Daily Market Outlook, November 14, 2023

Daily Market Outlook, November 14, 2023

Munnelly’s Market Commentary…

Asia - stocks exhibited a mixed performance as markets awaited the release of US Consumer Price Index (CPI) data. The Nikkei 225 saw advancement, driven by earnings releases and Japan's consideration of corporate tax breaks for companies implementing an 8% wage increase. Meanwhile, the Hang Seng and Shanghai Composite indices displayed indecisiveness, influenced by weak New Yuan Loans and Aggregate Financing data. Price action remained range bound ahead of the Biden-Xi meeting, where an announcement of a deal on a fentanyl crackdown by China was anticipated. The varied performance across these markets reflects the influence of both domestic factors, such as earnings and economic data, and broader geopolitical considerations, such as the upcoming meeting between leaders from the US and China. Investors are navigating a complex landscape influenced by a mix of economic indicators and global events. Upcoming Chinese industrial production and retail sales data are highly anticipated as timely updates on the state of the world's second-largest economy. The data releases will provide crucial insights into the current economic activity, given ongoing concerns about growth in China. The consensus expectation is that the data will confirm a faltering in activity. The market will closely analyse indicators such as industrial production and retail sales.

Europe - The latest labour market data from the UK shows a decrease in the annual growth of regular pay, dropping to 7.7% in September compared to the previous figure of 7.9%. Additionally, overall pay growth also experienced a decline, falling to 7.9% from an adjusted 8.2%. However, there are still challenges in interpreting the data, which makes it difficult for the Office for National Statistics (ONS) to accurately assess the tightness of the labour market. Despite these challenges, the ONS described the overall situation as being similar to the previous quarter. This data provides insights into the ongoing changes in wage growth in the UK, which is an important factor in understanding the wider economic situation and informing policymakers about the state of the labour market.

In the German ZEW survey for November, it is anticipated that both the current conditions and expectations readings will have increased. Despite the near-term growth outlook remaining uncertain, the forecast suggests a fourth consecutive rise in expectations, reflecting optimism and hopes for improvement in the coming year. The ZEW survey serves as a key indicator of economic sentiment in Germany, and these expected rises in current conditions and future expectations signal a positive outlook among survey participants, potentially hinting at an anticipated economic recovery.

US - Stateside, The upcoming US Consumer Price Index (CPI) data is anticipated to be a key release for global financial markets, closely observed for insights into the interest rate outlook. Forecasts indicate a decline in annual headline inflation for October, primarily attributed to the recent decrease in oil prices and its ripple effect on gasoline prices. The prediction suggests a drop to 3.3% from the 3.7% recorded in September, marking the lowest rate in three months, though not a new low for the year. In contrast, core inflation, which excludes volatile food and energy prices, is expected to remain stable at 4.1%. Despite a notable decline earlier in the year, the recent months have seen a slowdown in the improvement of core inflation. This deceleration is particularly evident in service sector inflation, indicating a level of persistence in certain components of the inflationary landscape. The CPI data will be closely scrutinised for its implications on monetary policy and the broader economic environment.

FX Positioning & Sentiment

The USD and EUR are experiencing a stall in their movements due to verbal intervention from Japan. Over the past 24 hours, there has been caution observed as the Japanese Finance Minister, Suzuki, has made repeated comments on the foreign exchange market, which has helped limit the gains of the USD and EUR. Both the USD/JPY and EUR/JPY are currently at their highest levels in terms of trends, and these moves are supported by fundamental factors. The USD/JPY reached 151.92 overnight, just below the high of 151.94 seen on October 22nd, which was the last time intervention occurred. The EUR/JPY reached 162.37 yesterday, marking its best performance since the high of 169 seen in July and August of 2008. The recent movements in the FX market have been more orderly and do not fall into the category of excessive volatility. It is believed that the comments on FX from Japanese officials are also a result of questions from reporters to the Ministry of Finance. However, actual intervention is seen as unlikely by most players in Tokyo. It is viewed as unnecessary to take any risks, as any declines in the USD and EUR are met with strong buying instead.

CFTC Data As Of 10-11-23

CAD bearish -3,555

EUR bullish 11,287

GBP bearish -1,547

AUD bearish decreasing -4,760

NZD bearish -747

MXN bullish 867

CHF bearish -2,047

JPY bearish increasing -8,558

Gold bullish increasing 32,422

USD bullish decreasing 9,060 (CFTC)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0690-1.0700 (1.8BLN).

