FTSE 100 FINISH LINE 27/8/25

FTSE 100 FINISH LINE

London shares remained unchanged for much of Wednesday before fading into the close, with worries regarding the independence of the U.S. Federal Reserve remaining a concern for investors. Cook's attorney stated that the Federal Reserve governor plans to initiate legal action to stop Trump from dismissing her. On Tuesday, the market decline ended a five-day upward trend for the index. The UK's blue-chip index reached an all-time high last week, buoyed by global markets after Fed Chair Jerome Powell indicated a potential interest rate reduction at the Fed's meeting in September.

In domestic economic news, the Confederation of British Industry (CBI) reported that their retail sales gauge for the United Kingdom experienced a slight increase, rising to -32 for August 2025, compared to a reading of -34 in July. This improvement, although still in negative territory, was better than market expectations, which anticipated a figure of -33. The reading indicates a persistent decline in retail sales volumes, marking the 11th consecutive month of downturn. This trend reflects ongoing challenges within the retail sector, potentially influenced by factors such as changing consumer behaviours, inflationary pressures, or broader economic conditions. However, there is a glimmer of hope looking forward; the outlook for September has brightened, with expectations improving to -16. This shift suggests that retailers may anticipate a recovery in sales, possibly due to seasonal factors, upcoming promotions, or changes in consumer sentiment. Overall, while the current situation remains challenging, there are signs that the retail environment could start to stabilise or improve in the near future.

Prudential's shares listed in London have risen by 1% to 984.6p, making them one of the top gainers on the FTSE 100 index. The insurer's new business profit for the first half, calculated on a traditional embedded value basis, has surged by 12% year-over-year at constant exchange rates. The company has announced a share buyback totaling $500 million in 2026 and another $600 million in 2027. Additionally, it anticipates an increase of over 10% in its ordinary dividend for each year from 2025 to 2027. Year-to-date, Prudential has experienced approximately a 54% gain, compared to a 13% rise in the FTSE.

JD Sports' shares increased by 4.8% to 98.5p, marking the highest level since January 10, making it the leading gainer on the FTSE 100 index. The British sportswear retailer has observed a positive trend in North America, where second-quarter like-for-like (LFL) sales declined by 2.3%, an improvement from the 5.5% drop in the first quarter. Overall, group LFL sales for the second quarter fell by 3% year-on-year. The company has announced a new £100 million ($135 million) share buyback program. RBC notes that the company has a chance to expand its customer base in the U.S. and other areas, enhance warehousing efficiency, and improve online offerings in Europe and the U.S., which could lead to increased margins. The company anticipates annual profits to align with market expectations of £852 million to £915 million. As of the last closing, the stock has declined approximately 2% this year.

British precious metals and mining stocks dropped, led by Hochschild Mining's 19.6% decline after slashing its annual gold production forecast. London's Precious Metals and Mining index fell 3.8%. Copper prices dropped due to a stronger dollar and concerns about sluggish Chinese industrial activity, while iron ore prices remained stable amid growing supply. Other companies like Fresnillo and Endeavour Mining also saw minor declines. Despite recent losses, the sub-index is up 102% year-to-date.

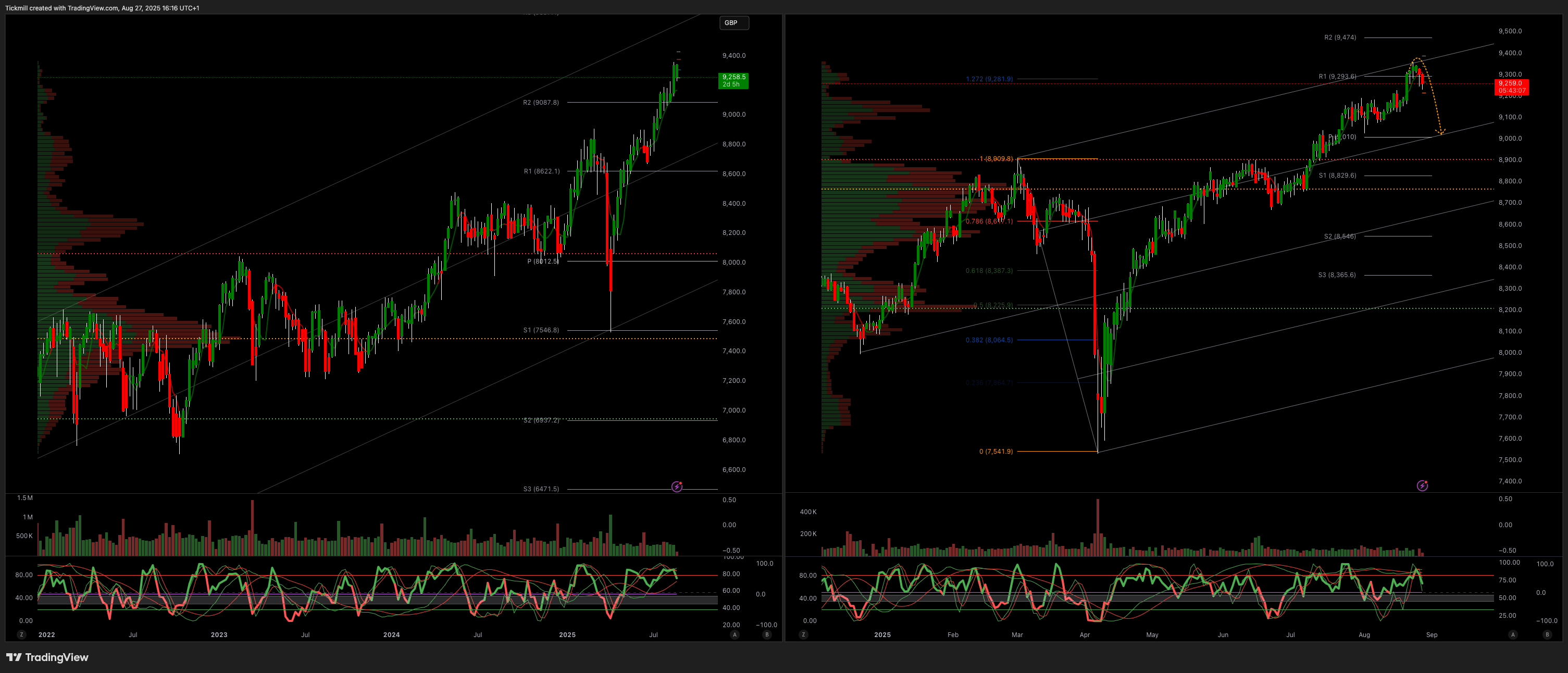

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!