GBPUSD Hits Fresh Lows As UK Borrowing Costs Soar

Cable Under Pressure

GBPUSD has broken to fresh lows on the year today with the pair now trading levels last seen in November 2023. The selling comes amidst the continued resurgence in USD this week alongside fresh downside in GBP on the back of weak UK economic data. On the data front, the BRC shop price index was seen falling 1% last month, continuing lower from the prior month’s -0.6% reading and below the -0.4% level the market was looking for. On the back of weaker-than-forecast PMI readings earlier in the week, the data has added to the bearish tone in GBP ahead of the weekend.

UK Borrowing Costs Soar

Alongside softer data this week, GBP is also coming under pressure amidst soaring UK borrowing costs. The yield on10yr UK gilts has soared above the 4.8% level this week, hitting highs last seen amidst the global financial crisis in 2008. 30yr gilt yields have also ballooned, now above 5.47%, hitting their highest levels since 1998. Fears over the impact that expected Trump tariffs will have on the UK economy, already in a weak, post-Brexit state, are fuelling the surge in yields with uncertainty likely to continue as we approach Trump’s inauguration.

FOMC Impact

On the USD front, a firm shift in the market’s outlook on the Fed is leading USD higher this week. Strong data is cementing the view that the Fed is likely to keep rates on hold near-term. Indeed, the December FOMC minutes last night saw Fed policymakers agreeing to slow the pace of easing amidst strong growth and upside inflationary risks. Tomorrow’s NFP data will now be key for USD with GBPUSD vulnerable to a fresh push lower if we get any upside surprises in the data.

