Dollar At Highs Ahead of Inflation Data Today

US Inflation Up Next

All eyes are on the US Dollar today as traders brace for the latest set of US inflation results. The market is expecting annualised CPI to prise to 2.6% from 2.4% last month. If seen, the data should further dilute near-term Fed easing expectations, creating support for a fresh driver higher in the Dollar. Traders have been scaling back their easing projections in the wake of Trump’s re-election with expectations that his protectionist and pro-growth policies will lead to a fresh rise in inflation. USD has been firmly higher recently, reflecting that outlook.

USD Downside Risks Muted

If data today undershoots forecasts, there is room for USD to correct a little near-term. Given the bull run we’ve seen since late September, the market is certainly ripe for a long squeeze. However, with Trump due to take office in January, any correction is likely to be short-lived and USD remains vulnerable to further upside in response to nay rhetoric or headlines from Trump ahead of January.

Powell on Deck

Beyond today’s data, traders will then be looking to Fed chairman Powell who speaks tomorrow. If Powell is seen to acknowledge the risks/uncertainty linked to a fresh Trump presidency, this could easily fuel a further push higher in USD as traders bring down December rate hike chances.

Technical Views

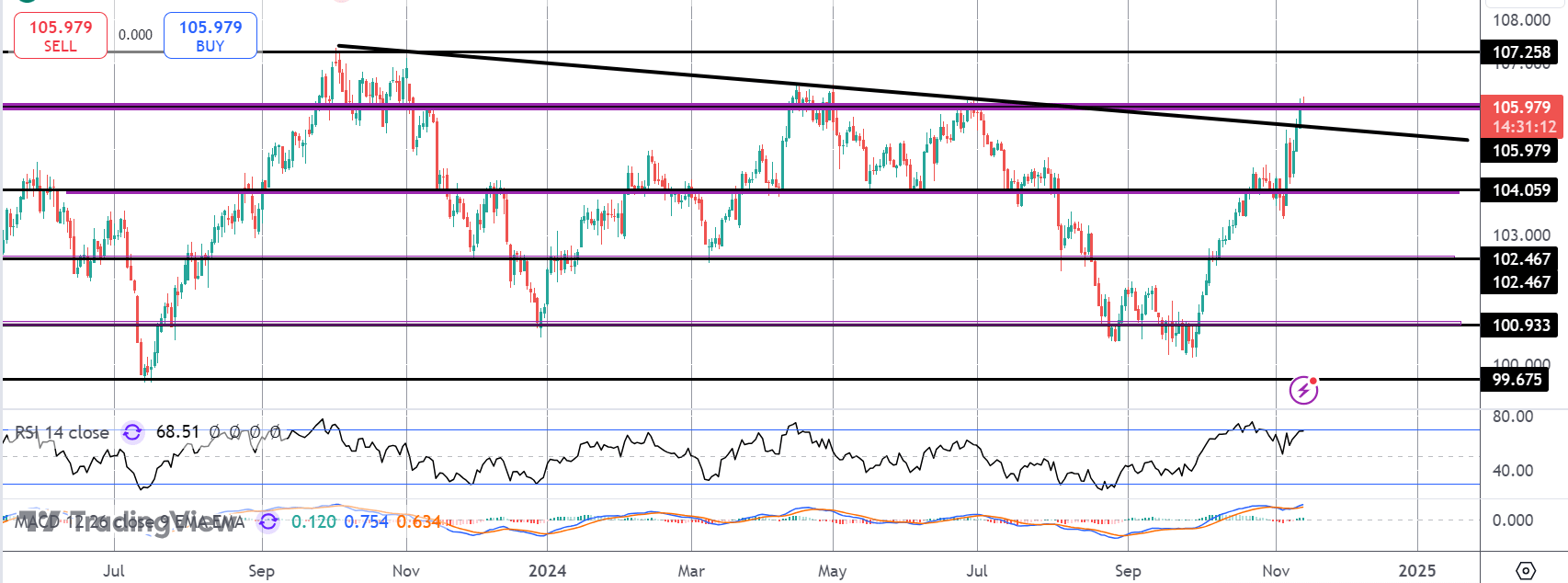

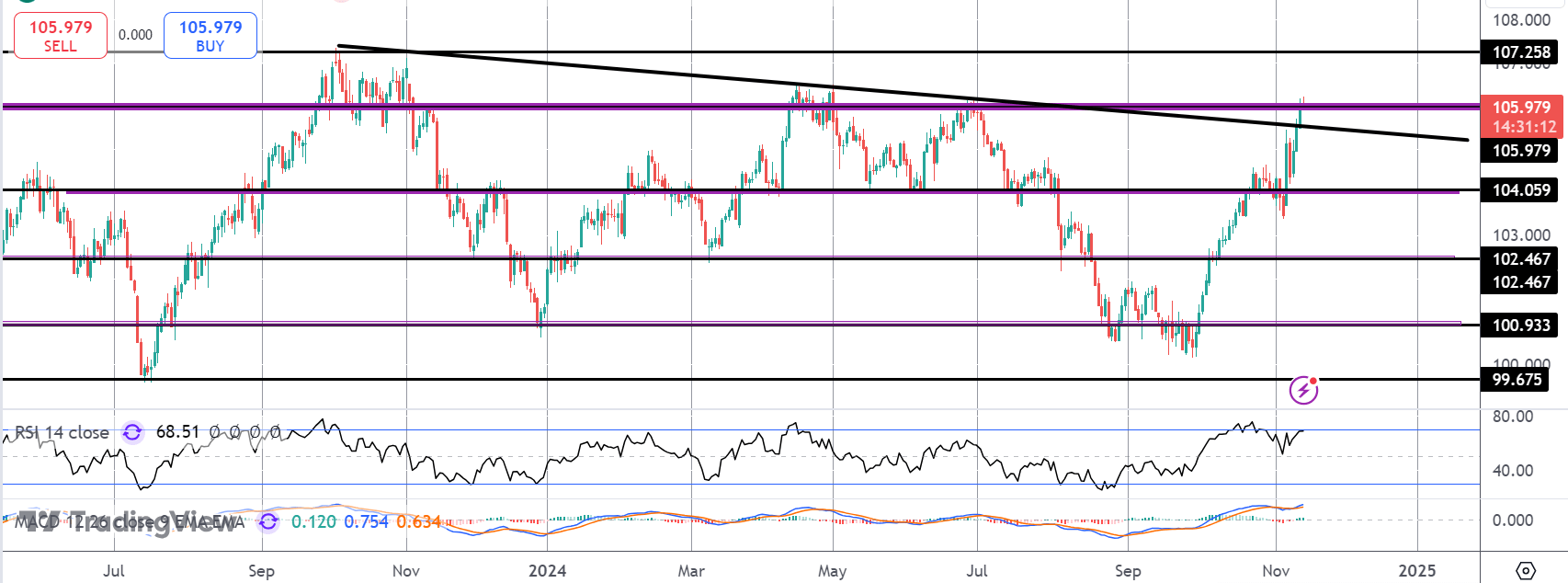

DXY

The rally in the DXY has seen the market breaking firmly higher with price now testing above the bear trend line from 2023 highs. Price is now testing the 105.97 resistance which, if broken, opens the way for a test of 107.25 above. To the downside, 104.05 remains key support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.