USD: Trump 2.0 and Trump’s ‘impossible trinity’

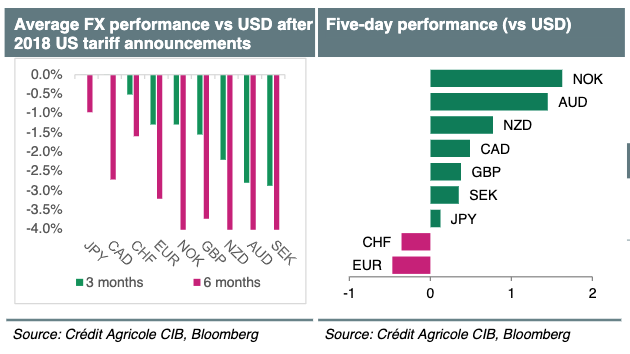

Ahead of Donald Trump’s second presidential term, we can draw several

lessons from his first term: (1) fiscal stimulus could increase the chances

of a soft landing in the US; and (2) trade tariffs could make US domestic

inflation stickier; resulting in (3) a less dovish Fed stance that could

burnish the rate appeal of the USD; while (4) efforts by US trade partners

to soften the blow from any trade tariffs to their economies with currency

depreciation could propel the USD higher across the board.

We also note that during his first term President Trump often resorted to

verbal interventions to halt the USD rally, presumably in response to the

competitive devaluation used by some US trade partners. His attempts

failed, however, because of what could be branded Trump’s ‘impossible

trinity’: (1) Trump’s weak-USD policy was seen as pro-inflationary; and

together with (2) a resilient US economy; it (3) forced the (independent)

Fed to turn more hawkish, in a boost to the USD.

We believe that the USD outlook could be shaped by the above drivers

but further note several important differences: (1) the US economy is

slowing and any tariffs could add to the downside risks to growth; (2) the

Fed’s easing will continue even if Trump’s policies render US inflation

stickier; while (3) the currencies of many US trading partners are much

weaker now and this could hinder any competitive devaluation.

We conclude that Trump’s ‘impossible trinity’ could work less well this

time around, allowing the US president to more effectively talk down the

USD. In all, we expect the USD to remain supported in the early stages of

Trump’s presidency but to lose ground in H225 as the US relative growth

advantage is gradually eroded and Fed cuts mount while Trump’s weak-

USD doctrine persists.

Focus next week will be on the October US CPI and retail sales as well

as Fedspeak as investors look for official ‘validation’ of the Trump trade.

The latest GDP and labour data out of the UK as well as ECB speakers,

the Eurozone GDP, German ZEW and Norwegian CPI could attract some

attention as well. Elsewhere, Australian labour market data will test the

RBA’s ability to remain hawkish. The weakening JPY has revived FX

intervention risks and is nudging the BoJ towards further rate hikes.

Japan GDP data will help determine how close another rate hike is.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!