Gold Hits New All-Time Highs

Gold Rally Continues

Gold prices continue to push further into new record highs across early European trading on Monday. The futures market is now up around 30% on the year as gold continues to advance, shrugging off ongoing Dollar strength. The greenback has recovered firmly in recent weeks as traders scaled back Fed easing expectations in response to stronger US labour market data and has some less-dovish signalling from the Fed.

Fed Easing Expectations

The market now prices in just two .25% cuts from the Fed this year, having previously been projecting a further .5% cut in November and at least another .25% cut in December. Despite this shift in outlook, however, gold prices have retained demand. Heightened global geo-political risks linked to the ongoing conflict between Russia and Ukraine and the war in the Middle East are undoubtedly keeping safe-haven flows well stocked. Additionally, the backdrop of increased G10 central bank easing means yields are coming down across the board, driving demand back into gold.

PMIs Due

Looking ahead this week, traders will be watching the latest batch of US, UK and eurozone PMIs. Any further weakness in these readings should reinforce easing expectations and drive gold prices higher near-term. Uncertainty ahead of the US elections is another factor feeding into safe-haven demand for gold currently as traders grapple with tight odds for both candidates.

Technical Views

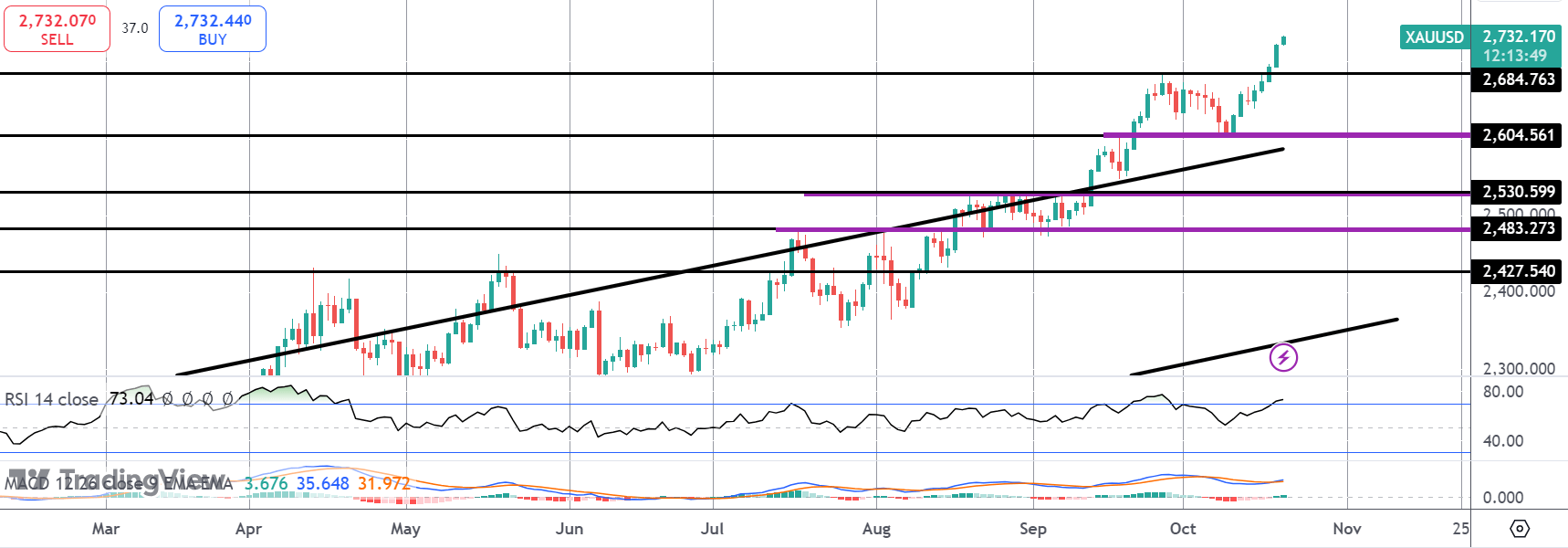

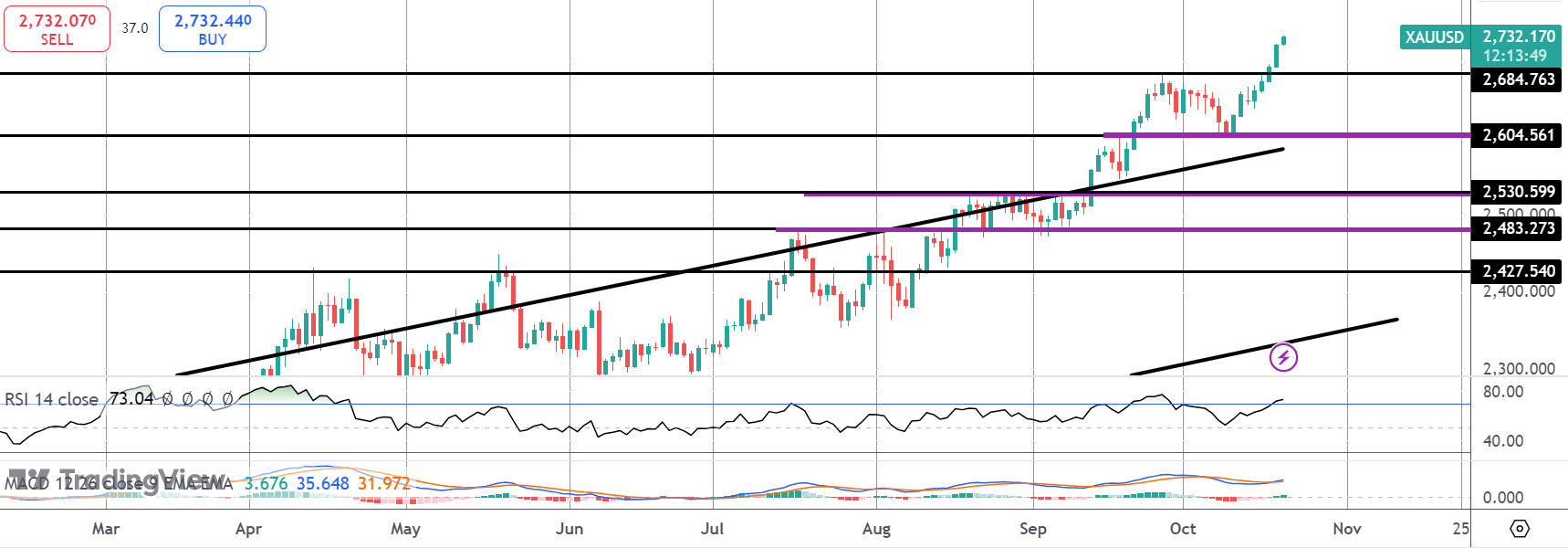

Gold

The correction lower in gold found strong support into the 2,604.56 level with price since turning sharply higher. The market is now above the 2,684.76 level and while above here, the focus is on a continuation higher. We are seeing bearish divergence in momentum studies, however, which is worth keeping an eye on if we get any reversal signals.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.