Institutional Insights - Credit Agricole USD: 2025 not a 2018-Redux

Credit Agricole - USD: 2025 not a 2018-redux

Donald Trump’s victory at the 5 November US elections has revived the theme of USD exceptionalism. In particular, the mix of fiscal stimulus and trade tariffs that the President-elect wants to implement in 2025 could

both boost US economic outlook and hurt the growth prospects for its main trading partners. Recent client meetings have further suggested that most FX investors are using 2018 as a template for what is to come

in 2025. In particular, three tariff rounds by the first Trump administration in 2018 propelled the USD c.10% higher across the board with EUR/USD slumping from 1.25 in January to 1.10 in December of that year.

There are some important differences, however: (1) while the recovering US economy and accelerating inflation encouraged the Fed to hike rates by 125bp in 2018, both US growth and inflation are expected to slow down and result in more Fed cuts from here; (2) the mix of tariffs and fiscal stimulus that supported US growth and inflation as well as US rates and yields in 2018 could create stagflationary conditions in the US that

could complicate but not derail the Fed easing cycle in 2025; and (3) the USD is stronger now than in 2018 and this could limit the ability of central banks like the ECB to ease if EUR/USD were to slump closer to parity.

We conclude that while the Trump victory has added to the upside risks to our USD forecasts, a replay of 2018 seems unlikely. Consistent with that, the USD rally in FX spot has not yet led to greater interests for

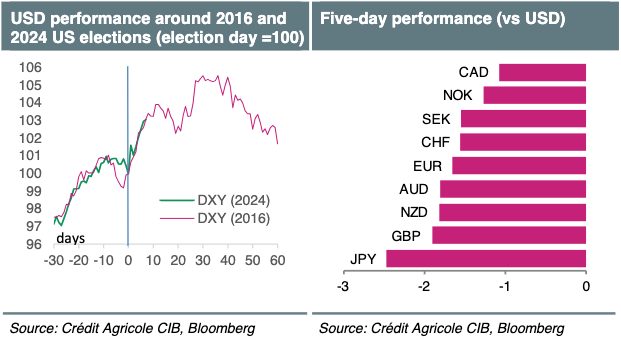

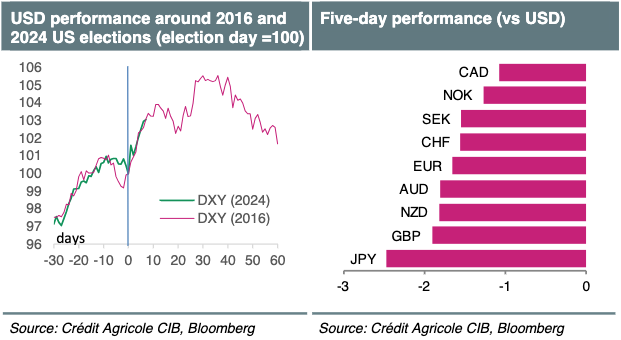

further upside in the option space, as shown by fairly balanced strikes in DTCC data and largely unchanged risk reversals across G10. We further note that the latest USD path is very similar to that after Trump’s

election win in 2016. To the extent that 2016 price action becomes a more dominant FX market template from here, we can conclude that many Trump-related positives are already in the price of the USD. We also note

that the USD is starting to look overvalued vs the EUR, AUD and CAD.

Looking ahead, the post-US election USD moves across the board will remain the main driver of the G10 FX price action in the near term. In addition, today's retail sales and IP figures should offer the first empirical

evidence on how well the US economy has held up this quarter. Next week, focus would be on the global PMIs for November, Eurozone wage growth and CPI data out of the UK and Canada.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!