GBPJPY Rallying on Central Bank Divergence

GBPJPY is rallying hard at the start of the week. Hawkish expectations ahead of the BOE meeting later this week are reinforcing the divergence between the BOJ and the BOE. This disparity in monetary policy approaches has been a key driver of the rally in the pair recently. With the BOE firmly committed to maintaining tightening, GBP has seen a fresh wave of buying recently. At the same time, JPY has been depreciating sharply on the back of the recent BOJ meeting.

BOJ Sticks to Stimulus

The BOJ kept its ultra-loose monetary policy in place this month and signalled that it was in no rush to exit its current stimulus program. Indeed, Governor Ueda signalled that the bank would remain patient in waiting for signs that the spike in inflation had become sustainable, requiring the need for the bank to exit its current monetary policy approach.

CPI Up Next

Ahead of the BOE on Thursday, the market will receive the latest UK inflation data tomorrow. This release has the potential to drive GBPJPY further higher if we see any stickiness, particularly in core inflation. On the other hand, if both CPI readings are seen falling further lower last month, GBPJPY has room to correct given the recent bull run we’ve seen.

Technical Views

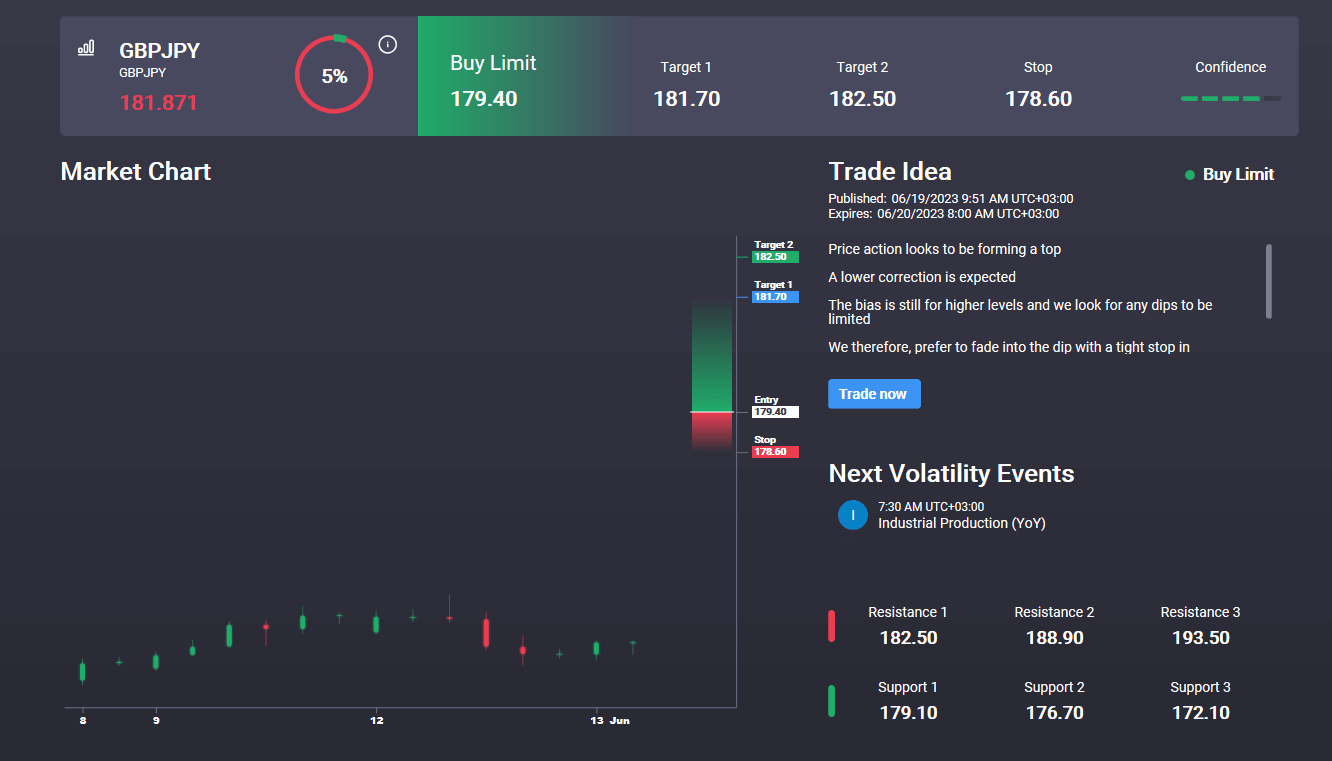

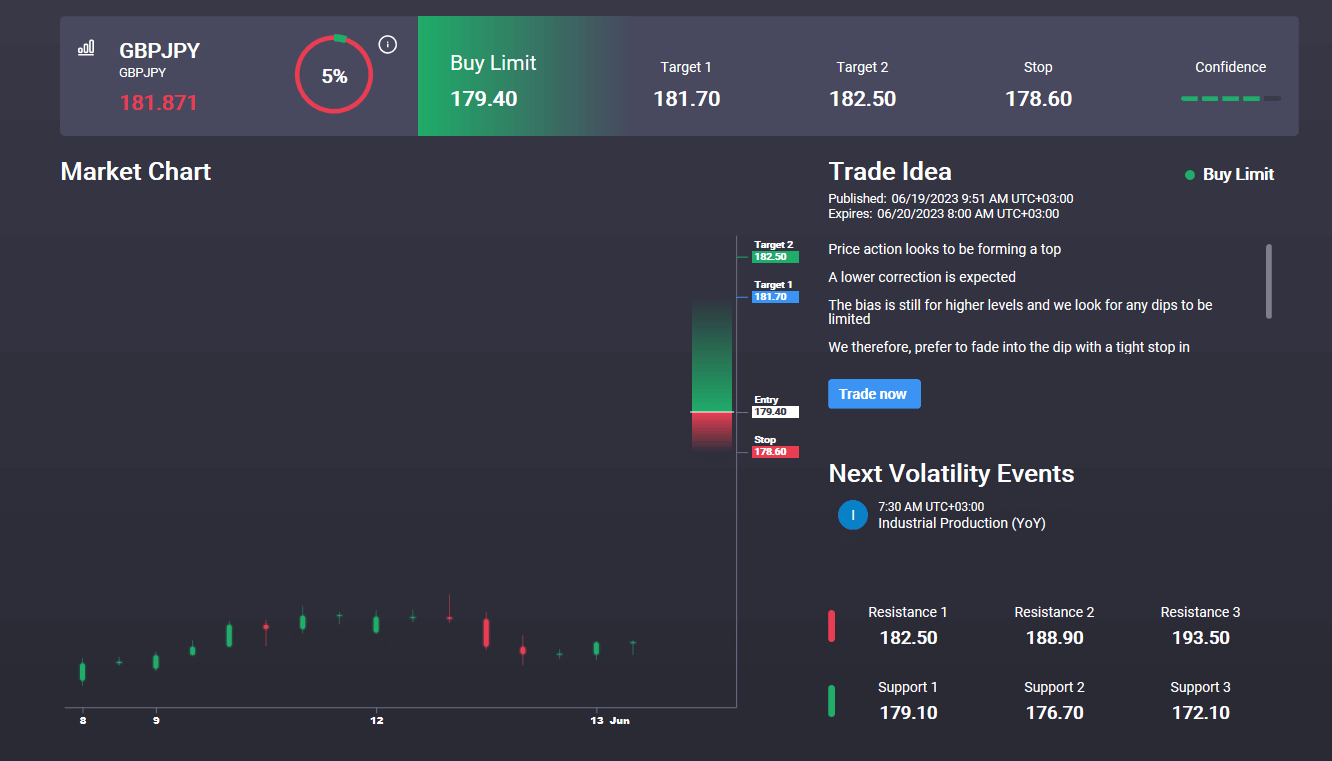

GBPJPY

The rally in GBPJPY has seen the market breaking out above the 175.01 level with price quickly advancing as high as a test above the 180.78 level. With momentum studies bullish, the focus is on a further move higher while price holds above this level, targeting 184.33 next. To the downside, any correction lower will see 175.01 come into view as the next support level. Notably, we also have a bullish GBPJPY signal in the Signal Centre today from 179.40 with an 80% confidence level.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.