Dollar On Watch Over Heavy Data Week

US Data in Focus

The US Dollar is on watch this week as traders prepare to receive a slew of US data. Following the reopening of the govt on the back of the record-long shutdown, delayed data from that period is now making its way through along with the resumption of the current data schedule. This week, traders will be watching US PPI and retail sales tomorrow, weekly jobless claims, prelim quarterly GDP, core PCE and Beige Book data on Wednesday ahead of the Thanksgiving holiday on Thursday and long weekend.

December Easing Expectations

Notably, pricing for a December cut has spiked back to above 70% today, from as low as 33% toward the end of last week. Dovish comments from Fed’s Williams on Friday seem to have fuelled the shift with the NY Fed President voicing his support for a further cut this year. Despite this shift in pricing, we’ve seen no subsequent reactive downside in USD suggesting traders are waiting to see what guidance we get from data this week.

Mixed Employment Data

Last week, the delayed September NFP came in well above forecasts at 199k vs 55k expected. However, the prior figure was revised lower to -4k from 22k and the unemployment rate was seen rising while wage growth cooled. Aside from the headline figure, the rest of the data was bearish which has likely fed into the uptick in rate cut expectations. If we see any fresh data downside this week, this should see easing prospects rising higher putting fresh pressure on USD. Alternatively, any upside surprises in data this week should see easing probabilities cooling, keeping USD supported.

Technical Views

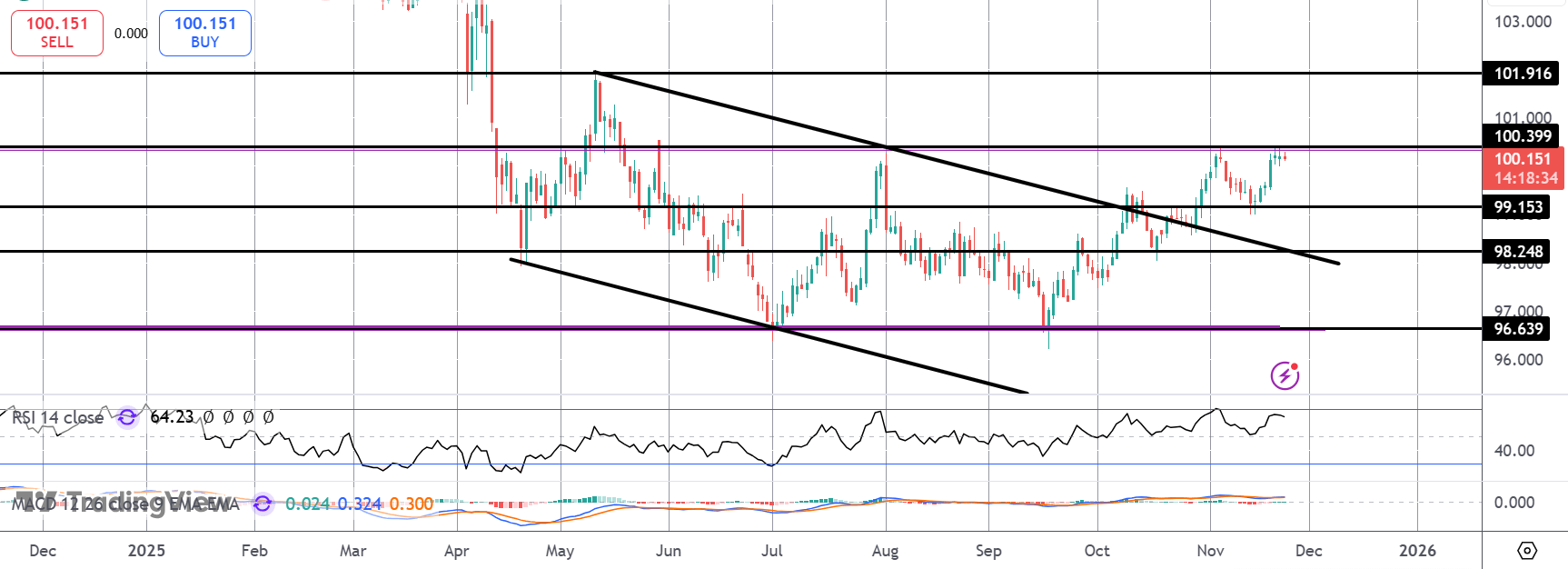

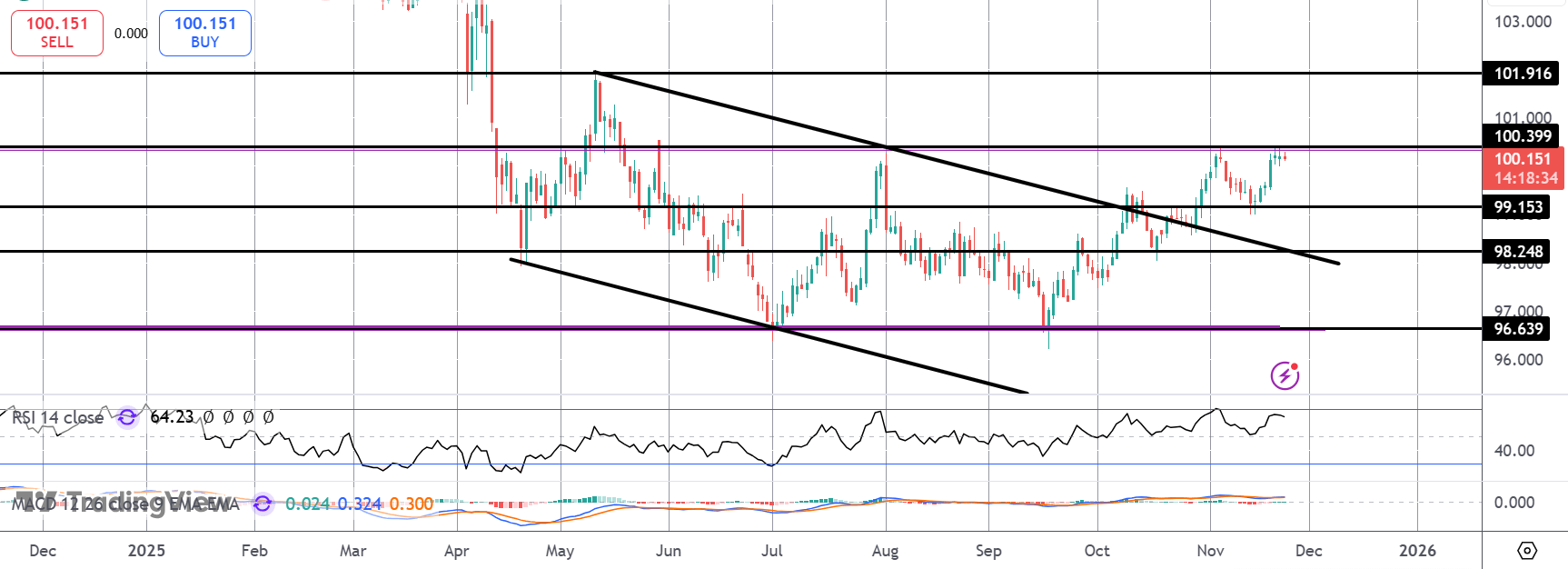

DXY

For now, the rally in the index remains capped by the 100.39 level resistance. While above 99.15, the focus is on a continuation higher and a breakout towards 101.91 next. Below 99.15, focus turns to 98.24 next and the retest of the broken bear channel highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.