Institutional Insights: BofA FX Quant Insight Month-end USD retracement

.jpeg)

FX Quant Insight Month-end USD retracement

Key Takeaways:

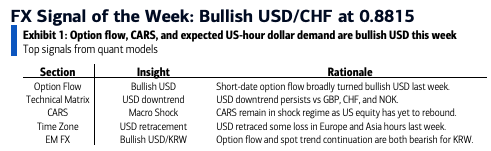

- Option flow and CARS models indicate a bullish outlook for the USD, with time zone dynamics suggesting further USD upside during US trading hours this week due to month-end rebalancing activities.

- USD retracement is more probable against European currencies. A 2-week EURUSD put spread is currently in place to capitalize on this expectation.

- Quant models also favor a bullish USD/CHF view, as the USD downtrend has struggled to break below the 200-day SMA, prompting bears to unwind positions or short puts.

Tactically Bullish USD on Month-End Retracement

Quantitative models broadly support a bullish stance on the USD this week. Recent option flow data highlights increased demand for USD calls, particularly against Asian and European currencies. The CARS model continues to signal a bullish USD macro shock regime, bolstered by the lack of a significant rebound in US equities last week. Time zone analysis reveals that the USD has retraced some of its month-to-date losses during European and Asian trading hours. Looking ahead, further retracement is anticipated during US trading hours as equity investors engage in month-end portfolio rebalancing activities.

Expectations for USD Retracement Against European Currencies

March's global FX outperformance has been concentrated in European currencies, making them likely candidates for USD retracement during month-end adjustments. Even if risk sentiment improves leading up to April 2, lagging high-beta currencies like the AUD and CAD are expected to experience more favorable price actions. A tactical position in a 2-week EURUSD put spread (entered at 31.5 pips, now at 45 pips) has been established to hedge against potential risk premium increases ahead of the April 2 US tariffs announcement.

From a quantitative perspective, the bearish view on CHF persists, with expectations of USD gains against CHF this week. The USD/CHF spot price has failed to break below the 200-day SMA at 0.8813, discouraging bears and prompting the unwinding of USD short positions. Spot trend analysis suggests that the current level is providing strong support, while marginal option flow data indicates modest shorting of USD/CHF puts last week as the spot downtrend encountered resistance at the 200-day SMA.

Risks to the Bullish USD View

The primary risk to this bullish USD outlook is the potential for weak US economic data, which could trigger increased structural supply of the USD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!