Daily Market Outlook, May 24, 2024

Daily Market Outlook, May 24, 2024

Munnelly’s Macro Minute…

“Profit Taking Ahead Of The Holiday Weekend”

Asian markets and currencies experienced a decline after a sell-off on Wall Street, which was prompted by data suggesting that the Federal Reserve may not change interest rates for the majority of the year. The MSCI's Asia Pacific Index was set for its worst day since May 8 and its first drop in five weeks, with significant decreases in shares in Hong Kong, mainland China and Japan. Chinese stocks in Hong Kong were also heading for their worst weekly performance since January. Despite this, US futures showed a slight increase after the S&P 500 experienced its biggest drop this month on Thursday. Market swaps now fully anticipate that the Fed's first quarter-point rate cut will occur in December, as opposed to November just a day earlier. While service provider activity saw its quickest increase in a year, industrial output also rose at a faster pace. This resilience makes it more challenging for inflation to decrease, leading to the likelihood of the Fed maintaining higher interest rates for a longer period.

UK data released this morning painted a mixed picture of consumer activity. The Office for National Statistics reported a significant 2.3% month-on-month decline in April retail sales, attributed to poor weather and reduced footfall. This drop was more severe than the consensus forecast of a 0.5% decline. Despite this, retail sales data can be volatile. The GfK's separate report indicated a rise in UK consumer confidence for the second consecutive month, with its headline index reaching -17, the highest since 2021, matching market expectations. This increase reflected notable improvements in consumer outlooks for personal finances and the broader economy.

In the Eurozone, Germany's Q1 GDP rose by 0.2%, confirming the preliminary release and signaling a return to growth after a 0.5% contraction in Q4. Survey evidence suggests continued economic growth for Germany in Q2. Meanwhile, French business confidence remained steady at 99.0 in May, according to the Insee survey.

Stateside, today's data releases include April's durable goods orders and the University of Michigan's final consumer survey for May. The preliminary consumer sentiment index saw a sharp drop to 67.4 from 77.2 in April, attributed to the renewed rise in inflation since the year's start.

Notable speakers today include the Fed’s Waller, who is set to deliver a keynote speech, along with several ECB officials. Contrastingly, the Bank of England has reportedly suspended all speeches and public statements until after the 4 July general election, though a monetary policy update is still scheduled for 20 June. Markets now assign a very low probability to a rate cut at the BoE meeting in June, following recent inflation data showing a smaller-than-expected decline and persistent service prices.

Overnight Newswire Updates of Note

Fed’s Bostic Says Policy Is Taking Longer To Slow Growth

DoubleLine CEO Expects Imminent US Recession, Gvt Debt Surge

UK Consumer Confidence Hits A Two-Year High In May

Japan Consumer Inflation Grows At Slower Pace In April

Goldman Says Market Pricing For RBA Rate Cuts Is ‘Too Shallow’

RBNZ ‘Absolutely’ Prepared To Hike Rates If Necessary, Silk Says

RBNZ Hawkesby: Cutting Rates Not Part Of Near-Term Discussion

SEC Opens The Door For Spot Ether ETFs In Big Crypto Victory

Oil Holds Near 3Mth Low As Market Shows Signs Of Weakness

Nvidia Cuts China Prices In Huawei Chip Fight, Sources Say

Large Anglo Shareholders Are Backing Miner’s Stance On BHP Talks

Samsung's HBM Chips Failing Nvidia Tests On Heat, Power Issues

Alibaba Is Said To Price $4.5 Billion Convertible Bond Sale

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0820-30 (2.3BLN), 1.0840-50 (1.7BLN), 1.0860-70 (1.8BLN)

1.0875 (3BLN), 1.0885 (571M), 1.0890 (2.3-BLN), 1.0900 (1.3BLN)

USD/CHF: 0.9110-15 (880M), 0.9150 (327M), 0.9200 (1.3BLN)

EUR/CHF: 0.9825-30 (823M), 0.9925-40 (856M)

EUR/GBP: 0.8555-60 (290M). GBP/USD: 1.2550-60 (462M), 1.2700 (407M)

AUD/USD: 0.6600-05 (1BLN), 0.6675 (906M)

AUD/NZD: 1.0825 (273M), 1.0900 (411M), 1.1000 (368M)

USD/CAD: 1.3720-25 (421M), 1.3735-50 (765M)

USD/JPY: 156.00 (1.3BLN), 156.50 (473M), 156.75 (498M)

