Institutional Insights: BNPP FX vol: Options volumes are a leading indicator

.jpeg)

BNPP FX vol: Options volumes are a leading indicator

KEY MESSAGES Large overall option volume in FX may signify that investors anticipate a depreciation of a currency against the USD, particularly in USDJPY. The net vanilla option volumes (total call minus total put) serve as a more reliable indicator of the returns for currency pairs, especially in USDCHF, GBPUSD, EURUSD, and USDCAD. Additionally, we observe that for the majority of currency pairs, shorter-tenor options (with expiries under 1 month) tend to provide more accurate signals. These shorter-tenor options encompass greater directional insights compared to longer-tenor options, indicating that they more accurately reflect investor expectations regarding future spot performance.

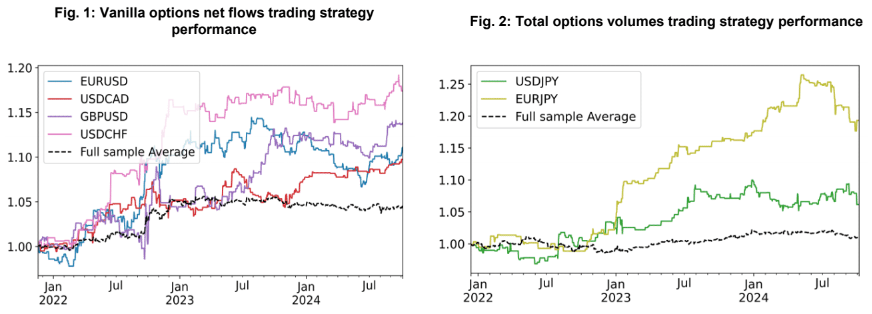

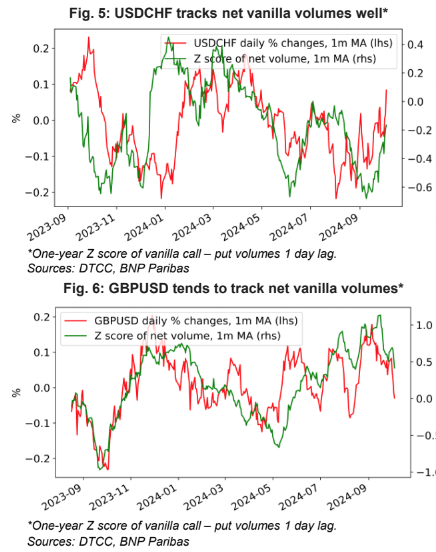

The data from DTCC regarding options has predictive potential. The idea of generating alpha by monitoring FX options volumes was initially pointed out in the Bank of England's Staff Working Paper No. 964, published in March 2022. In this analysis, we broaden the examination of FX option volumes and demonstrate that both directional volumes and total volumes possess predictive capabilities. Our findings indicate that net flows from vanilla options (the difference between total daily calls and total daily puts) with a maturity of less than 1 month can provide reliable signals for next-day spot movements in USDCHF, USDCAD, GBPUSD, and EURUSD (see Fig. 1). For USDJPY and EURJPY, the behavior of the spot market is more effectively explained by overall option volumes (see Fig. 2). Elevated readings suggest that the currency pairs are likely to move upwards, while low volumes generally indicate a downward trend. These patterns are most applicable on days when spot price movements fall within standard ranges. However, external factors, like the recent LDP election outcomes in Japan, can alter the cause and effect, potentially leading to situations where significant spot movements influence subsequent options flows. Consequently, we believe that the options flows reported to DTCC provide critical insights into potential future directional movements of the underlying assets.

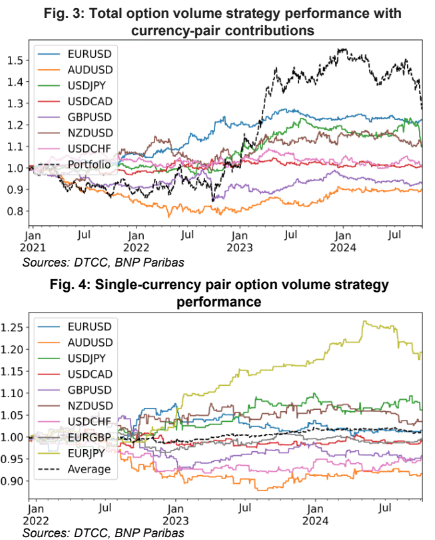

Aggregate traded option volumes serve as a key indicator. We have replicated the BoE analysis and updated it with recent data to show that options volumes still possess predictive power. We normalize total daily options volumes (maximum 6 months tenor) against their respective 21-day moving averages to assess daily volumes among DM USD currency pairs (excluding Scandies). Our analysis takes a cross-sectional approach, where we short currencies (against USD) that ranked in the top quartile for volumes the prior day. Conversely, we go long in currencies (against USD) that were in the bottom quartile. This strategy allows the portfolio to have a directional bias towards USD; it is not neutral. The portfolio has shown strong performance in 2022 and 2023, although recent underperformance can be attributed, in part, to USDJPY.

Options volumes play a significant role in JPY pairs: In the portfolio depicted in Fig. 3, there are some pairs that contribute minimally to performance. Fig. 4 illustrates a trading strategy based on single-pair options volume (buying a pair when its daily volumes exceed one standard deviation above the one-year average and vice versa) to identify underperformers and outperformers. Our findings indicate that USDJPY and EURJPY are the most productive (refer to Figs. 11 and 12 in the appendix as well). Additionally, we observe that the strategy is somewhat effective for EURUSD, but only under lower thresholds. Vanilla call and put volumes provide further insights: Since our original analysis, options trade reports now offer information on whether trades are calls or puts. Distinguishing between total call volume and total put volume assists in formulating a more effective trading strategy for most currency pairs in our analysis (Fig. 1). Furthermore, we find that this strategy is particularly effective for shorter-tenor options – specifically, using only sub-1 month expiries rather than sub-6 month. We believe this indicates that shorter-tenor options hold more directional information than longer-tenor ones, implying that they better represent investor expectations of future spot performance.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!