Daily Market Outlook, September 14, 2022

Daily Market Outlook, September 14, 2022

Overnight Headlines

- Bank Of Japan Conducts Rate Check On FX, Nikkei Says

- Asia Stocks Slump Following Wall Street Rout On Strong Inflation

- Goldman Says Get Ready For Fresh Cross-Asset Pain On Real Rates

- Dollar-Yen Verbal Intervention Returns With Currency Pair Near 145

- BoJ Boosts Bond Buying Again As Yields Approach Its Policy Limit

- Japan Sept Factory Mood Tanks On Cost Pressure - RTRS Tankan

- Japan's Core Machinery Orders Extended Gains In July

- China Sets Yuan Fix At Strongest Bias On Record To Lift Currency

- China’s Yuan To Get Support From Economy, Trade Surplus - Paper

- China's Shadow Bank Lending Shows Biggest Jump Since 2017

- France Cuts 2023 Growth Forecast 1% Citing ‘Tense’ Backdrop

- Dollar Has Biggest Daily Pct Gain Since 2020 After Unexpected Rise

- Treasury 5y Yield Rises To Highest Since 2008, Tops June Peak

- Nomura Calls For 100bps Fed Hike In Sept As Speculation Rises

- Oil Steadies As US Restocking Plan Counters Roaring Inflation

- Biden Officials Weigh Buying Oil At Around $80 To Refill Reserves

- JPMorgan Sees Oil Prices Climbing As Alternatives Fall Short

- Apple To Use TSMC's next 3-NM Chip Tech In iPhones, Macs Next Year

The Day Ahead

- Asian equities and bond markets fell sharply after the negative closes in Europe and on Wall Street following the release of US inflation data. The annual rate of US headline CPI fell by less than expected in August to 8.3%. Moreover, core inflation continued to climb and rose more than expected to 6.3%, led by stronger domestic services inflation. The outcome cemented market expectations for another 75bp increase in interest rates by the Fed next week, with speculation that a 100bp hike could be in play.

- UK August CPI inflation data released earlier this morning showed the headline annual rate easing to 9.9% from 10.1% in July. The outcome was slightly weaker than expected and was the first moderation in nearly a year. Core inflation edged up to 6.3% from 6.2% as we predicted but was slightly above market expectations. The fall in headline inflation was driven by lower petrol prices which offset rises in other components such as food and clothing & footwear.

- Looking ahead, the UK government’s energy price guarantee announcement for households means that the rise in energy bills in Q4 will be significantly lower than previously anticipated, and the peak in inflation will be lower, probably not much higher than the current level. On the other hand, the support to household incomes could boost demand and domestic inflationary pressures further out.

- For the rest of the day, UK house price and Eurozone industrial production figures are likely to attract limited attention. Potential downside risks to the consensus forecast for Eurozone industrial production for July (-1.0%m/m) and expect a drop closer to 2%, suggesting a weak start for industrial activity in Q3.

- There may be some focus on the European Commission with reports that it will announce plans to tackle the energy crisis, including measures to curb consumption and a windfall tax on energy surplus profits. Reports suggest, however, that mooted price caps on imported gas may not be put forward at this point due to disagreements among member states.

- US producer price data are due and will provide an indication of pipeline inflationary pressures. The year-on-year rate is expected to fall further partly reflecting lower energy prices. For Fed policymakers, however, yesterday’s CPI inflation report will not have allayed concerns that domestic inflationary pressures are continuing to build.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9920-30 (1.47BLN), 0.9950 (670M), 1.0000 (1.92BLN)

- 1.0020-25 (588M)

- USD/JPY: 144.60-70 (410M)

- EUR/CHF: 0.9400 (492M), 0.9650 (1.05BLN)

- GBP/USD: 1.1500 (317M), 1.1515 (504M), 1.1700 (407M)

- AUD/USD: 0.6750 (261M), 0.6800 (425M), 0.6900-05 (729M)

- USD/CAD: 1.3125-35 (575M), 1.3175-85 (390M)

