How Far Can Crypto Correction Push?

BTC Correcting Lower

Following a parabolic move higher this month, crypto prices are starting to correct this week. BTC futures printed gains of almost 50% from the November lows, stalling just shy of the $100k mark this week. The market is now seeing heavy selling with BTC down almost 7% from the record highs printed on Friday. The move has been linked to profit taking on failure to pierce above $100k. With the long US weekend ahead, some players are calling this a good time to bank recent gains. The question now is how deep this correction is likely to run?

Institutional Demand Softening Following Record Inflows

Looking at industry data, institutional demand is starting to soften here. Following record weekly inflows of more than $3billion last week. Data this week shows outflows of almost half a billion so far. If this figure starts to increase, we can expect the current decline to push deeper, with some players calling for price to fill the CME gap posted on November 8th.

MicroStrategy Buys Again

Despite the pullback, and the bearish forecasts which accompany every turn, there is still plenty of bullish sentiment around. MicroStrategy was seen making yet a further, record purchase of BTC yesterday. The fund bought a further 5.5k units of BTC yesterday, totalling around $5.4 billion. Saylor’s fund now holds around $36 billion in BTC and is projecting the coin to make a fresh push higher early next year, with at least a further 40% of upside to go.

Technical Views

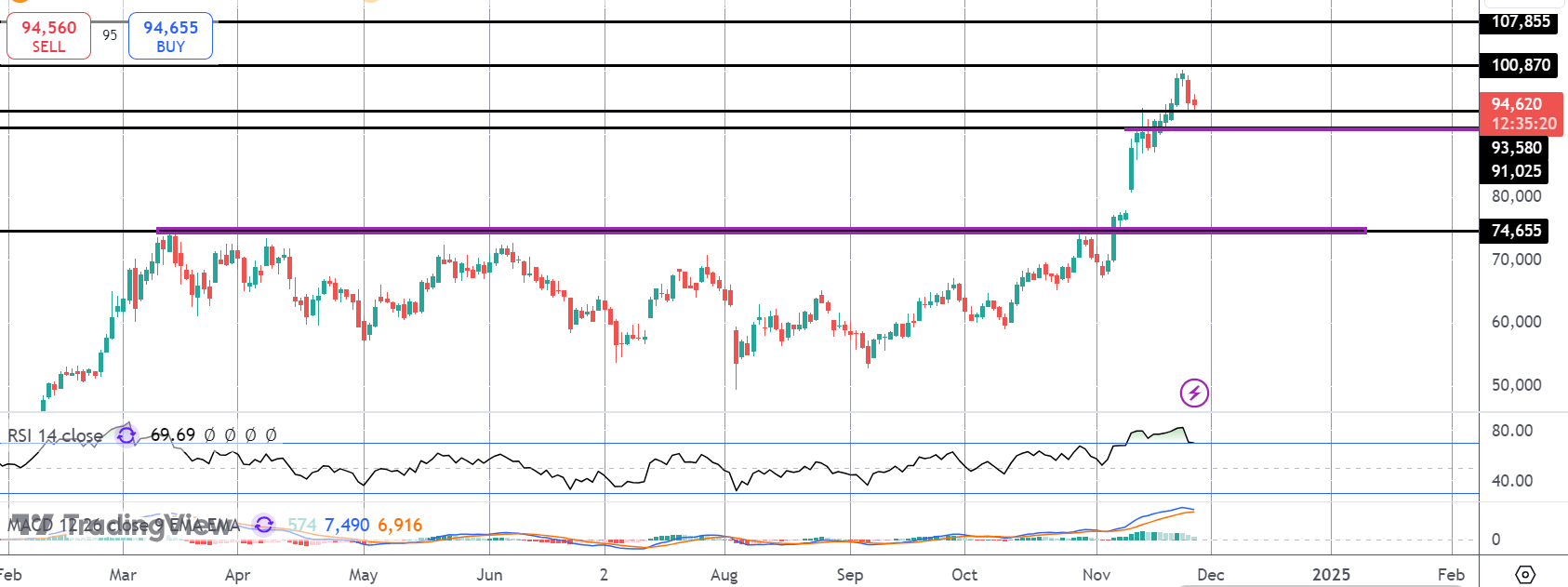

BTC

For now, the rally in BTC has stalled ahead of the $100k level. While price holds above the 91,025-level support, the focus is on a further push higher and a breakout towards 107,85. Below, 91,025, however, focus turn to the 74,655 level in line with falling momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.