Daily Market Outlook, May 22, 2024

Daily Market Outlook, May 22, 2024

Munnelly’s Macro Minute…

“Sticky UK Inflation Supports Sterling, FOMC & Nvidia On Deck Later”

Asian equities stumbled due to a lack of domestic drivers, while the S&P 500 approached another all-time high ahead of Nvidia's earnings. Mainland China and Hong Kong stocks traded in narrow ranges, with Japan seeing a slight decline. The S&P 500 set its 24th record of the year, with minimal movement in US stock futures and a slight increase in European market contracts in Asia. The Reserve Bank of New Zealand hinted at potential interest rate cuts starting in 2025, leading to a surge in the New Zealand currency and government bond yields. The central bank maintained its interest rates for the sixth consecutive meeting.

Newly published data shows that UK CPI inflation dropped to 2.3% from 3.2% in March, the lowest level since December 2021. However, the decrease was not as large as expected. This decline was mainly driven by lower energy prices as a result of the new Ofgem energy price cap. Core inflation, which excludes food and energy, also decreased less than anticipated to 3.9% from 4.2% in March, with services prices remaining relatively stable, dropping slightly to 5.9% from 6.0%. Despite the significant drop in the headline inflation rate, the higher-than-expected figure diminishes hopes for a June interest rate cut from the Bank of England. However, there is one more inflation release before the June policy meeting, which is expected to show a further decline closer to the 2.0% target. April's UK public finance data revealed a slightly higher-than-expected net borrowing figure of £19.6bn for the first month of the new financial year, which is just over a billion higher than the same month last year.

The rest of today's data slate is scant. The UK house price index from the ONS suggests that the market may have reached its peak. In the US, existing home sales are expected to have declined for the second consecutive month in April, following a large increase in February that was seen as unsustainable.

Bank of England policymaker Breeden is scheduled to speak today, focusing on the technical aspects of macroprudential policy rather than immediate interest rate outlooks. Several US Federal Reserve policymakers are also scheduled to speak.

This evening, the US Fed will release the minutes from its last policy meeting in late April and early May. Prior to that meeting, there were concerns in the markets that the Fed might signal a need for further rate hikes. However, the message that the next rate move is likely to be a cut, though it may be delayed due to persistent inflation, reassured investors. According to fed fund futures, there is approximately a 66% probability of a rate cut by September, with 43 basis points of easing already factored in for the year. The market is anticipating significant movement in Nvidia's stock after their earnings report, with options indicating a potential 8.7% swing in value, which could impact the company's market worth by $200 billion. Analysts are questioning the potential for further growth considering Nvidia's already impressive 77% profit margin and a 93% increase in stock value this year.

Overnight Newswire Updates of Note

New Zealand Holds Rates, Now Sees Cuts Starting Later In 2025

Waller Says Fed Could Cut Rates At ‘End Of This Year’ If Data Softens

Fed’s Collins, Mester Emphasize Need For More Data To Cut Rates

ECB’s Lagarde Sees June Rate Cut With Inflation ‘Under Control’

ECB’s Nagel: Back-To-Back ECB Rate Cuts Not A Given

BoE Governor Predicts ‘Quite A Drop’ In UK Inflation In April Figure

Cboe Posts Amended ETH ETF Filings, Industry Renews Approval Hopes

US To Sell Gas In NE Reserve As Summer Driving Season Kicks Off

Apple Takes Steps Toward Asking Court To Dismiss US Antitrust Case

China May Raise Tariffs On Some US, EU Cars, Lobby Group Says

Israel-Saudi Normalization Deal Within Reach But Israel Might Balk

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0825-35 (1.6BLN), 1.0860 (836M), 1.0875-85 (602M)

USD/CHF: 0.9100 (429M). GBP/USD: 1.2740-50 (818M)

AUD/USD: 0.6640-55 (685M). NZD/USD: 0.6100 (836M)

USD/CAD: 1.3625 (730M), 1.3680 (1.1BLN), 1.3725 (802M)

USD/JPY: 154.00 (2.1BLN), 155.00 (385M), 155.60 (1.2BLN)

CFTC Data As Of 17/05/24

Japanese yen net short position is -126,182

British pound net short position is -20,075

Euro net long position is 17,155 contracts

Swiss franc posts net short position of -41,107

Bitcoin net short position is -177 contracts

Equity fund managers raise S&P 500 CME net long position by 60,168 contracts to 920,863

