Institutional Insights: Citi Equity Markets Positioning Model

CITI Equity Markets Positioning Model

The US-Europe Positioning Gap Widens

CITI'S TAKEThe gap between net positioning on US versus European markets continuesto widen and this effect is observed both in futures and ETF markets. S&P positioning is setting new highs for a fourth consecutive week andincreasingly the hold-out shorts are capitulating. In contrast, investorsremain bearish Eurostoxx while ETF outflows are accelerating. Recent newflow on French politics is unlikely to change the status quo.

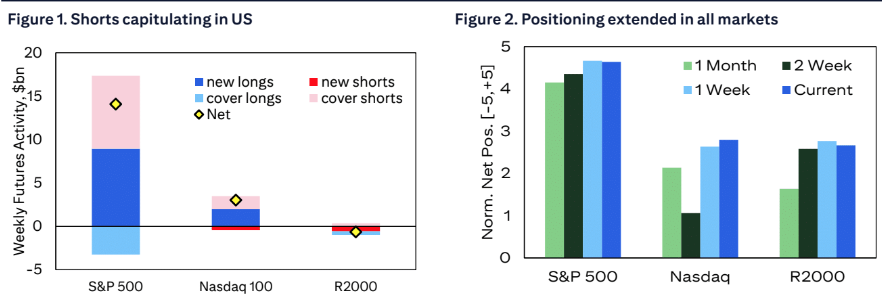

US Equities —S&P futures positioning is completely one-sided +4.6 normalised.Continued inflows of new longs chasing the rally means average profits are still onlymoderate. The three US markets are now the most extended bullish in the report aswell as carrying the most profits. As we stated last week, contrarians are not being rewarded.

Europe Equities —Eurostoxx positioning remains net bearish and roughlyunchanged over the past two weeks. However, as the sell-off has been modest, the carried losses are not currently posing a threat of forced unwinds.

Asia Equities —For the Hang Seng and A50 indices, both longs and shorts are moderately in loss. Net positioning remains moderately bullish and has turnedincreasingly so in the past week as flow momentum turned positive towards thelatter half of the week. Meanwhile, Nikkei's positioning continues to trend towards neutrality.

Dollar net positioning continues to set new highs indicating continued flow momentum chasing the ongoing rally in S&P. In the past week the bullish flows were evenly split between new long risk flows and capitulation of existing short positions, and a similar pattern was seen in Nasdaq. The US equity markets are now the top three most extended markets. However, the gradual build-up of positioning means that average profit levels are still modest. The exception here is Russell 2000 where shorts are 5% in loss and at risk of a short squeeze.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!