Institutional Insights: Credit Agricole 'Gold: The Ultimate Safe Have & Our Forecasts'

Institutional Insights: Credit Agricole 'Gold: The Ultimate Safe Have & Our Updated Forecasts'

One notable characteristic of FX markets in 2025 has been the surge in gold prices across the board. Several factors are contributing to this: (1) gold has emerged as a critical hedge against currency devaluation amid persistent global inflation, extensive fiscal spending plans, and rising concerns over fiscal dominance in the US and Japan; (2) gold has regained its status as the ultimate hedge against risk aversion since traditional safe-haven fiat currencies have lost their luster; (3) historically, gold has performed well during periods marked by increasing geopolitical tensions and stagflation risks; and (4) it serves as a preferred diversification asset for emerging market central banks seeking to reduce their dependency on the USD and other developed-market fiat currencies.

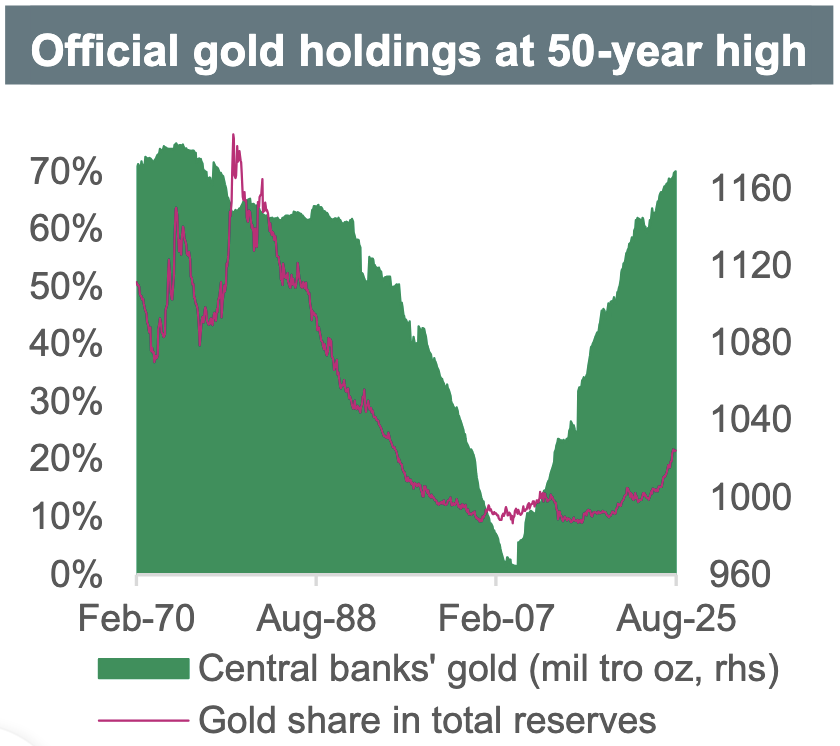

We are revising our gold forecast to reflect recent trends and believe that XAU may remain buoyant in the coming months due to ongoing political, fiscal, and stagflation risks, as well as the continuing easing cycle by the Fed. However, it is important to note that physical gold holdings by central banks are nearing record highs, a threshold reached just before the US terminated gold convertibility with the USD in 1973. Accordingly, we conclude that the outlook for XAU will increasingly hinge on the USD's trajectory and global real interest rates rather than solely on physical demand, leading us to anticipate that gold could peak in H126.

In the immediate future, G10 FX markets are likely to pay attention to (1) the developments concerning US regional banks; (2) the trade tensions between the US and China; (3) the political climates in the US, France, and Japan; and (4) efforts to conclude the war in Ukraine. The USD may not entirely capitalize on any additional spikes in risk aversion if investor sentiment becomes more dovish regarding the Fed.

Diminishing political risks in France and Europe could provide support for the EUR. Meanwhile, the ongoing endeavors by Japanese parties to establish a coalition government may be crucial for the near-term outlook for the JPY.