Technical Views

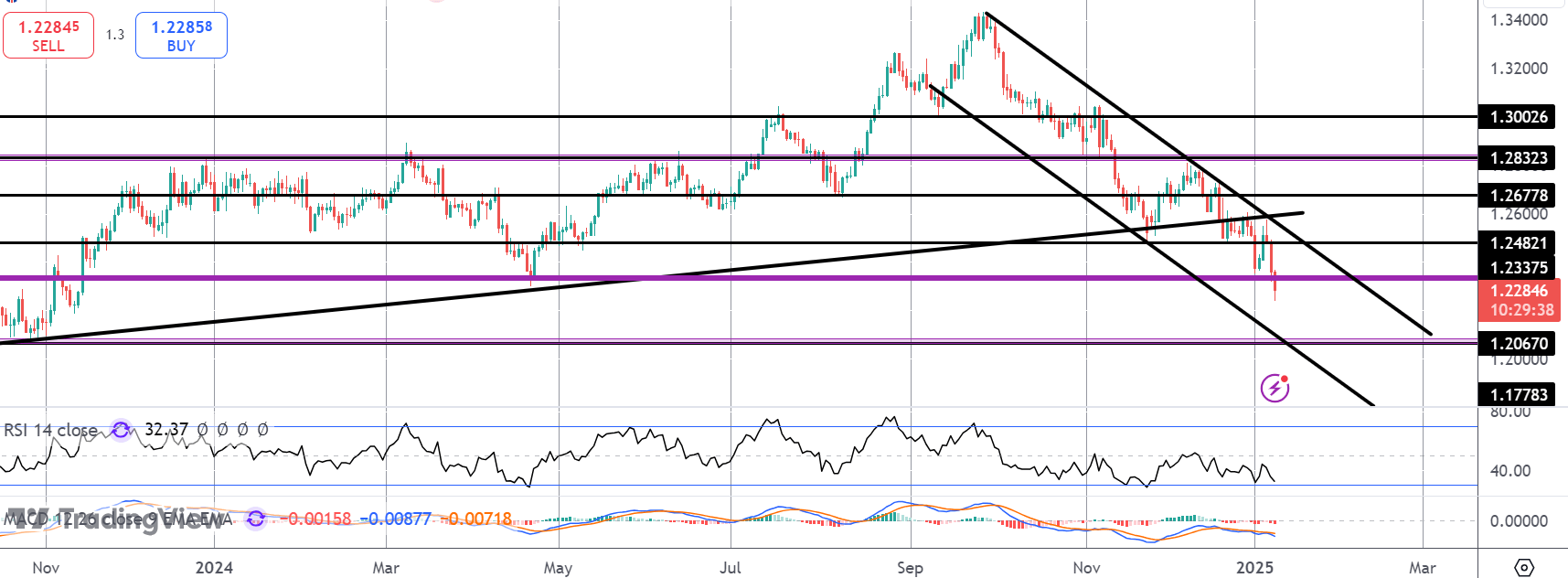

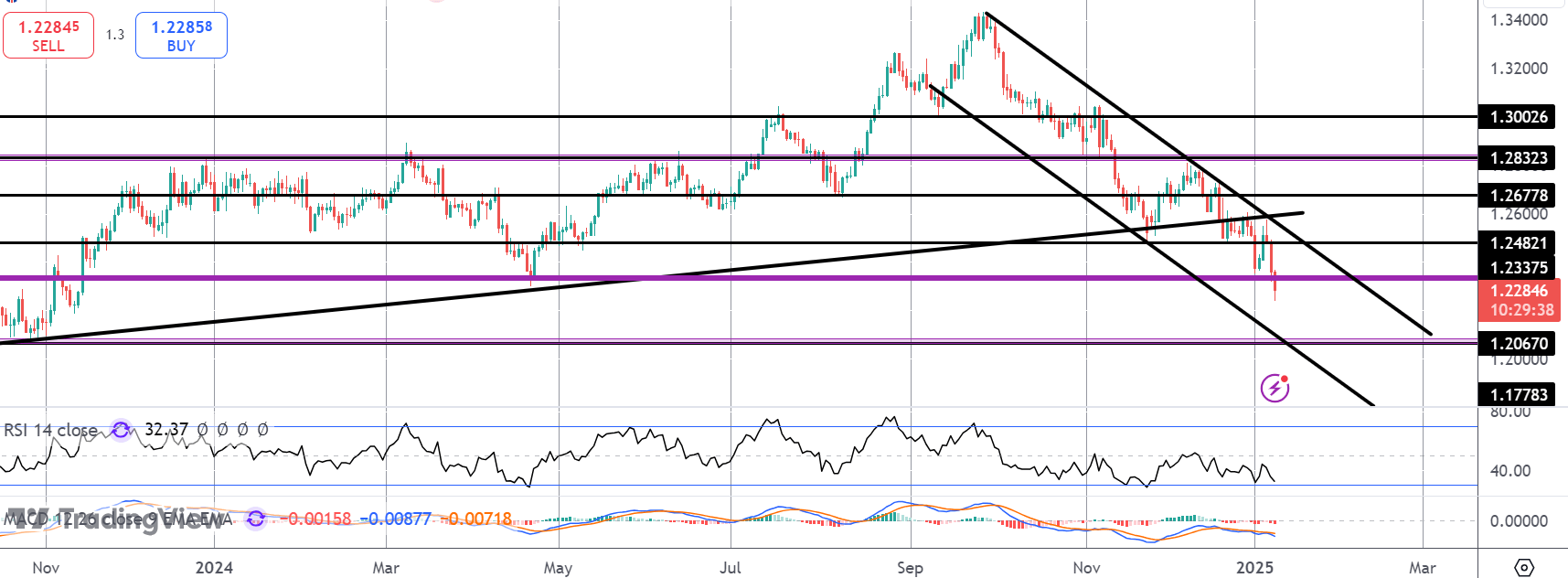

GBPUSD

The sell off in GBPUSD has seen price breaking below the 1.2337 level. Price continues to trade within a narrow bear channel and with momentum studies bearish, focus is on a further push lower towards the 1.2067 level next. Bulls need to see a move back above 1.2677 to alleviate bearish pressure here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.