GBPUSD Recovers - NFP Up Next

GBP Bounces Back

The British Pound is stabilizing today following a shar drop yesterday as traders speculated that the UK chancellor might be forced out of her role. Emotional scenes during the UK PMQs yesterday sparked a heavy unwinding of GBP longs as traders drew their own conclusions from footage of the tearful UK chancellor in parliament amidst uncertainty over whether the UK PM was backing her or not. Reeve’s commitment to fiscal discipline has been seen as a strong upward driver for GBP and speculation that a replacement chancellor might be less fiscally responsible and more open to increasing borrowing, weighing on the GBP outlook. Today, however, GBP is rally in response to news that the PM is backing Reeves.

Dovish BOE Comments

Away from the political sphere, GBP was also rocked by dovish comments from the BOE this week. Speaking at the ECB’s Sintra panel, BOE governor Bailey reaffirmed his view that the trajectory for interest rates is lower but warned that it was still too early to properly assess the inflationary impact of tariffs. Speaking away from that panel, we then heard BOE’s Taylor voicing support for faster rate cuts in the UK amidst the risk of a hard landing for the economy.

US Jobs on Watch

Looking ahead today, GBPUSD will be very much driven by the USD response to incoming US jobs data. If the NFP is seen falling again, particularly if there’s a downside surprise, this should see USD come under heavy selling pressure, allowing GBPUSD to recover further.

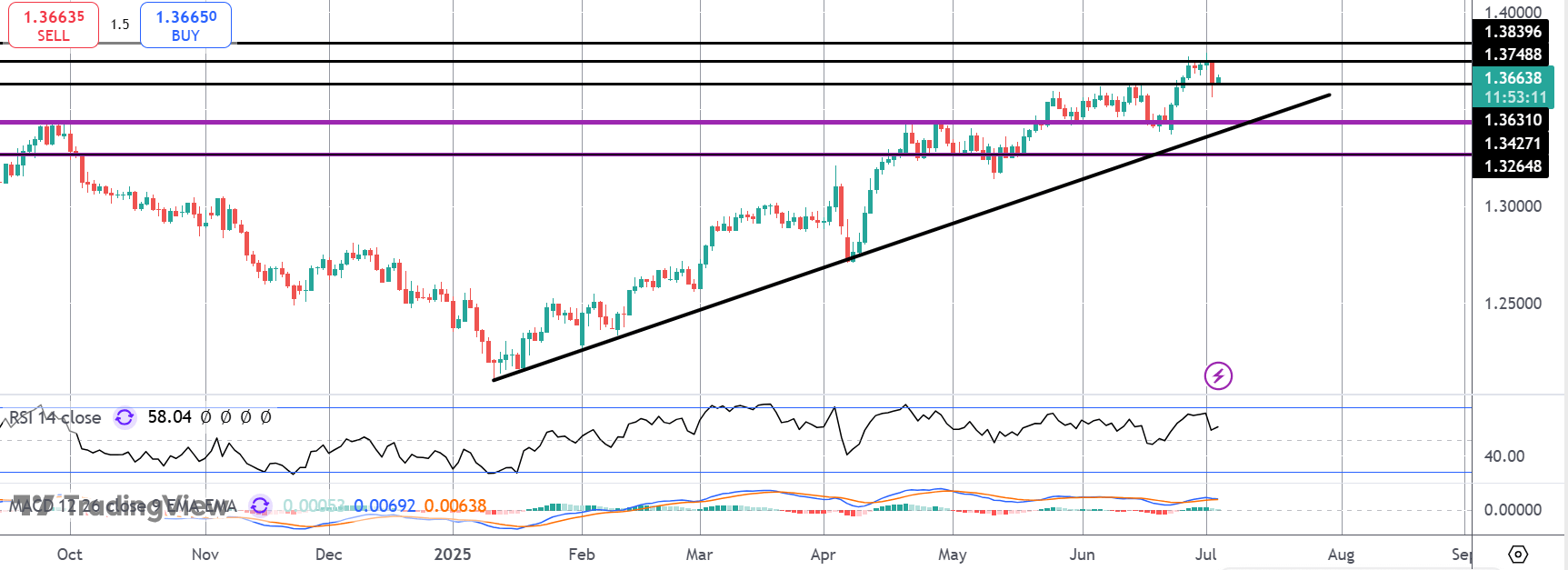

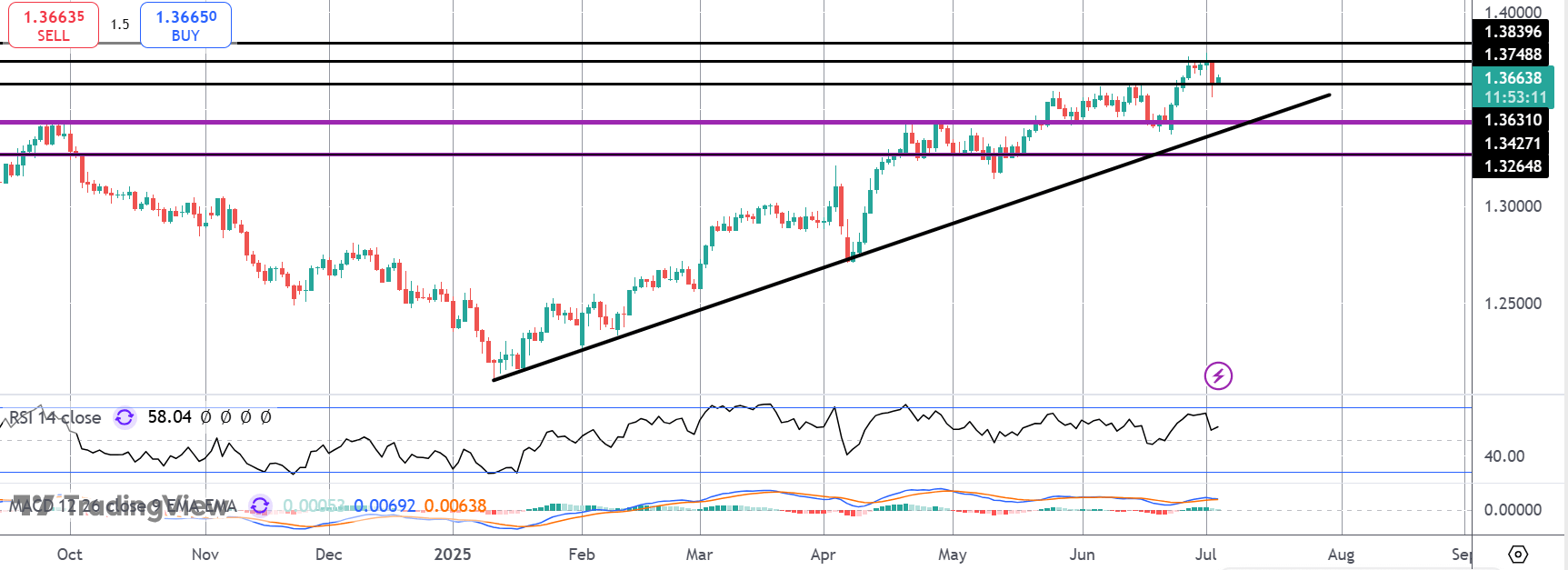

Technical Views

GBPUSD

The sell off in GBPUSD has found support for now into the 1.3631 level. While this support holds, focus is on a fresh push higher with 13839 the next target for bulls. To the downside, deeper support at the 1.3427 level and bull trend line will be the key pivot for bulls to defend to maintain the upside focus.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.