Next week, FX investors will also keep an eye on the US CPI, October PMIs, and University of Michigan sentiment in anticipation of the October Fed meeting. The USD might remain susceptible against other safe havens if new US data, along with concerns surrounding US regional banks and a potential government shutdown, sustain expectations for aggressive Fed rate reductions.

Elsewhere, the spotlight will be on UK retail sales, PMIs, CPI, along with Japanese CPI, Eurozone PMIs, and speeches from ECB officials.

We maintain a neutral stance on EUR/USD for Q4 2025, given that many positive factors for the Euro and negative factors for the Dollar are already reflected in current pricing. A potential short-term upside for EUR/USD could arise from President Trump's ongoing challenges to Fed independence and the persistent U.S. government shutdown. We also observe that fears regarding U.S. external imbalances have eased with unprecedented foreign capital inflows into U.S. markets.

However, we are cautious about potential political risks in France emerging in late 2025, which might hinder the Euro's performance against the Dollar. We predict a weakening of the Euro against the Dollar throughout 2026.

The Dollar has recently stabilized due to worries about aggressive portfolio outflows from U.S. markets diminishing and concerns over its reserve currency status fading. Despite some near-term negatives for the Dollar, such as the ongoing Fed easing cycle and concerns about fiscal dominance affecting Fed policy, we anticipate a rebound in the next 6-12 months. This is driven by an improving economic outlook in the U.S. and persistent inflation, which could enhance the Dollar's appeal in contrast to the prevailing dovish Fed market sentiment. Additionally, the Dollar's dominance as the premier reserve currency remains unchallenged.

