Daily Market Outlook, May 8, 2024

Daily Market Outlook, May 8, 2024

Munnelly’s Macro Minute…

“Japanese Officials Mute A Policy Shift Aimed To Support JPY”

Overnight, equity markets experienced a period of consolidation following recent increases, with the Asia-Pacific region showing a general softening. The absence of significant economic data releases yesterday led to attention being drawn to hawkish remarks from the Fed's Kashkari, who suggested that an uptick in policy interest rates might occur, although he also emphasized that such a move is not the most probable scenario.

Japanese stocks fell due to Toyota Motor's lower profit estimate and Nintendo's bleak outlook. Mainland Chinese and Hong Kong equities paused as investors awaited significant tech earnings next week. Treasury rates rose, boosting the dollar for a third day, despite warnings from the central bank governor. Governor Kazuo Ueda warned financial markets about a possible policy change, and Finance Minister Shunichi Suzuki stated that the administration is ready to take necessary action.

Today, there are no major UK data releases scheduled, but Thursday's overnight releases will include the RICS residential market and the S&P Global/REC jobs surveys. The RICS survey, alongside mortgage approvals data, suggests a recovery in the sector, with the net balance of respondents reporting higher prices reaching its least negative level since October 2022. The REC UK jobs report will be closely monitored by policymakers to gauge labor market trends and their potential impact on wage growth and inflation. The Bank of England's interest rate decision tomorrow is expected to maintain rates at 5.25%, with speculation centered on future policy signals, particularly regarding the possibility of a rate cut in June, which remains uncertain according to market sentiment.

European data highlights include March's industrial production figures for Germany, showing a 0.4% monthly decline following gains in the preceding two months. While there are signs that manufacturing activity in the Eurozone's largest economy is stabilizing, ongoing challenges persist due to its reliance on global demand and low-cost energy sources.

Stateside, the calendar is quiet this week, with attention likely shifting to scheduled speeches by Fed officials, notably Boston Fed President Collins.

Overnight Newswire Updates of Note

BoJ’s Ueda Tweaks Weak Yen Remarks In Possible Hint Of Rate Hike

Japan’s Suzuki: Watching FX Movement With A Sense Of Urgency

Fed's Kashkari: Fed Will Hold Rates Where They Are If We Need To

Mnuchin Says Strong Dollar Helps, For Now, In Financing US Debt

US Revokes Licences For Supply Of Chips To China’s Huawei

EUR/USD Edges Lower After Hawkish Remarks From A Fed Official

10-Yr Treasury Yield Falls As Investors Consider Fed Policy Path

Oil Slip On Rising US Stockpiles, Cautious Supply Expectations

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0675-90 (858M), 1.0750 (945M), 1.0775-80 (746M), 1.0825 (1.1BLN)

USD/CHF: 0.8900 (1BLN), 0.9050 (319M), 0.9125 (460M), 0.9150 (338M)

GBP/USD: 1.2500 (460M). EUR/GBP: 0.8580-90 (865M)

AUD/USD: 0.6495-0.6500 (1BLN), 0.6600 (1BLN)

NZD/USD: 0.5900 (255M), 0.5950 (392M)

USD/CAD: 1.3745-60 (1BLN)

USD/JPY: 154.50 (489M), 155.00 (360M), 155.50-60 (1BLN)

The USD is still heavily positioned long against a basket of currencies, including the MXN. On the other hand, the EUR, JPY, CHF, GBP, and CAD are all heavily positioned short against the Dollar. It's important to note that stretched positioning doesn't always mean we should take the opposite side. Instead, we use positioning data to identify where markets might be most imbalanced and combine that with upcoming risk events to find opportunities where stretched positioning could be forced to adjust.

