Daily Market Outlook, May 29, 2024

Daily Market Outlook, May 29, 2024

Munnelly’s Macro Minute…

“Markets Rattled By Hawkish Fed Rhetoric Prompting Higher Yields”

On Wednesday, Asian markets were evaluating the consequences of the overnight increase in Treasury yields, yesterday saw a jump in US consumer confidence, while hawkish-sounding remarks from a Fed official also weighed on Treasuries and broader risk sentiment. Markets have pushed out the first fully priced Fed rate cut until December after the US elections, resulting in a drop in stocks and bonds across Asia. The MSCI Asia Pacific Index declined for a second consecutive day, with Hong Kong equities experiencing the greatest losses, while benchmark rates on Japanese bonds reached their highest point since 2011.

Today marks the first significant indication of Eurozone CPI inflation for May as German figures are set to be released. Regional inflation data from Germany will be reported throughout the morning, culminating in the national report at 13:00 BST. It is anticipated that the annual rate of Germany’s EU-harmonised inflation measure will rise to 2.7% from 2.4%, primarily due to base effects from energy prices and public transport ticket prices. Tomorrow at 10:00 BST, the Eurozone flash CPI report for May will be released. Similar to Germany, it is expected that the downtrend in Eurozone annual inflation will be temporarily interrupted, mainly due to an energy price base effect. Ahead of the Eurozone data, national data from France and Spain will also be released. While these inflation figures are not expected to change the outlook for the ECB's interest rate cut next week, they may contribute to caution regarding further easing in the latter half of the year. Additionally, Eurozone money and credit data will be released this morning. The latest data from March confirmed subdued monetary dynamics, with M3 money supply growth at 0.9% and private sector loans growth at 0.4%. It is projected that M3 money supply growth will increase to 1.3% in April.

Stateside, the Fed will release its Beige Book, which contains anecdotal comments on economic conditions. Given the mixed nature of recent economic data, it will be interesting to see if this provides any clarity. Fed speakers today include Bostic, who will discuss the economic outlook.

Overnight Newswire Updates of Note

Australia’s Elevated Inflation Suggests RBA To Extend Pause

BoJ’s Adachi: Further Policy Changes Need To Proceed Carefully

NZ Business Confidence Weakens Further As Strain Felt

IMF Lifts China Growth Forecast To 5% Citing Fast Start To 2024

Fed’s Kashkari: Interest-Rate Hikes Not Entirely Ruled Out

Yen Nears Record Low Versus Euro On Carry, Interest Rate Outlook

10-Yr Treasury Yield Rises Above 4.5% Following Weak Auction

Oil Extends Gain As Geopolitical Risks Simmer Before OPEC+ Meet

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 161.20 ($980.2m), 154.75 ($872.5m), 158.00 ($711.4m)

EUR/USD: 1.0875 (EU1.47b), 1.0800 (EU1.32b), 1.0890 (EU923.8m)

USD/CNY: 7.2200 ($974.5m), 7.2474 ($499.5m), 7.2500 ($354.7m)

AUD/USD: 0.6600 (AUD411.4m)

USD/CAD: 1.4050 ($1.02b), 1.3800 ($721.8m), 1.3550 ($510m)

USD/BRL: 5.2500 ($359.6m), 5.1690 ($332.1m)

USD/MXN: 17.23 ($382.8m), 16.94 ($325.5m)

GBP/USD: 1.2650 (GBP844.3m)

NZD/USD: 0.5575 (NZD310m)

CFTC Data As Of 24/05/24

Japanese Yen net short position is -144,367 contracts

British Pound net long position is 1,053 contracts

Euro net long position is 41,475 contracts

Bitcoin net short position is -890 contracts

Swiss Franc posts net short position of 40,645 contracts

Equity fund managers raise S&P 500 CME net long position by 25,714 contracts to 946,576

Equity fund speculators increase S&P 500 CME net short position by 38,575 contracts to 317,912

