EUR/USD Drops to Critical 1.0500 Support Level; Technical Rebound Likely

The US Dollar continues to exhibit significant strength against major peers, reaching levels not seen since early November 2023. The election of Donald Trump, along with the Republican Party securing control of both the Senate and the House of Representatives, has introduced a new wave of policy expectations. Markets are anticipating a blend of protectionist trade measures and expansionary fiscal policies, including proposed universal import tariffs of 10% and substantial tax cuts for corporations and individuals.

The prospect of higher import tariffs raises concerns about increased costs for imported goods, which could slow down or even reverse the disinflation trend that has essentially been the core idea behind recent investor positioning across all asset classes. Hopes for a sustainable convergence of US inflation toward the Fed’s target have been further eroded by the prospect of government tax cuts, which could stimulate economic growth by increasing disposable income and encouraging investment.

However, the shift in the Fed’s easing outlook mainly concerns the rate trajectory for next year. The US CPI report released yesterday aligned with estimates, further cementing the outlook for a Fed rate cut in December. Interest rate derivatives currently price in an 82.8% probability of a 25 basis point reduction to a target range of 4.25%-4.50%, up from 66.6% a week ago.

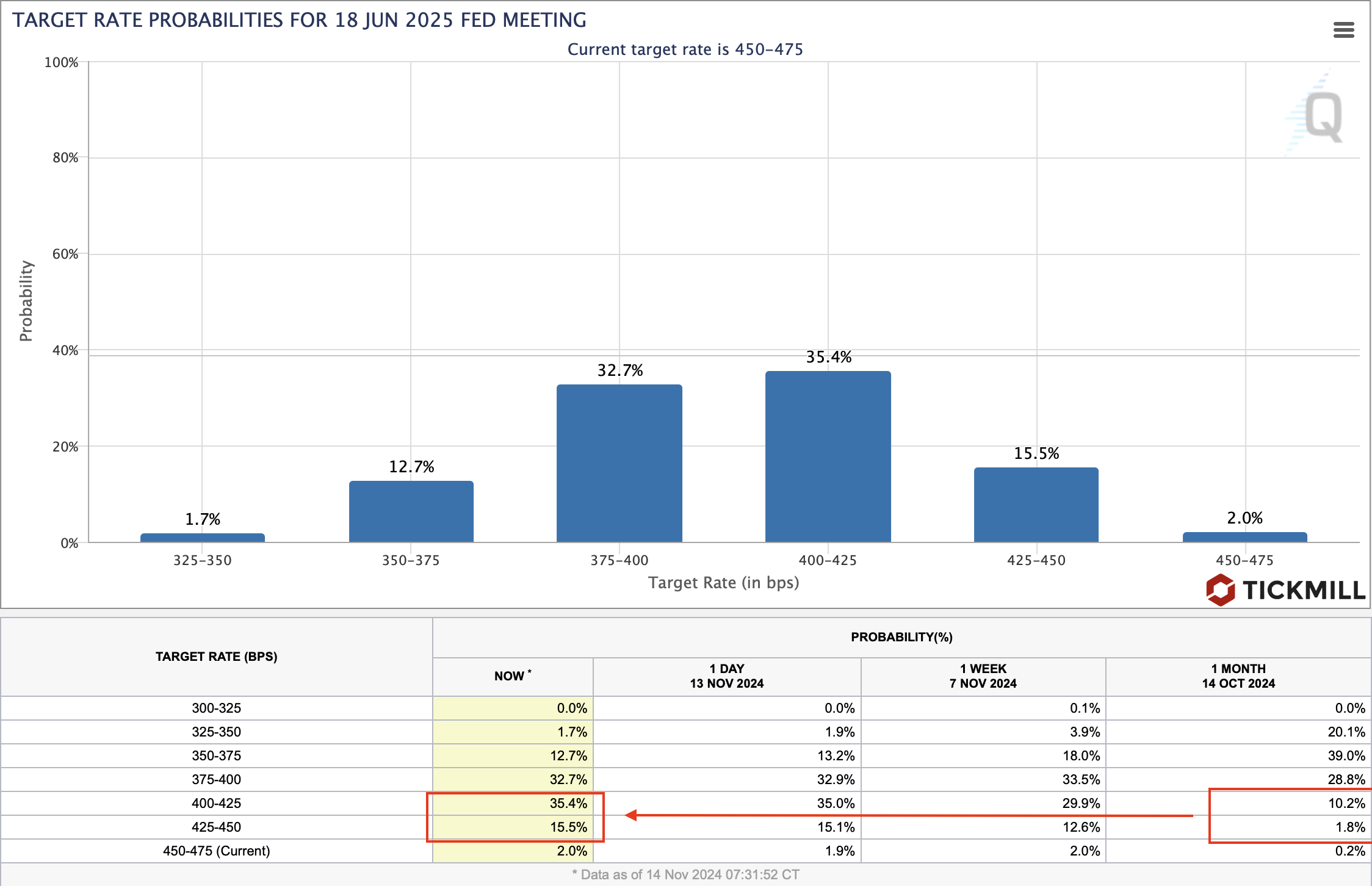

Examining the implied probability distribution for the June 25 meeting, the odds have shifted toward fewer cuts: for example, the chance for two rate cuts (from current levels) has risen from 10.2% a month ago to 35.4%, and the probability that the Fed will pause after December has increased from 1.8% to 15.5%:

Across the Atlantic, the ECB appears poised to maintain or even enhance its accommodative monetary policy stance. Comments from ECB Governing Council Member Olli Rehn suggest that the Deposit Rate could decline towards the neutral rate—estimated between 2% and 2.25%—by the first half of 2025.

This dovish outlook contrasts with the Fed's position and contributes to the Euro's depreciation against the Dollar. Expectations of lower interest rates in the Eurozone reduce the appeal of Euro-denominated assets, prompting capital flows towards the US where yields are relatively more attractive.

On the technical side, EUR/USD has reached a critical medium-term support level around 1.0500, where previous price action has often seen rebounds and reversals. This level holds significant technical importance. The sharp decline leading to this level reflects market expectations of a "red wave" in US politics, with both Congress and the presidency under Republican control. Should the 1.0500 level hold, a short-term recovery is likely, potentially lifting EUR/USD toward the 1.0600 level:

The British Pound has declined to a four-month low against the US Dollar, influenced by both domestic and international factors. Anticipation is building ahead of Bank of England Governor Andrew Bailey's speech, where insights into future monetary policy actions are expected.

Following a recent 25 basis point cut to 4.75%, the BoE may signal the pace and extent of future easing, especially in light of potential inflationary pressures from fiscal policies. However, persistent inflation in the services sector and higher-than-expected average earnings growth suggest underlying inflationary momentum, which could complicate the BoE's policy decisions.

The GBP/USD pair has broken through a critical ascending support line, initiating a steep downward trajectory that appears to be accelerating. This breakdown has left the pair in a "free fall" scenario, with limited technical support nearby. Market participants are now looking toward the 1.2600 level as a possible area for stabilization, driven potentially by profit-taking or technically driven buying. Should the 1.2600 level fail to hold, stronger support may emerge around the 1.2500 level, a historically significant zone that could attract buyers and mitigate further downside risk:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.