Dollar Rallying on US Elections Uncertainty

Trump Trade

As the US elections draw nearer, now just 3 weeks away on Nov 5th, markets are starting to show some skew. The US Dollar has been rising steadily in recent weeks. While part of this move can be explained by a hawkish shift in the market’s Fed outlook, election views are certainly starting to play a bigger role in FX moves. The rise in USD can therefore be seen as traders starting to price in the risk of a Trump win. The so-called ‘Trump-trade’ effect of a stronger USD and weaker commodities prices and weaker EMFX, was a key theme of Trump’s last presidency. With traders now eyeing the very real risk of a fresh term for Trump, markets are starting to display a similar dynamic.

Polling Risks

While national polls show Harris as holding a 2-point lead over Trump, the memory of polling upsets from the first Trump presidency are all to raw in traders’ minds. Notably, several key state polls have showed a declining lead for Harris recently with some switching to showing Trump as the favourite. As such, the risk of a Trump win cannot be ruled out and heading into the election, USD looks likely to stay well bid accordingly, keeping commodities prices and EMFX weighed lower.

Technical Views

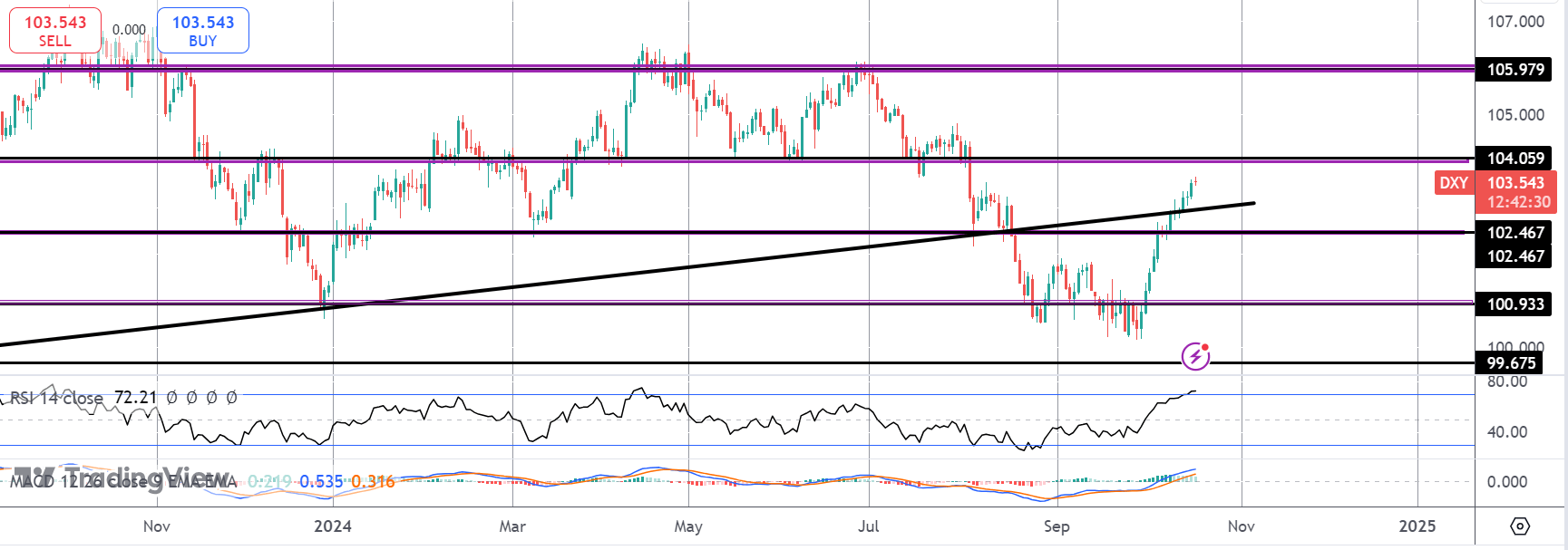

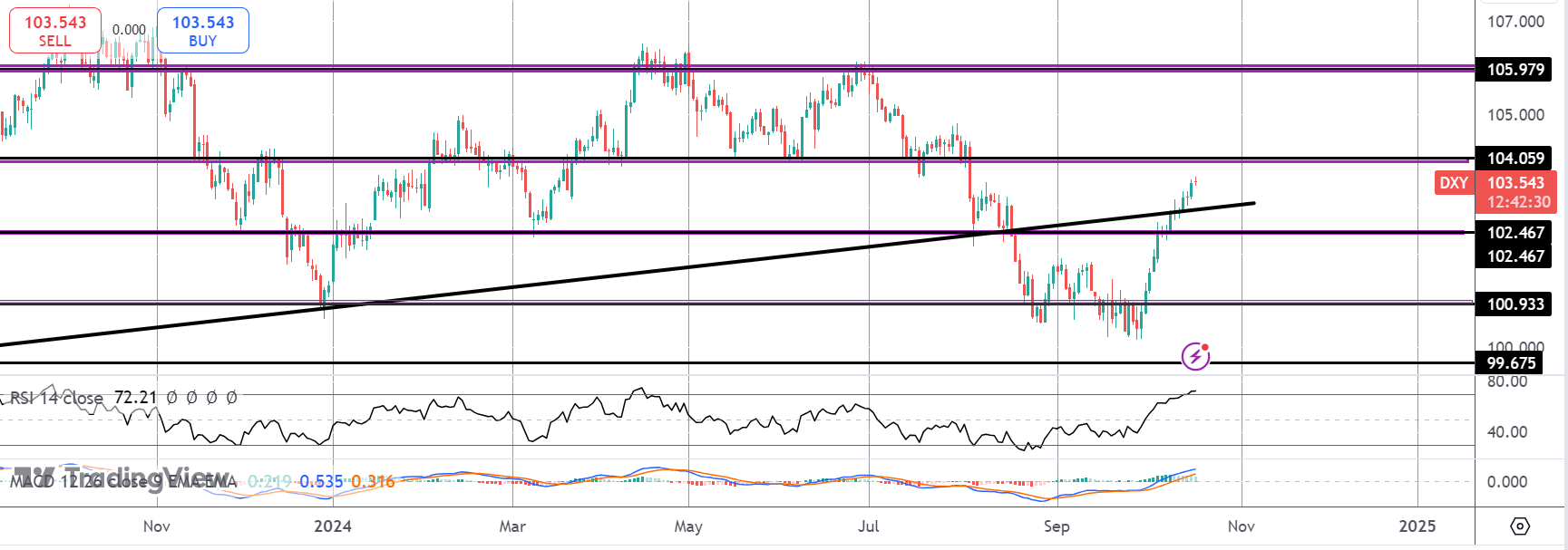

DXY

The rally in DXY off the 100.93 lows has seen the market breaking back above the 102.46 level and back above the broken bull trend line. While above here and with momentum studies bullish, the focus is on a continuation higher and a test of the 104.05 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.