Daily Market Outlook, November 29, 2023

Daily Market Outlook, November 29, 2023

Munnelly’s Market Commentary…

Asia - Stocks in the Asia-Pacific region displayed a mixed performance in the wake of volatile trading on Wall Street. The US dollar weakened, and treasury bonds gained ground following dovish comments from the Federal Reserve. Investors also considered the Reserve Bank of New Zealand's decision to keep interest rates unchanged but hinted at the possibility of future rate hikes. The Japanese Nikkei 225 index experienced fluctuations, initially impacted by a stronger currency but later recovering from its lows. The Bank of Japan reiterated its commitment to maintaining an accommodative policy and implementing further easing measures if necessary. On the contrary, the Hang Seng index in Hong Kong and the Shanghai Composite index both declined, with challenges in the property sector and rising domestic money market rates. The People's Bank of China's open market operations resulted in a net daily drain, adding to the complexities influencing the regional market dynamics.

Europe - The data for today's money supply predicts that M4 broad money growth will be significantly lower than last year in October. Forecasts for mortgage approvals suggest a rise from the previous month but a significant drop compared to the same period last year, indicating sluggishness in the housing market. Net consumer credit remains high, raising concerns about whether it may partly reflect distressed borrowing. Chancellor Hunt is expected to be questioned by a parliamentary committee today regarding the Autumn Statement. Observers in the market will be eager to detect any indications or clues he may provide about potential tax cuts in the upcoming Spring Budget. Additionally, Governor Bailey of the Bank of England is scheduled to speak. Although it is anticipated that he will advise against expecting an early interest rate cut, market participants will be interested to hear if he offers any insights or comments on the consequences of the recently announced Autumn Statement. This focus on both fiscal and monetary policy indicates that today is an important day for financial markets, as participants seek clarity on the direction and policies that will shape the economic landscape.

In the Eurozone, November's business confidence data is expected to show signs of sentiment bottoming out. Recent surveys have hinted at a tentative optimism that growth will start to pick up next year, although current activity readings remain subdued. German November CPI data will be closely monitored for insights into the Eurozone's outcome as a whole. The consensus points to a further modest decline in both overall and core inflation. These indicators provide an overview of economic conditions and inflationary pressures, shaping the broader economic outlook for both the UK and the Eurozone.

US - Stateside, the upcoming data calendar includes a second reading for Q3 GDP, which is predicted to have a slight upward revision to 5% annualised growth. This revision would highlight the strength of economic activity during the summer months, although it may not be considered particularly newsworthy by markets. The October advanced report on international trade is expected to show a slight decrease in the trade in goods deficit and will be a more current indicator. The Federal Reserve's Beige Book, which provides anecdotal reports on the economy, is of particular interest as it offers a real-time snapshot of various economic aspects including activity strength and inflationary pressures. Investors and analysts will closely analyse the Beige Book for insights into current economic conditions and factors that influence the Federal Reserve's policy considerations.

FX Positioning & Sentiment

This week, the markets will be influenced by FX hedge rebalancing flows at the end of the month. According to models from Citibank and Barclays, the preliminary estimates indicate a stronger than average sell signal for the USD in November. For those investors who have proportional asset allocated portfolios, CitiQuant's model predicts outflows from global equities and inflows into global bonds, with the strongest inflows going into Canadian and Asian bonds. The FX hedging model suggests that the USD selling may stand out against both the AUD and NZD. The AUD/USD and NZD/USD are currently testing their respective 200 daily moving averages, and a close above those levels would be a bullish sign for the antipodeans. The USD is on track to have its weakest monthly performance in a year and is unlikely to do any better in December, which is typically its worst month for performance.

CFTC Data

The release of CFTC data for the period of November 15-21, though delayed due to the holidays, offers insights into the evolving market sentiment. Despite the potential outdated nature of the data, it sheds light on the short-term trends leading up to the end of 2023. In November, the USD index witnessed a gradual decline, reflecting a more pessimistic Federal Reserve rate outlook. During the specified period, the EUR exhibited a 0.32% increase, suggesting a substantial addition to long positions in the EUR. Conversely, the JPY decreased by 1.32% as the U.S.-Japan spreads narrowed, indicating a likely reduction in significant short positions in the JPY. The GBP saw a 0.32% increase, attributed to less dovish language from the Bank of England and UK inflation staying above the target. Both the AUD and CAD experienced gains of 0.74% and 0.09%, respectively, driven by a positive outlook on China and a reduction in substantial short positions. Bitcoin (BTC) witnessed a 3.54% increase, accompanied by a reduction of 1,344 contracts as of November 14. Sellers were active leading up to a 2023 high, with 38k contracts being sold. While the data may be dated, it provides valuable clues about the short-term market direction during this period.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0895-1.0900 (1.8BLN) , 1.0970-75 (1.6BLN)

