Daily Market Outlook, November 22, 2023

Daily Market Outlook, November 22, 2023

Munnelly’s Market Commentary…

Asia - Stocks in the Asia-Pacific region had a mixed performance due to negative sentiment from Wall Street, where weak data and pre-Thanksgiving positioning affected the market. The latest FOMC minutes had little impact on prices, and geopolitical developments, such as North Korea's satellite launch and the agreement between Israel and Hamas, were also taken into consideration. The Nikkei 225 outperformed and recovered from initial losses despite the government's lowered view on the economy. The KOSPI was pressured by North Korea's satellite launch plans, while the Hang Seng and Shanghai Comp were cautious due to a lack of fresh macro drivers from China, but Baidu's post-earnings performance supported the Hong Kong benchmark.

Europe - All eyes in the UK will be on British Chancellor Jeremy Hunt who is set to unveil 110 measures aimed at bolstering the UK economy in his second autumn statement. In response to calls from concerned Tory MPs for tax cuts, the announcement is geared towards "turbo charging" growth. Initial steps will be taken to reduce personal taxes, with plans to extend tax breaks for business investment and reduce national insurance contributions. Further income tax reductions are anticipated in the spring, coinciding with a near-10% increase in the minimum wage for low-paid workers. The comprehensive measures reflect an effort to stimulate economic activity and address fiscal concerns within the political landscape.

The forecast for Eurozone (EZ) Consumer Confidence in November is -17.6, showing a slight improvement compared to the previous month's figure of -17.9. This forecast suggests a marginally more positive outlook among consumers in the Eurozone for the specified period, reflecting potential changes in economic sentiment or expectations. IN an otherwise quiet data slate focus will turn to comments from Centeno from the ECB/BOP who will present the Financial Stability, while Elderson from the ECB will give a speech in Berlin.

US - Stateside, Nvidia’s eagerly anticipated earnings report was released after the close on Wall Street last night. The company's Q3 earnings and Q4 forecasts exceeded expectations, but due to the high expectations already built into the stock, there was only a slight increase in share prices. The company acknowledged that sales to China would be significantly reduced due to US restrictions on technology transfers, but stated that growth in other regions would offset this. This caused a significant drop in stock prices, with the value sinking to under $475.00 at one point. Despite this, the company's market capitalization remained at $1.2 trillion. The high volume of orders caused the stock price to continue moving erratically even hours into the Asian trading day. As of the official close, the stock was down 1.7% at $499.44. Datawise the focus will be on US jobless claims released a day early due to Thanksgiving holidays, markets are looking for another modest uptick from last week's 220k to 223k today.

FX Positioning & Sentiment

The USD/CNH currency pair experienced a decline to 7.1325 from 7.1440 following the People's Bank of China (PBOC) fixing the USD/CNY lower. This movement once again poses a threat to breaking the 200-day moving average support, currently at 7.1313. The PBOC's fixing at 7.1254 was below the expected range of 7.1430-7.1480 and significantly lower than the previous fixing of 7.1406 and the Tuesday spot low of 7.1256. This indicates the PBOC's clear intention to strengthen the yuan while the USD weakens, potentially leading to speculation of an upcoming easing of China's monetary policy.

CFTC Data As Of 17-11-23

USD net long up as JPY sales trump EUR buys, in Nov 8-14 period, $IDX -1.42%

Specs broadly long feeling pain as USD slips in new period on lower Fed view

EUR$ 1.69%, specs +19,851 contracts now +108,907 on lower Fed rate view

$JPY +0.01%, specs -26,209 contracts, now -130,249 contracts; pair lower

GBP$ +1.63% in period, specs -11,478 contracts now -11,478 contracts

AUD$ (+1.11%), $CAD (-0.53%) saw specs sell into strength

BTC +0.27%, specs +333 contracts now -1,344; specs sell near BTC 2023 highs (RTRS)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0925 (EU1.56b), 1.0600 (EU1.32b), 1.0940 (EU1.17b)

USD/JPY: 147.75 ($1.17b), 149.10 ($671m), 151.50 ($651.2m)

USD/CNY: 7.2420 ($814.5m), 7.3000 ($795.9m), 7.2000 ($741.7m)

AUD/USD: 0.6320 (AUD1.1b), 0.6440 (AUD1.05b), 0.6437 (AUD621.4m)

USD/CAD: 1.3650 ($580m), 1.3750 ($446.5m)

USD/MXN: 17.25 ($1.33b), 16.80 ($500m), 18.25 ($486.1m)

GBP/USD: 1.2500 (GBP328.8m)

EUR/GBP: 0.8710 (EU629.9m), 0.8810 (EU500.6m), 0.8735 (EU457.7m)

USD/BRL: 5.0290 ($335.8m)

