Daily Market Outlook, May 28, 2024

Daily Market Outlook, May 28, 2024

Munnelly’s Macro Minute…

“US & UK Back Online, Month End & Inflation Data Eyed”

On Tuesday, Asian markets saw a second day of gains as the dollar weakened in anticipation of upcoming inflation reports that could impact global monetary policy. The MSCI AC Asia Pacific index rose, led by gains in Hong Kong stocks, while US and European equities futures markets remained strong. Investors were considering the possibility of a US interest rate cut.

As May comes to an end, there is a packed data schedule with the U.S. PCE price index and China PMIs taking the lead, along with a lineup of central bank speakers and month-end rebalancing flows that will impact the markets.

The markets in the U.S. and UK were closed on Monday. In the U.S., the data calendar for the upcoming week includes the May consumer confidence, the second estimate of Q1 GDP, the Fed Beige Book, the core PCE price index, and Chicago PMI. Several Fed officials including John Williams, Neel Kashkari, and Raphael Bostic are scheduled to speak during the week.

BOJ board member Seiji Adachi is set to deliver a speech and news conference in Japan. Key data highlights from Japan include services PPI, Tokyo May core CPI, April employment, industrial production, and retail sales.

In the Eurozone, important data releases include flash May HICP, consumer confidence and sentiment indices, the German Ifo business climate survey, and CPI. ECB chief economist Philip Lane will be delivering a speech on inflation in the Eurozone on Monday. There are no major data releases scheduled in the UK, with Bank of England Governor Andrew Bailey's speech on Thursday being the only potential event of significance.

China is set to publish industrial profits on Monday and official May PMIs on Friday. The PMIs will be closely monitored for any indications of an increase in factory and services activity following a slowdown in April.

The latest ECB inflation expectations survey will have a significant impact on the upcoming European Central Bank meeting, where interest rates are expected to be cut. The Eurozone CPI report for May is forecasted to show a small rise in inflation, which argues for caution. In the US, consumer confidence measures have been declining, possibly due to concerns about inflation. Despite some positive news from the University of Michigan survey, consumer sentiment is still down for the month. Today's Conference Board indicator is also expected to show a decline, raising questions about its impact on consumer spending.

Overnight Newswire Updates of Note

Australian Retail Sales Failed To Spring Back In April

Australia’s Spike In Young Unemployed Signals Weaker Job Market

Jump In Japan’s Business Service Prices Supports BoJ Hike Case

RBNZ To Introduce Mortgage Restrictions As Debt, Home Prices Climb

UK Shop Inflation Back To ‘Normal’ Levels As Election Draws Near

USD/JPY Falls From 157.00 As US Dollar Meets Fresh Supply

Oil Steadies As Geopolitical Tensions Rise Before OPEC+ Meeting

China Stocks Eye Gains; Traders Await CPI Reports

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0770 (270M), 1.0790-00 (703M), 1.0825 (338M)

1.0850-60 (980M), 1.0870-75 (1.11BLN), 1.0900-10 (2.5BLN)

1.0980-85 (703M)

USD/JPY: 155.50 (1.12BLN), 155.90-10 (1.05BLN), 156.45-50 (555M)

157.75 (280M), 158.00 (600M)

USD/CHF: 0.9050 (800M)

AUD/USD: 0.6615-25 (461M), 0.6650 (933M), 0.6725 (523M)

NZD/USD: 0.6050 (307M), 0.6110-15 (321M)

Japan's Finance Minister Suzuki has once again started verbally intervening in the foreign exchange market, expressing the desire for stable FX rates. He is closely monitoring FX movements but refraining from commenting on actual market interventions as a general practice. The focus is currently on the negative impacts of a weak yen. Japanese officials are feeling more confident after the recent G7 approval of FX measures. Although the market has been relatively stable recently, there are no plans for new interventions at this time.