Technical & Trade Views

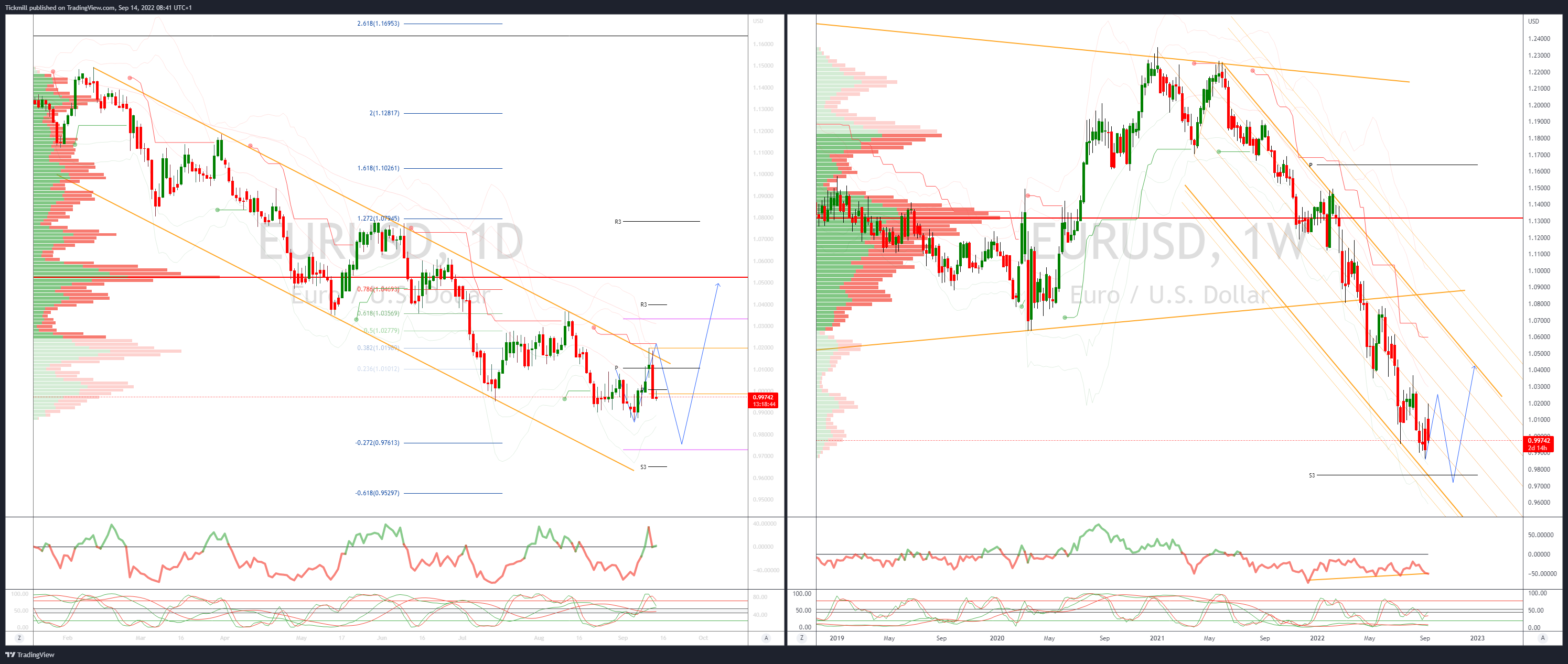

EURUSD Bias: Bearish below 1.0250

- Aggressive Fed expectations weigh into U.S. PP

- Expectations of an aggressive Fed, FEDWATCH prices Sept 21 100pt hike at 37%

- U.S. PPI today and retail sales Thursday are event risk for the EUR/USD

- Ukraine on back burner for markets, but potential major factor

- 20 day VWAP bands contract - mixed signals favour a range

- September 0.9864-1.0198 range appears a viable range into Fed on Sept 21

- Rejection of 1.0131 Upper VWAP and close below 1.0002 is bearish

- 0.9950 469 mln 1.0000 1.808 BLN are the close strikes on Wednesday