USD/CHF: 0.9100 (694M)

GBP/USD: 1.2190-1.2200 (300M), 1.2250-60 (505M)

AUD/USD: 0.6350-55 (1.5BLN). NZD/USD: 0.5910 (875M)

USD/JPY: 150.00 (675M), 151.00 (413M)

Overnight Newswire Updates of Note

Fed’s Barr Says Supervisors Scrutinise Banks’ Interest-Rate Risks

Yellen Says She Disagrees With Moody’s Negative Outlook On US

GOP Johnson Turn To Democrats To Pass Plan To Avert Shutdown

US To Buy 1.2Mln Barrels Of Oil For Strategic Petroleum Reserve

China Economy Likely Struggled To Gain Traction Despite Stimulus

BoJ Aim For Higher Prices And Wage Hikes, Deputy Governor Says

Japan FinMin: Will Continue To Take Necessary Steps On FX Moves

Goldman Sees Australia And NZ Inflation Falling Below 3% In 2024

Australian Consumer Sentiment Slumps Following RBA’s Rate Hike

Poll: ECB To Hold Rates Through Mid-2024 Despite Halting Economy

PM Sunak Opens Rift With Tory Right By Reviving Centrist Cameron

Bogus BlackRock XRP Filing Spoofs ETF Watchers, Crypto Traders

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4375

Below 4350 opens 4285

Primary support 4200

Primary objective is 4468

20 Day VWAP bullish, 5 Day VWAP bullish

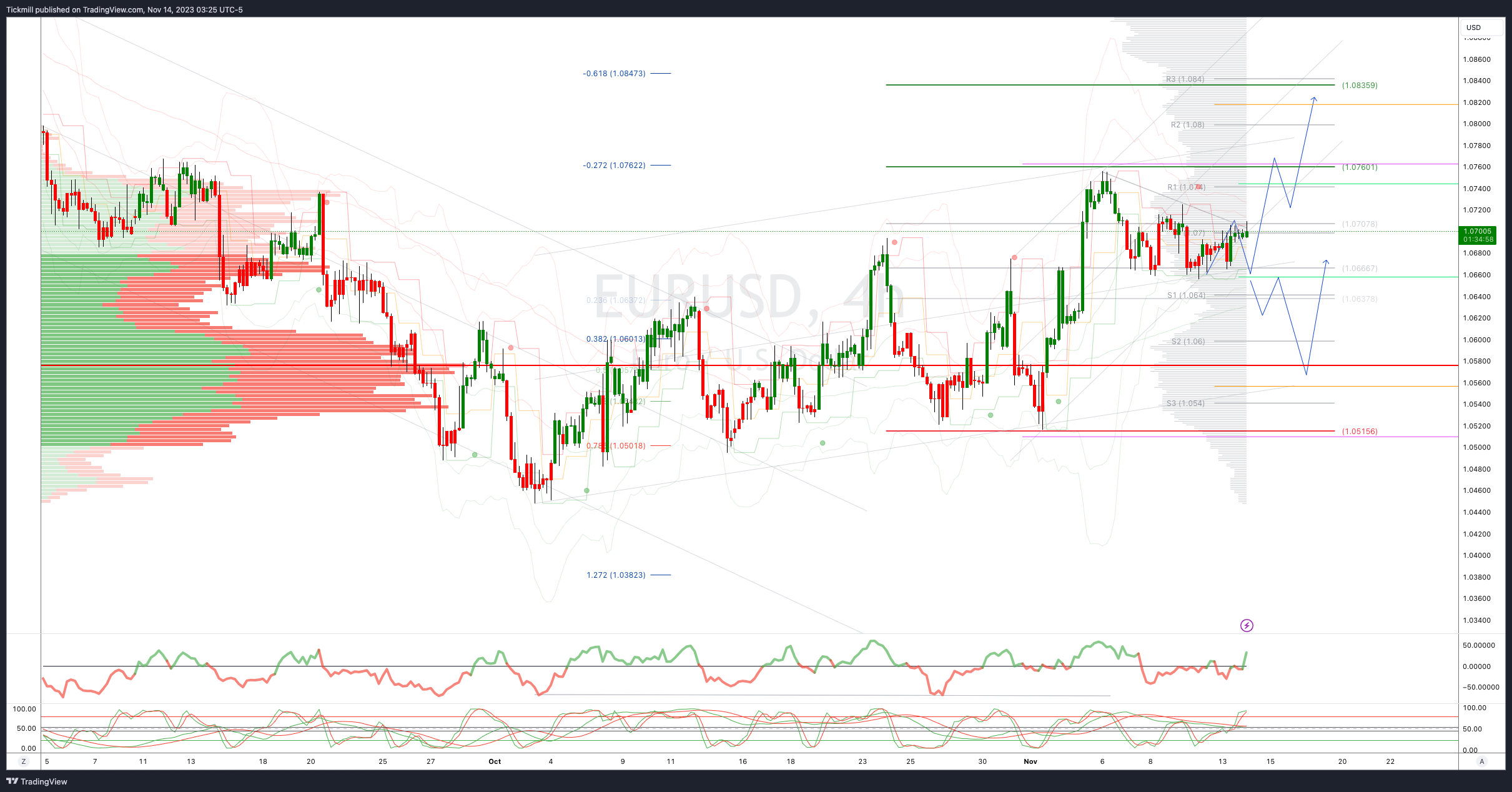

EURUSD Bias: Bullish Above Bearish Below 1.0630

Below 1.06 opens 1.0540

Primary support 1.06

Primary objective is 1.08

20 Day VWAP bullish, 5 Day VWAP bullish

