Daily Market Outlook, November 17, 2021

Daily Market Outlook, November 17, 2021

Overnight Headlines

- Japan Machinery Orders Keep Flat In September On Month

- Fed’s Daly: Today's Inflation In Mid-2022 Is `Different Conversation'

- Raimondo: China Not Living Up To Commitments In Phase 1 Deal

- Janet Yellen Warns Debt Limit Measures May Run Out After Dec. 15

- Manchin Says He Will Meet With Powell Ahead Of Fed Chair Pick

- EU Shelves Taiwan Trade Upgrade Amid Balancing Act On China

- New Zealand To Ease Auckland Domestic Border Curbs In Mid-Dec

- Yen Slides To Weakest Level Since 2017 As Treasury Yields Rise

- Oil Sags As Traders Assess Potential For Joint Stockpile Release

- US Asks China To Release Oil Reserves As Part Of Econ Discussions

- HK Banks Face Deadlines To Migrate $205Bln Of Contracts Tied To Libor

- India Could Bar Transactions In Crypto, Permit Holding As Assets

- APAC Stocks Fall As Japan's Auto Shares Slip; Baidu Earnings Ahead

- China Evergrande Dissolves Some Units Of Online Marketplace

- Net Inflows Into UBS ETFs This Year Have Been Only To ESG Funds

The Day Ahead

- Risk tone in the financial markets were more mixed after equity market rises at the start of the week. Weaker-than-expected external trade data from Japan weighed on Japanese stocks, although their Chinese counterparts were firmer. Markets continued to digest yesterday’s US retail sales and industrial production figures, which beat expectations, and implications they may have on monetary policy, including speculation about a quicker tapering pace.

- UK October inflation figures, released this morning, increased more sharply than expected. Annual headline CPI inflation jumped up to a decade high of 4.2% from 3.1% in September, above expectations for a rise to 3.9%. The increase primarily reflected higher energy prices after Ofgem raised its price cap, but core inflation (excluding food and energy) also increased more than predicted to 3.4% from 2.9%.

- Inflation is set to remain elevated and probably move even higher in the near term with the BoE forecasting a peak of around 5% in April next year. However, inflation is still generally expected to start to ease back from H2 2022 onwards. Nevertheless, an extended period of above-target inflation and indications that the labour market remained strong after the furlough scheme ended means that a Bank of England interest rate rise next month remains in play.

- Eurozone CPI figures for October are also due today, although they are final estimates. The earlier flash estimate showed an unexpectedly sharp rise to 4.1% in October from 3.4% in September. The increase mostly reflected higher energy prices, although core inflation also increased to 2.1% from 1.9%. There’s a chance the final reading could be revised down to 4.0%. In any event, headline inflation could edge higher still in the near term before falling from early next year.

- In the US, October housing starts will provide further indications of economic activity at the start of Q4 following yesterday’s retail sales and industrial production reports, both beating expectations. In particular, there have been signs of late that, after a soft patch over the summer, spending on items less affected by supply constraints has accelerated.

- Policymakers continue to face a difficult trade-off between fostering the economic recovery and tackling inflation. Bank of England MPC member Mann, who voted to leave interest rates on hold at the last meeting, speaks at an event today. There are also a number of ECB and US Fed speakers scheduled today.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1300 (295M), 1.1360 (440M), 1.1390 (964M)

1.1465-70 (510M), 1.1495-1.1505 (2.55BLN)

USD/JPY: 114.00-10 (400M), 114.20-25 (350M), 115.00 (610M)

GBP/USD: 1.3500-20 (272M). EUR/GBP: 0.8445 (839M)

AUD/USD: 0.7300 (933M), 0.7450 (525M). USD/CHF 0.9120 (226M)

USD/CAD: 1.2500 (551M), 1.2525 (810M), 1.2540-55 (1.12BLN)

USD/ZAR 15.65-75 (385M), 15.25-30 (275M)

Standout FX option strike expiries for the week ahead

(Reuters) – The hedging of FX option strikes can influence FX price action if nearby, and more so when the strikes are large and soon to expire, so it's worth being armed with this information in advance.

