Daily Market Outlook, November 18, 2021

Daily Market Outlook, November 18, 2021

Overnight Headlines

- N.Z. 2-Year Inflation Expectations Rise To 10-Year High

- Fed's Evans Says Taper To Take Until Mid-2022 To Complete

- US Trade Rep Admits Need For ‘Course Correction’ In Asia

- Euro Hit By Bets ECB Monetary Policy Will Diverge From Peers

- Yields Fall As Buyers Step In, Tepid Demand For 20-Year Auction

- Oil Under Pressure As US Looks To Lead SPR Shock Treatment

- China Reserve Bureau Working On Crude Oil Release

- NFT Marketplace OpenSea Offered $10 Billion Valuation

- Global Stock Markets Stalled In Thursday Asia Trade

- China Huarong Gets $6.6 Billion Equity Injection In Bailout

- Chinese Developer Yango Scrambles to Avoid Missing Bond Payment

- Nvidia Forecasts Upbeat Revenue On Metaverse Hopes

- Cisco Falls As Sales Forecast Miss Estimates On Supply Issues

The Day Ahead

- Asian equity markets were mostly lower, with Chinese stocks weighed down by disappointing earnings in the tech sector, while reports of an economic stimulus package in Japan reduced losses in the Nikkei-225 index. Meanwhile, global oil prices fell on reports of a possible coordinated release of oil reserves by countries including the US and China.

- There are no major UK or European data releases in today’s calendar. However, we will see updates on UK consumer behaviour early tomorrow from the GfK consumer confidence report and official retail sales. Consumer confidence fell sharply over the past two months to 17 in October, its lowest level since February, and we forecast a further decline to 18 in November. That may reflect concerns about the impact of higher inflation on potential spending power.

- Meanwhile, the official UK retail sales measure has now declined for five months in a row. However, last week’s GDP report showed that overall consumer spending continued to rise in Q3, suggesting that there has been a switch in purchases away from goods towards services which are not counted as part of retail sales. Look for a pickup in retail sales in October, but still expect only relatively modest growth of 0.5%, a sign that the spending remains subdued ahead of the key pre-Christmas period.

- US watchers will focus on the release of the Philadelphia Fed and Kansas City Fed manufacturing surveys, as well as weekly jobless claims data. Earlier this week, the NY Fed Empire manufacturing survey’s general business conditions index was stronger than expected, but it remains to be seen whether that is reflected in today’s other regional surveys. A notable result from the Empire survey was that it signalled further upward price pressures.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1300 (295M), 1.1360 (440M), 1.1390 (964M)

1.1465-70 (510M), 1.1495-1.1505 (2.55BLN)

USD/JPY: 114.00-10 (400M), 114.20-25 (350M), 115.00 (610M)

GBP/USD: 1.3500-20 (272M). EUR/GBP: 0.8445 (839M)

AUD/USD: 0.7300 (933M), 0.7450 (525M). USD/CHF 0.9120 (226M)

USD/CAD: 1.2500 (551M), 1.2525 (810M), 1.2540-55 (1.12BLN)

USD/ZAR 15.65-75 (385M), 15.25-30 (275M)

Standout FX option strike expiries for the week ahead

(Reuters) – The hedging of FX option strikes can influence FX price action if nearby, and more so when the strikes are large and soon to expire, so it's worth being armed with this information in advance.

Standout EUR/USD strikes Friday between 0.9110-25 on $1.3 billion.

EUR/GBP Friday has 857 million euros at 0.8515-25 and 887 million euros at 0.8600.

USD/CAD Friday has $1.6 billion at 1.2350-55 and $550 million each at 1.2370 and 1.2475.

USD/JPY Friday there are $1.3 billion between 113.90-114.00 and $1 billion at 114.20-25.

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Edges higher as short – covering underpins