157.00 (3.4BLN), 157.20-30 (762M)

FX markets are reducing positions ahead of a long UK/U.S. holiday weekend. Low FX option implied volatility is consistent with low FX realized volatility. FX option expiries and related hedging flows can have a greater influence on FX. Flows are larger near strikes as volatility traders neutralize FX exposure. These flows can help to draw/contain FX near the larger strike before expiry. USD/JPY is trading around a massive $3.4 billion 157.00 strike expiring Friday. EUR/USD is in the low 1.08's after USD demand, but massive strikes are just above. AUD/USD is around A$1 billion 0.66 and GBP between 800 million in the mid/upper 1.26's.

CFTC Data As Of 17/05/24

Japanese yen net short position is -126,182

British pound net short position is -20,075

Euro net long position is 17,155 contracts

Swiss franc posts net short position of -41,107

Bitcoin net short position is -177 contracts

Equity fund managers raise S&P 500 CME net long position by 60,168 contracts to 920,863

Equity fund speculators increase S&P 500 CME net short position by 40,882 contracts to 279,337

Gold NC Net Positions: $204.5K vs $199.6K

Technical & Trade Views

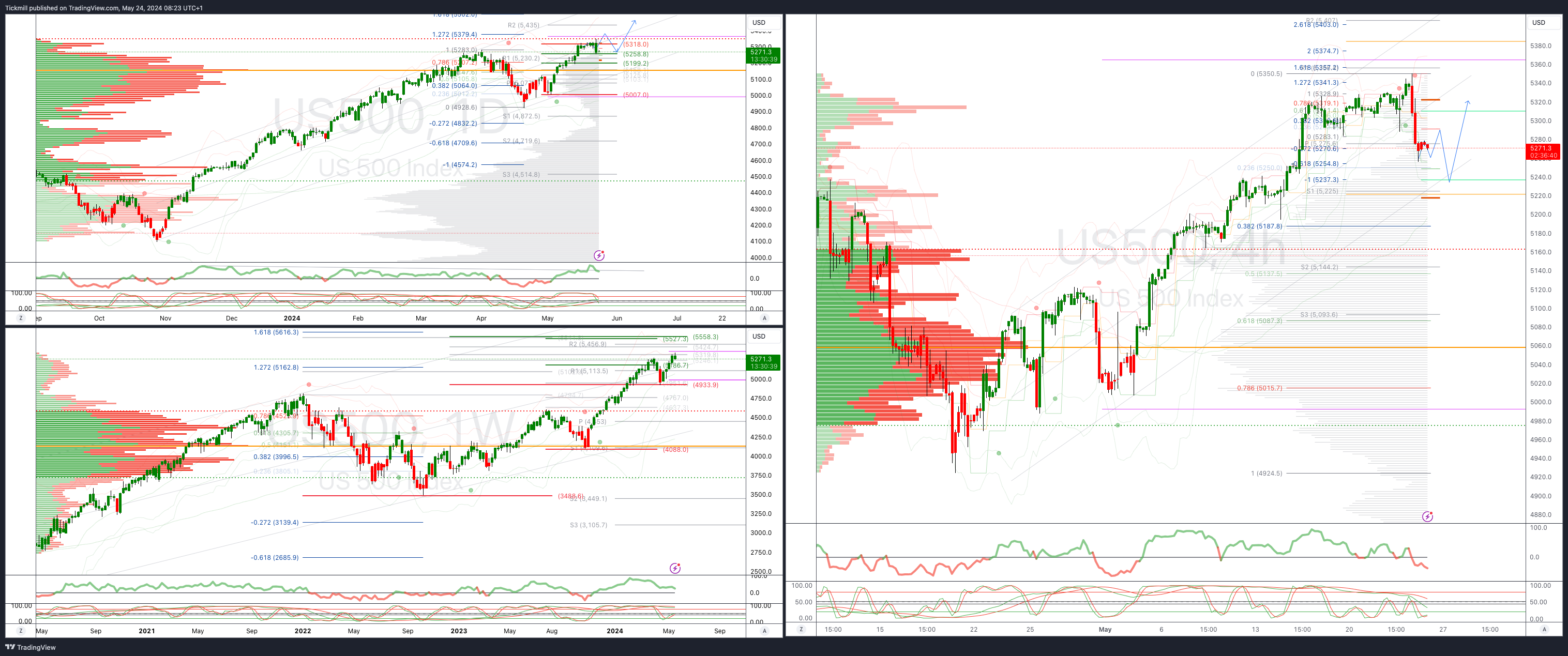

SP500 Bullish Above Bearish Below 5230

Daily VWAP bullish