Standout EUR/USD strikes this week are on Wednesday between 1.1495-1.1505 on 2.3 billion euros. Thursday has 860 million euros between 1.1450-60, and 500 million euros at 1.1500. Friday has 550 million euros at 1.1445-50 and 1 billion euros at 1.1495-1.1500. The biggest USD/CHF strikes are Thursday at 0.9120-25 on $573 million and Friday between 0.9110-25 on $1.3 billion.

For GBP/USD Thursday has 790 million pounds at 1.3400, 507 million pounds at 1.3500 and 604 million pounds at 1.3550.

EUR/GBP Thursday has 800 million euros at 0.8400 and 759 million euros at 0.8450-60. Friday has 857 million euros at 0.8515-25 and 887 million euros at 0.8600.

AUD/USD Thursday has A$735 million 0.7250-65, A$486 million 0.7405-10, A$433 million 0.7385 and A$1 billion between 0.7430-45.

The biggest USD/CAD Thursday at 1.2330 on $1.2 billion, 1.2380 on $770 million and 1.2500 on $1.1 billion. Friday has $1.6 billion at 1.2350-55 and $550 million each at 1.2370 and 1.2475.

Standout USD/JPY strikes this week are on Friday there are $1.3 billion between 113.90-114.00 and $1 billion at 114.20-25.

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Key support gives way as stops tripped pre-Europe

