Dollar Rallying Ahead of Trump Inauguration

Trump & USD

The US Dollar is pushing higher today ahead of Trump’s inauguration later this afternoon. With US markets off-line for Martin Luther King today, trading action should be seen most in futures and FX markets. The rally in USD today suggests a cautiously bullish view that Trump’s early action as president will help drive USD higher. There has been plenty of analysis over recent months regarding the likely impact of the protectionist and pro-growth policy actions he has signalled though today’s rally could be seen as more of a safe haven bid amidst growing uncertainty.

Positioning Opportunities

Looking at the latest positioning data across markets, there is an overwhelming long USD trade in place. However, the bulk of that position (around 60%) is against CAD, CHF and AUD. Expectations of fresh trade wars and downside impact on commodity currencies are fuelling the CAD/AUD/CHF short position. As such, there is plenty of room for pairs like EURUSD and GBPUSD to trade sharply lower if we see a fresh USD rally this week and traders rebuild those positions. For GBP in particular, rising expectations of near-term BOE cuts make it a strong candidate for fresh selling. JPY on the other hand is currently being supported through expectations of a forthcoming BOJ hike this week which should keep USDJPY pressured provided a hike is delivered.

Technical Views

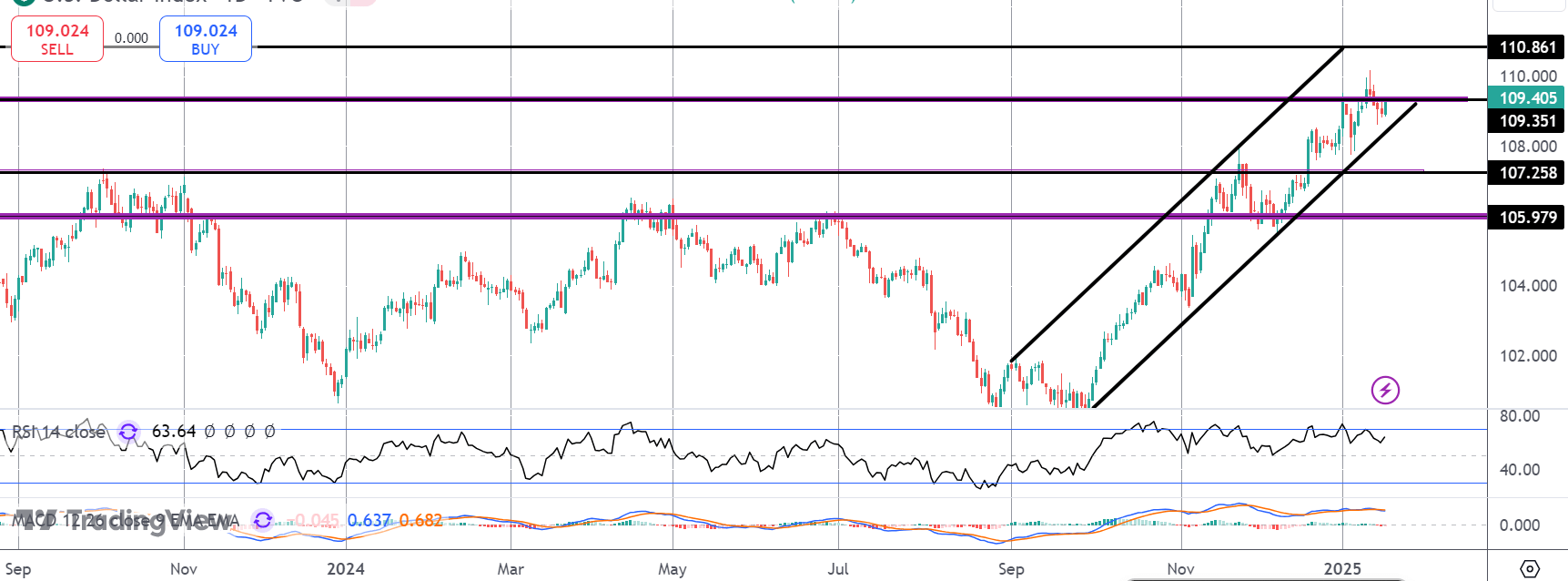

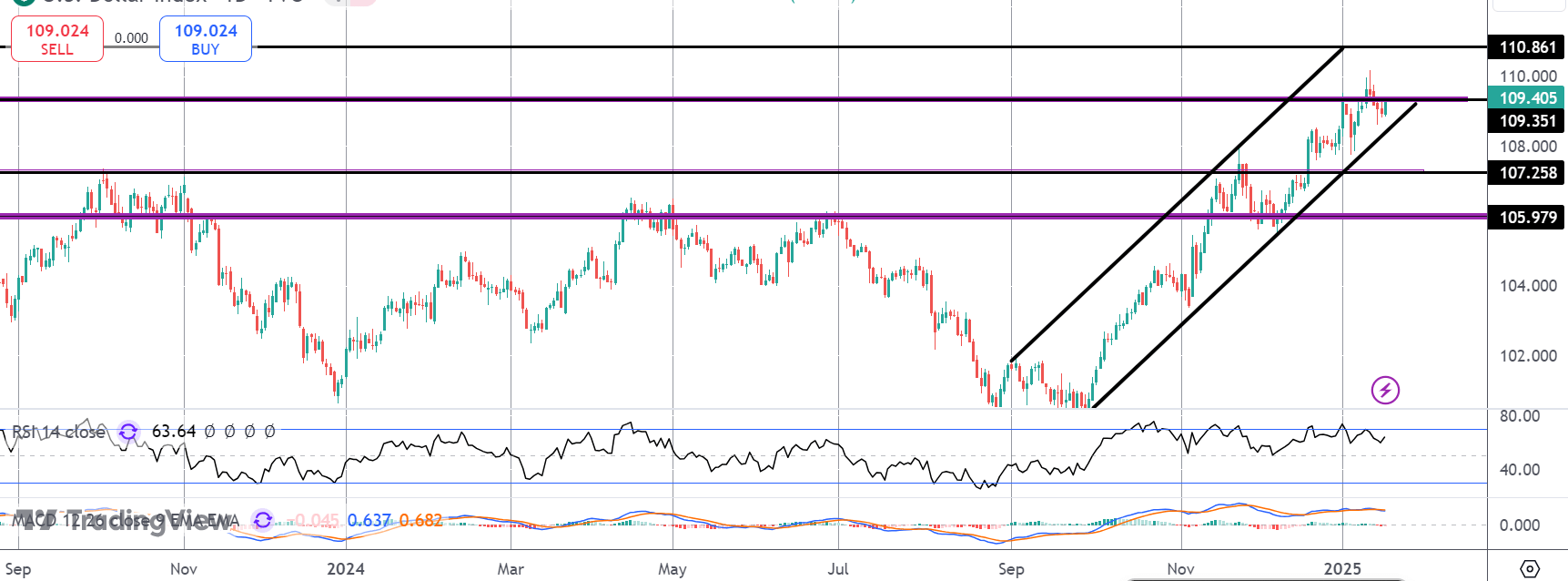

DXY

The index is once again testing the 109.35 level following a correction below the level from YTD highs. Back above there, focus will be on a continuation towards the 110.86 level next, in line with the bull channel. However, softer momentum studies readings signal risk of failure with 107.25 the next support to note if we do break down near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.