Weekly VWAP bullish

Below 5230 opens 5187

Primary support 5250

Primary objective is 5379

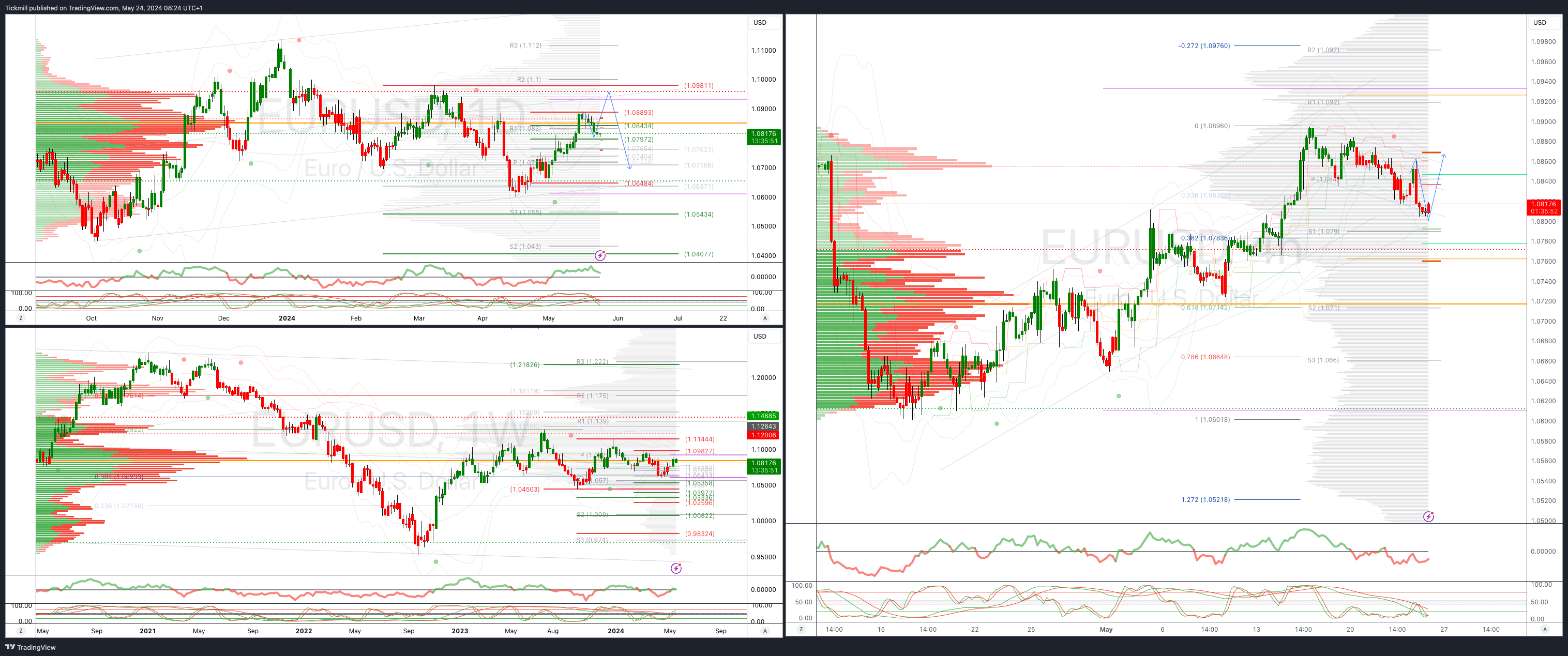

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

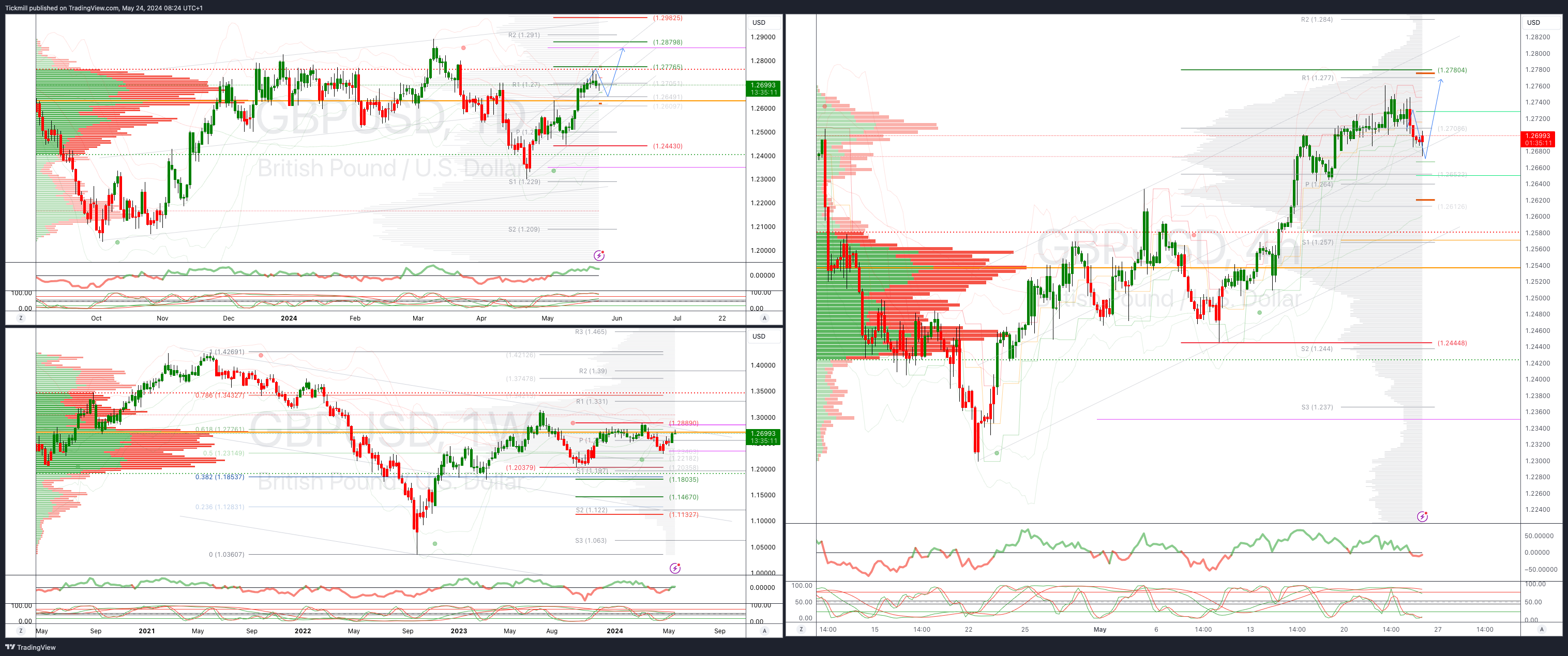

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2780

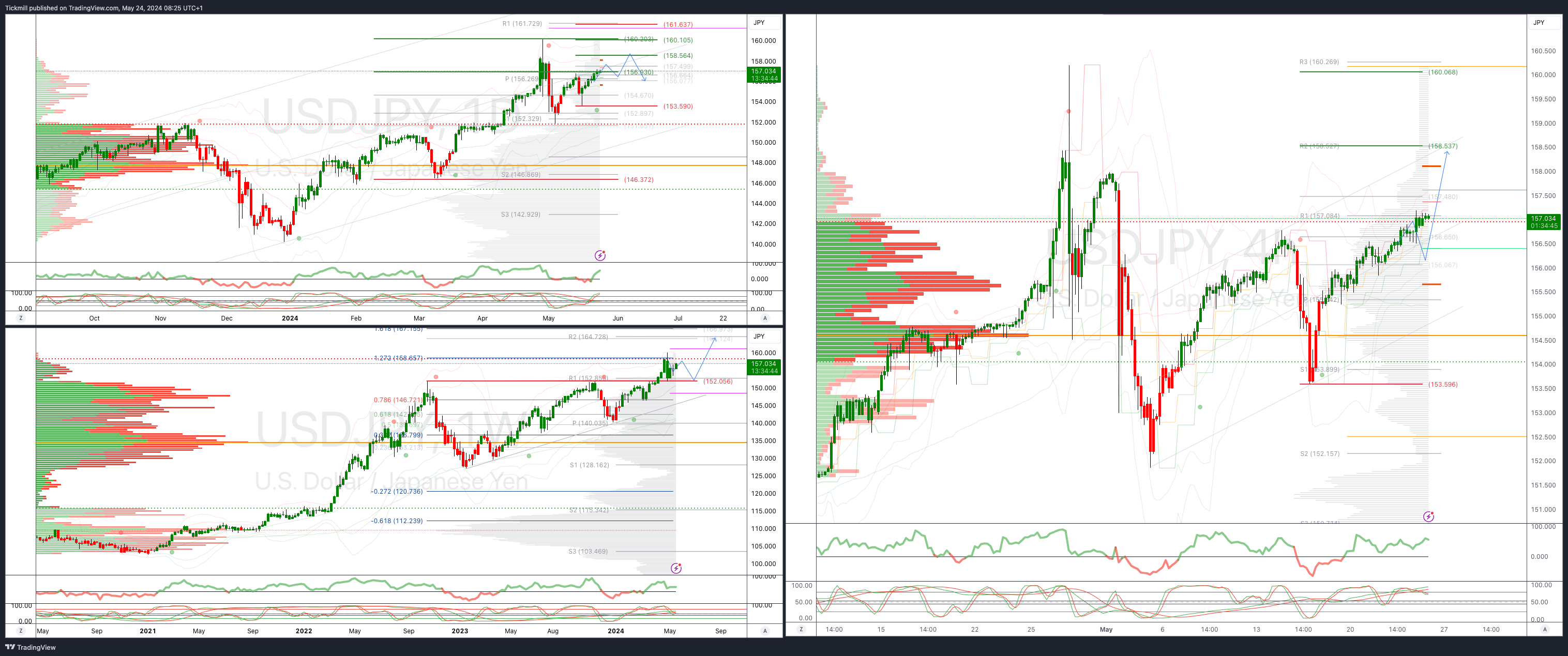

USDJPY Bullish Above Bearish Below 153.59

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

