Institutional Insights - Credit Agricole FX Weekly

Cherry picking turning sour?

Investors have been ebullient post President-elect Donald Trump’s victory and the Republican red wave in US Congress. They appear to be cherry picking what they like about Trump’s agenda, however, choosing

to focus on his pledges of deregulation and tax cuts and ignoring his protectionist and anti-immigration agenda that threatens to curb growth and add to inflation.

The VIX and MOVE indexes of US equity and rates market volatility as well as average G10 FX volatility have headed lower. Investors are either discounting the policy uncertainty under Trump 2.0 or not even trying to price it. But, as the escalation in the Russia-Ukraine war showed this week, there are still significant geopolitical risks out there that can lead to higher asset market volatility to the benefit of the CHF and JPY.

Investors will continue watching this front as both sides in the conflict rush to make territorial gains ahead of Trump’s inauguration.

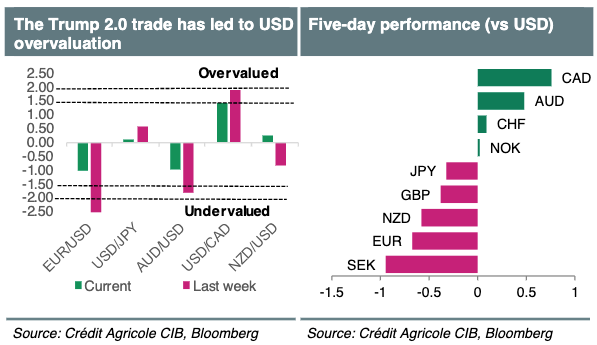

Investors’ attitude towards Trump 2.0 led to the USD becoming significantly overvalued in three out of the five USD crosses covered by our FAST FX model last week. While the USD has come back to Earth a bit this week and is no longer significantly overvalued, it is still looking expensive against the EUR, AUD and CAD, according to a preliminary update of our FAST FX model. The final update will occur at the New York close later today.

The coming week will see investors focus on US consumer confidence and core PCE inflation data. With investors still uncertain about a Fed rate cut in December, the data will be important for the USD. Investors are also anxiously awaiting Trump’s pick for his Treasury Secretary. While the pick will signal the President-elect’s aggressiveness towards pursuing tax cuts and tariff hikes, investors should also pay attention to the nominee’s attitude towards the USD.

While the RBNZ will likely cut rates by 50bp next week, signs of a bounce in the economy as well as resilient core inflation risk the central bank disappointing doves with its OCR forecasts. Australian monthly trimmed-mean inflation risks reinforcing the RBA’s hawkish bent. It remains to be seen whether evidence that Eurozone inflation and the German ifo consolidated in November would help calm the perfect storm of tariff angst and geopolitical risks that has recently engulfed the EUR.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!