Equity fund speculators increase S&P 500 CME net short position by 40,882 contracts to 279,337

Gold NC Net Positions: $204.5K vs $199.6K

Technical & Trade Views

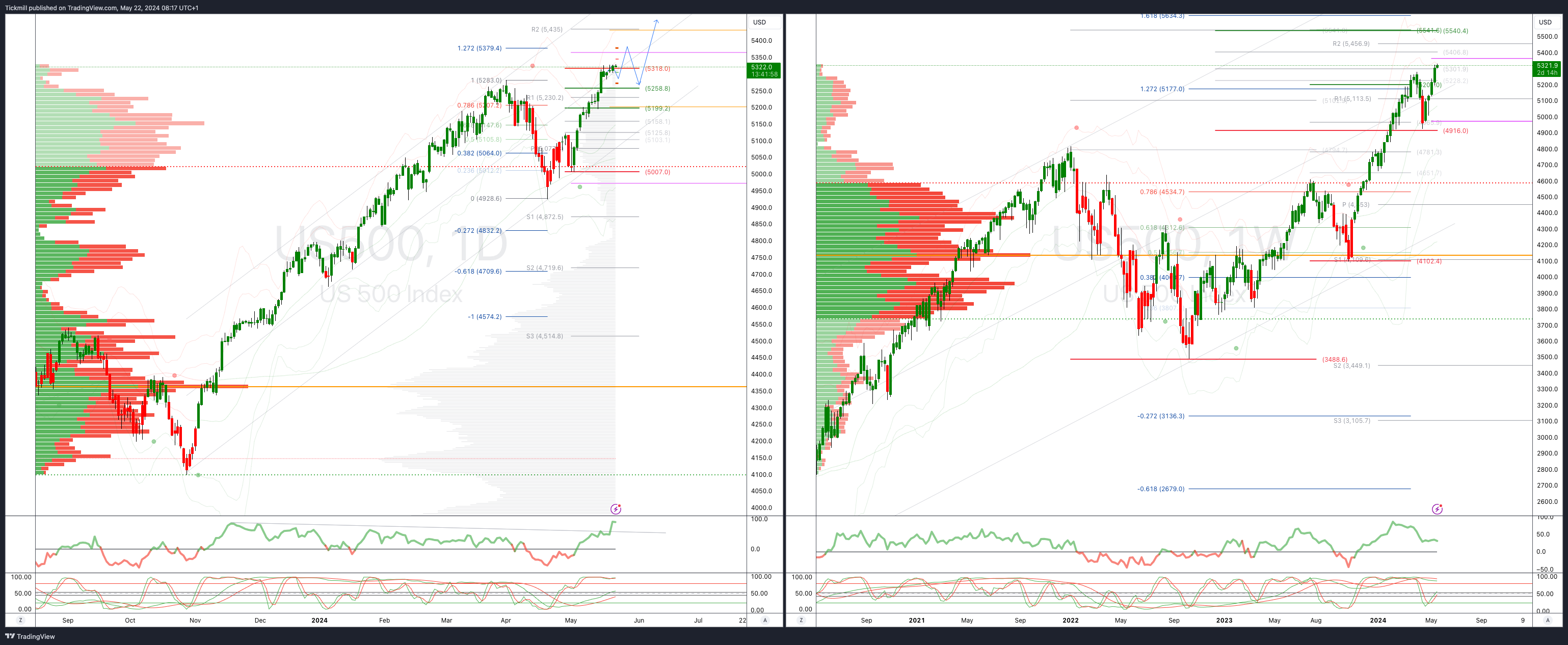

SP500 Bullish Above Bearish Below 5280