CFTC Data As Of 5/05/24

Japanese Yen net short position is -168,388 contracts

British Pound net short position is -28,990 contracts

Euro net short position is -6,777 contracts

Bitcoin net long position is 6 contracts

Swiss Franc posts net short position of -41,786 contracts

Equity fund managers cut S&P 500 CME net long position by 17,130 contracts to 815,943

Equity fund speculators trim S&P 500 CME net short position by 14,932 contracts to 168,931

Gold NC Net Positions increased to $204.2K from previous $202.9K

Technical & Trade Views

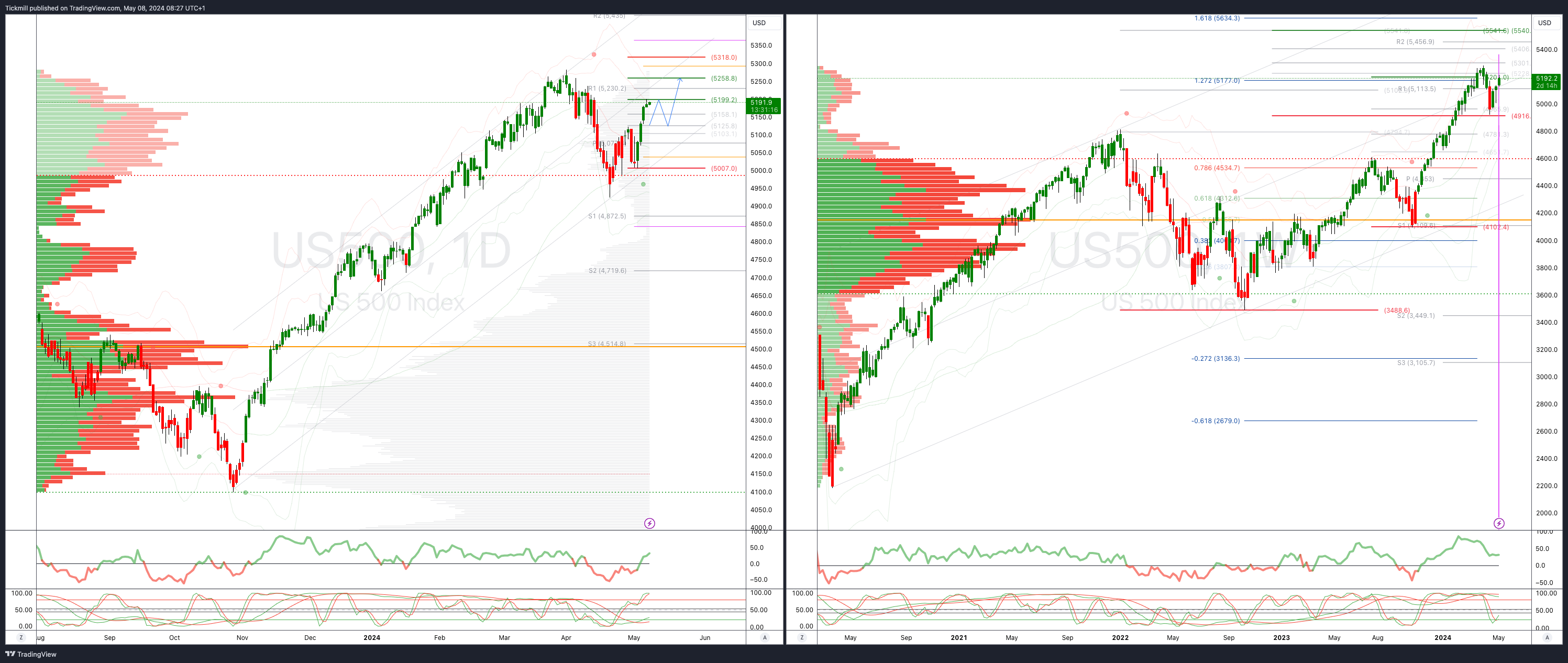

SP500 Bullish Above Bearish Below 5158

Daily VWAP bullish

