Rising Geopolitical Uncertainty

Gold prices are pushing higher again as we move through the middle of the week linked to a resurgence in geopolitical uncertainty and a softer US Dollar. A fresh Israeli offensive in Gaza and concern over the ballooning humanitarian crisis there has spooked investors with traders wary of the risks of a broader violence linked to outrage over the fresh assault. Alongside this, a deteriorating tone in Russia/Ukraine peace talks, including threats from Russia of pulling out, is adding to bearish risk sentiment. Against this backdrop, gold is seeing a fresh influx of safe haven demand which looks likely to continue near-term while uncertainty remains. Indeed, if Russia does pull out of peace talks, this could see gold prices firmly higher within days.

USD Weakness Boosting Gold

A fresh sell off in USD is also helping drive upside in gold prices here. Weak US data as well as fading optimism over US/China trade talks has seen the greenback giving back the gains of the prior week. Near-term fed easing expectations are creeping higher again on the back of the recent downside inflation surprise. Any further data weakness should feed into this narrative, keeping gold prices underpinned near-term.

Near-Term View

For gold bears, the main hopes now are for a fresh Israeli ceasefire, a breakthrough in Russia/Ukraine talks or positive headlines on US/China negotiations. Without any of these, gold prices look likely to continue higher near-term.

Technical Views

Gold

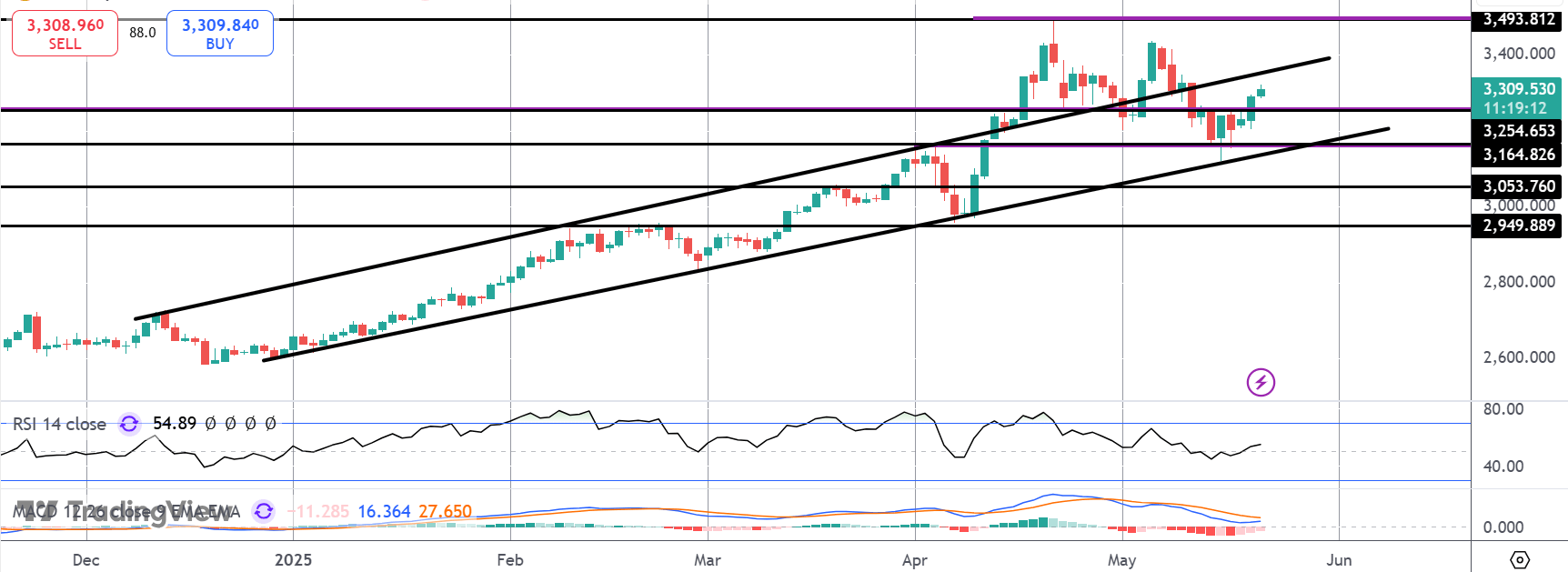

The rally in gold off the bull channel lows has seen price moving back above the 3,254.65 level with bulls now eyeing a return to YTD highs. The bull channel highs could offer some resistance ahead of that test. However, while above 3,164.82, the outlook remains firmly bullish.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.