CFTC Data As Of 24/05/24

Japanese Yen net short position is -144,367 contracts

British Pound net long position is 1,053 contracts

Euro net long position is 41,475 contracts

Bitcoin net short position is -890 contracts

Swiss Franc posts net short position of 40,645 contracts

Equity fund managers raise S&P 500 CME net long position by 25,714 contracts to 946,576

Equity fund speculators increase S&P 500 CME net short position by 38,575 contracts to 317,912

Gold NC Net Positions: $229.8K vs $204.5K

Technical & Trade Views

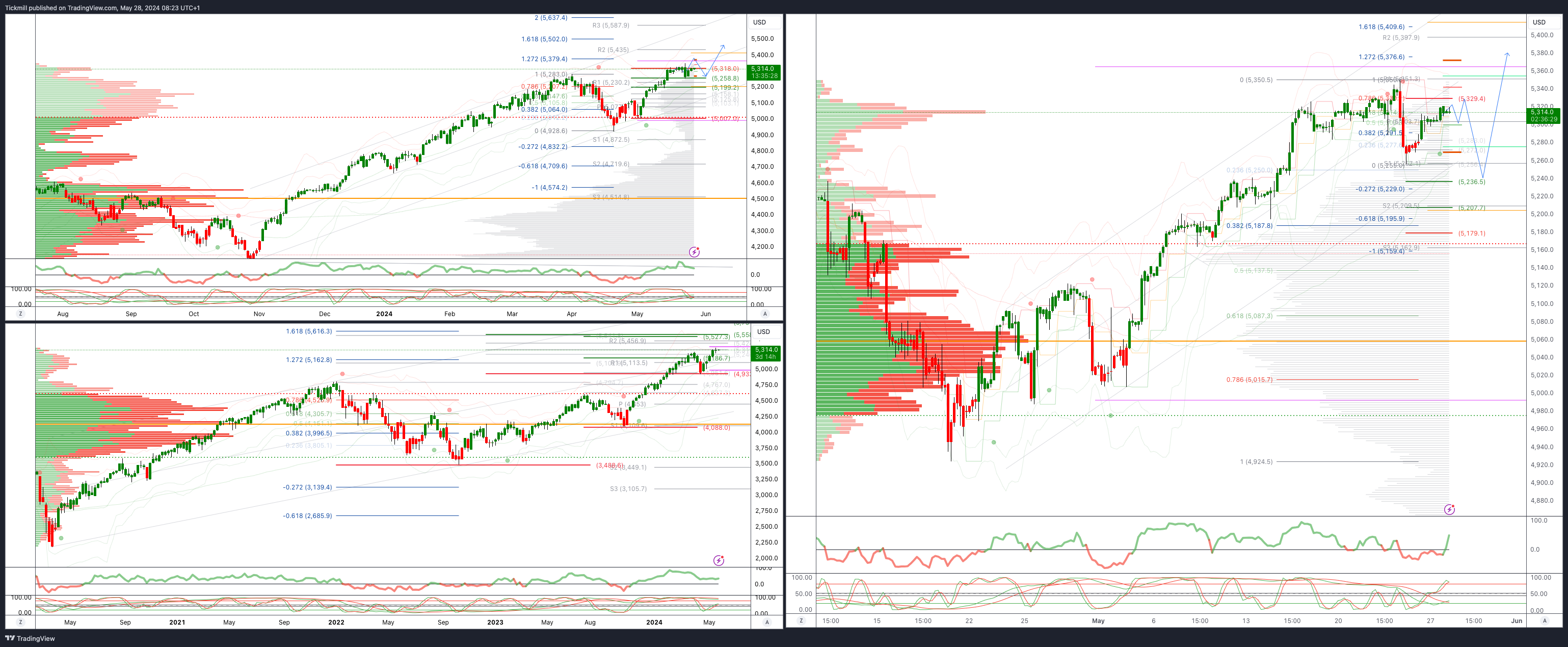

SP500 Bullish Above Bearish Below 5330

Daily VWAP bullish