- Trades -0.3%, after touching a new trend low at 1.1263, as stops tripped

- Move came late morning taking out stops below 1.1290, 61.8% 2020-2021 rise

- Technicals - 5, 10 & 21 day and week moving averages track south

- 21-day Bollinger bands expand, while daily momentum studies slide

- Strong bearish trending signals target 1.1040, 76.4% of 2020-21 climb

- 1.1329 lower 21 day Bollinger band suggests EUR oversold short term

- Asian 1.1263-1.1326 range is initial support and resistance

- Traders have grown more bullish USD versus funders like EUR recently

- Option premiums for volatility and downside strikes grew as EUR/USD fell

- Longer dated implied volatility remains firm - 2022 warnings

- Risk reversals hold highest EUR put vs call vol premium since May 2020

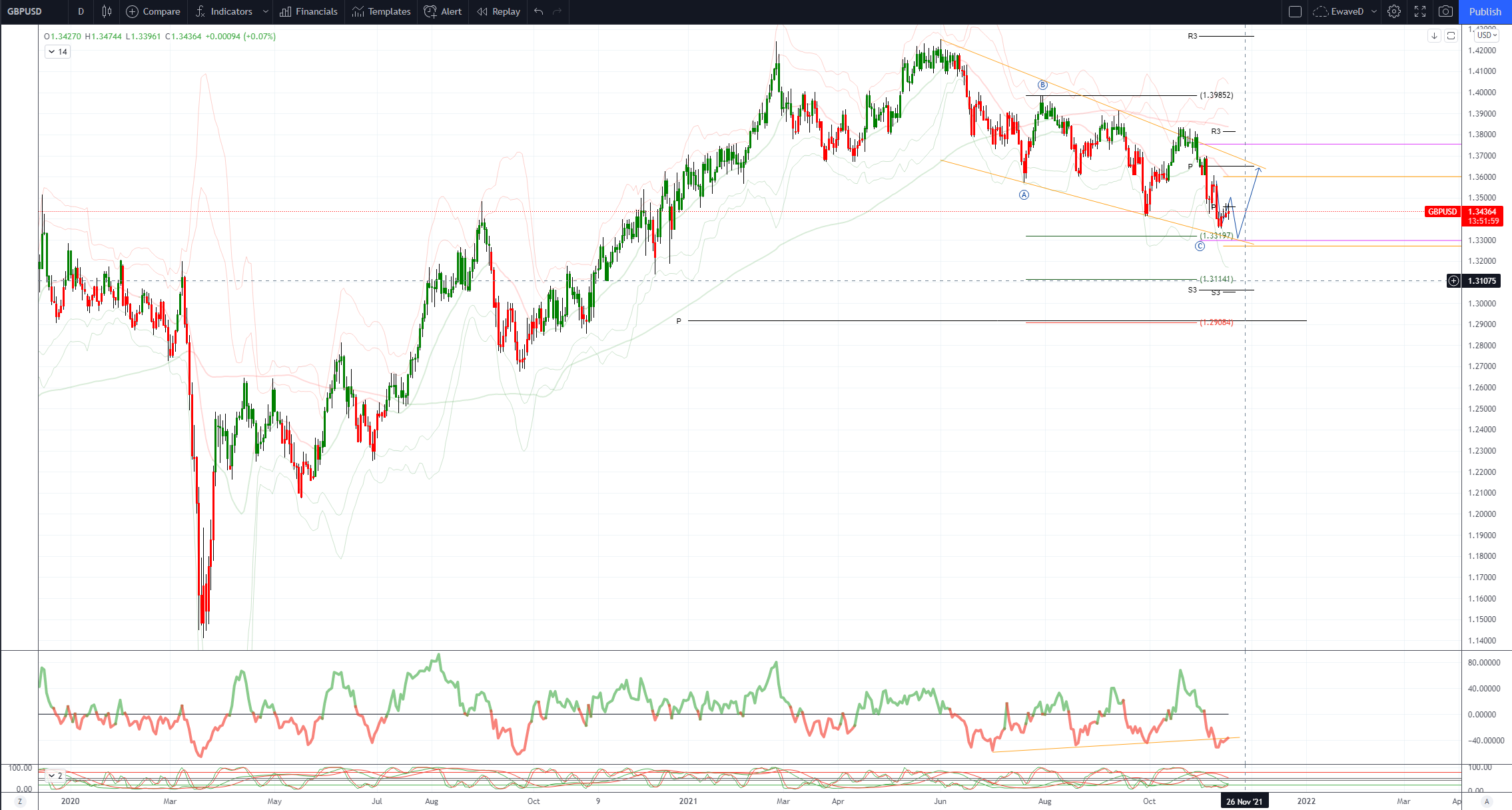

GBPUSD Bias: Bearish below 1.36 Bullish above.

- 0.1% in a 1.3400-1.3433 range as downside EUR/USD stops tripped

- Sterling looks poised to rebound if the USD falters.

- Charts - 10 & 21 daily and weekly moving averages head south

- 21-day Bollinger bands fall, bearish setup - though cable has stalled

- 1.3453 10 DMA first resistance, close above suggests consolidation

- 1.3602 21 DMA the pivotal resistance, with a sustained break bullish

- November 1.3354 low and 1.3296 lower 21-day Bollinger band support

- IMM speculators flipped to net GBP short on dovish BoE hold

- IMM speculators cut gross GBP longs by 3,251 contracts in week ended Nov 9

- They also raised gross GBP short positions by 23,889 contracts to 66,097

- Combination flipped net position to GBP short: 12,093 contracts

- First net GBP short position for four weeks

- Bearish shift in GBP bets fuelled by BoE's rate hold on Nov 4

- On Monday, BoE's Bailey said he is very uneasy about inflation

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY consolidates gains ahead of 115, test inevitable

- USD/JPY consolidating recent gains just ahead of 115, test inevitable

- Good resistance still from option players defending massive barriers

- Also $609 mln vanilla expiries at 115.00 strike today

- Stops above likely massive, many Japanese importers will have to cover

- Japanese exporters offers to trail higher but maybe not enough to cap

- 115.00 break targets 115.51 high in March 2017, towards 118-120 after?