Gold NC Net Positions: $229.8K vs $204.5K

Technical & Trade Views

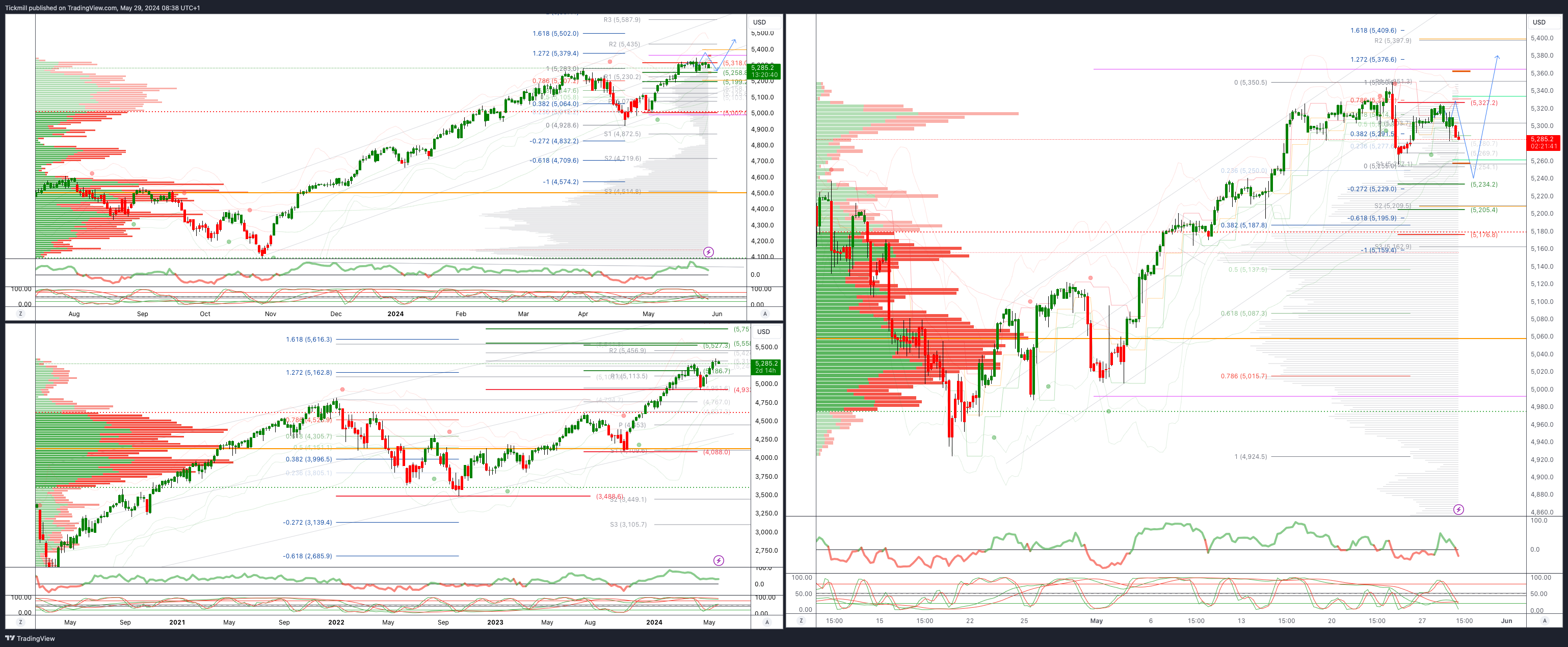

SP500 Bullish Above Bearish Below 5330

Daily VWAP bullish