Weekly VWAP bullish

Below 5120 opens 5045

Primary support 4987

Primary objective is 5258

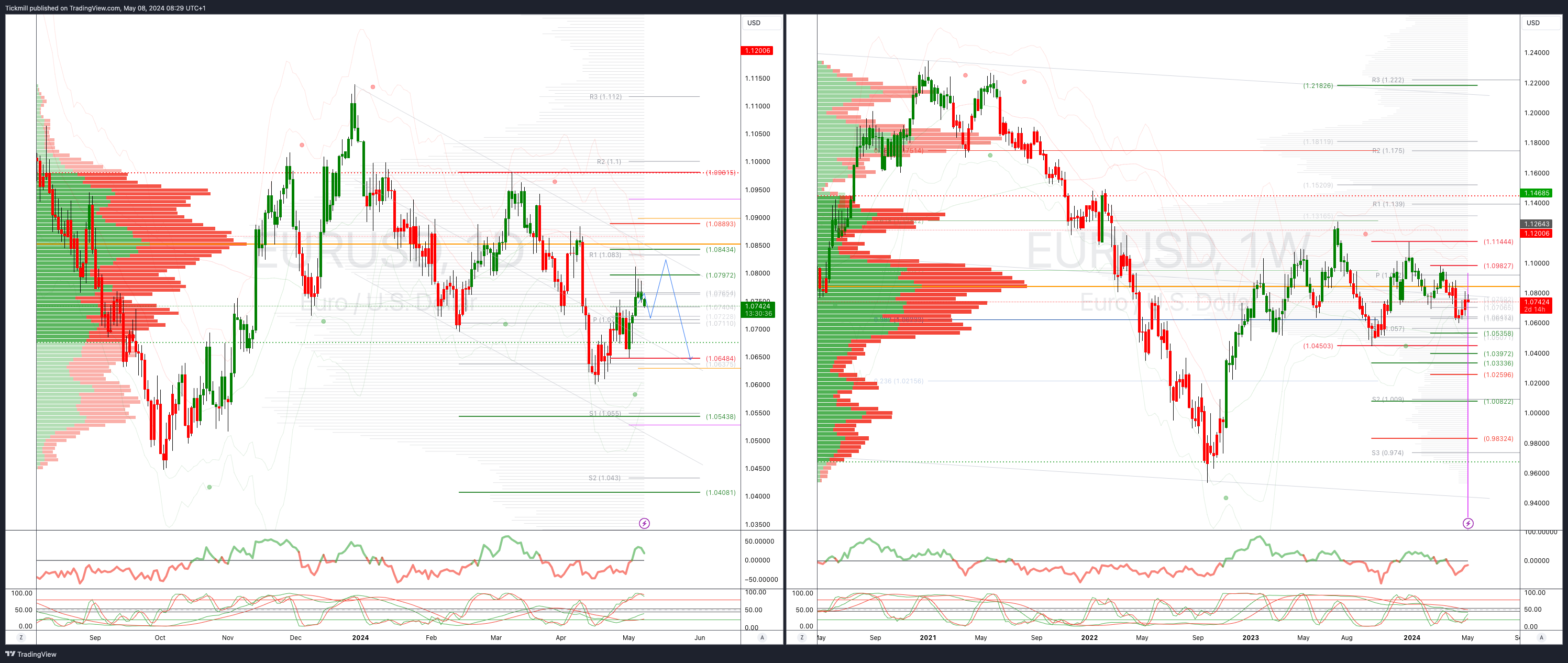

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0843

Primary resistance 1.850

Primary objective is 1.0550

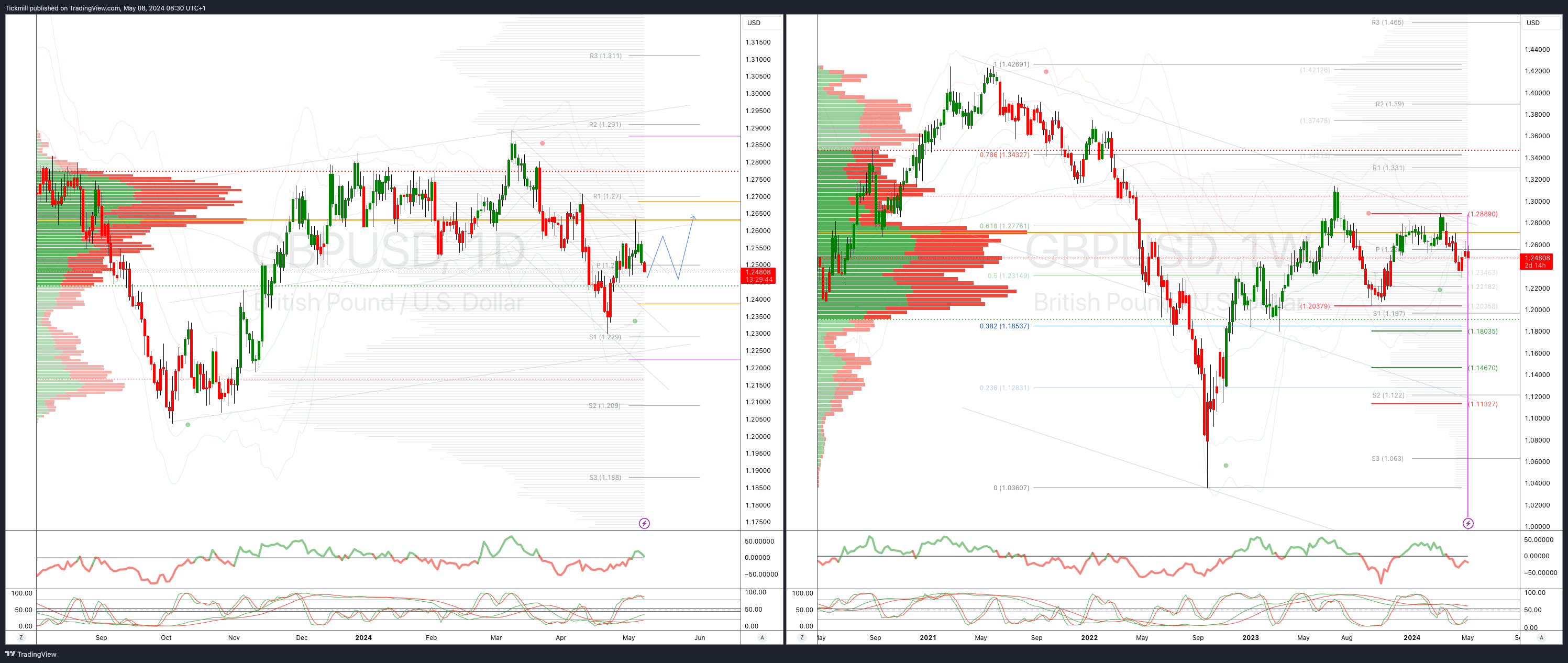

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.26

