Institutional Insights: BofA Sell Side Indicator 04/02/25

.jpeg)

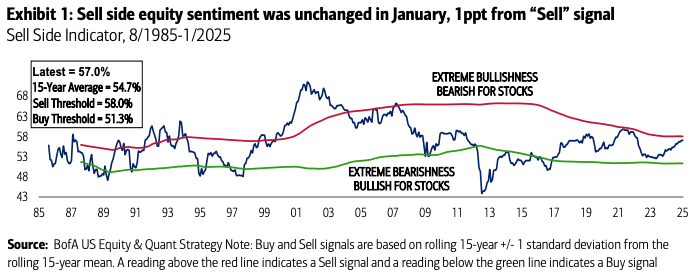

Sell Side Indicator — The bulls press pause

Equity sentiment remains stable but bullish, reaching a three-year high. The Sell Side Indicator (SSI) reveals a recommended equity allocation of 57.0% in January, marking its highest level since early 2022. The past year witnessed a 2.6 percentage point increase in the SSI, indicating caution amidst escalating trade tensions and policy risks.

While Wall Street remained cautious, with equity allocations unchanged amid a 2.8% gain in the S&P 500 last month, the SSI is merely 1 percentage point away from signalling a "Sell" sentiment, nearing the closest point since December 2021. This proximity to a potential shift in sentiment underscores the need for vigilance in a crowded market.

Historically, when the SSI levels have been high, the S&P 500's near-term total returns have been positive less frequently, suggesting potential market challenges ahead. Despite this caution, the estimated price return over the next twelve months stands at 10.5%, signalling opportunities for selective stock purchases rather than broad index investments in 2025.

Furthermore, corporate sentiment, as indicated by S&P 500 earnings transcripts, hit a record high in the fourth quarter, boding well for future EPS growth. However, the looming threat of Trump's tariffs, including those on Mexico, Canada, and China, could dampen market enthusiasm and potentially impact S&P 500 EPS negatively by up to 8% if implemented.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!