Daily VWAP bullish

Weekly VWAP bullish

Below 5258 opens 5200

Primary support 5160

Primary objective is 5379

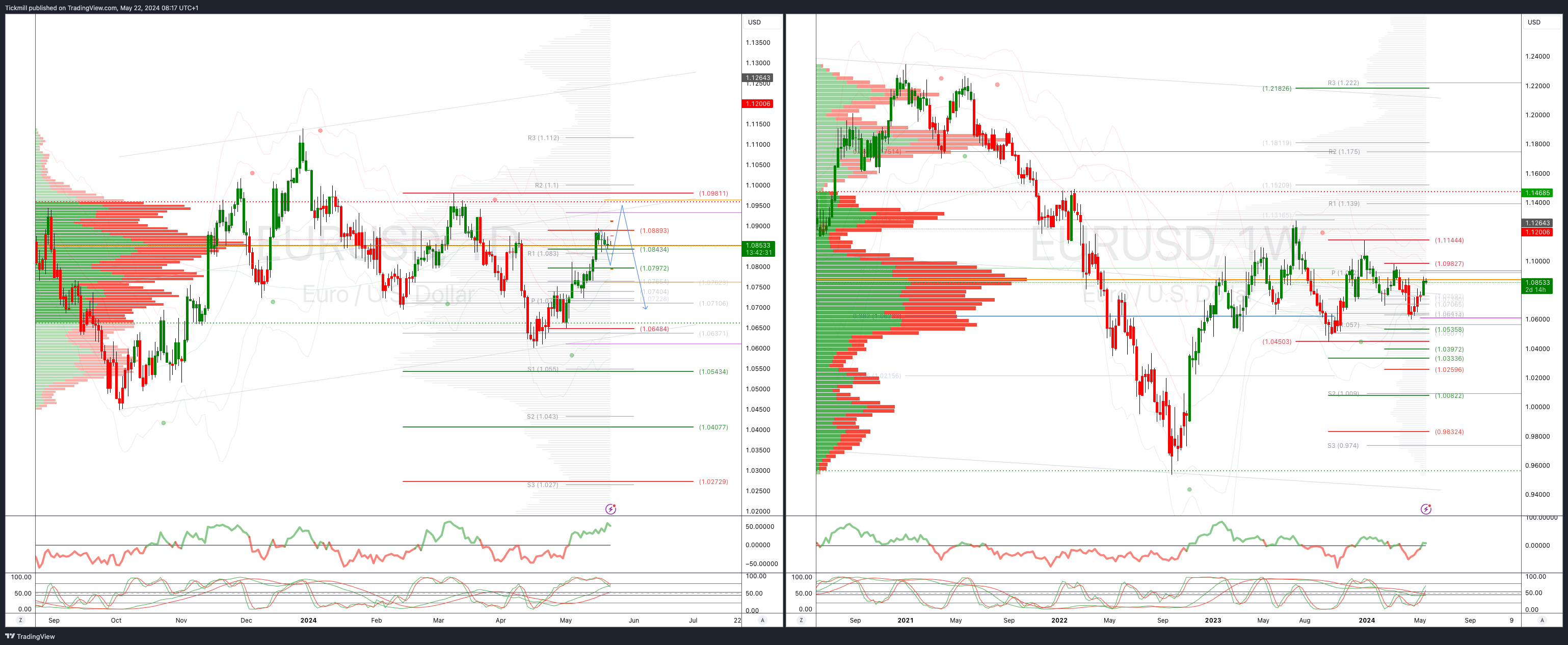

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