Weekly VWAP bullish

Below 5230 opens 5187

Primary support 5250

Primary objective is 5379

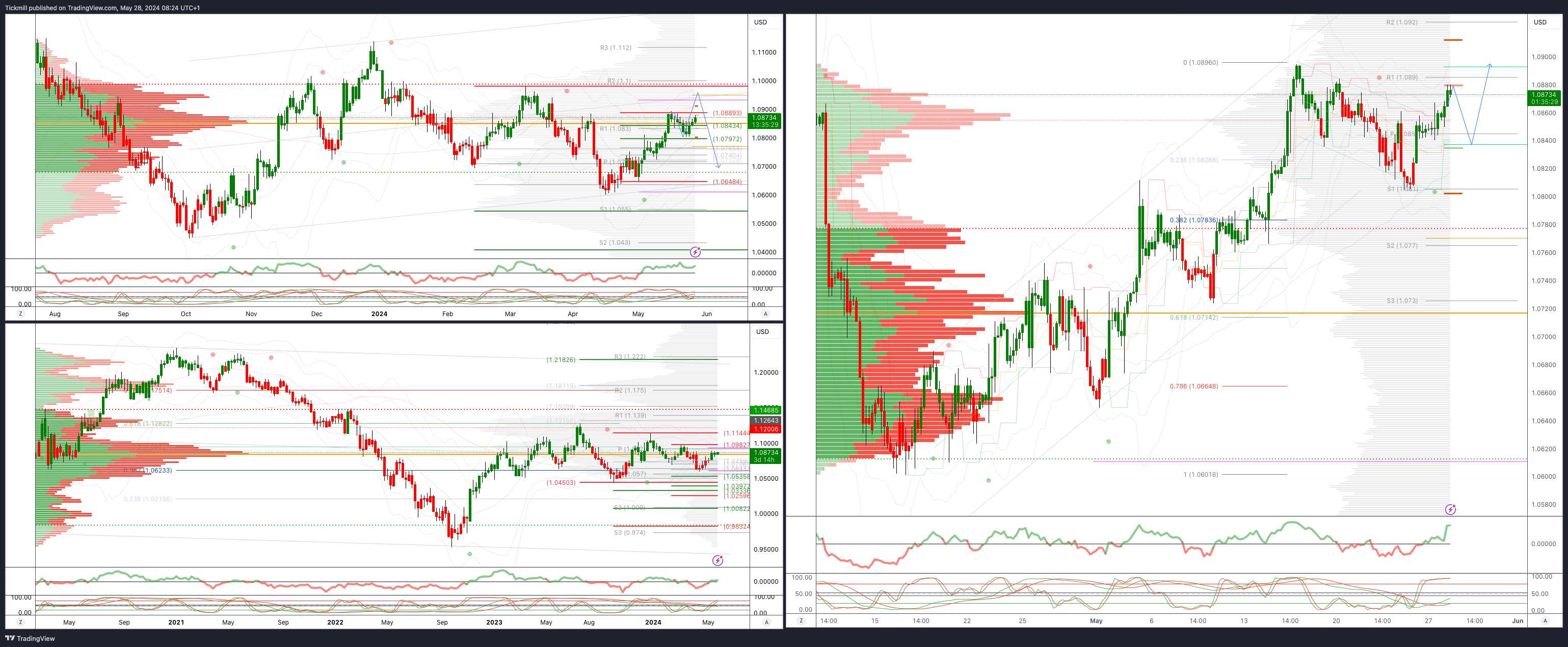

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

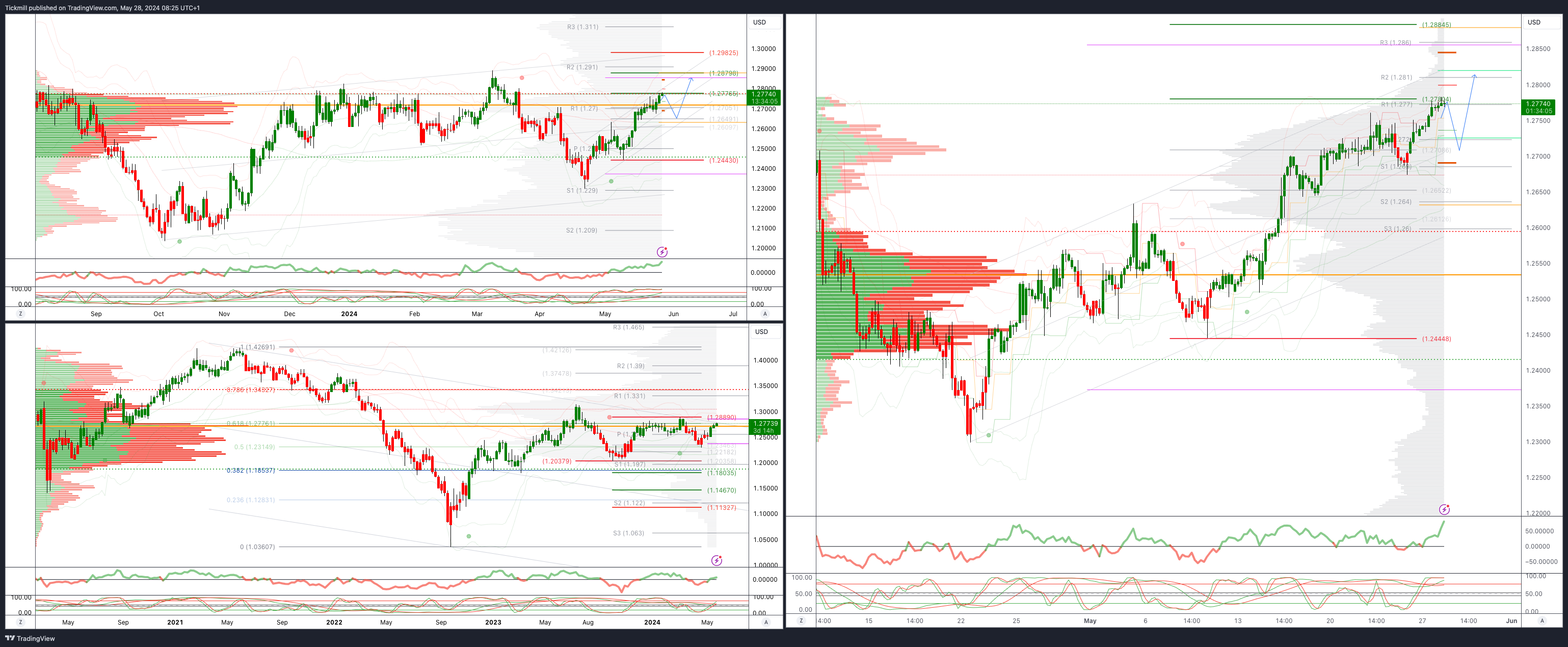

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2780 TARGET HIT NEW PATTERN EMERGING

