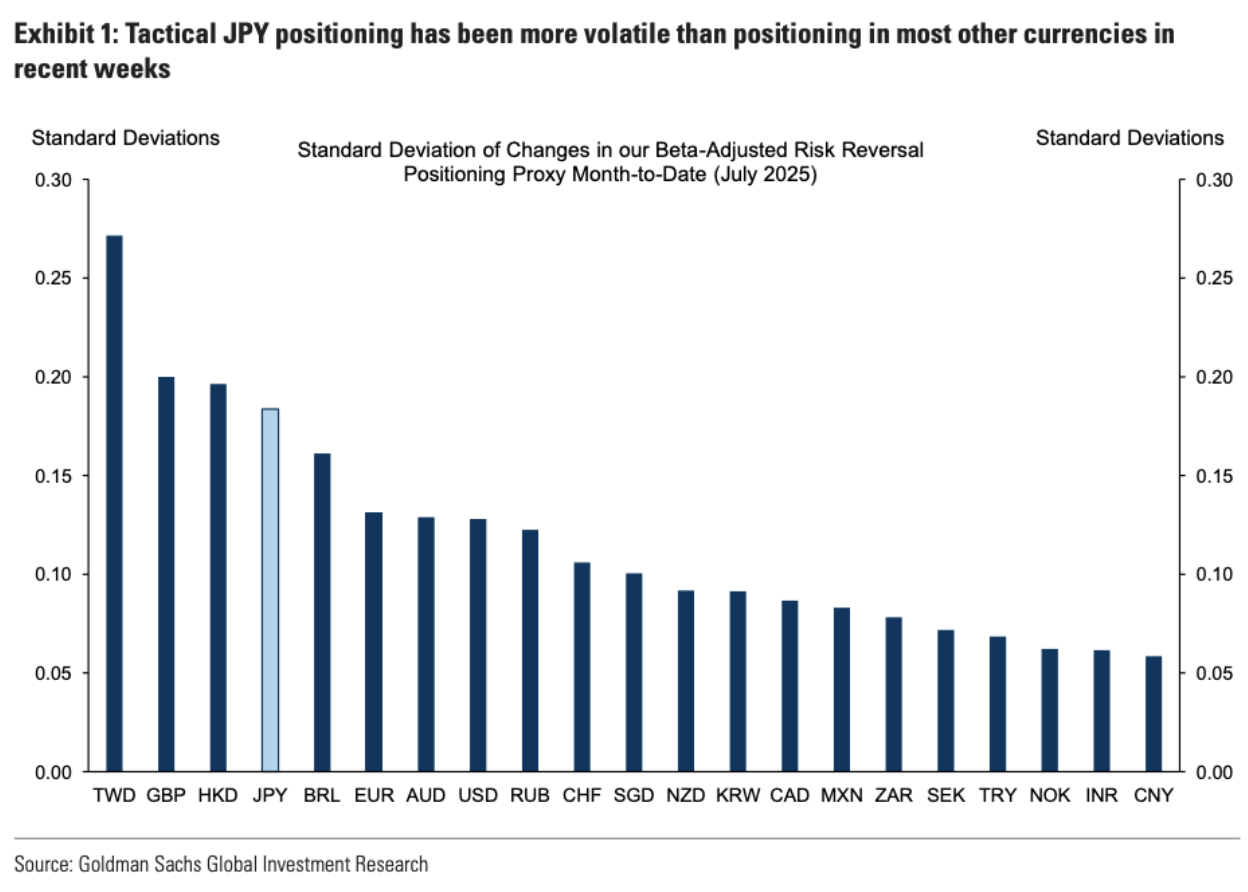

3. Neutral Tactical Positioning: JPY positioning has become more neutral following the Upper House election but remains volatile compared to other currencies. While election-related implications have diminished, tensions persist between the high cost of holding USD/JPY shorts and improving U.S. growth expectations versus downside risks that make long Yen positions fundamentally appealing.

We expect the Yen to strengthen over the coming months as macro conditions support additional Fed rate cuts. Near-term easing could gain traction as soon as next week, further bolstering JPY. However, the tactical backdrop for USD/JPY remains challenging, warranting caution on entry points. Negative growth data may trigger an initial reaction, but we believe this would mark the beginning of a longer-term trend for Yen appreciation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!