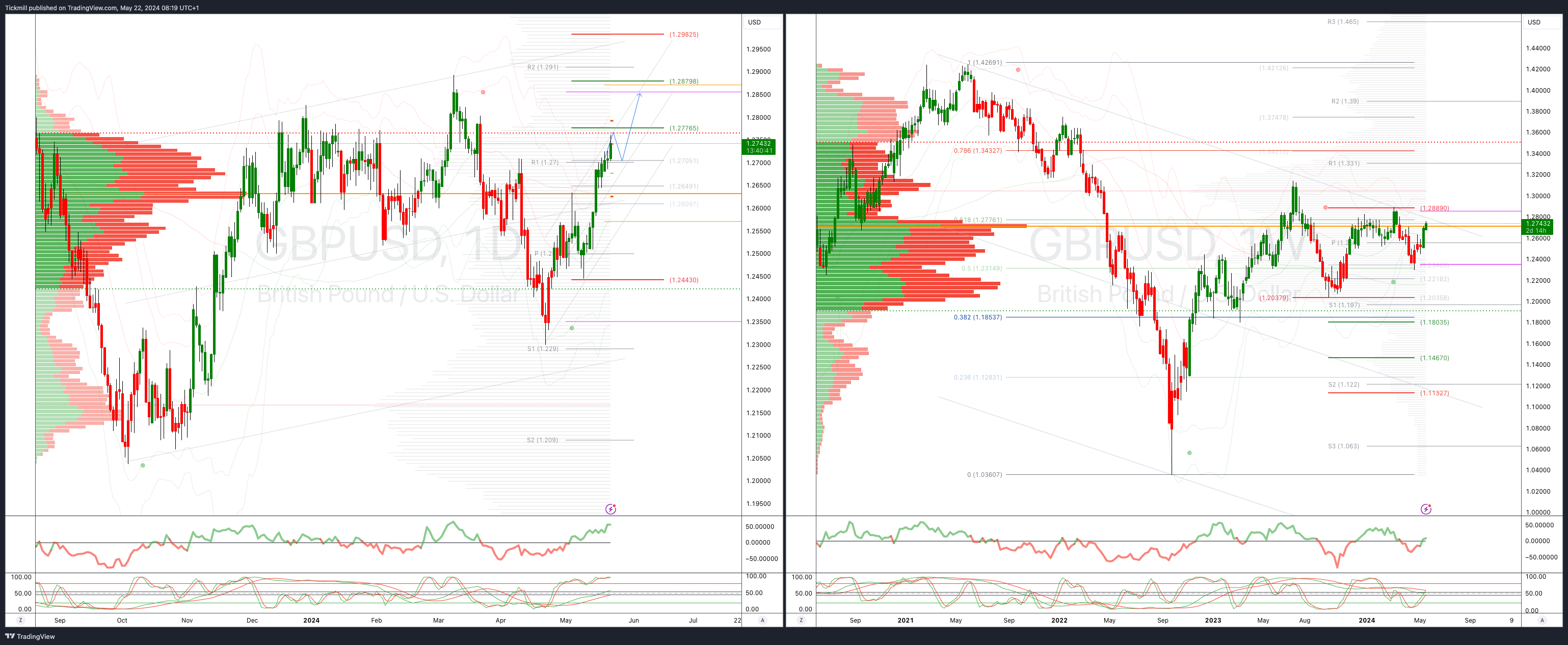

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2443

Primary objective 1.2776

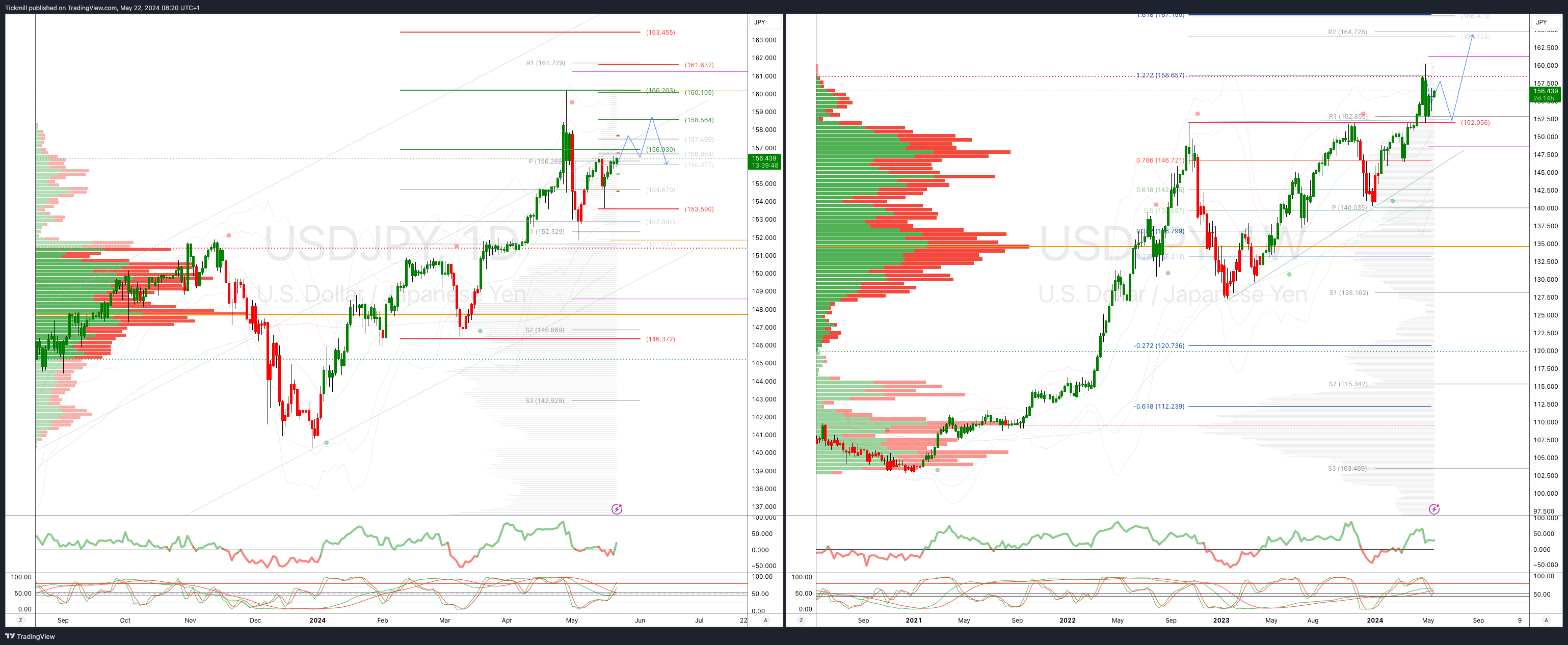

USDJPY Bullish Above Bearish Below 153.59

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