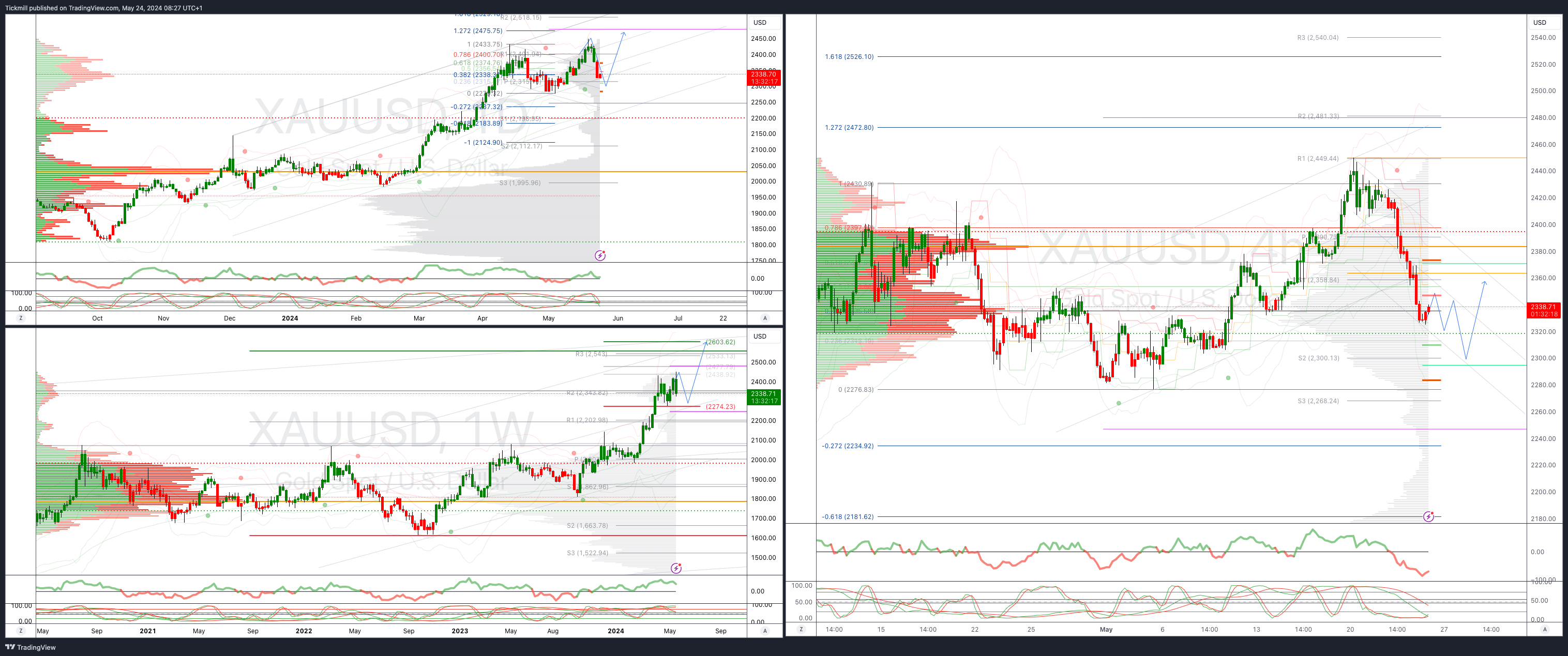

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Below 2330 opens 2280

Primary support 2330

Primary objective is 2560

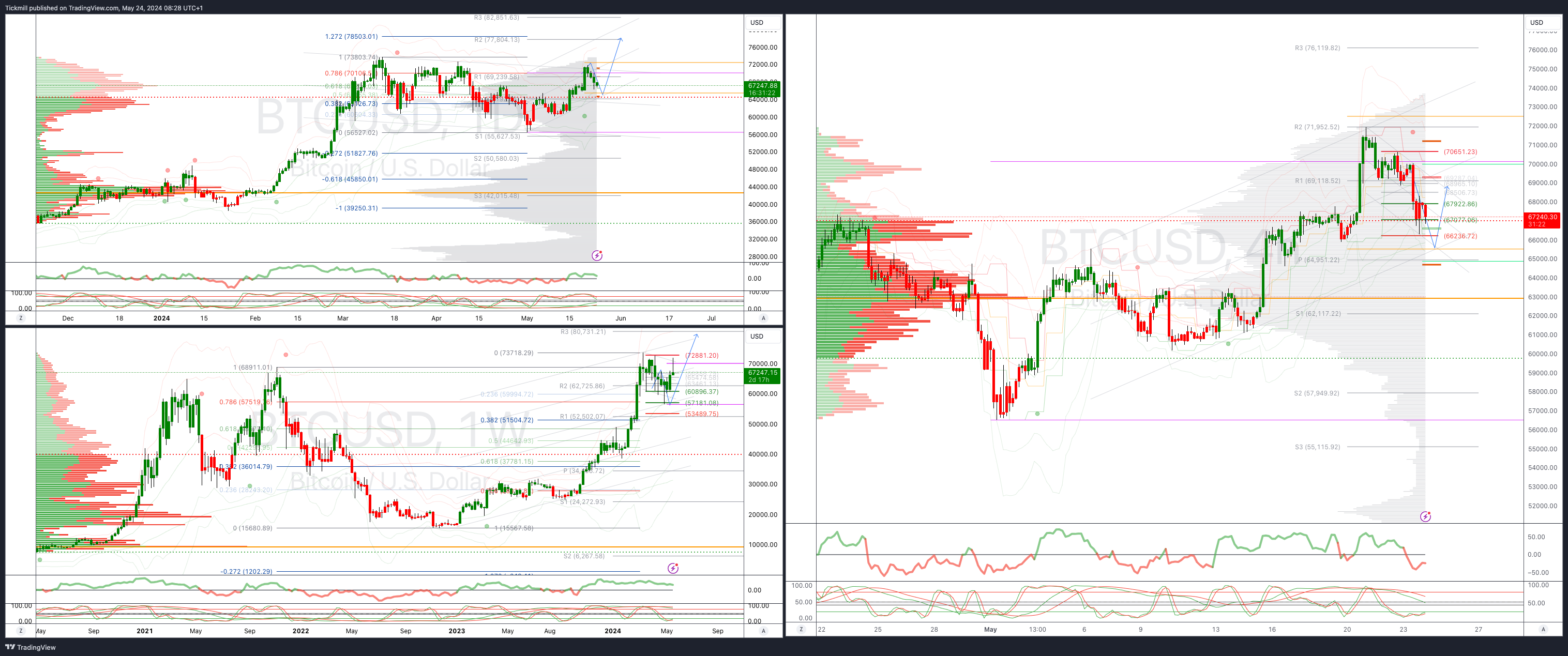

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bullish

Weekly VWAP bullish

Below 65000 opens 63000

Primary support is 65000

Primary objective is 78500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!