FTSE 100 FINISH LINE 8/8/25

FTSE 100 FINISH LINE

UK stocks dipped on Friday, continuing the downward trend from the prior session after the Bank of England's rate decision raised worries about inflation, as investors evaluated U.S. President Donald Trump's temporary selection for Federal Reserve governor. This week, investors assessed a range of robust corporate earnings that aided in the recovery of British stocks from last Friday's largest decline in almost four months. Nevertheless, market sentiment remained shaky following the Bank of England's divided rate decision, in which four out of nine policymakers opted to maintain current rates due to ongoing inflation worries—indicating that the central bank's rate-cutting phase may be approaching its conclusion. Concurrently, expectations for rate reductions in the U.S. became firmer after President Trump announced he would nominate Council of Economic Advisers Chairman Stephen Miran to temporarily fill a vacant seat at the Federal Reserve, as the White House continues its search for a successor to Fed Chair Jerome Powell, whose term expires on May 15, 2026. The market is contemplating the possibility that appointing Miran to the Fed, even on a provisional basis, could be a strategic maneuver by Trump to enhance his influence over monetary policy, in line with his ongoing advocacy for reduced interest rates. On that day, the leading gainers among sectors were precious and industrial metal miners, with increases ranging from 1.5% to 1.1%, mirroring the upward trends in gold and copper prices.

Shares of British pharmaceutical company GSK rose by 1.5% to 1,403.5p. The stock is one of the top percentage gainers on the FTSE 100 index. The company is set to receive $370 million upfront from CureVac as part of a settlement regarding mRNA patents with Pfizer/BioNTech. Year-to-date, GSK's stock has increased by approximately 4.29%.

Shares of Flutter listed in the UK have decreased by 2.75%, currently at 22,332p. The company's net income plummeted by over 88% to $37 million on Thursday, impacted by non-cash charges and one-off expenses for the quarter. Flutter, the world's largest online betting company, reported second quarter revenue of $936 million from its UK and Ireland operations, marking a 1% year-on-year increase. Peel Hunt has downgraded Flutter's rating from "add" to "hold," citing weaknesses in international markets. Overall, including the session's gains, FLTRF has risen approximately 8.5% year-to-date.

Shares of British logistics software company Pennant International Group have dropped approximately 14% to 24p. The company anticipates that its fiscal year turnover will fall short of market expectations due to delays related to the GenFly contract awarded by the UK Ministry of Defence back in August. The commencement of the GenFly contract has been postponed to the fourth quarter of 2025 or later because of the MOD approval process, resulting in a revenue shift to 2026, according to PNIG. The company projects a first-half revenue of £4.5 million, which represents a 39.2% decline from the previous year. After accounting for gains during the session, PNIG is down 11.6% year-to-date.

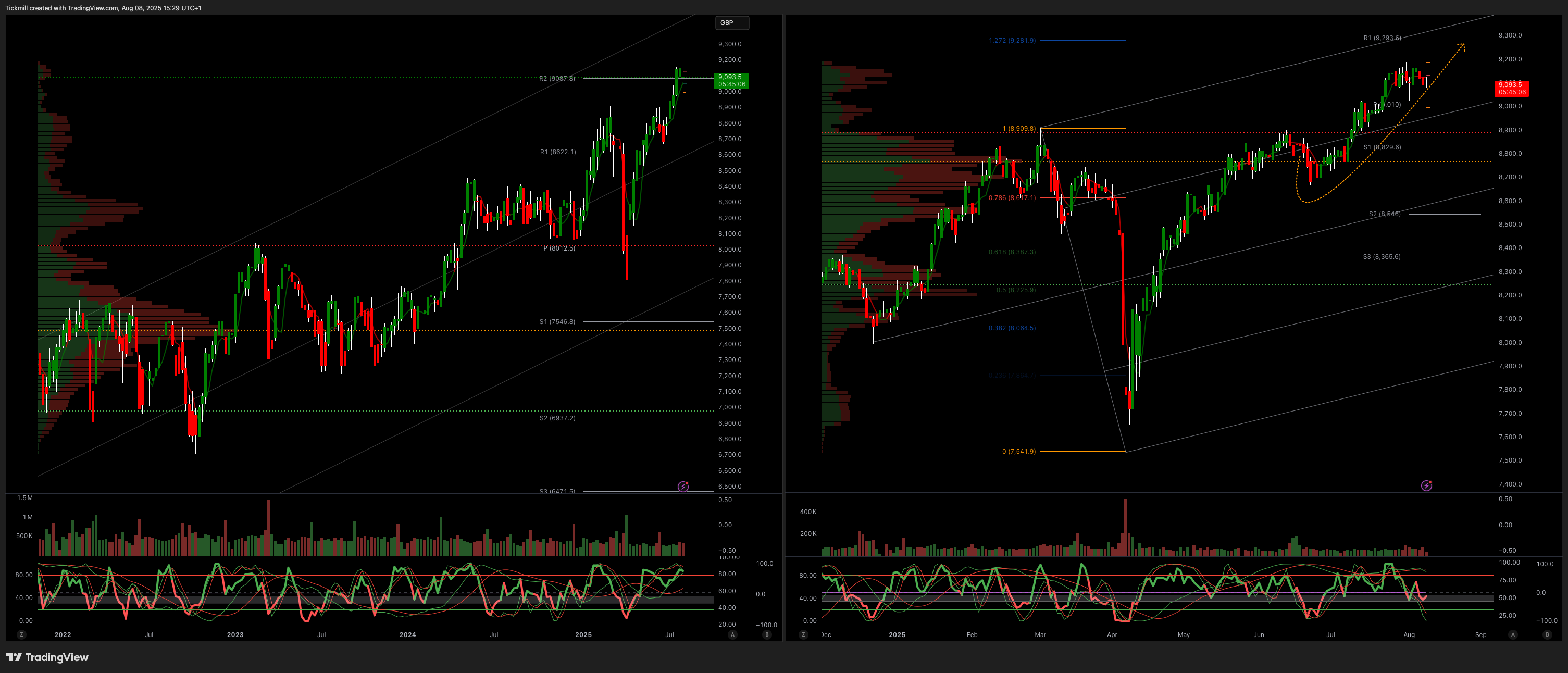

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!