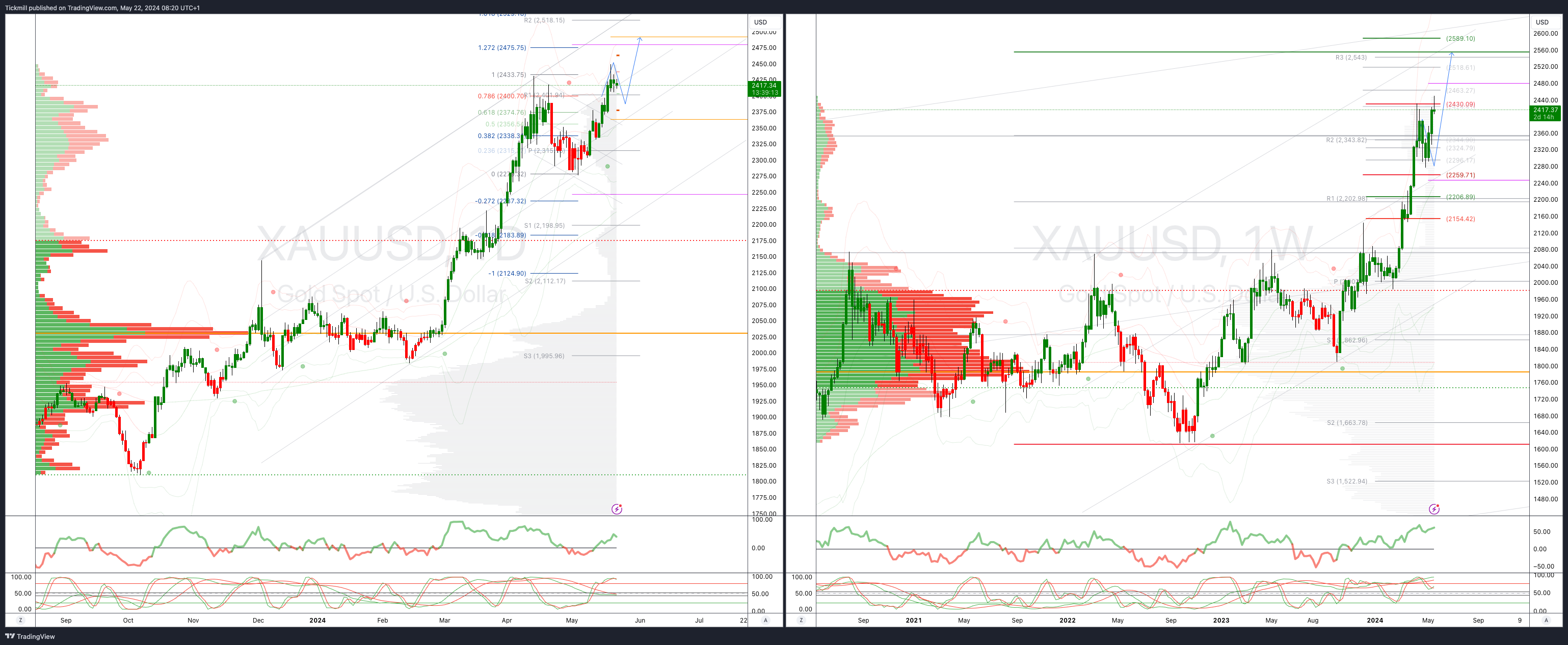

XAUUSD Bullish Above Bearish Below 2376

Daily VWAP bullish

Weekly VWAP bullish

Below 2330 opens 2240

Primary support 2260

Primary objective is 2560

