FTSE 100 FINISH LINE 11/8/25

FTSE 100 FINISH LINE

Britain's leading stock index rose on Monday, driven by gains in healthcare and consumer shares; however, declines in defence stocks due to upcoming Russia-Ukraine peace talks limited the overall increase. The healthcare sector increased by 1.1% on Monday. Drug manufacturer GSK announced that the U.S. Food and Drug Administration will prioritise the review of its medication for uncomplicated gonorrhoea, resulting in a 0.8% rise in its shares. Major player AstraZeneca also saw a 1.5% gain. British American Tobacco and spirits company Diageo each rose by over 1%. Retailer Marks & Spencer reinstated click-and-collect services for clothing after a nearly four-month break due to a cyber hack and data breach, boosting its shares by 2.4%.Conversely, a measure of the aerospace and defense sector fell by 0.7% to its lowest point in over a week as discussions of a possible truce in the Russia-Ukraine conflict advance. U.S. President Donald Trump is set to meet Russian President Vladimir Putin on August 15 in Alaska to discuss ending the war in Ukraine. Trump stated that the involved parties, including Ukraine's President Volodymyr Zelenskiy, are nearing a ceasefire agreement. Defense stocks, which have been among the top performers this year, declined by 0.8% last week as peace negotiations gained traction. On Monday, it was reported that the hiring plans of British companies have dropped to their lowest level since the COVID-19 pandemic. Recruiters noted that the increase in starting salaries is at its slowest in over four years, indicating a declining job market. Looking forward, U.S. inflation figures are expected on Tuesday, which will play a crucial role in the Federal Reserve's interest rate decision next week.

Admiral Group shares rise nearly 1% to 3,370p after Morgan Stanley upgrades the stock to "equal-weight" from "underweight," citing limited risks in the UK car insurance market and potential regulatory action. The price target is raised to 3,300p, indicating a 1.5% downside. The brokerage remains cautious about the UK motor market's fragmentation. The average stock rating is "buy," with a median price target of 3,573p. Shares are up nearly 29% year-to-date.

Plus500 shares have dropped 5.5% to 3,236p, making it the leading loser on the FTSE midcap, which has decreased by 0.12%. The online trading platform anticipates that its FY25 results will align with expectations, notwithstanding a strong performance in Q2 revenue and core profit. Peel Hunt has downgraded the stock rating from "buy" to "hold." The shares have seen positive performance this year but may now take a breather due to the current lack of upgrades, according to Peel Hunt. Since the July trading update—which revealed preliminary Q2 results—PLUSP has increased by 4.5%. The company has also announced a $165 million share buyback. When accounting for session gains, PLUSP has risen nearly 23% year-to-date, compared to the FTMC's 6.5% increase.

Shares of Oxford Nanopore Technologies fell 1.3% to 212.2 pence as co-founder and CEO Gordon Sanghera announced he will step down by the end of 2026. The board is searching for a successor. ONT is up approximately 64% year-to-date.

Shares of Marshalls fell 1.2% to 203.5p as the company reported a HY adjusted pretax profit of £22 million, down from £26.6 million the previous year. The market remains challenging with subdued demand affecting prices and product mix, with no expected improvement through 2025. Guidance remains unchanged. The landscape division underperformed despite better results in other divisions, leading to a ~29% YTD decline compared to a 6.47% rise in FTSE mid-cap.

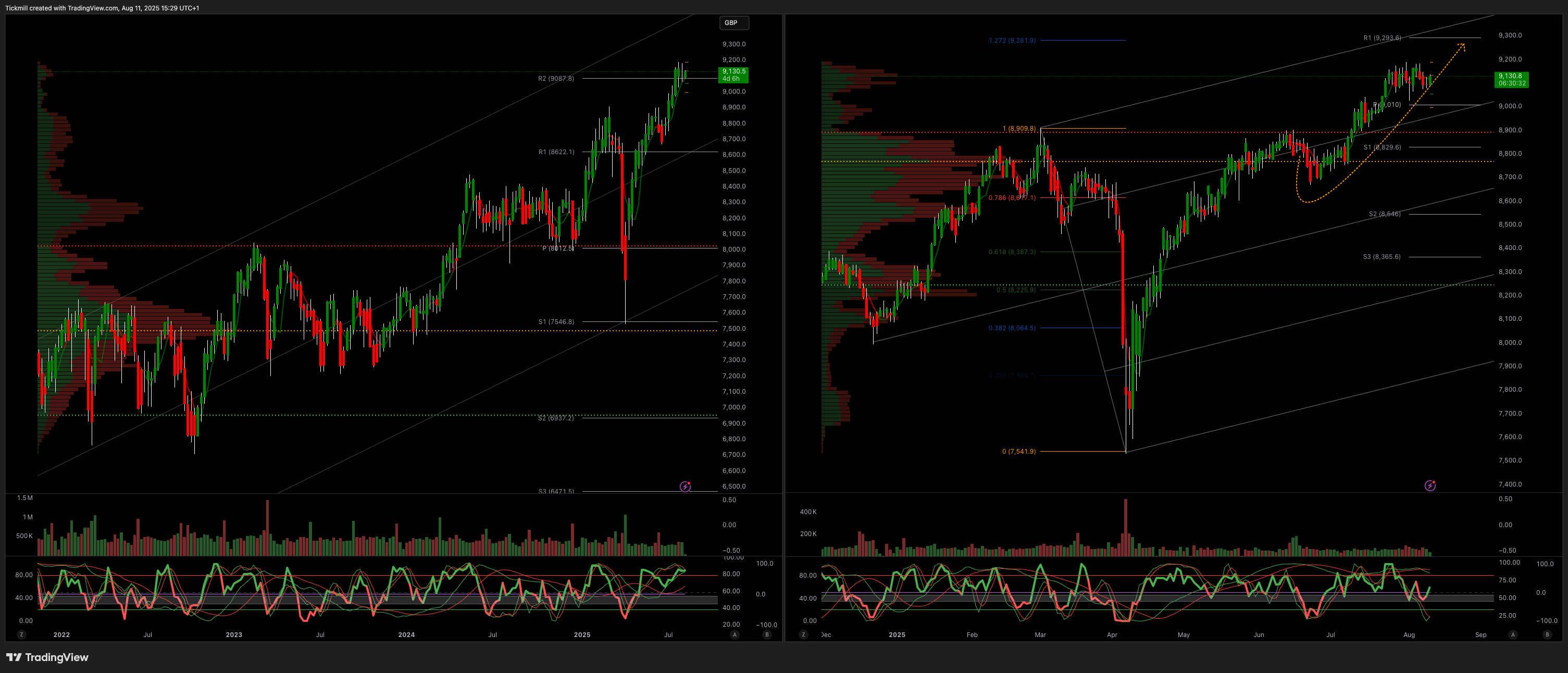

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!