Weekly VWAP bullish

Below 5230 opens 5187

Primary support 5250

Primary objective is 5379

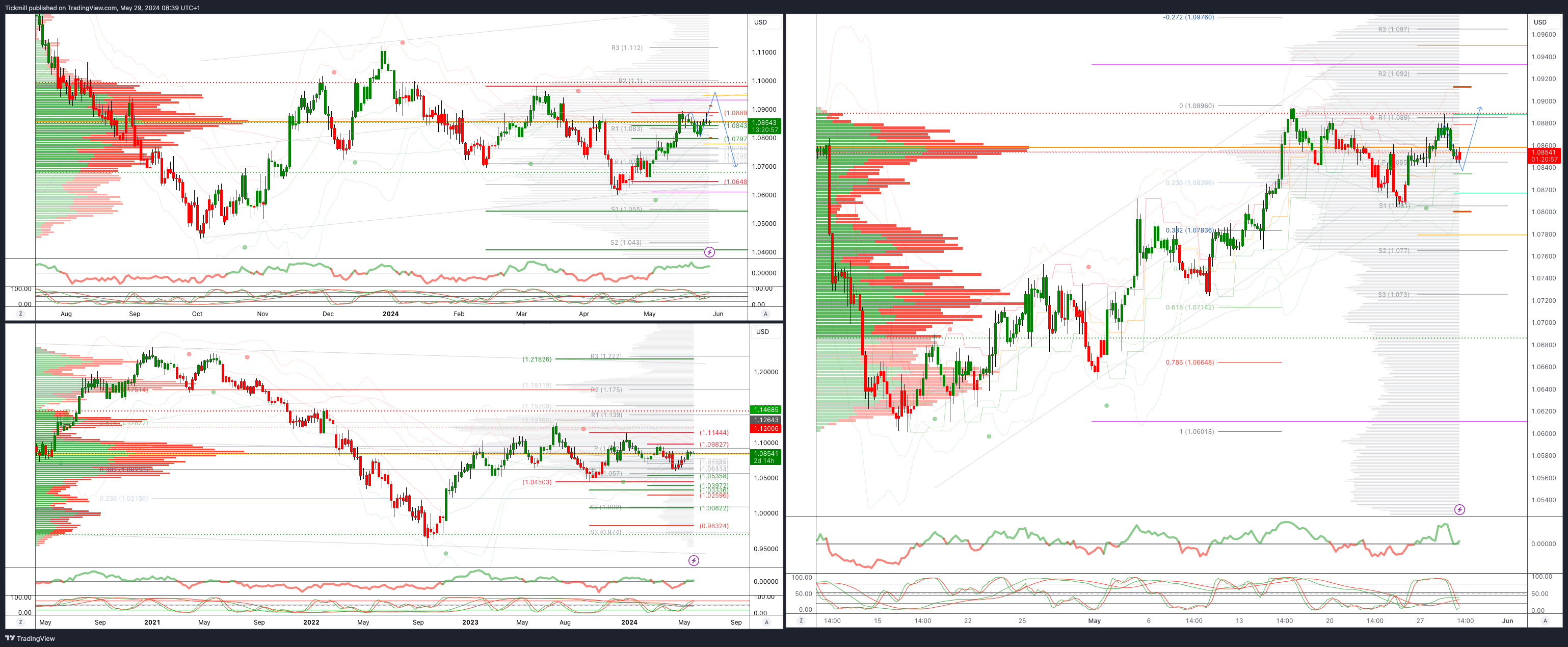