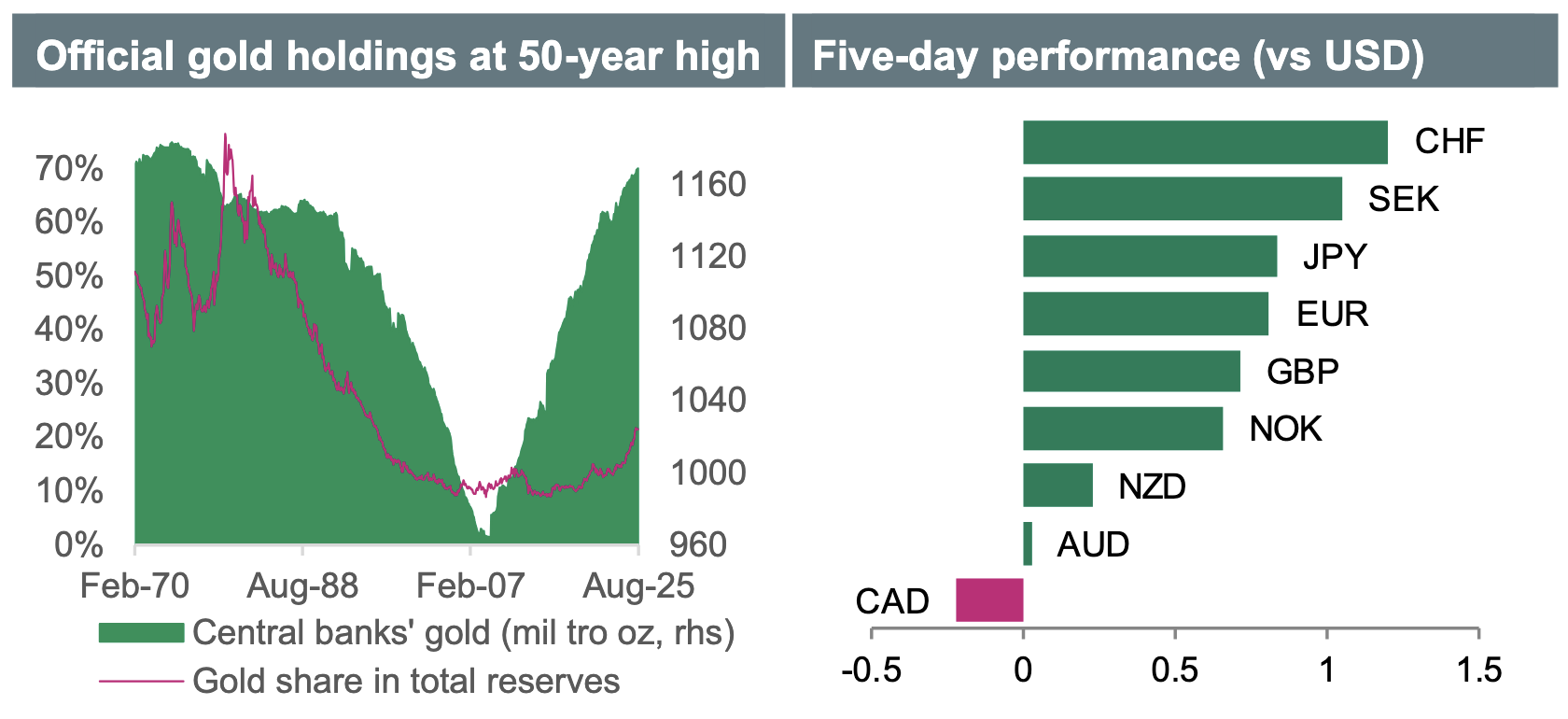

The uncertainties surrounding tariffs have increased demand for safe-haven currencies like the Swiss Franc (CHF), even against the recovering Euro. We expect EUR/CHF to rise throughout the year as the return of a zero interest rate policy in Switzerland may make the CHF an attractive funding currency, although lower inflation differentials might limit real valuation increases.

We anticipate that LDP President Sanae Takaichi will become Japan’s next Prime Minister, potentially placing downward pressure on the Japanese Yen (JPY) due to her reluctance to implement Bank of Japan (BoJ) rate hikes, increased fiscal spending that could bolster the Nikkei, and concerns about Japan's fiscal sustainability. However, rising inflation remains a priority for Takaichi, particularly if linked to a weak Yen. The BoJ’s target range for USD/JPY is considered to be 145-155, with anything above 155 likely accelerating rate normalization in Japan. Meanwhile, the JPY stands as a solid hedge against possible stagflation.

Our outlook for the British Pound (GBP) is neutral to slightly optimistic due to conflicting factors: the possibility of stringent fiscal austerity measures in November that could negatively impact the economy, and the decreasing risks of stagflation encouraging the Bank of England (BoE) to support economic recovery. We believe many potential negative factors are already accounted for in the GBP exchange rate and do not foresee escalating concerns regarding the UK’s fiscal health impacting its creditworthiness. We expect the BoE to initiate rate cuts in 2026, which should allow the GBP to regain some value against the Euro and the Dollar in Q4 2025, and to outperform the Euro in 2026.

The less friendly relationship between the U.S. and Canada may have affected the Canadian Dollar (CAD) during the latter half of summer, compounded by expectations of additional BoC easing following disappointing jobs reports. Consequently, USD/CAD is likely to remain closer to 1.40 than 1.35 for the time being.

Concerns about U.S. tariffs and a global trade conflict seem to have peaked. A more focused trade dispute between the U.S. and China, rather than a broad global conflict, could be slightly less detrimental for the Australian Dollar (AUD), which remains closely tied to the Chinese Yuan (CNY). Australia’s bond market is overly prepared for interest rate cuts, yet the tight labor market is producing solid inflationary pressure, further supported by increased government spending post-election.

New Zealand's economy is feeling the effects of U.S. President Trump's tariffs, but we remain optimistic due to business surveys indicating recovery, particularly following a trade agreement with a 15% tariff rate. New Zealand’s construction sector is also showing signs of revival thanks to RBNZ interest rate cuts, while dairy farmers are benefiting from near-record payouts which may encourage increased consumer spending.

Gold prices are likely to remain buoyed by ongoing market concerns that increased government borrowing and persistent inflation in G10 countries could complicate efforts to sell off growing public debt. Fears surrounding fiscal influence over the Fed may exert further downward pressure on U.S. real yields, providing additional support for gold. A significant rebound in the U.S. economic outlook or rising real interest rates would be required to undermine gold’s strength going into 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!