Institutional Insights: Credit Agricole FX Weekly 29/11/24

Upgrading our USD outlook

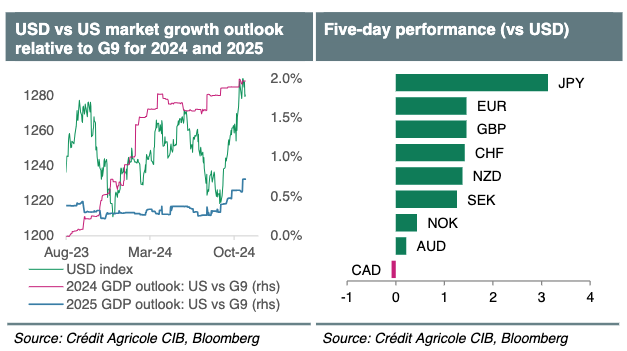

We upgrade our USD outlook in the wake of the November US elections. Trade tariffs and fiscal stimulus during President-elect Donald Trump’s second term could give US growth and inflation a modest boost and cut

short the Fed easing cycle. Many positives are already in the USD price and it should remain close to but not exceed recent highs on a sustained basis in 2025. A return of Trump’s ‘Weak USD Doctrine’ and market fears

about fiscal dominance in the US could further weigh on the USD in 2026.

The EUR could remain pressured by economic weakness, political and geopolitical risks in Europe as well as US tariff angst and ECB rate cuts. Many negatives seem to be in its price and the oversold and undervalued

EUR/USD could stabilise close to recent lows in 2025 and recover toward 1.10 in the longer run. The GBP could continue to trade as the EUR’s high-yielding, safe-haven proxy and outperform it from here.

The grinding lower of the US-Japan rates spread as the Fed cuts and the BoJ hikes rates while USD/JPY’s vol remains elevated will reduce its carry attractiveness and drag the exchange rate lower. It will be a bumpy

ride, however. While the threat of China tariffs will weigh on the AUD and NZD in 2025, their rate spreads with the USD should not. The RBA should continue holding off cutting rates potentially missing this rate cutting

cycle altogether. The RBNZ is expected to match Fed rate cuts. Stronger global growth should see the AUD and NZD recover in 2026.

Prospects of returning near-zero rates and overvaluation make the CHF our favourite funding currency, although near-term political/geopolitical uncertainties could prop it up for a bit longer than thought initially. We

expect a more modest recovery for Scandies that should still outperform the EUR thanks to a less depressed regional outlook, with our preference still going to the NOK. The CAD should be able to hold up vs the USD, as

long as Canada’s trade ties with the US do not face increasing hardships.

Focus next week will be on the November Non-Farm Payrolls, ISMs and the University of Michigan Consumer confidence as investors start to position ahead of the December Fed meeting. Many Fed-related positives are already in the price of the USD, however, and it would take positive labour market surprises in particular to give the currency a boost. Elsewhere, focus would also be on Canadian labour data, the final global PMIs and Swiss CPI for November.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!