Overnight Newswire Updates of Note

Israeli Govt Approves Hostage Deal, Pause In Fighting With Hamas In Gaza

Japan Cuts View On Economy For First Time In 10 Months

China Govt Advisers Call For Steady Growth Target In 2024, More Stimulus

South Korea Approves Motion To Partially Suspend 2018 Military Accord

US Nuclear-Powered Sub Arrives In South Korea After Satellite Launch

Fed Minutes Show FOMC In Position To 'Proceed Carefully' On Future Hikes

ECB’s Lagarde Says Too Early To Declare Victory On Inflation

ECB's Schnabel Says Disinflation Process Is Projected To Slow

JPMorgan Expects BoE To Deliver Its First Rate Cut In Q4 2024

JGB Yields Bounce From Multi-Month Lows As BoJ Trims Bond Purchases

Nvidia Earnings Crush Wall Str Estimates Again, Company Tempers China Outlook

HP’s Stock Falls Despite Solid Results, Vow To Ship AI PCs In H2 2024

Disney Sees Higher Costs To Create Content After Hollywood Pay Raises

Judge Finds Evidence That Tesla, Musk Knew About Autopilot Defect

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4525

Below 4519 opens 4485

Primary support 4420

Primary objective is 4580

20 Day VWAP bullish, 5 Day VWAP bullish

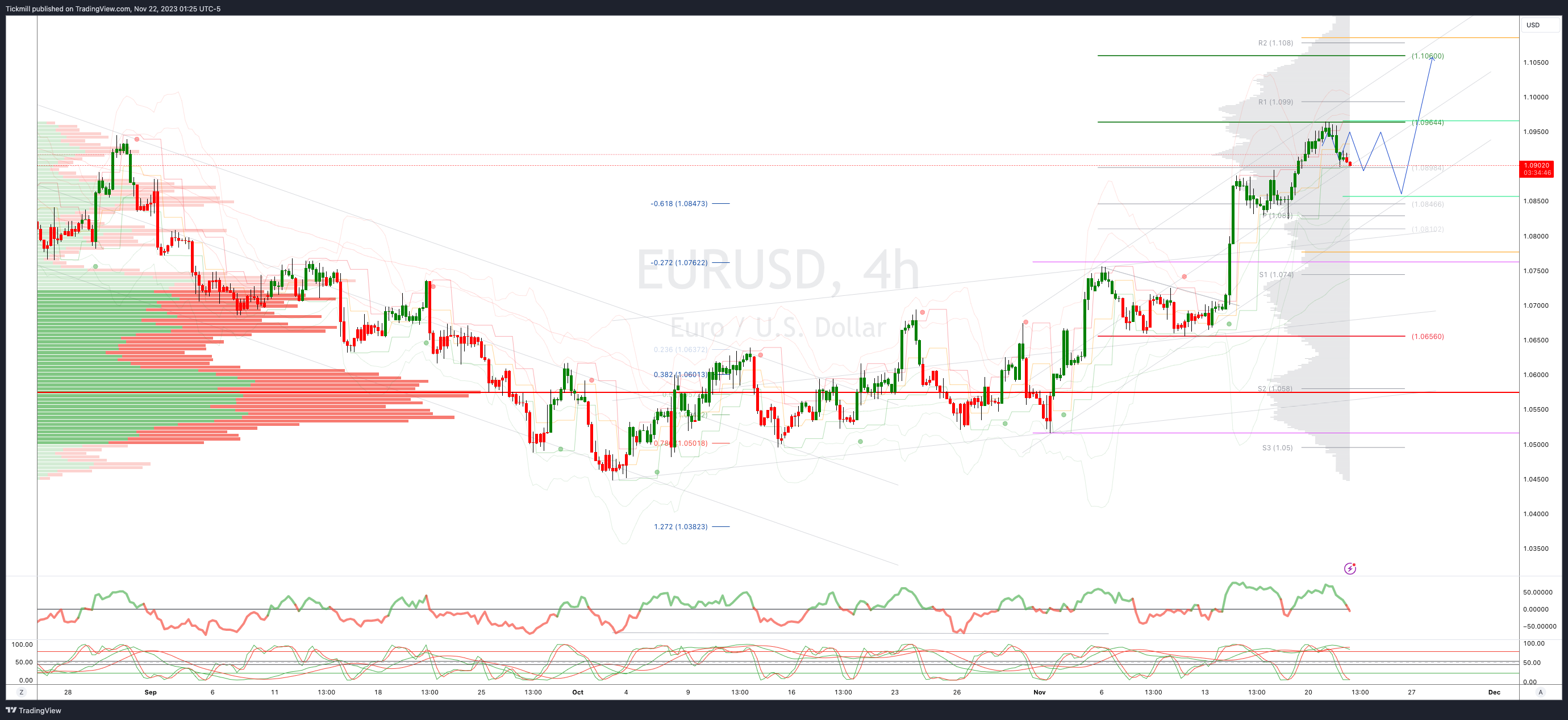

EURUSD Bias: Bullish Above Bearish Below 1.0830

Below 1.08 opens 1.0750

Primary support 1.0650

Primary objective is 1.10

20 Day VWAP bullish, 5 Day VWAP bullish

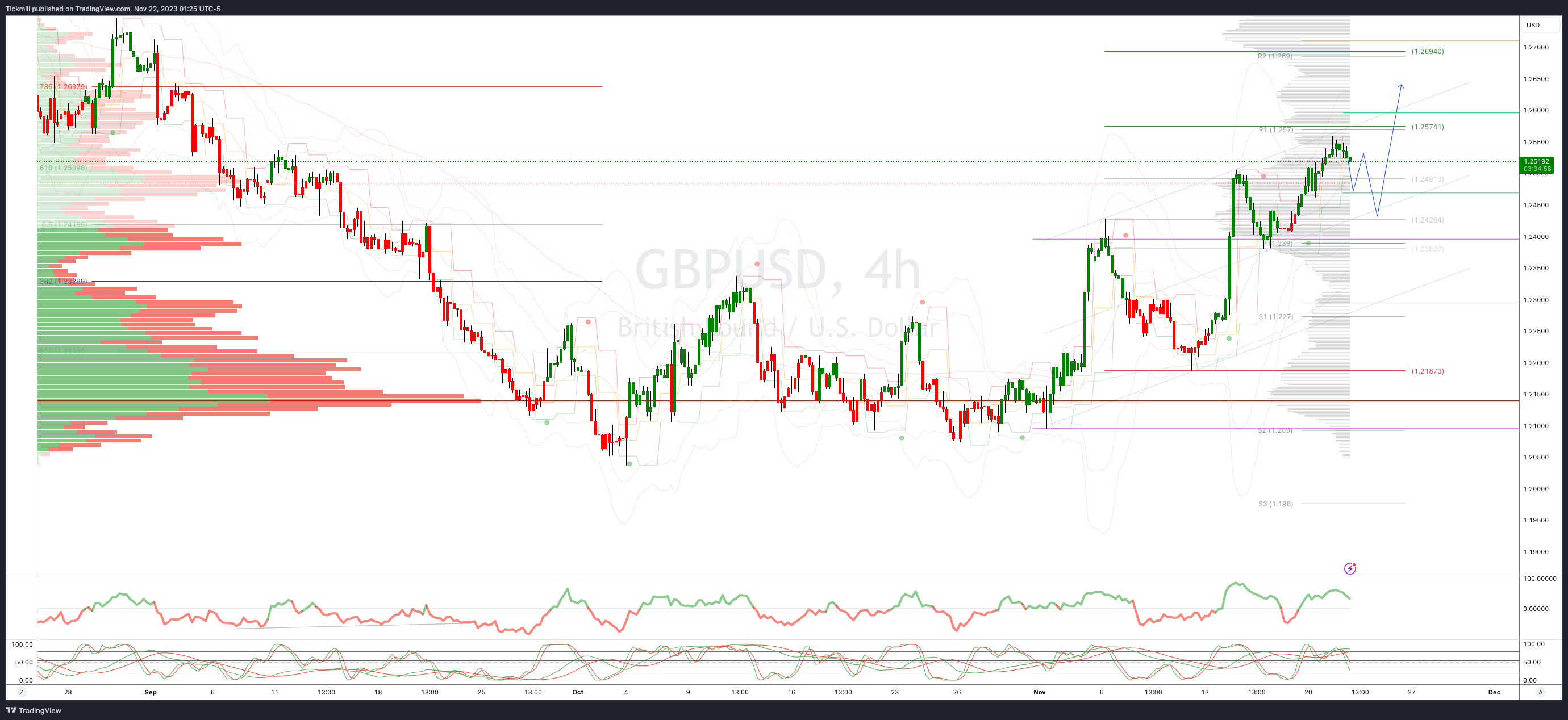

GBPUSD Bias: Bullish Above Bearish Below 1.2430

Below 1.24 opens 1.2350

Primary support is 1.2185

Primary objective 1.2570

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 149

Above 149 opens 149.80

Primary resistance 147.30

Primary objective is 147

20 Day VWAP bearish, 5 Day VWAP bearish

AUDUSD Bias: Bullish Above Bearish Below .6520

Below .6500 opens .6420

Primary support .6330

Primary objective is .6620

20 Day VWAP bullish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 34000

Below 33600 opens 32400

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!