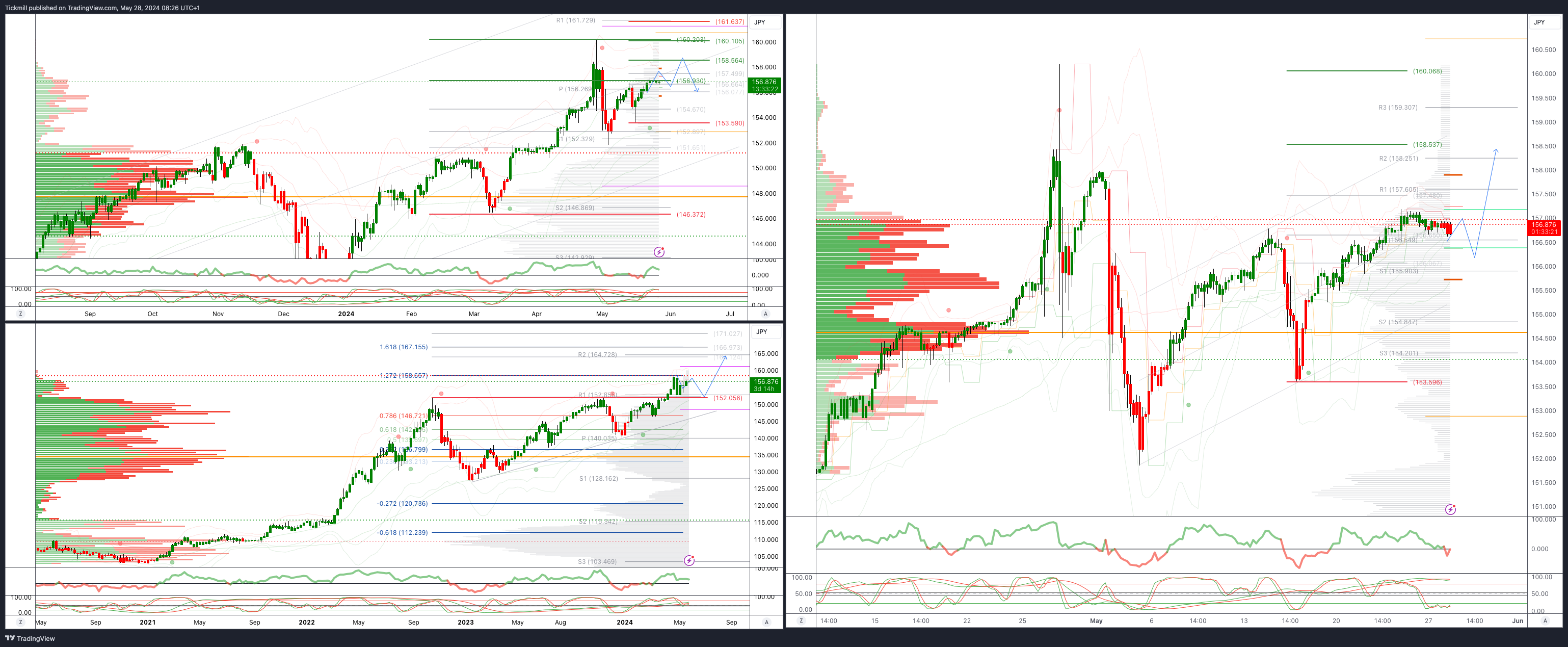

USDJPY Bullish Above Bearish Below 153.59

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

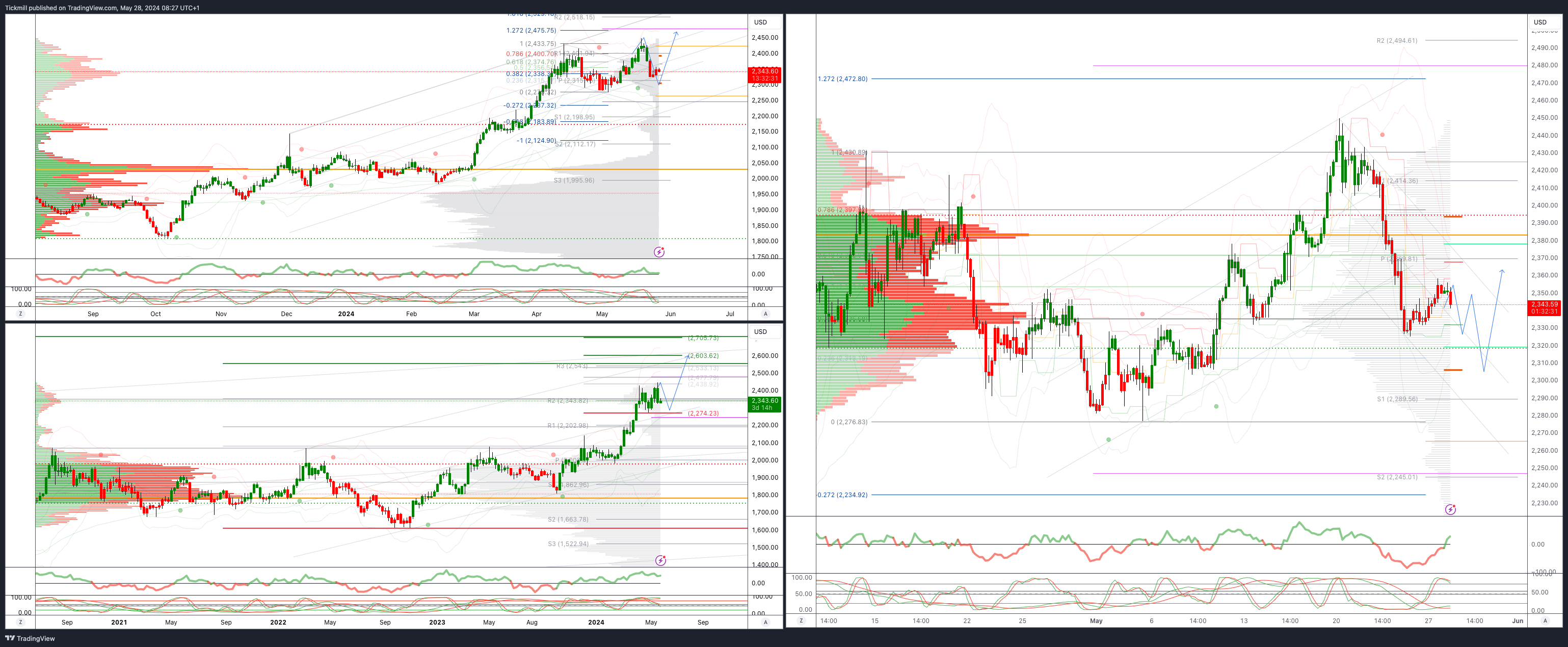

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Below 2330 opens 2280

Primary support 2330

