Institutional Insights Credit Agricole USDJPY

.jpeg)

Institutional Insights Credit Agricole USDJPY

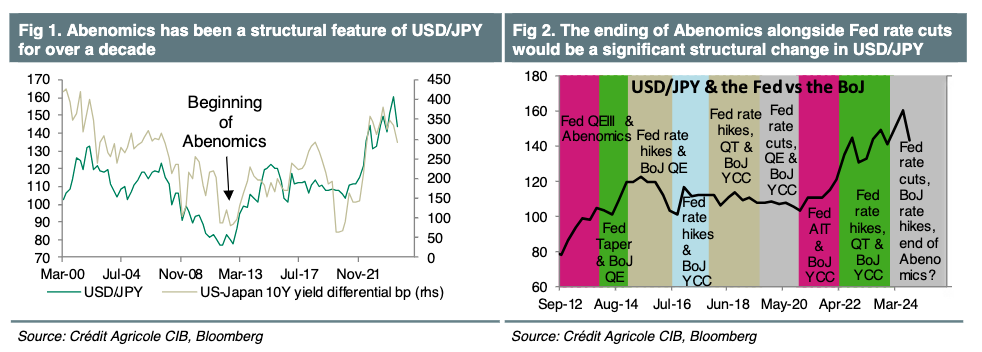

JPY: bye, bye Abenomics?

The surprise victory of Shigeru Ishiba in the LDP presidential election

raises the risk of a move away from Abenomics, which has been a source

of structural weakness in the JPY for over a decade.

It is debatable how quickly Ishiba will move away from Abenomics. He

prevailed in the LDP presidential election with support from members of

the “succession faction”, favouring sticking with former PM Fumio

Kishida’s New Capitalism. Ishiba’s new cabinet, including his Finance

Minister, Kato Katsunobu, suggests that he is not in a rush to dump

Abenomics.

Japan’s general election on 27 October will be an important gauge of

Ishiba’s ability to overcome LDP factional politics and move away from

Abenomics. A stronger-than-expected showing by the LDP would help

Ishiba solidify his power and potentially move away from Abenomics.

Our Japan economists expect temporary acceleration in the BoJ’s rate

normalisation cycle and forecast a 25bp rate hike by the BoJ in January

2025 before a long pause in rate hikes as the economy and inflation slow.

Simulating the impact of the end of Abenomics using our FAST FX model

shows that USD/JPY’s short-term fair value could fall to 139 from 146

currently, if investors’ expectations for steep Fed rate cuts are realised.

If Fed rate cuts are in line with those expected by our US economist and

so less aggressive, USD/JPY’s fair value still declines to 141.

Ishiba’s premiership is adding to the volatility in USD/JPY by introducing

the risk of a move away from Abenomics. Accordingly, we are lowering

our USD/JPY forecasts for end-2024 from 154 to 144 and for end-2025

from 140 to 138.

Given the closeness of the US presidential election, we are taking a

neutral view of the outcome in terms of our forecasts. We continue to

think a victory by former President Donald Trump would be a positive for

USD/JPY and a victory by Vice President Kamala Harris a negative for

the exchange rate.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!