- 20 Day VWAP bearish, 5 Day bearish

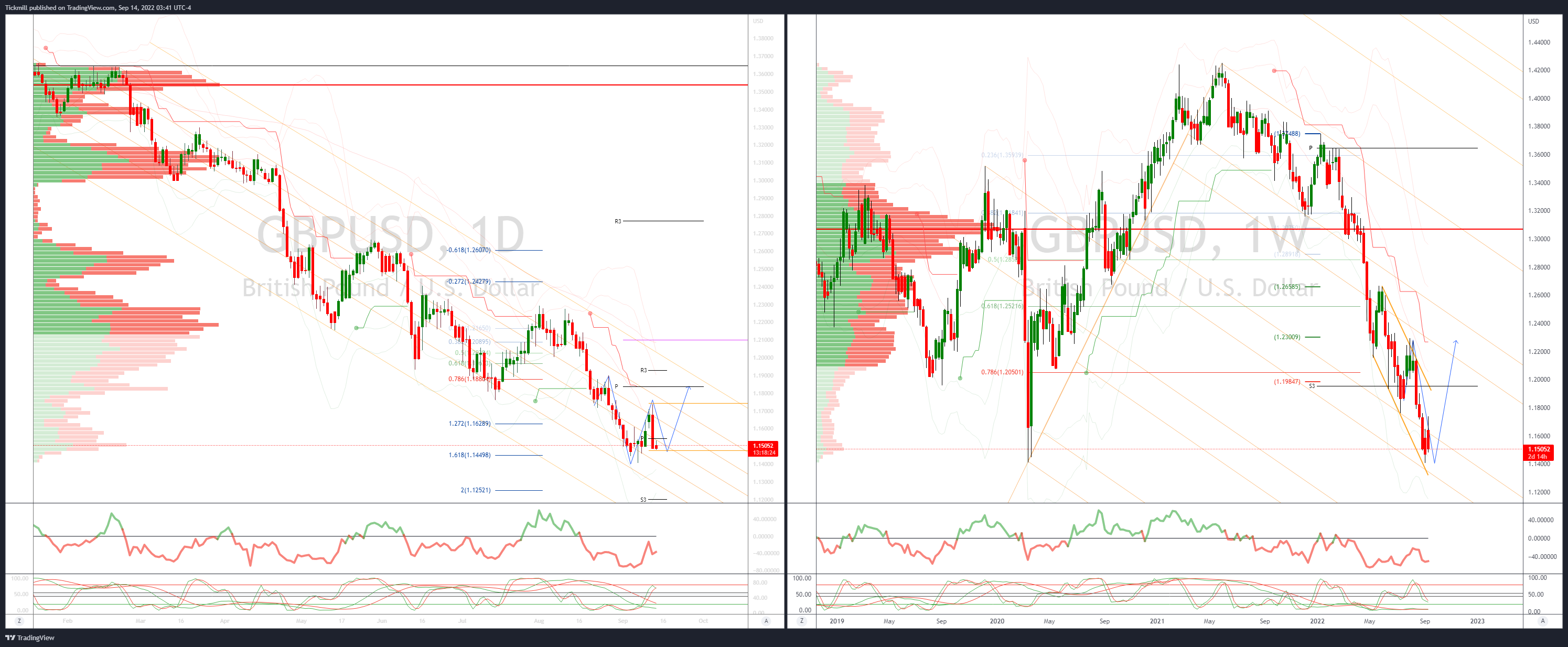

GBPUSD Bias: Bearish below 1.19

- Bearish outside day reversal pattern

- UK inflation come sin slightly below forecast, GBP dips

- Off 0.1% after closing down 1.6%, as the USD rebounded after strong U.S. CPI

- Techs: slump left a bearish outside day and mixed daily momentum studies

- 20 day VWAP contract

- Downside bias returns, after Tuesday's failure at the 1.1673

- 1.1407 September low then 1.1355 lower 20 day VWAP band are initial support

- 1.1673, then NY 1.1738 high first resistance

- 20 Day VWAP is bearish, 5 Day bearish