Primary objective is 2560

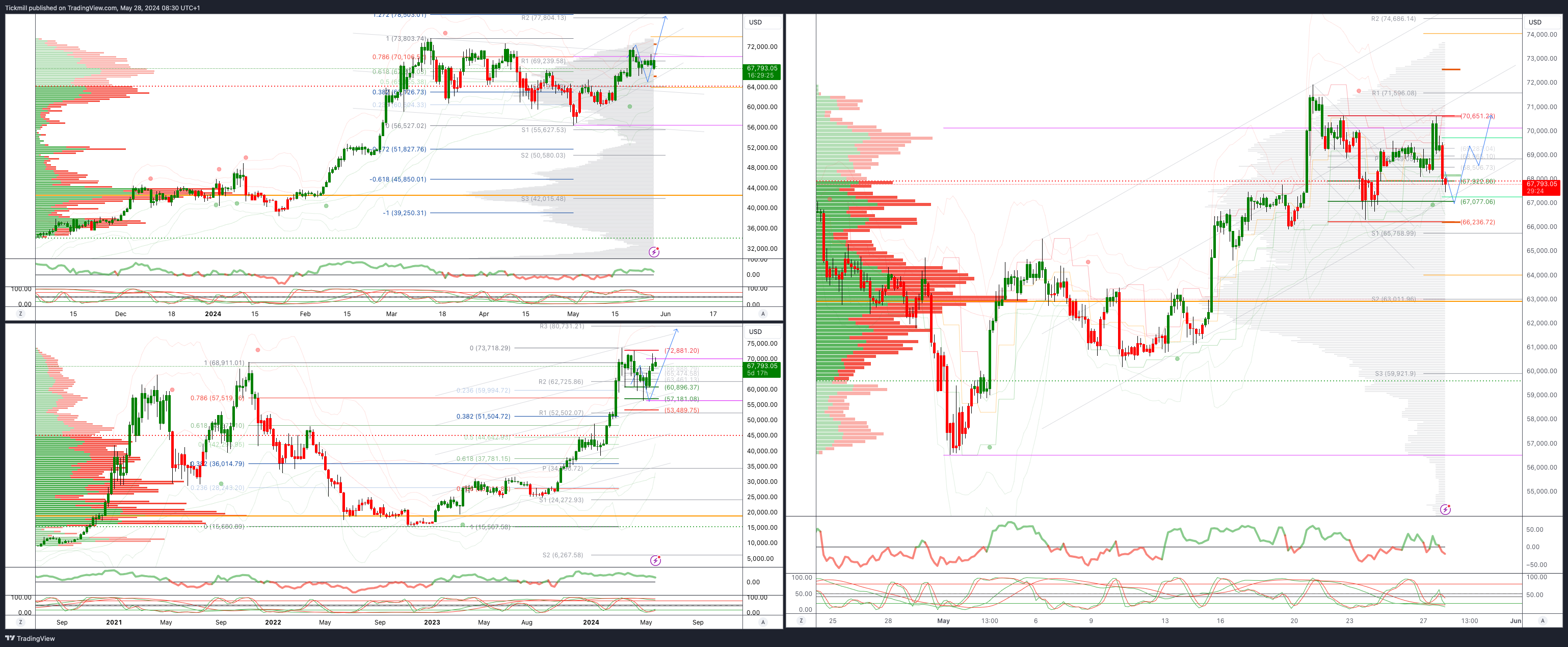

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bullish

Weekly VWAP bullish

Below 65000 opens 63000

Primary support is 65000

Primary objective is 78500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!