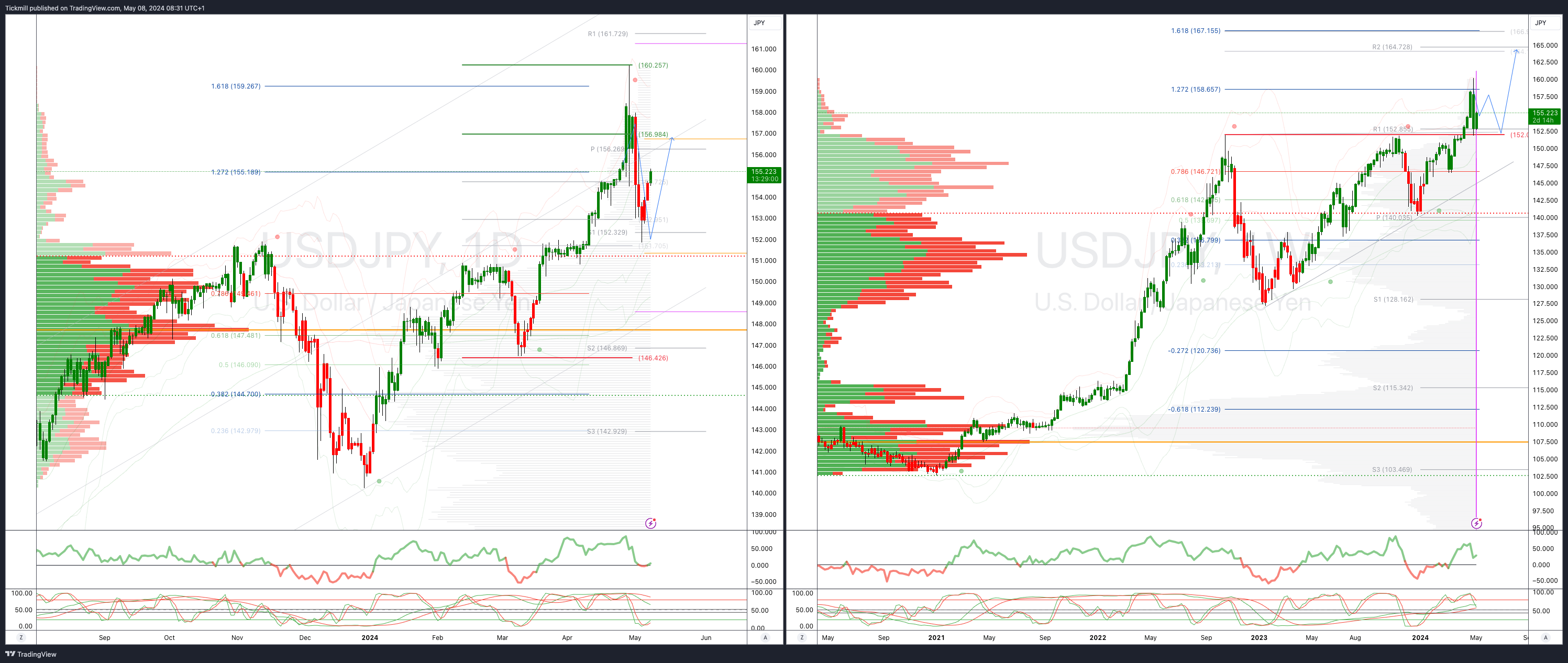

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

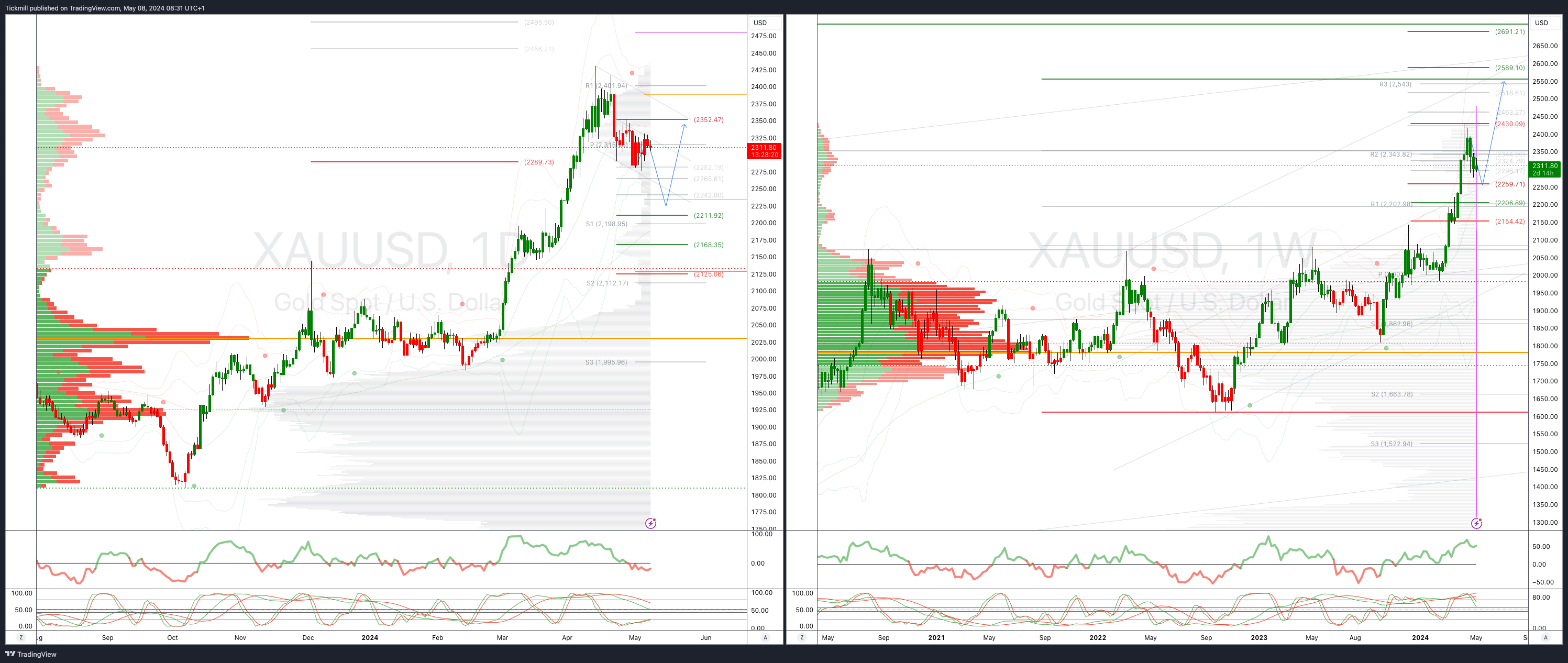

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Above 2360 opens 2400

Primary support 2260

Primary objective is 2560

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!