Dollar Volatility Risks Into Inflation Today

Dollar Softens on PPI Miss

The US Dollar continues to pull back from highs ahead of today’s keenly awaited US inflation data. Yesterday, a weaker-than-forecast set of PPI readings saw the greenback coming under fresh selling pressure. The Dollar had been rising high on the back of last week’s strong jobs data. However, yesterday’s data has fuelled some uncertainty ahead of CPI today, suggesting risks for an undershoot.

US Inflation Due

On the numbers front, the market is looking for headline CPI to rise to 2.9% from 2.7% prior, year-over-year. If confirmed, or topped, this should see traders further pushing out their Fed rate cut expectations in coming months, leading to fresh buying in USD. However, if inflation comes in below forecasts today, this should see March rate cut chances creeping back up, putting downward pressure on the Dollar.

Hawkish BOJ Chatter

USD is also being weighed on midweek by a fresh rise in JPY linked to renewed hawkish BOJ expectations. Comments from BOJ governor Ueda have fuelled expectations of a forthcoming BOJ rate hike at the next meeting. Ueda said that the BOJ would hike rates again if current improvements in the economy continue. These comments come days after Ueda noted that the BOJ would be considering a hike at the upcoming meeting. If US inflation undershoots today, this could fuel a strong shift into JPY buying near-term, leading USD lower.

Technical Views

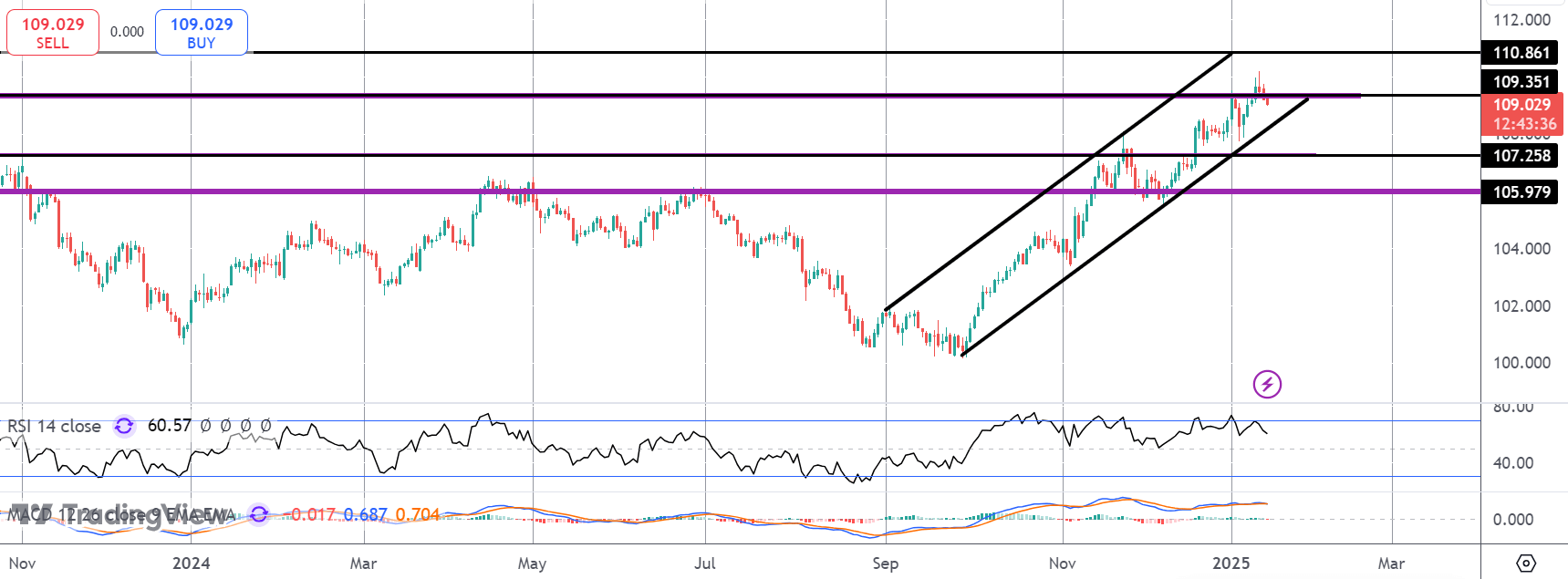

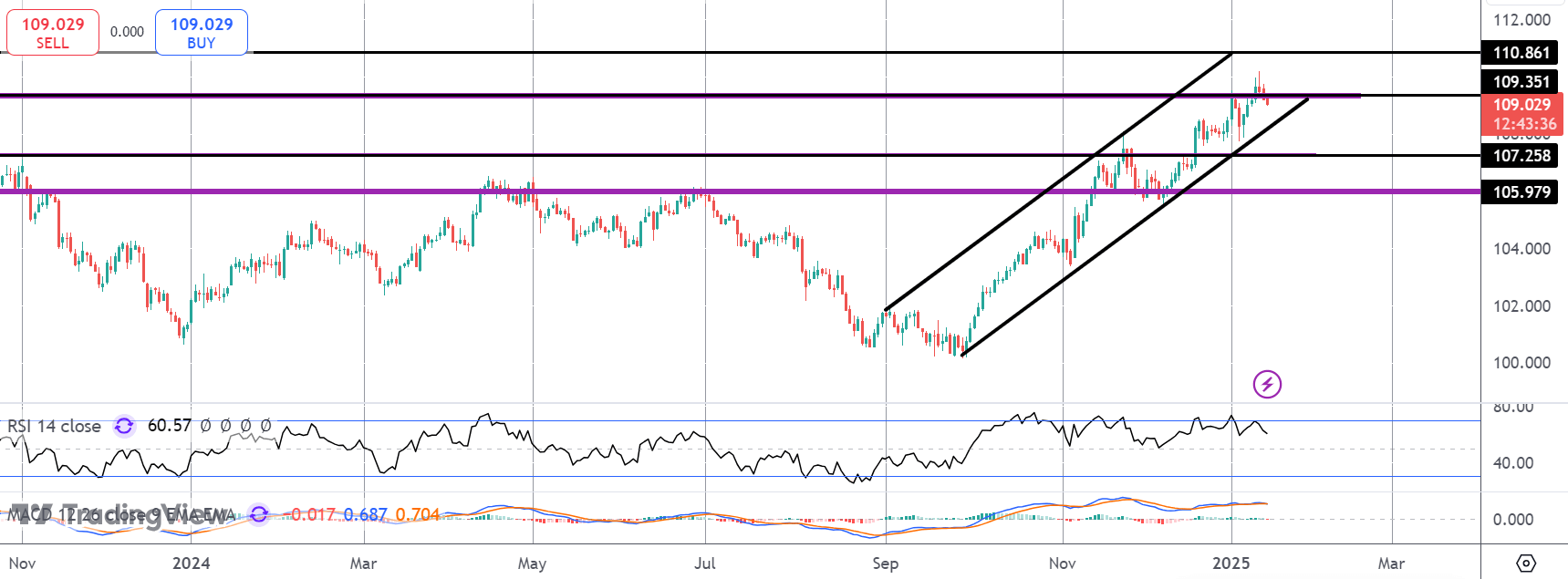

DXY

The rally in DXY has stalled for now with price reversing back under the 109.35 level. With momentum studies softening, a deeper correction is possible here. However, the broader bull bias remains while price holds within the bull channel or at least above the 107.25 level support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.