Dollar Firms Following Powell Rates Warnings

DXY Rising on Friday

The Dollar is firming up again midweek following comments from Fed chair Powell last night which seemed to dilute near-term easing prospects. Powell reiterated his view that the Fed must proceed with caution in any further rate cuts given the fine balance between downside labour market risks and upside inflation risks. Elaborating on this situation, Powell explained that cutting rates too quickly would leave the economy vulnerable to a fresh surge in inflation. However, cutting rates too slowly might see the jobs market weaken further. As such, Powell signalled that incoming data will be closely scrutinised ahead of each meeting decision.

Market Expectations & US Data

Despite these warnings from Powell yesterday, the market is still pricing in a further .25% cut next month with pricing for an additional cut by year end around 70%. Given this dovish view, there is room for USD bears to be unseated if inflation continues to rise and the Fed delays the next rate cut. Looking ahead, incoming data tomorrow and Friday will be key for how DXY ends the week. In particular, the weekly jobless figure tomorrow and core PCE on Friday will be the main focus for traders. Yesterday, a fresh drop in US PMIs served as further evidence of economic weakening, endorsing bears’ dovish expectations for now.

Technical Views

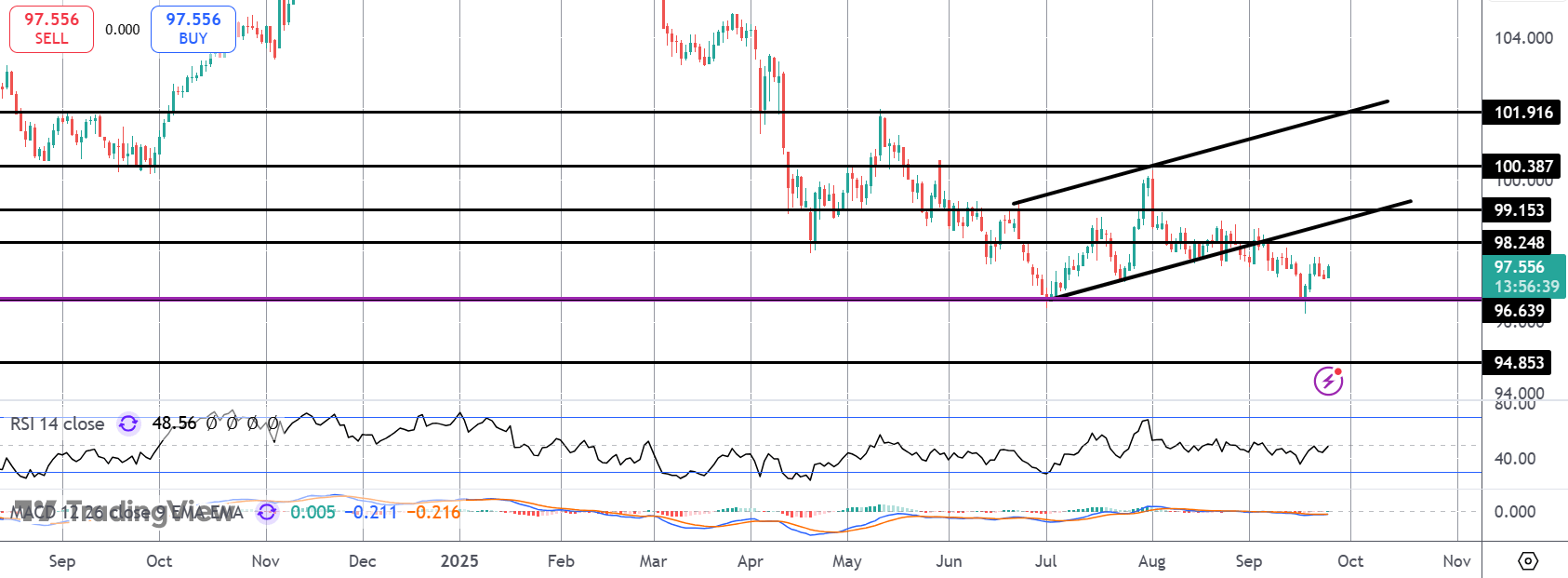

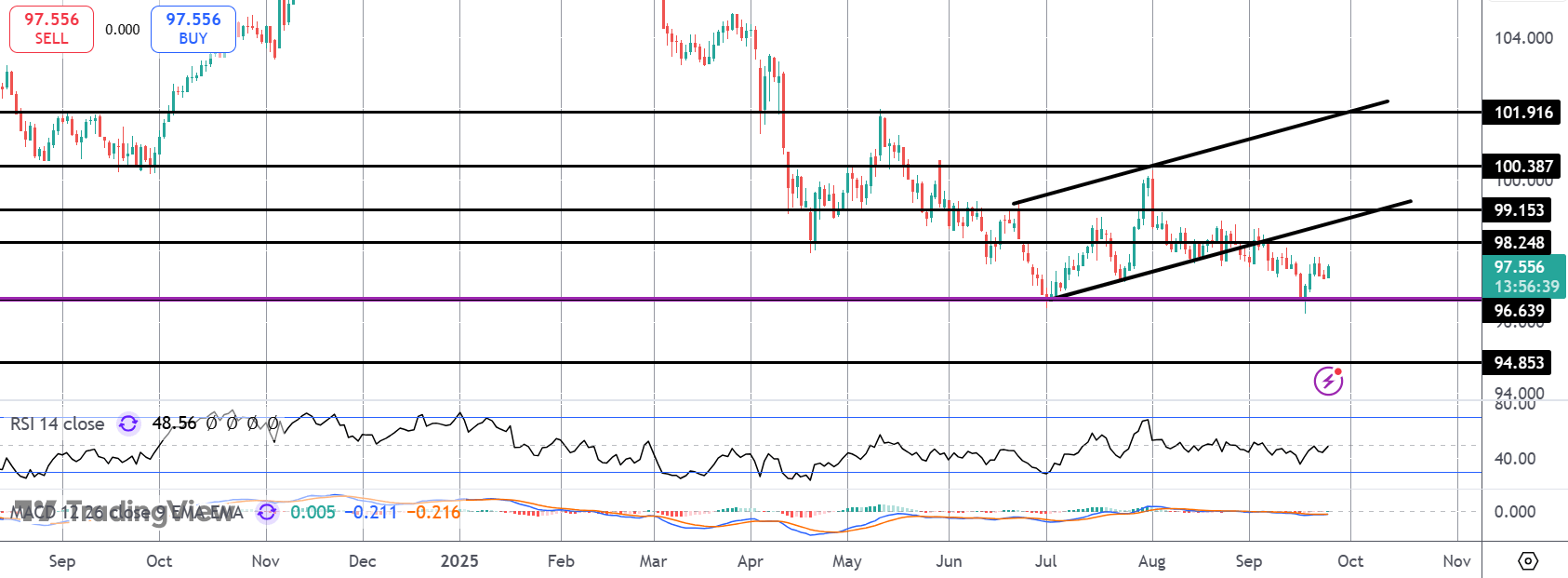

DXY

With the index back in the green today, focus is on a continued bounce of the 96.63-level support with 98.24 the initial resistance for bulls to face. Above there, a retest of the broken bull channel and the 99.15 level will be next. While price holds below the broken channel, risks of an eventual break lower remain seen.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.