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

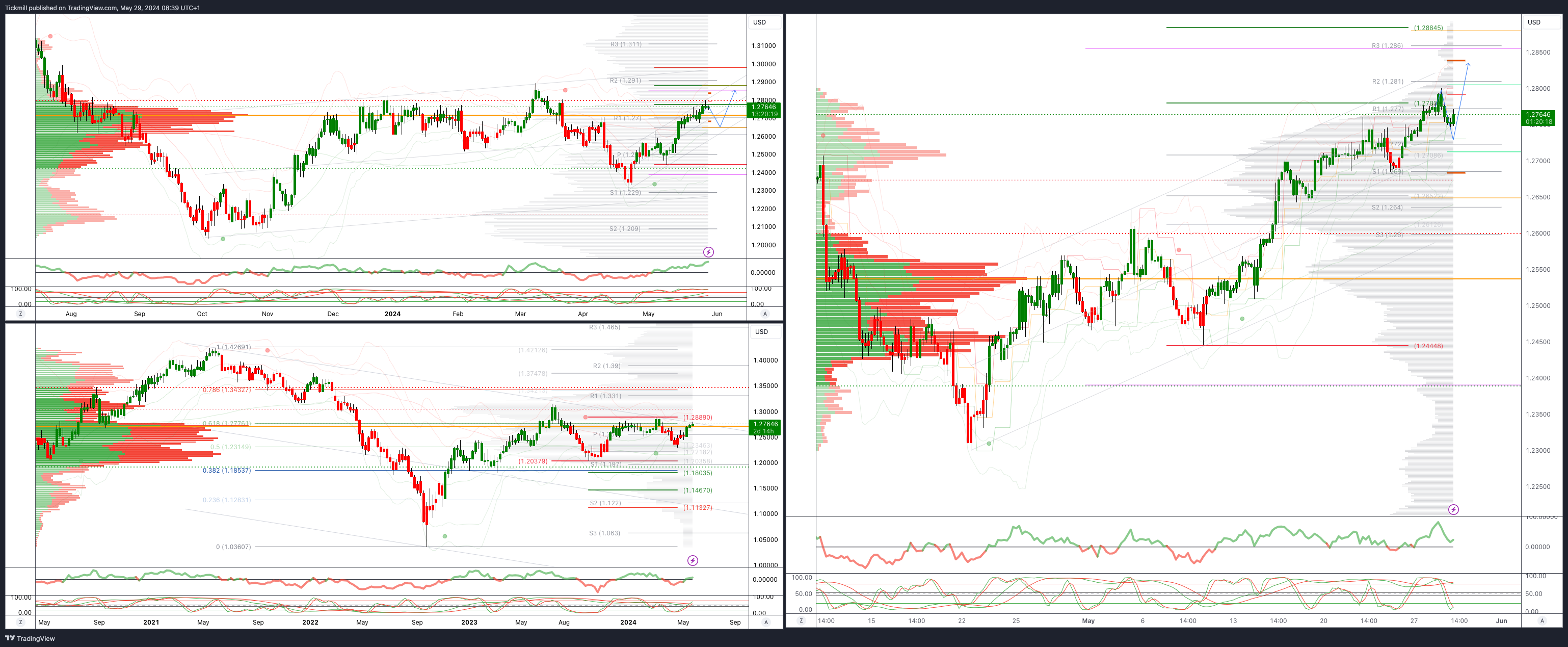

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2780 TARGET HIT NEW PATTERN EMERGING