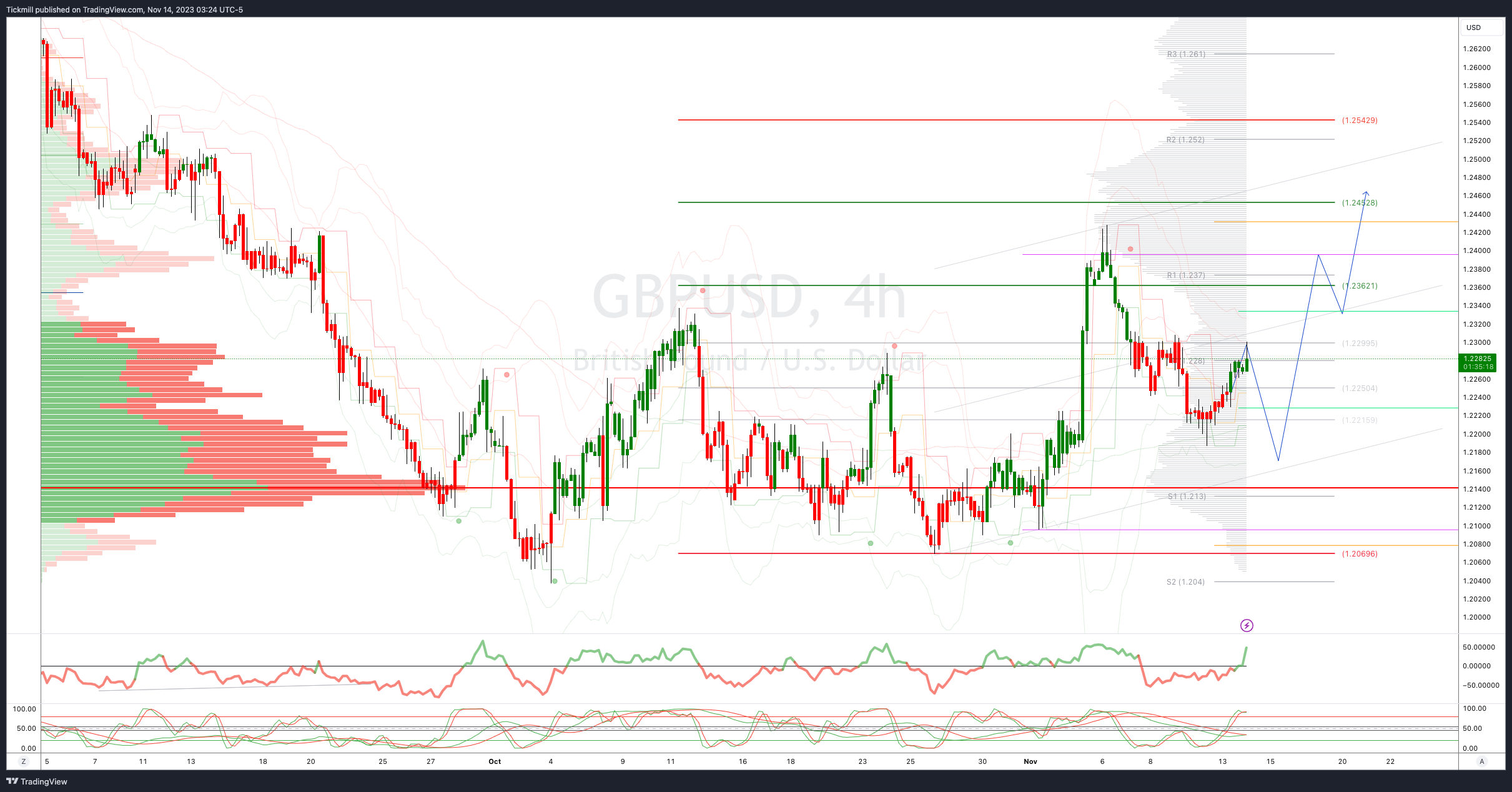

GBPUSD Bias: Bullish Above Bearish Below 1.2230

Below 1.22 opens 1.2150

Primary support is 1.2069

Primary objective 1.2450

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 150

Below 149 opens 148.30

Primary support 147.30

Primary objective is 152.50

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6450

Below .6290 opens .6250

Primary support .6330

Primary objective is .6620

20 Day VWAP bearish, 5 Day VWAP bullish

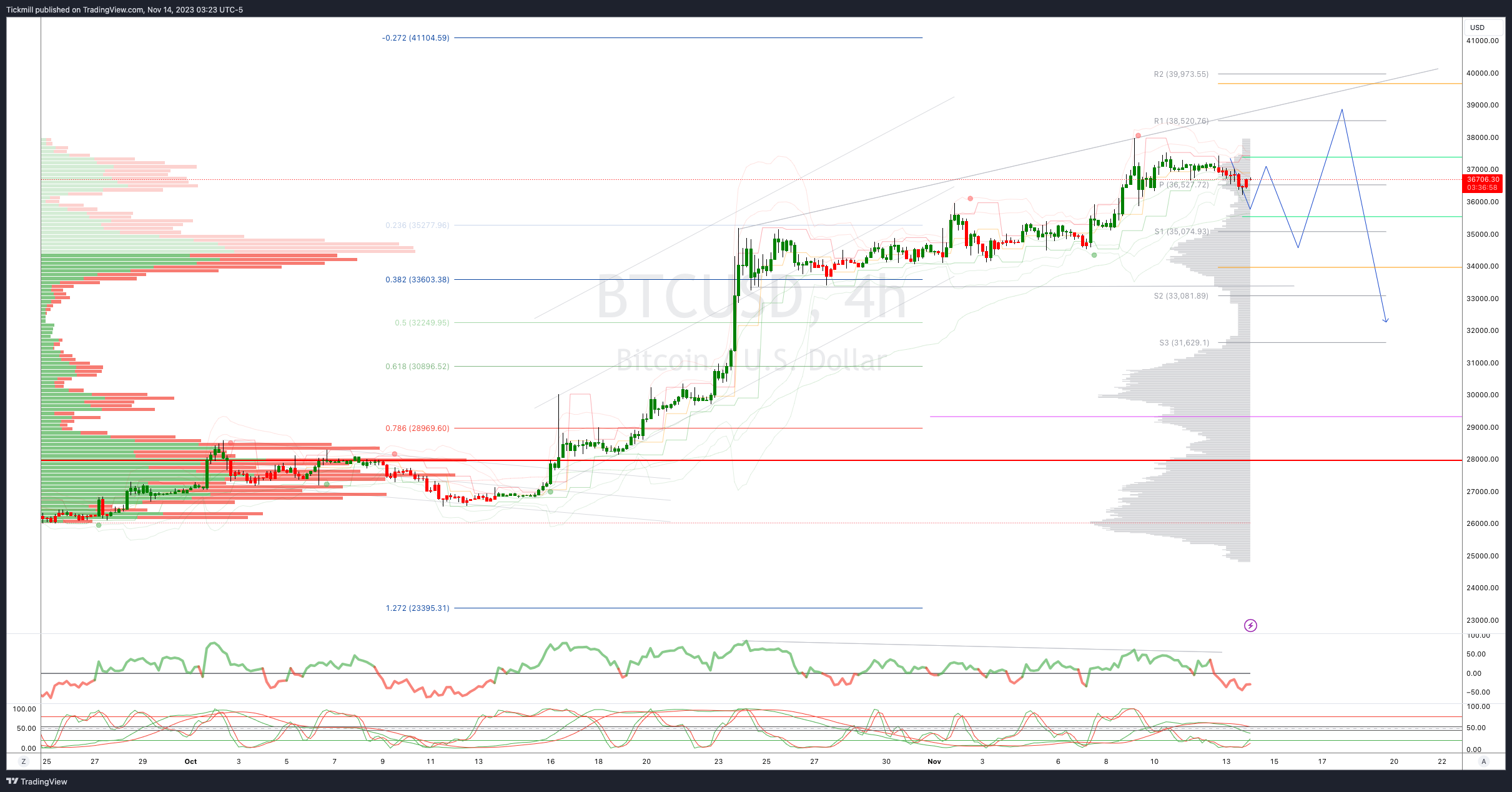

BTCUSD Bias: Bullish Above Bearish below 34000

Below 33600 opens 32400

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullis

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!