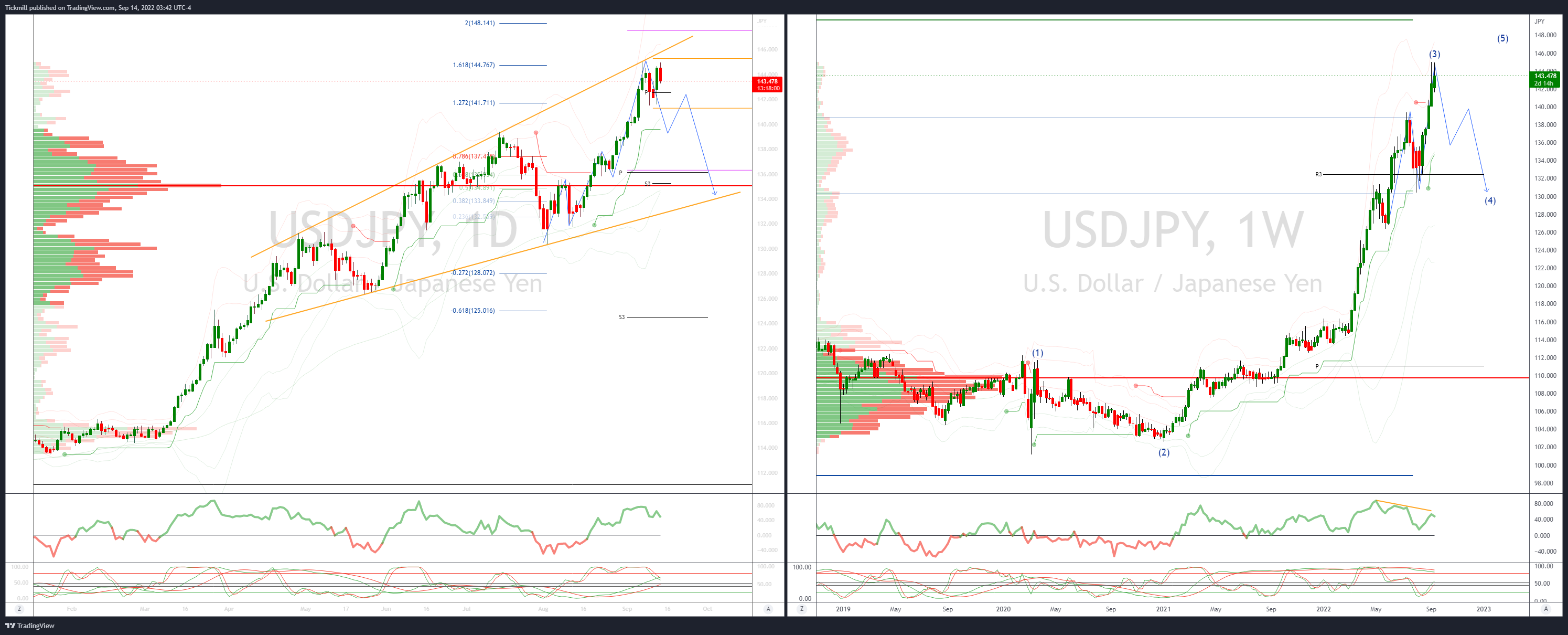

USDJPY Bias: Bullish above 139

- USD/JPY attempts up rebuffed

- Stronger MoF/Japan govt talk threatening intervention sets market tone early

- Defense of option barriers at 145.00 cited, tick above 144.99 high 9/7

- Japanese exporter offers also noted up top, importers from @144.00

- Specs eyeing test of 145.00 soon however on talk Fed maybe more hawkish

- US yields buoyant but off early Asia highs, Tsy 2s @3.775%, high 3.805%

- Smattering of option expiries 144.49-83 today, total $695 mln

- Asia risk off post-Wall St crash, Nikkei -2.2% @27,994, E-Minis +0.2% @3959