- Higher US yields after strong data overnight supportive, Tsy 10s @1.645%

- Some JPY crosses may have based, GBP/JPY 153.95-154.31, better bid

- AUD/JPY too but off from 84.16 high yesterday, Asia 83.90 to 83.49

- EUR/JPY weakest of lot, risk still down, 129.91-130.05

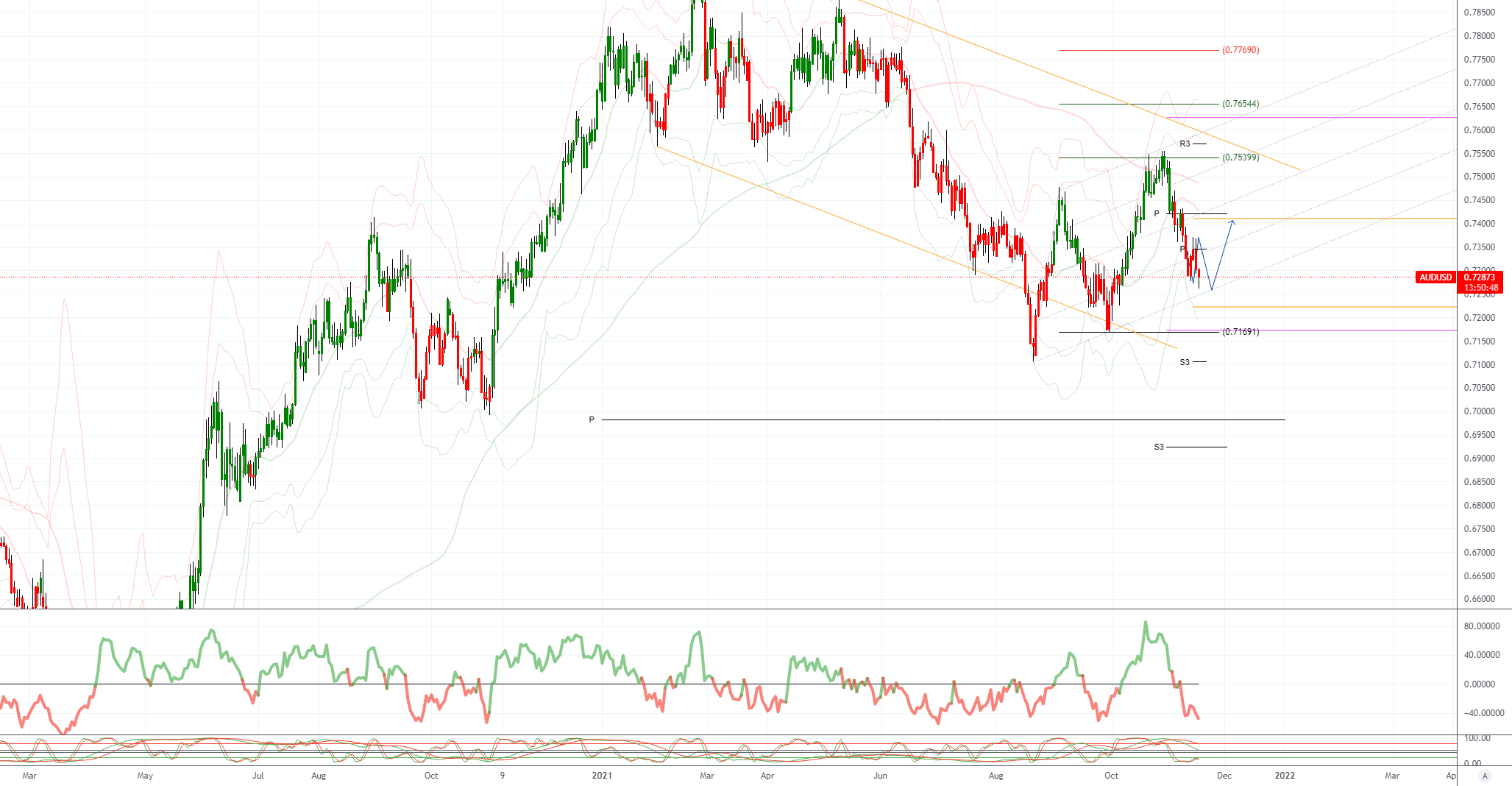

UDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD opened -0.56% at 0.7305 after USD soared following strong US data

- Pair came under pressure following Aus wage price index - which came in as expected

- Gloomy Asian equity markets added pressure with AXJ index easing 0.30%

- AUD/USD traded down to 0.7280 and it is at session low into the afternoon

- Support at last week's 0.7277 low and 76.4 fibo at 0.7261

- A break below 0.7260 targets the Sep 29 low at 09.7170

- Resistance is at the 10-day MA at 0.7348 and break eases downward pressure

- AUD/USD vulnerable while commodities ease and Fed/RBA expectations diverge

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!