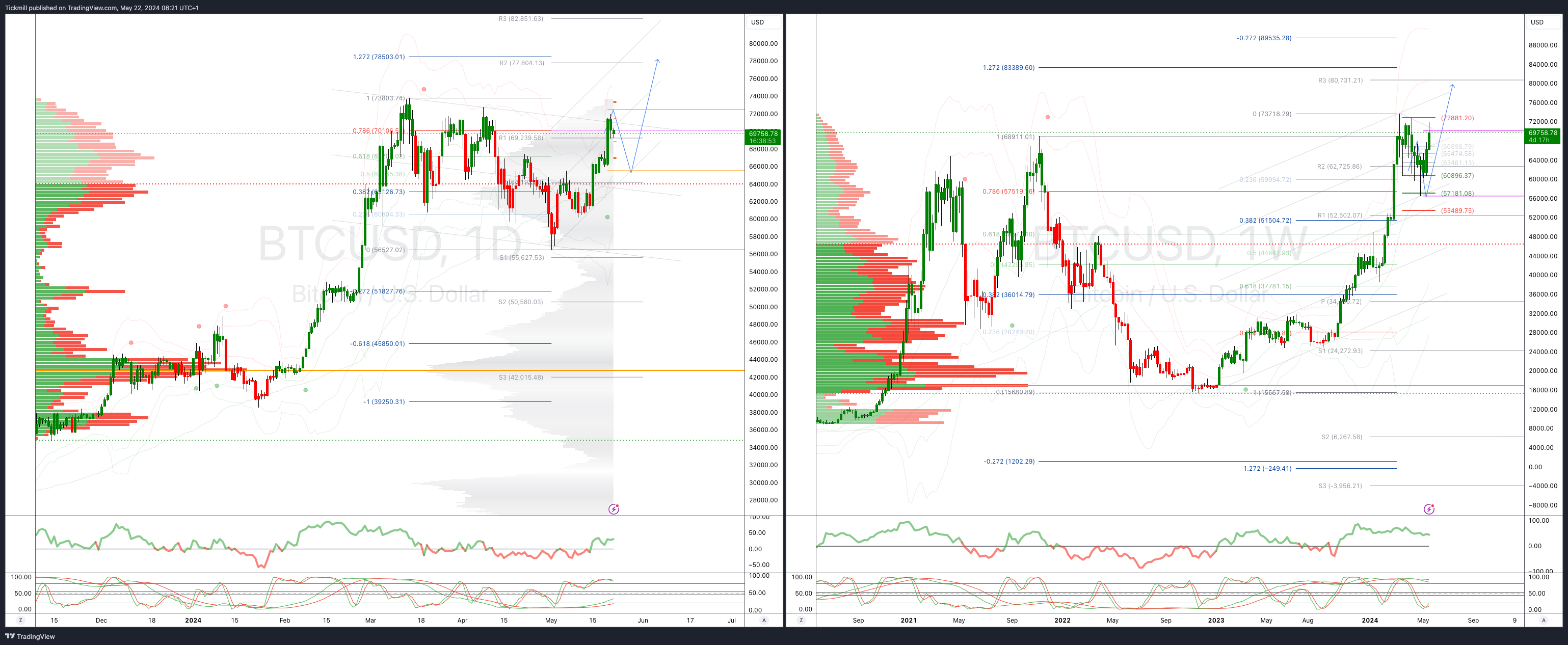

BTCUSD Bullish Above Bearish below 65500

Daily VWAP bullish

Weekly VWAP bullish

Above 70500 opens 78500

Primary support is 65000

Primary objective is 78500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!