FTSE 100 FINISH LINE 05/08/25

FTSE 100 FINISH LINE 05/08/25

UK stocks erased early gains on Tuesday, initially boosted by positive earnings from Diageo and Smith+Nephew, while anticipations of a Bank of England interest rate reduction later this week provided additional encouragement; however, investors reduced risk heading into the close. Diageo increased by 6.6% and ranked among the top gainers in the FTSE 100, as the largest spirits manufacturer in the world projected stable sales for 2026 despite tariff challenges and raised its cost-saving goals. The medical equipment and services sector led the gains, rising 11.1% to its highest level since November 2021, following Smith+Nephew's increase in first-half profits and the announcement of a new $500 million share buyback. British medical products had the largest increase in the FTSE 100, climbing almost 15%. BP saw a 2.6% rise after the oil giant announced it would review assets and expenses to boost profitability, with second-quarter profits exceeding expectations. Fresnillo jumped 6% after reporting positive first-half results. Precious metal miners grew 2.6% as gold prices approached a two-week peak. GOL/Travis Perkins was the leading gainer in the FTSE 250, rising 7.7% after the UK building materials company indicated it expects to meet full-year adjusted operating profit expectations, including property gains. Spectris gained 1.9% following a £41.75-per-share takeover bid from U.S. private equity firm KKR. In contrast, Domino's Pizza Group fell 13.6% after revising down its annual core profit forecast. Data released on Tuesday indicated that Britain's services sector experienced the largest decline in new orders since November 2022 and made job cuts at the quickest pace in six months, raising concerns for the Bank of England about growth. The BoE is generally anticipated to lower interest rates to 4% on Thursday from 4.25%, marking the fifth reduction in this cycle, though some policymakers might choose to maintain rates due to inflation exceeding its 2% target.

Technical & Trade View

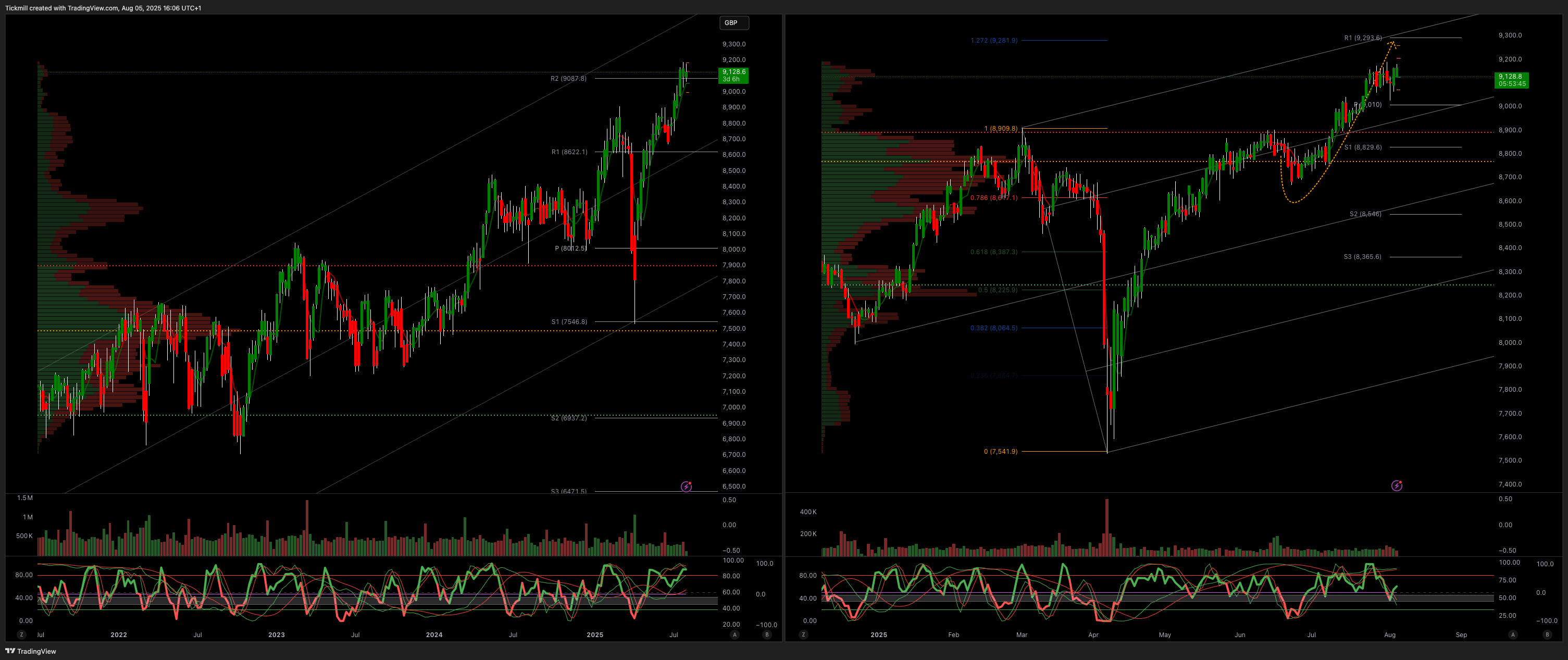

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!