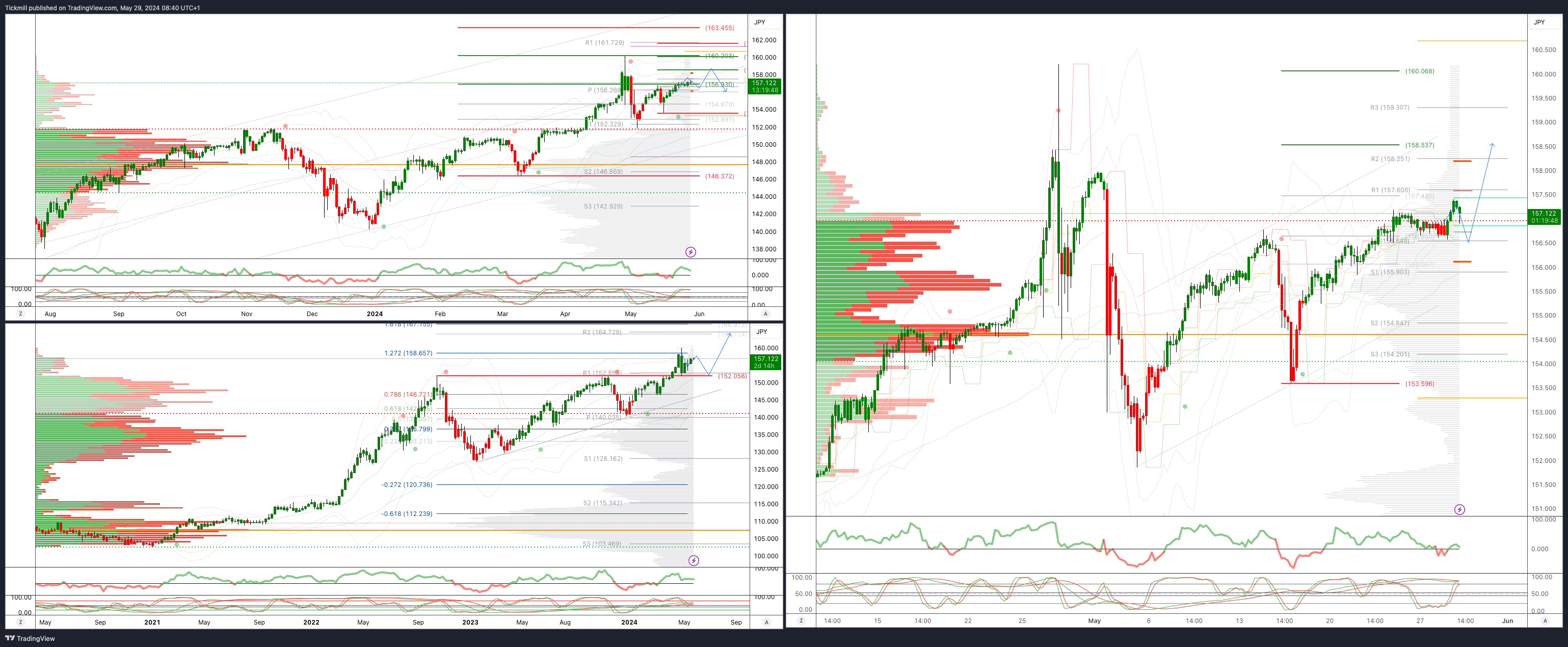

USDJPY Bullish Above Bearish Below 153.59

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

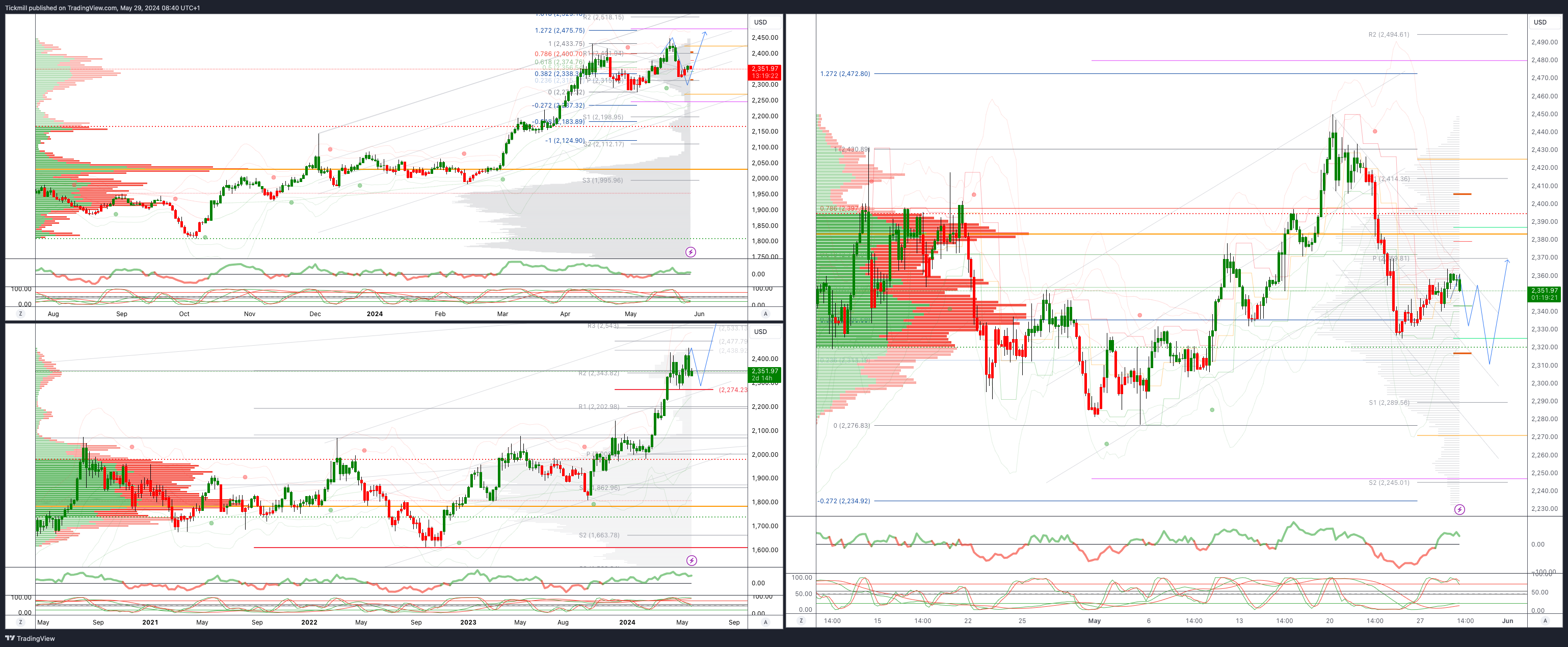

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Below 2330 opens 2280

Primary support 2330

