EURUSD Implied Volatility Hits 2016 Levels

Elections on Watch

All eyes are on the US elections today with traders bracing for the risk of significant volatility if Trump is re-elected. In recent sessions, the US Dollar has softened as traders have paired back bets on Trump, in line with a polling shift back towards Harris. However, the vote remains incredibly close and too tough to call given that Harris’ lead falls well within the voting margin for error.

Market Scenarios

In terms of gauging likely market reaction today, consensus looks to be built around a Trump win being a net-positive for USD, crypto and certain stocks. Commodities, EMFX and risk FX would be the big losers in this scenario. On the other hand, if Harris wins, USD looks vulnerable to some near-term weakness though stocks and commodities should rebound with a broad move higher against USD in FX markets too.

Implied Volatility Spiking

As an indicator of the uncertainty in markets heading into the voting today, overnight implied volatility in EURUSD is at its highest level since the US elections in 2016, some eight years ago. Implied volatility for USDMXN is also at its highest level in eight years, reflecting how vulnerable the Peso is in the event of a Trump win and a return to protectionist US trade policies.

Technical Views

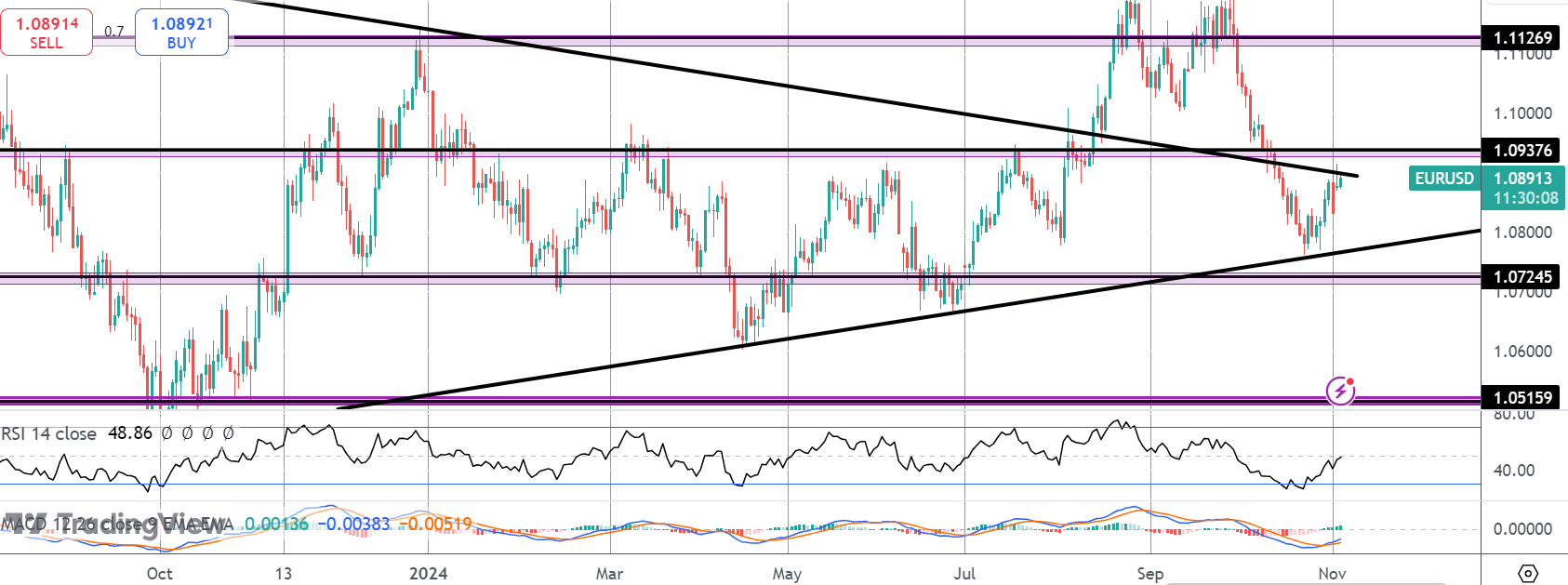

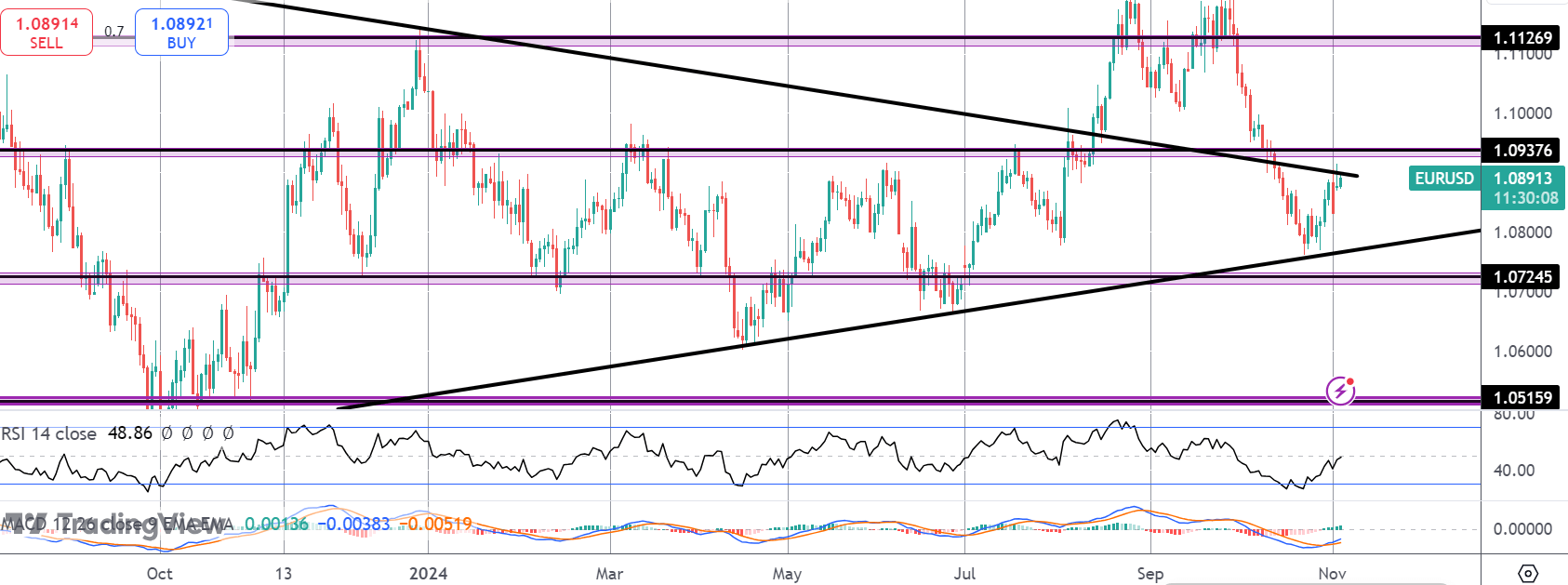

EURUSD

Ahead of the vote, EURUSD is being capped by the contracting triangle top and the 1.0937 level. If we break higher, 1.1126 will be the next bull target while to the downside, a break of 1.0724 opens the way for a test of 1.0515 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.