Institutional Insights: Credit Agricole EUR/USD: still negative but not as bearish as before

Institutional Insights: Credit Agricole EUR/USD: still negative but not as bearish as before

We maintain our negative EUR/USD outlook from current levels but we tone down the bearishness of our 3M and 6M forecasts. This is because: 1. We now see a growing risk of a more front-loaded Fed easing cycle than before that could erode the (real) rate appeal of the USD. That being said, we doubt that the Fed would meet the current aggressive market rate cut expectations and therefore continue to see the USD recovering from current levels if not as aggressively as before in the next three to six months. 2. The US presidential election could be a closer race than suggested by the polls at present. We further continue to believe that Donald Trump has a chance of winning and expect this to boost the USD in Q424. That being said, the prospect for a Republican sweep of US Congress and therefore the chances for a strong USD rally have now faded in our view. 3. Market fears about potential political turmoil in France have now eased and could relegate sovereign debt risks to a secondary EUR/USD driver. This should reduce but not completely remove the downside risks to the EUR outlook in the coming months and quarters. With the above in mind, we now expect EUR/USD to trade close to 1.08 in Q424 and Q125 vs 1.05 and 1.07 before, respectively. Further out, we expect that the combination of a relatively more aggressive Fed easing amidst a worsening US economic outlook and a softer inflation outlook to push the USD lower still, with EUR/USD revisiting 1.12 by Q425.

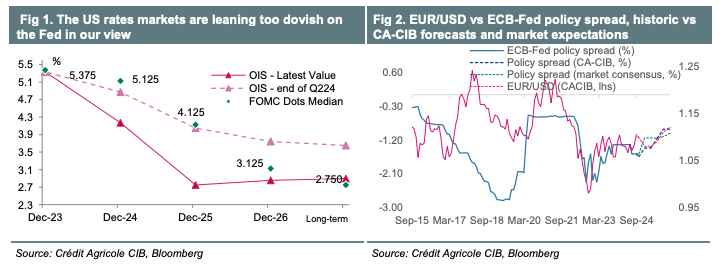

Relative ECB-Fed rate outlook still key At the start of 2024, we based our bearish EUR/USD outlook on the expectation that the ECB would ‘out-dove’ the Fed. We continue to expect the ECB to deliver a total of three rate cuts this year and to follow these by another three rate cut in 2025. We now see a risk of a more frontloaded Fed easing cycle, however, with the FOMC responding to the latest softening of the US labour market outlook by delivering three 25bp cuts in 2024 rather than the two cuts expected before. We still expect the Fed to push policy rates to 3.5% in 2025. Our current Fed forecast still implies a less dovish policy stance than expected by US rates investors at present. In particular, US rates markets are pricing in four rate cuts this year and another five rate cuts next year. While recent Fedspeak seems to suggest that the FOMC would revise down its dot plot next week, we doubt that the Fed would meet the current aggressively dovish market rate cut expectations (Figure 1). It is also worth highlighting that the Eurozone rates markets are only slightly more dovish on the ECB than us. The current rate market views suggest a more aggressive convergence between the Fed and the ECB relative policy outlook in the next three to six months than implied by our own forecasts (Figure 2). We should also mention, however, that the current rate market expectations also imply a less aggressive convergence in the next six to twelve months than we expect. Based on that, we continue to see the risks for EUR/USD as tilted to the downside this year and early next year. At the same time, we maintain our more constructive outlook on EUR/USD for H225 (Figure 2)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!