Primary objective is 2560

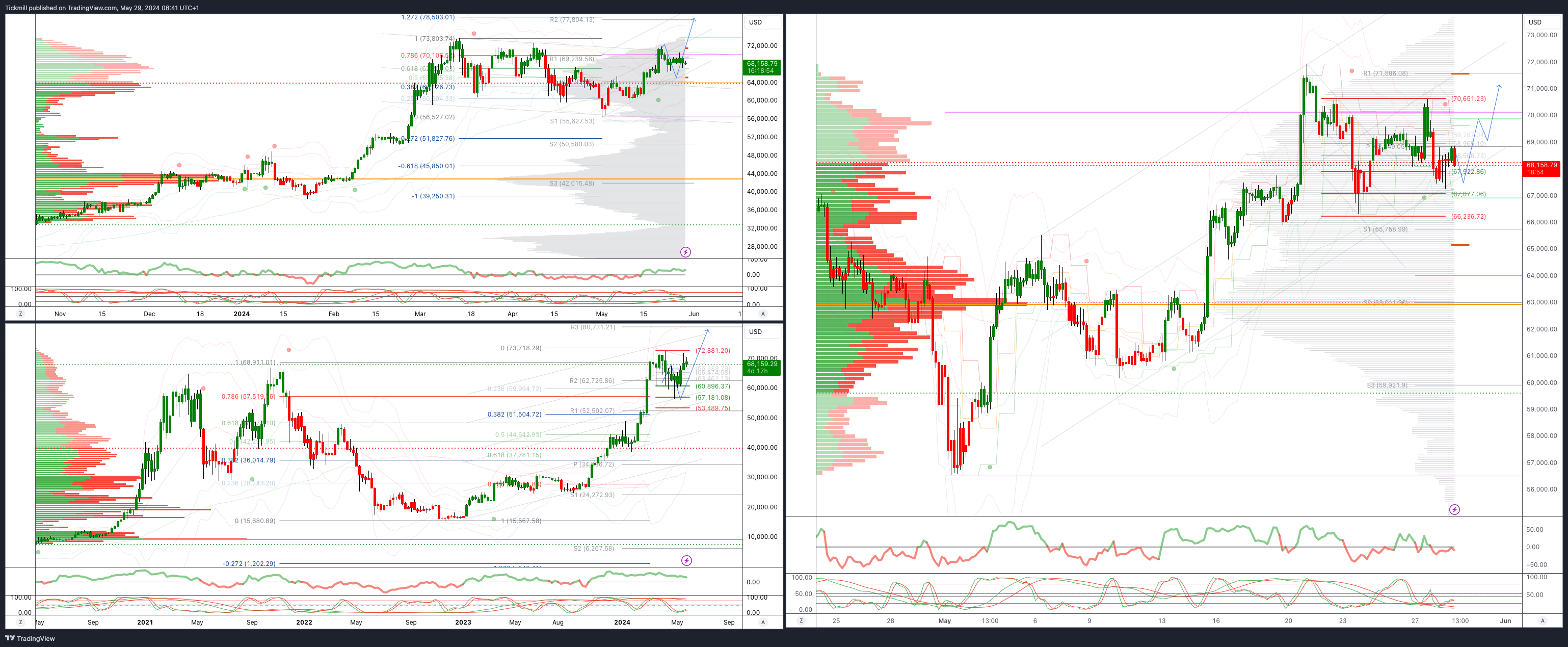

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bullish

Weekly VWAP bullish

Below 65000 opens 63000

Primary support is 65000

Primary objective is 78500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!