Gold Rally Stalls As USD Breaks Out

Gold Falls Despite Middle East Conflict Fears

Gold prices are looking relatively muted across early European trading on Monday, following a pullback from last week’s breakout move to fresh all-time highs. Price reversed from highs above 2433 and are now trading back below the 2364.93 level. The reversal comes despite news of Iran’s retaliatory attacks against Israel over the weekend. Seemingly, traders had already prices in such a response, leading to the push higher last week. For now, the market awaits further developments in the situation though it seems that safe-haven flows are tending towards USD currently, given the drop back in Fed easing expectations.

US Inflation Still A Problem

A fresh uptick in US inflation last month has seen the market scaling back its near-term Fed rate-cut expectations. Pricing is now pegging a September rate cut with risks that this projection ends up being pushed back too if inflation remains elevated in coming months. If USD continues to push higher near-term, this will likely see some corrective action in gold. However, safe-haven demand should keep the metal well supported. As we move forward, the best scenario for gold bulls would be to see USD inflation start to weaken again, leading USD lower. If inflation continues to rise, however, this will make the outlook more uncertain near-term.

Technical Views

Gold

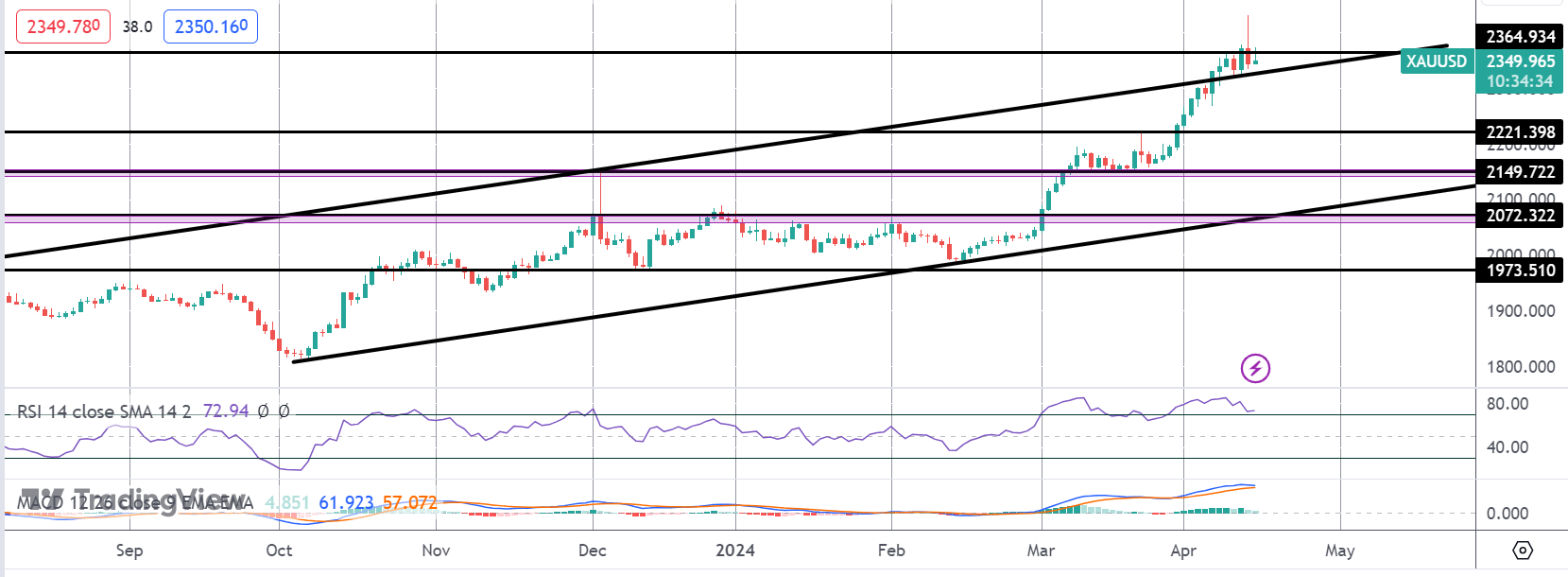

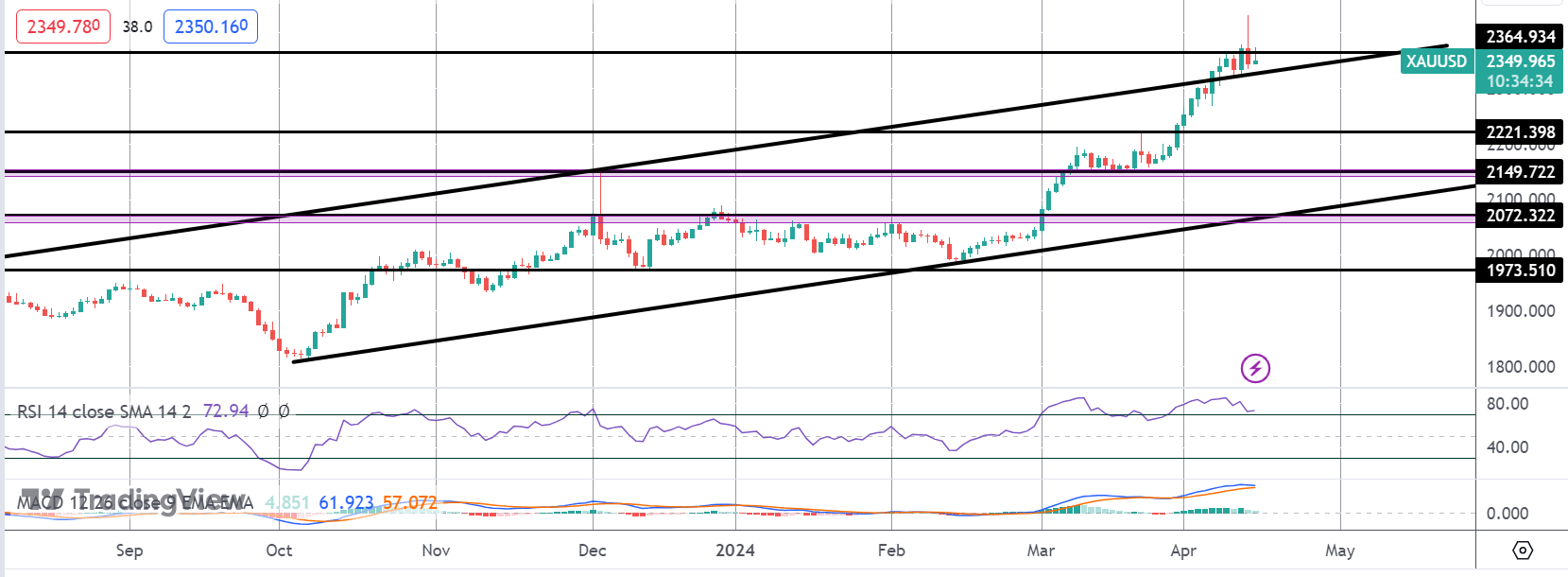

The rally in gold prices has stalled for now at the 2364.93 level. Price is sitting just atop the bull channel highs. However, with bearish divergence in momentum studies, the market is vulnerable to a reversal lower. To the downside, 2221.39 will be the key support to note with bulls needing to keep this level intact to maintain the broader bullish outlook.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.