- EUR/USD opened unchanged around 1.1320 and traded 1.1316/38

- Heading into the afternoon it is settling around 1.1330

- USD broadly eased in Asia and led to EUR/USD shorts to pare back

- EUR/USD is oversold and may need to correct higher in the immediate-term

- EUR/USD trending lower with 5,10 & 21-day MAs in a bearish alignment

- Selling rallies while 10-day MA at 1.1445 holds is the favoured strategy

- EUR/USD options warned of downside risk by ramping premiums

- Those premiums peaked after erasure of big 1.1300 barriers Wed's

- Noted profit taking in FX spot and options space since

- Benchmark 1-month implied volatility back at 6.5 from 7.1, 3m 6.1 vs 6.4

- However, 1-month 5.3 Monday - reached 6.3 as expiry got ECB/FED

- Cen-bank risk will continue to underpin those dates expiring just after

- Downside risk hasn't gone away- options hold big premium for EUR put vs call

- But implied volatility setbacks suggest downside drop/panic over for now

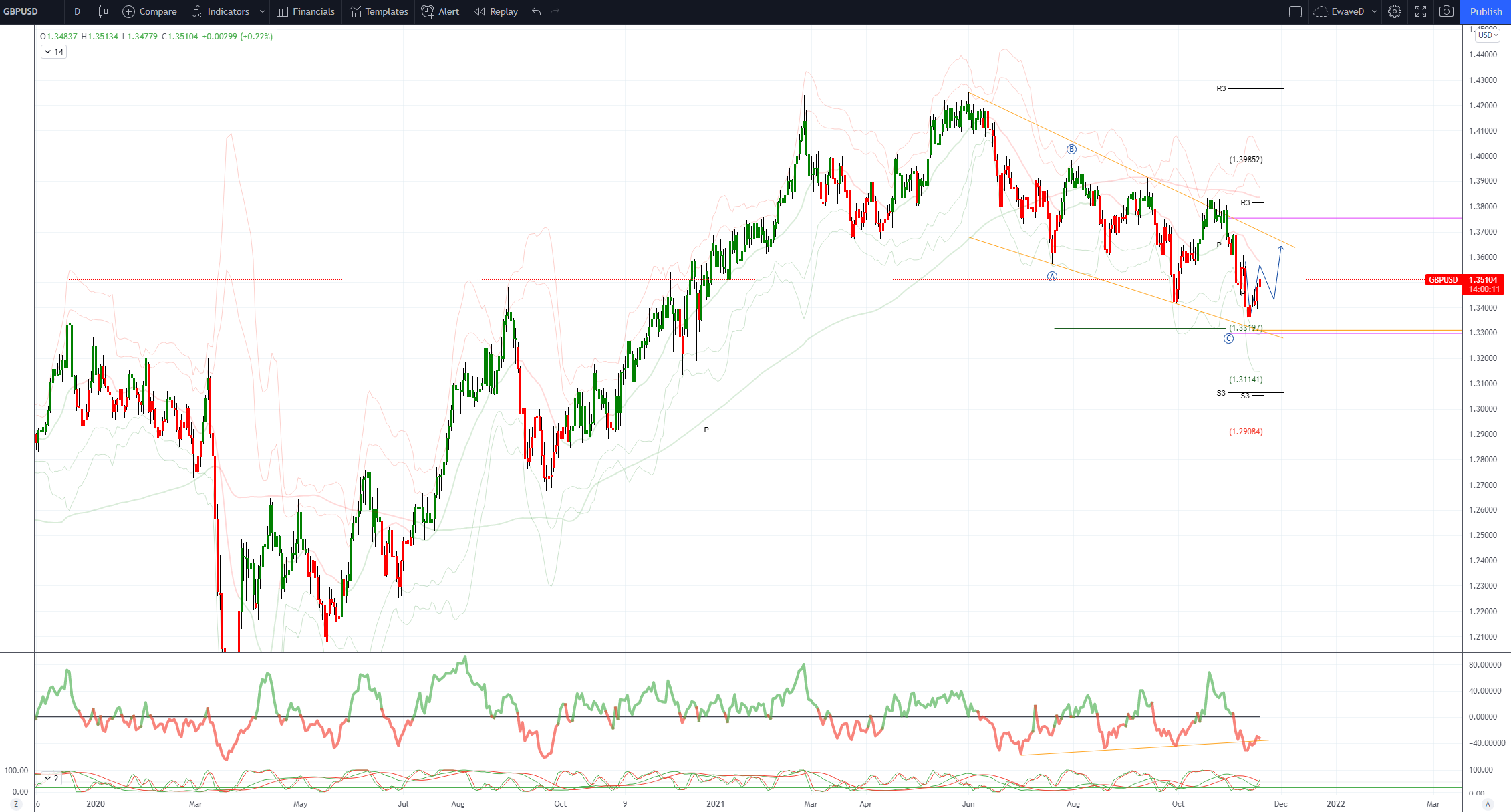

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Bid with solid interest, while oil and USD slip

- +0.05% in 1.3486-1.3504 range with steady and occasional heavy flows

- China... & US working on lowering oil price

- Brent off 0.5% to $79.88 in Asia, after falling 2.6% on Wednesday

- If successful, sustained lower oil would ease inflation pressure

- Charts - 5, 10 & 21 daily moving averages conflict, 21 day Bolli bands fall

- Neutral setup - close above 1.3462 10 DMA suggests a period of consolidation

- 1.3589 21 DMA is the pivotal resistance - sustained break would be bullish

- Primary downtrend remains in play while 21 DMA caps

- IMM speculators flipped to net GBP short on dovish BoE hold

- IMM speculators cut gross GBP longs by 3,251 contracts in week ended Nov 9

- They also raised gross GBP short positions by 23,889 contracts to 66,097

- Combination flipped net position to GBP short: 12,093 contracts

- First net GBP short position for four weeks

- Bearish shift in GBP bets fuelled by BoE's rate hold on Nov 4

- On Monday, BoE's Bailey said he is very uneasy about inflation

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY sees choppy Asia PM trade, from 113.88 to 114.26

- Trading thin in Asia PM, USD/JPY choppy, from 113.88 to 114.26 EBS

- Little in way of volume, move perhaps on one or a few large flows

- Bargain hunting from Japanese importers, short-specs eyed from low

- Move down post-Tokyo fix stopped ahead of 200-HMA at 113.85

- More bids eyed towards 113.76 low Monday

- Massive $4.1 bln option expiries between 113.90-114.65 to contain action

- $1.5 bln alone between 113.90-114.05, $1.4 bln between 114.20-25

- More steady US yields supportive, Treasury 10s to 1.579% before bouncing

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD claws back some ground but upside likely constrained

- AUD/USD up 0.1% in Asia after falling to a low of 0.7251 on AUD/JPY sales

- Weighed down by risk-aversion as global inflation concerns remain entrenched

- Diverging Fed-RBA rate expectations undermines Aud; RBA resolutely dovish

- Lower commodities & metals prices take a toll; copper, Dalian iron ore fall

- AUD/NZD sold; RBNZ rate hike bets rise on higher inflation expectations

- Support 0.7250, 0.7226 Oct 6 low; resistance 0.7300-05, 0.7325-30

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!