1.1000-10 (1BLN), 1.1035 (685M)

GBP/USD: 1.2300 (770M). EUR/GBP: 0.8600 (300M)

AUD/USD: 0.6500 (2.8BLN), 0.6525 (1.6BLN)

USD/CAD: 1.3520-25 (552M), 1.3595-1.3605 (603M), 1.3670 (305M)

USD/JPY: 146.50 (480M), 148.00 (1.3BLN), 148.15 (1.4BLN), 148.50 (1BLN)

Overnight Newswire Updates of Note

New Zealand Keeps Rates Unchanged, Forecasts Risk Of Hike

Australia’s Monthly Inflation Cools, Boosting Case For RBA Pause

BoJ Policymaker Says Premature To Debate Exit From Ultra-Low Rates

Fed's Goolsbee: He Has Some Concern About Overshooting On Rates

With Fed Likely Done Hiking Rates, Waller Flags Pivot Ahead

Australia, NZ Dlrs Hit 4-Mth Highs, RBNZ Stuns With Hawkish Call

US Yields Hit Multi-Month Lows As Traders Eye Fed Cuts In 2024

Oil Holds Advance With OPEC+ Meeting And Weaker Dollar In Focus

Gold Hits Six-Month High As Fed’s Rate-Cut Momentum Swells

Hang Seng Index Heads For One-Year Low As Alibaba, Meituan Sink

Toyota's October Global Output Hits Record Despite Supplier Accident

Apple Pulls Plug On Goldman Credit-Card Partnership - WSJ

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4540

Below 4519 opens 4485

Primary support 4420

Primary objective is 4600

20 Day VWAP bullish, 5 Day VWAP bullish

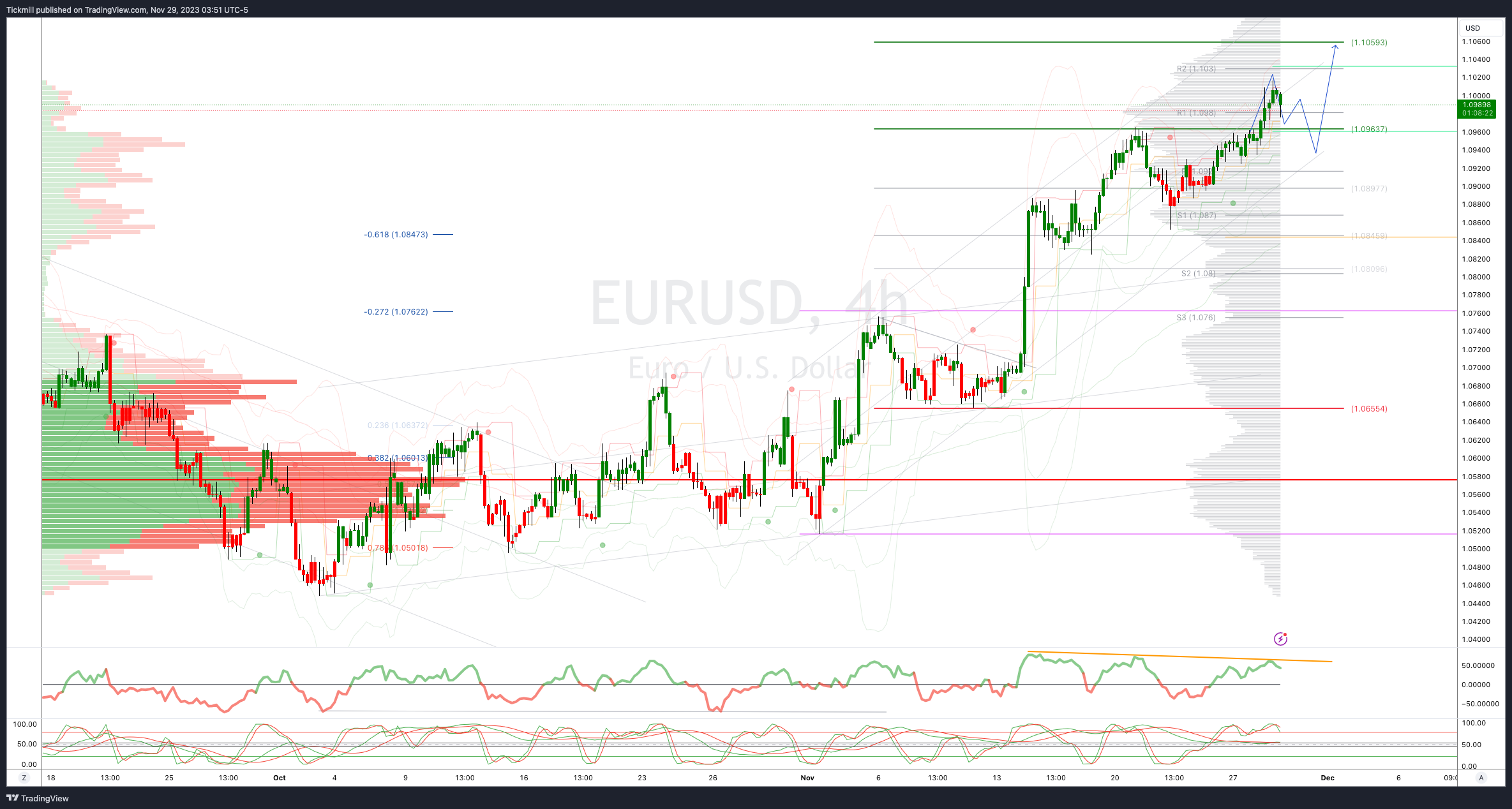

