GBP Resilient Despite Weak UK Data

UK Retail Activity Plunges

GBPUSD remains in the green today despite bearish UK data, with a weaker US Dollar helping keep the pair propped up. The UK BRC retail sales monitor for November came in well below expectations at -3.4% vs 0.3% prior and 0.7% expected. The decline comes on the back of four prior months of growth in the reading and has been attributed to a number of factors such as a poor weather in the UK over the month and a later than usual Black Friday. Notably, a decline was recorded in every category of the reading with shopping centres seeing the worst declines as a result of reduced footfall.

BOE Easing Expectations

GBPUSD is enjoying a mild recovery off the November lows, following heavy declines over November. The current rally looks more a function of current USD weakness than any bullishness towards GBP. Looking ahead, expectations are split over whether the BOE will cut rates again at the upcoming rates meeting this month. UK data has been broadly on the weaker side though inflation has been moving higher again, creating a difficult situation for the bank. While the economy could clearly do with some further support, the bank risks inflation accelerating higher if it cuts again. Against this backdrop, I judge GBP risks to be skewed a little higher near-term with the BOE likely to keep rates paused for now while the Fed pushes ahead and cuts further, offering GBPUSD some support through year end unless we see a resurgent move higher in USD.

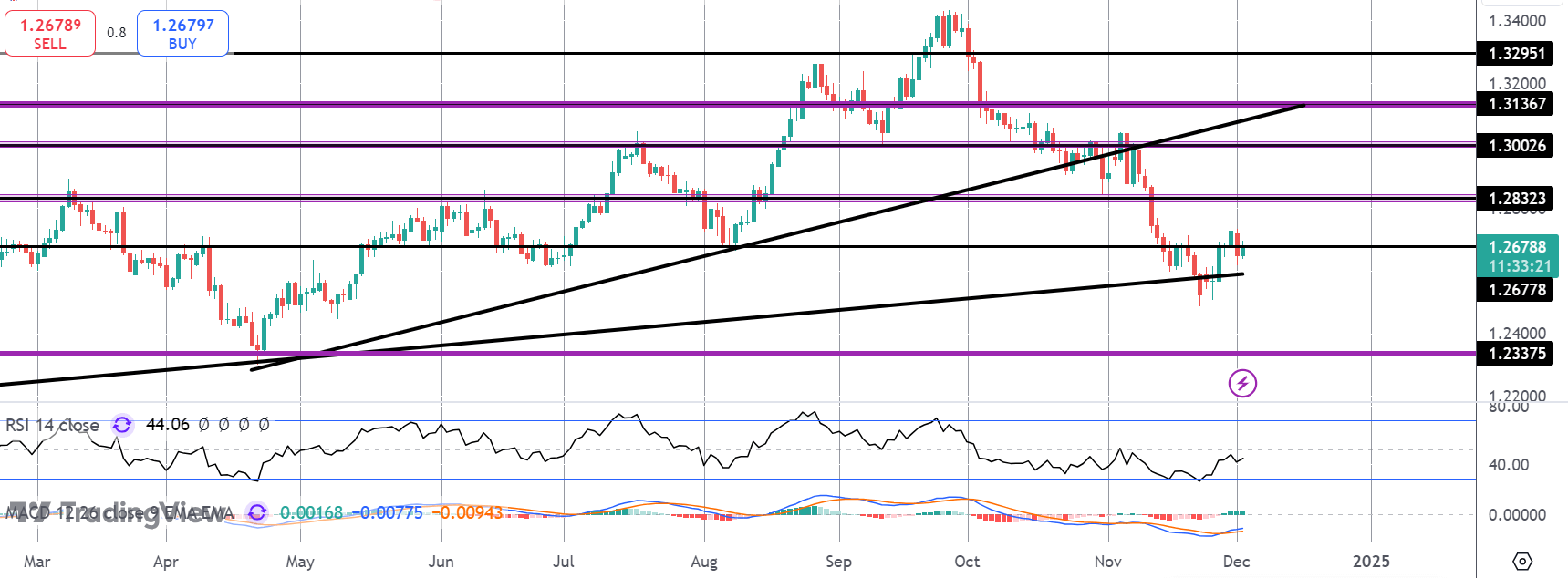

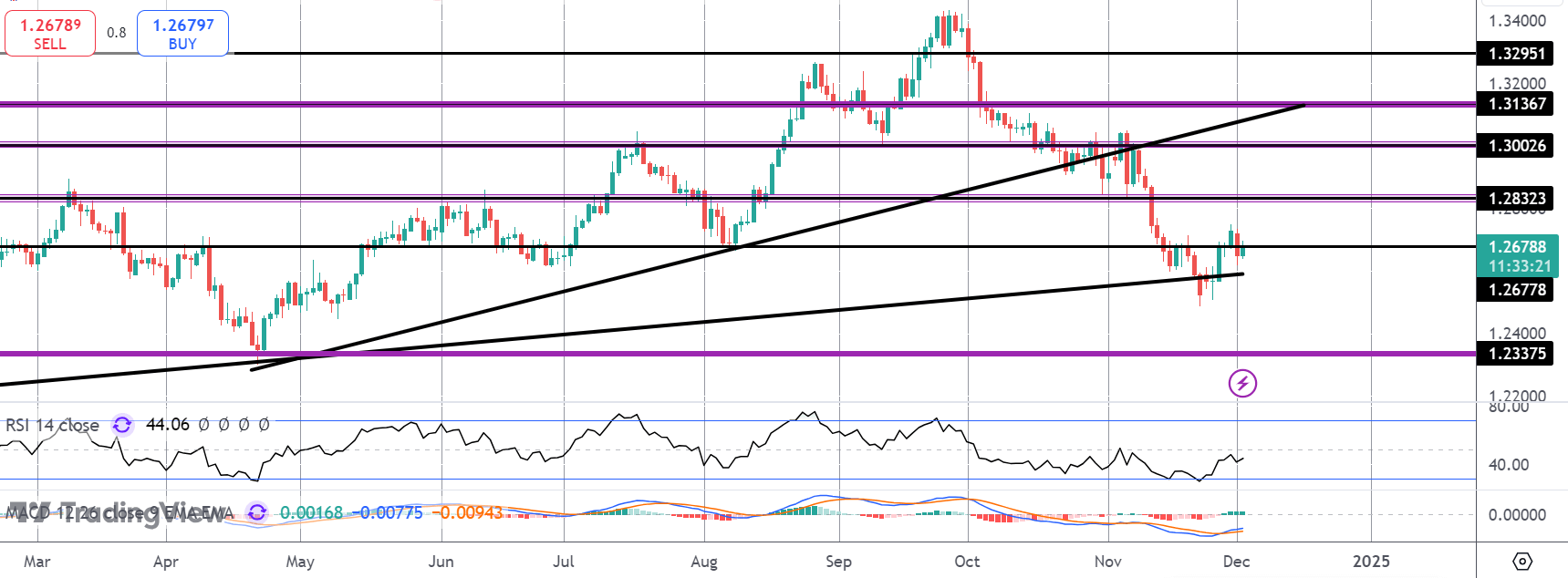

Technical Views

GBPUSD

The recovery in GBPUSD has seen bouncing back above the bull trend line from 2023 lows and now attempting to reclaim the 1.2677 level. Above here, 1.2832 is the next hurdle for bulls. To the downside, 1.2337 is the next bear target should we resume the broader decline.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.