IMF Warns Of China Econ Downgrade Over Covid Policy

IMF Concerns Over China Covid Policy

The focus on China continues to build this week. Following ugly scenes of police clashing with protestors at the weekend, the scrutiny of the government’s zero-covid policy has intensified leading the IMF to warn that it might be forced to downgrade its Chinese economic outlook unless the policy is abandoned. IMF MD Georgieva made these comments yesterday in Berlin, warning that growing uncertainty linked to record defaults in the property sector and the broader disruption caused by lockdowns and business closures, meant that the crisis-lender might be forced to cut its outlook. This comes on the back of the lender cutting its China growth forecasts in October to 3.2% this year and 4.4% next year.

PMI Data Drops

The impact of recent lockdowns was reflected very clearly in the latest PMI data released overnight. The Chinese manufacturing PMI was seen falling to 48 in November, below the 49 level the market was looking for. This marks the weakest reading since April, when China was reeling in the wake of two month’s worth of widespread lockdowns. Non-manufacturing was hit even harder, falling to 46.7 from 48 prior. With both readings well into contractionary territory, the outlook for overall GDP is tuning lower into the end of the year.

China Announces Crackdown

Given that covid cases in China are soaring, it seems hard to think the Chinese government will u-turn on its covid policy. Indeed, the Chinese government has warned that it will crackdown even harder on anyone taking part in any further protests. This will include stricter monitoring from the Chinese internet watchdog targeting anyone deemed to be liking or creating content in opposition to the government’s covid policy. This comes on the back of further violent clashes between protestors and police yesterday in Guangzhou. Reuters has confirmed footage of protestors and police engaged in street battles.

Two-Way Risks

Looking ahead, the outlook appears quite clear. If China maintains its zero covid policy in coming months the economy will suffer sharply as a result. Furthermore, continued clashes between protestors and police risk spilling over into a national security situation, which will further harm the economic outlook for China, hurting global risk sentiment. However, if the government takes the unlikely step of scrapping its zero covid policy, we can expect risk sentiment to rise sharply in response.