- JPY crosses mixed, some off hard from recent highs, some still buoyant

- 20 Day VWAP is bullish, 5 Day bearish

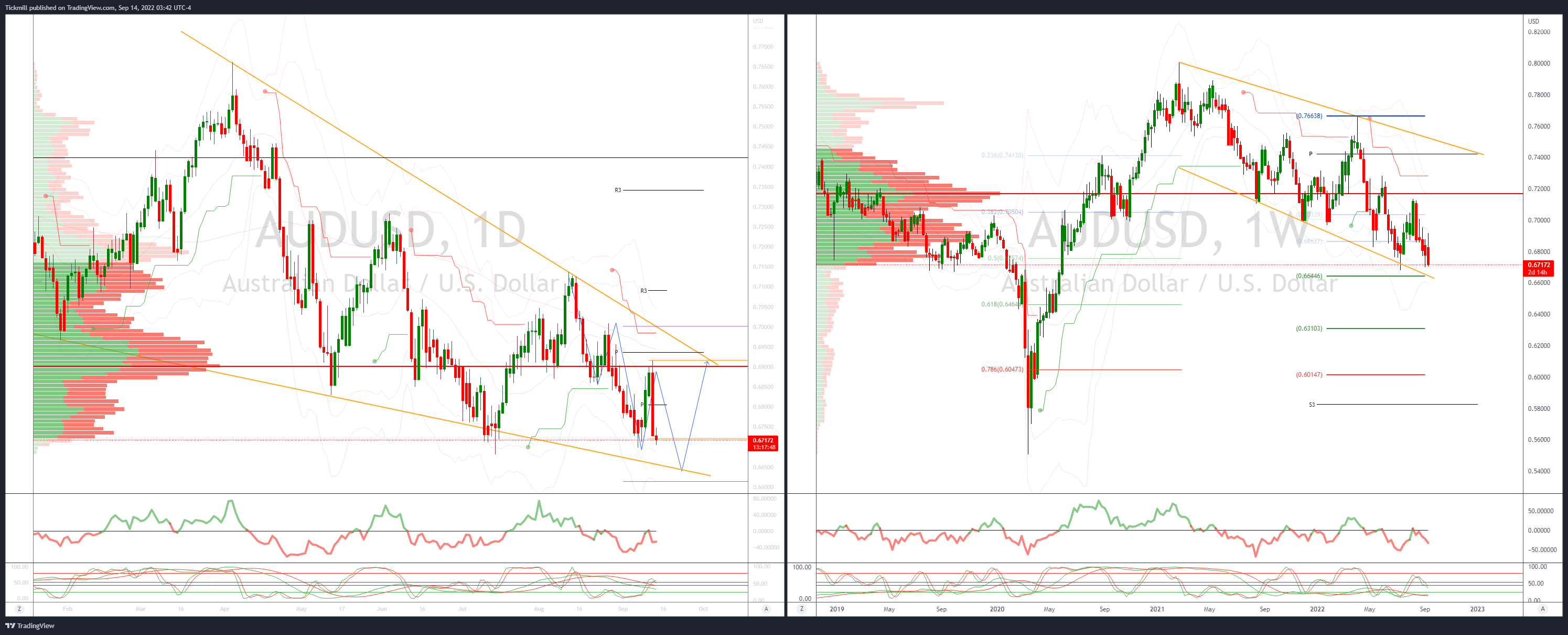

AUDUSD Bias: Bearish below .70

- Muted bounce – markets slide, USD to remain fi

- Up 0.1% in a quiet morning - bargain hunting into the 2.25% fall yesterday,

- Tuesday's risk rout after strong U.S. CPI fuelled Fed hike expectations

- Hard to see the USD falling far ahead of the September 21st rate decision

- Asian stocks hit hard, Nikkei -2.1%, AsiaxJP stocks -1.9% and ASX 200 -2.6%

- 0.6682 July and 2022 base initial supports

- 0.6785/91, then 0.6845 are first resistance