EURUSD Bias: Bullish Above Bearish Below 1.0950

Below 1.0940 opens 1.09

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

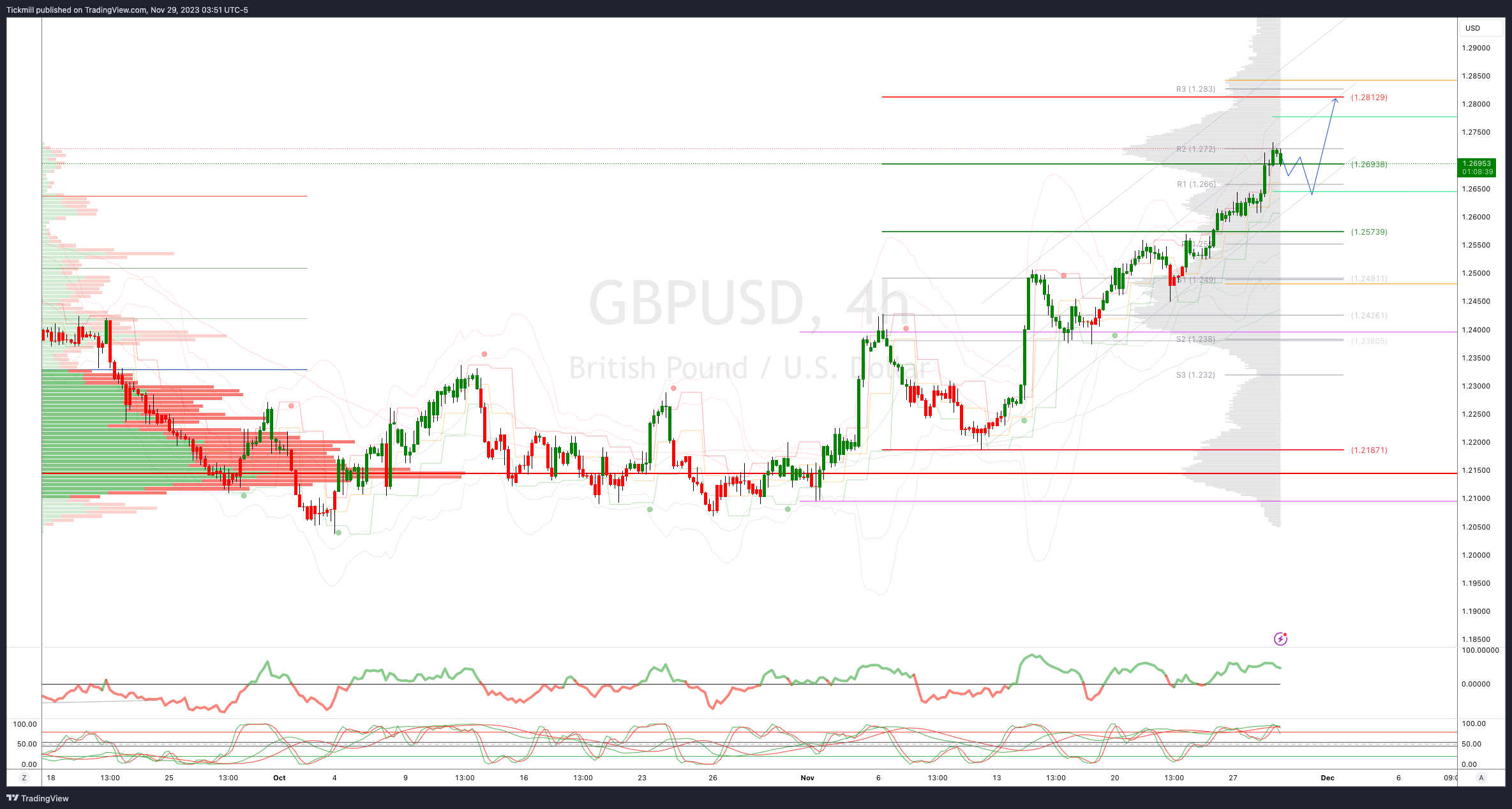

GBPUSD Bias: Bullish Above Bearish Below 1.2640

Below 1.2630 opens 1.2575

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 148

Above 148.10 opens 149

Primary resistance 149.70

Primary objective is 145

20 Day VWAP bearish, 5 Day VWAP bearish

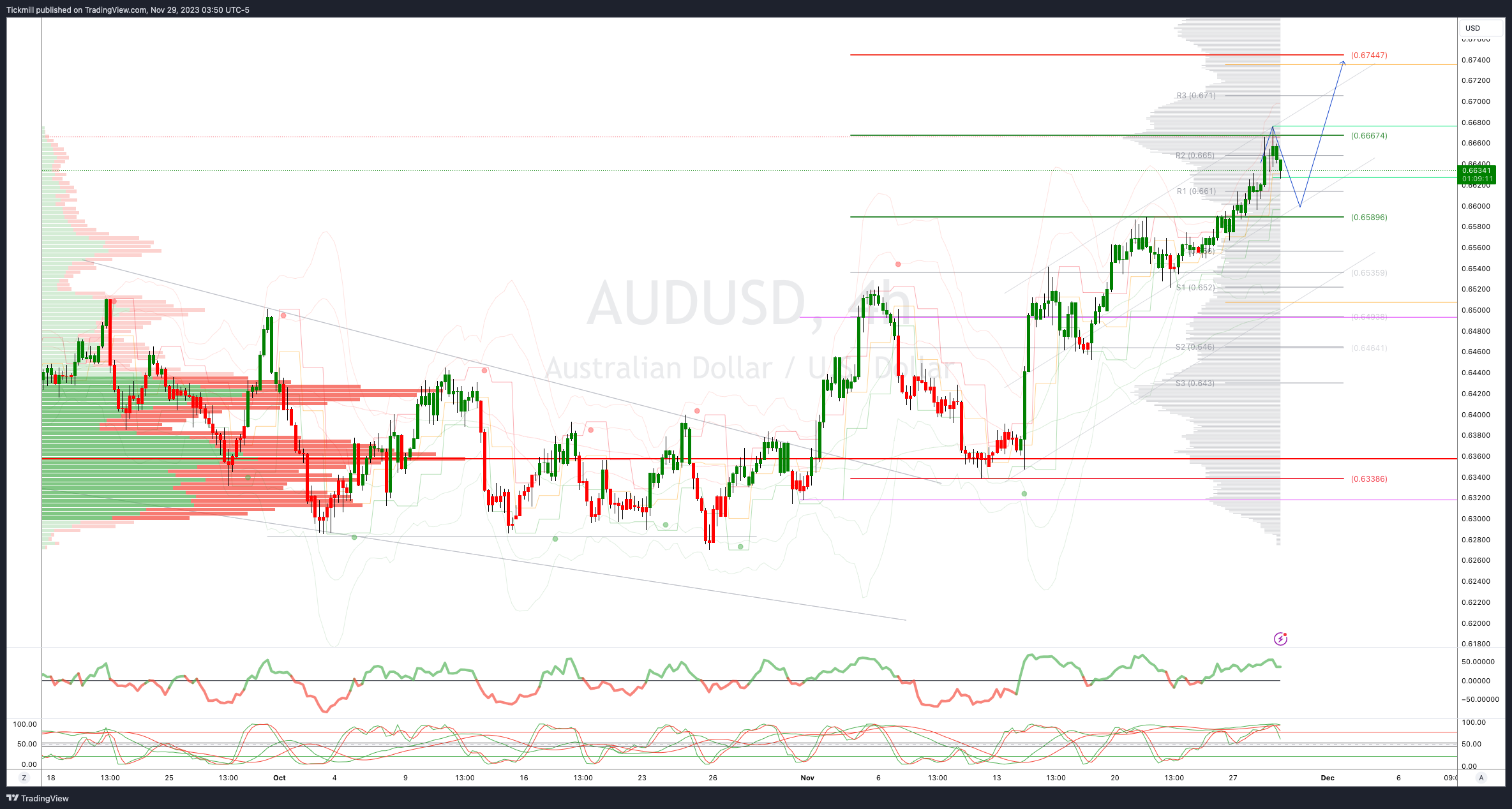

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6580 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 34000

Below 33600 opens 32400

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!