Technical Views

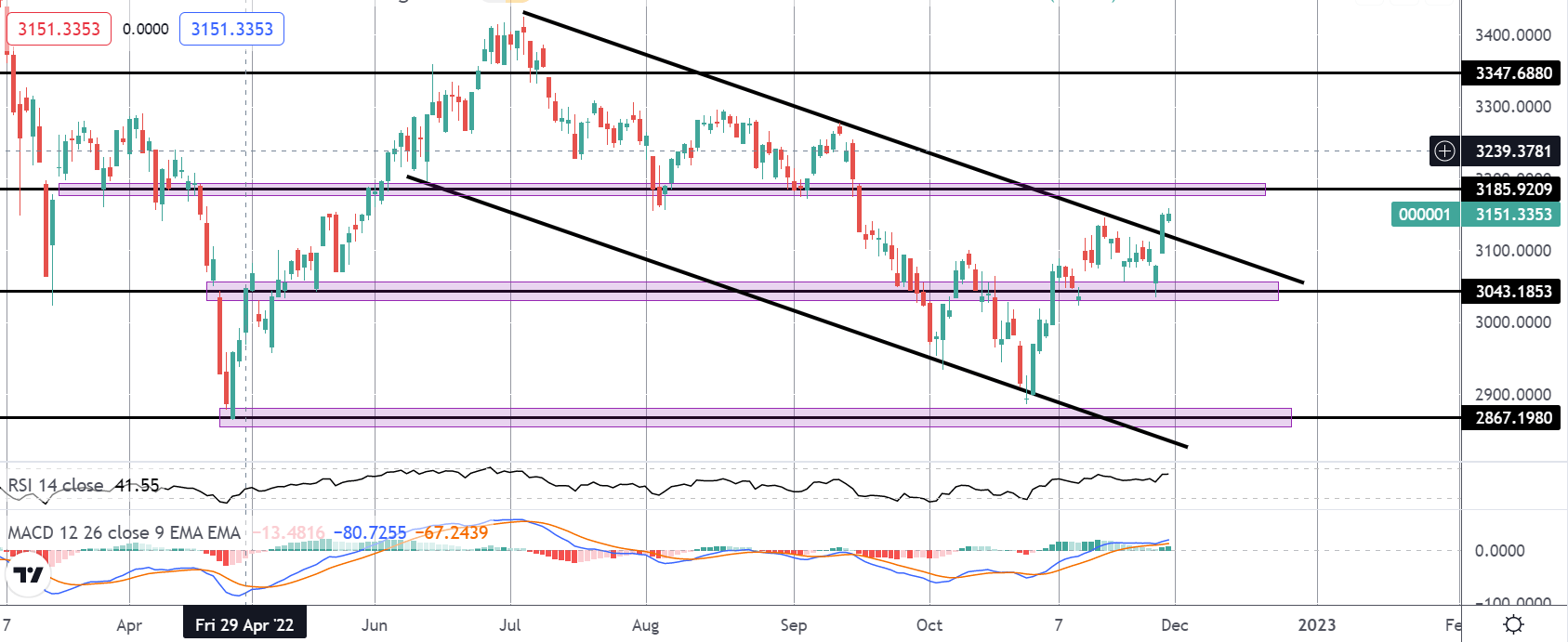

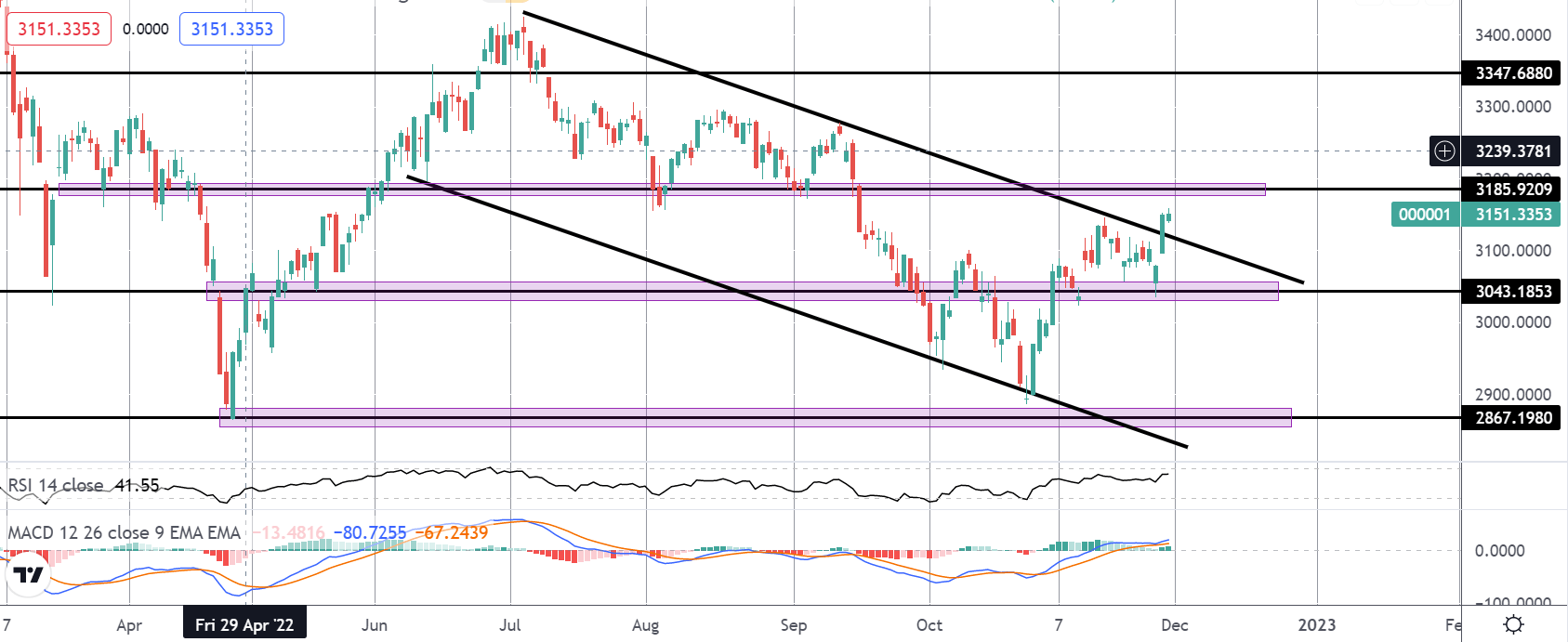

Shanghai Composite

The rally off recent lows around the 2867.1980 level has seen the marker breaking above the 3043.1853 level and above the bear channel resistance. With momentum studies bullish, the focus is on a further push higher while price holds above 3043.1853. The next hurdle for bulls is the 3185.9209 level which, if broken turns focus to the 3347.6880 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.