- 20 Day VWAP is bearish, 5 Day bearish

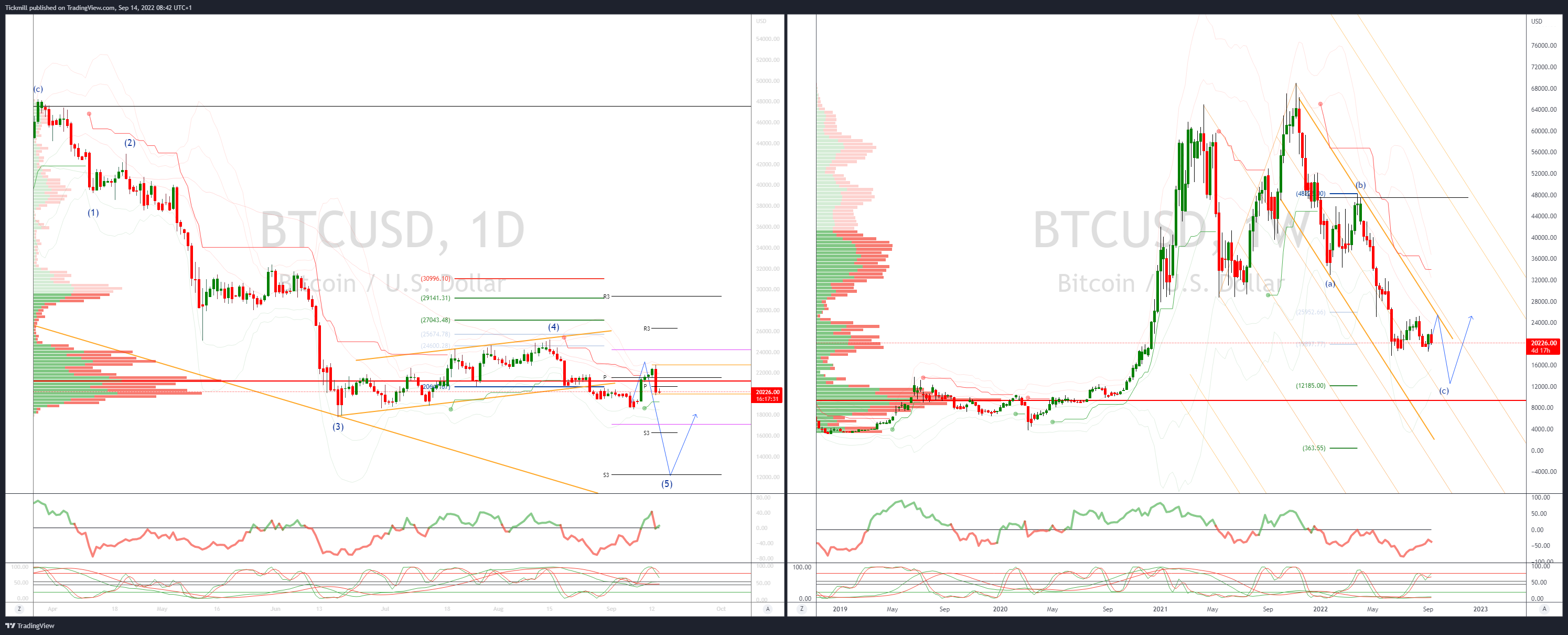

BTCUSD Bias: Bearish below 25.3K

- BTC recovers above 20k after US CPI – induced risk rout

- BTC rises 0.7% to 20,309 after falling to 19,862

- Might stay above 20k support, avoid bearish signal

- Wed close below 19,360 cues VWAP downtrend channel

- Risk rout triggered by US CPI data abates in Asia

- Asia stocks down by significantly less than Wall St

- ETH merge expected Thursday; may attract new investors

- But impact of the energy-saving move mostly priced in

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!